You could fill out rpd 41285 without difficulty using our PDF editor online. In order to make our tool better and simpler to work with, we continuously design new features, with our users' feedback in mind. To get the process started, take these easy steps:

Step 1: Click on the "Get Form" button in the top area of this webpage to access our PDF tool.

Step 2: As you access the PDF editor, you will get the form ready to be filled out. Other than filling out different fields, you may also do some other things with the PDF, namely writing any text, editing the initial textual content, inserting illustrations or photos, placing your signature to the document, and much more.

Pay close attention when completing this pdf. Ensure that all necessary fields are filled in accurately.

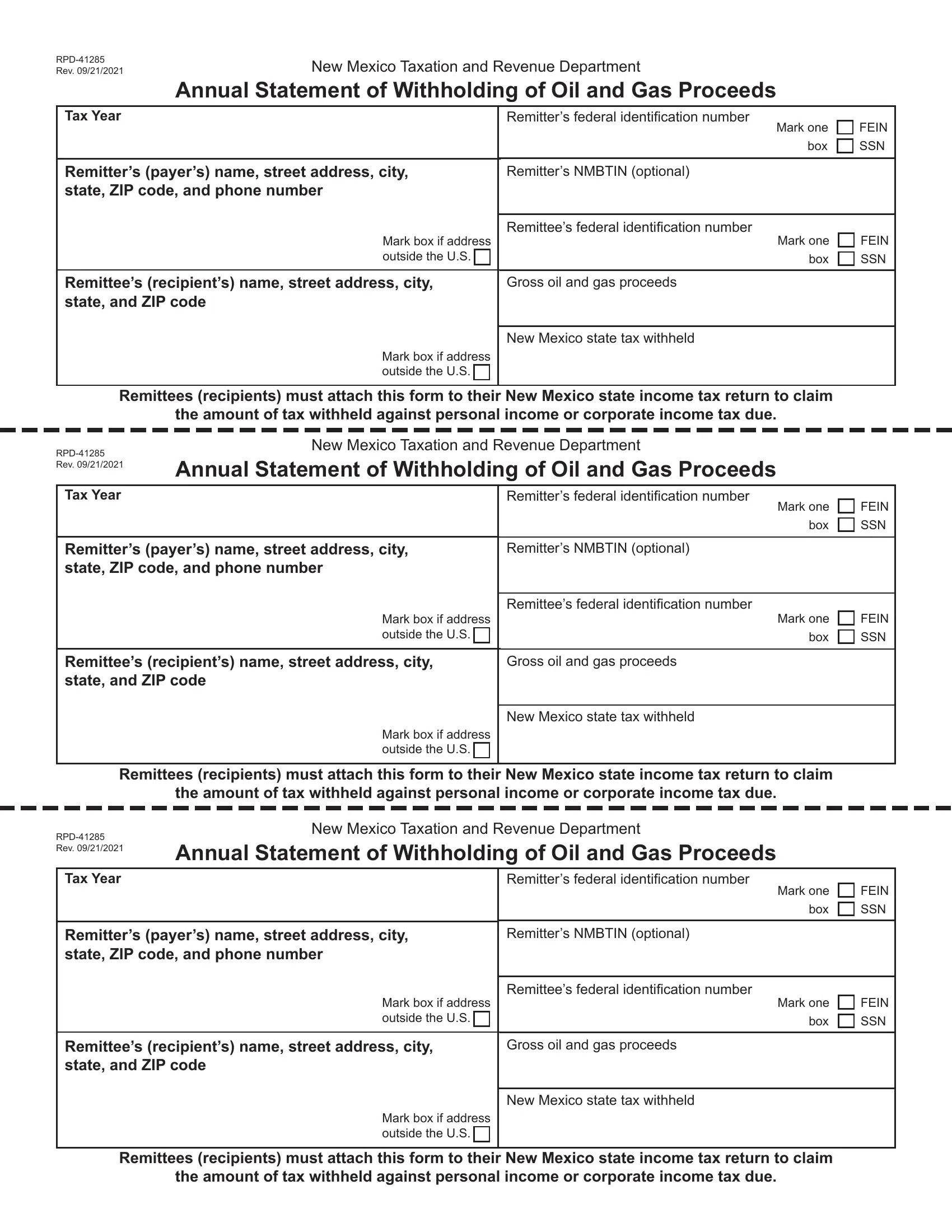

1. It is recommended to fill out the rpd 41285 properly, thus be attentive when filling in the parts comprising these fields:

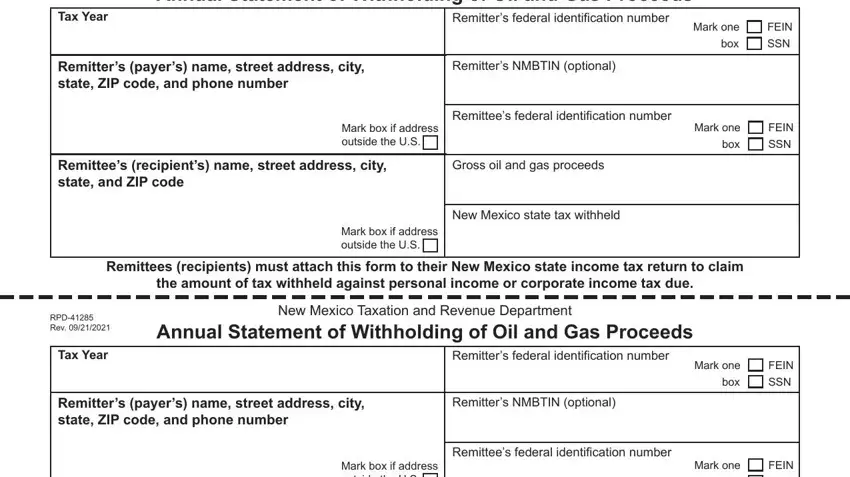

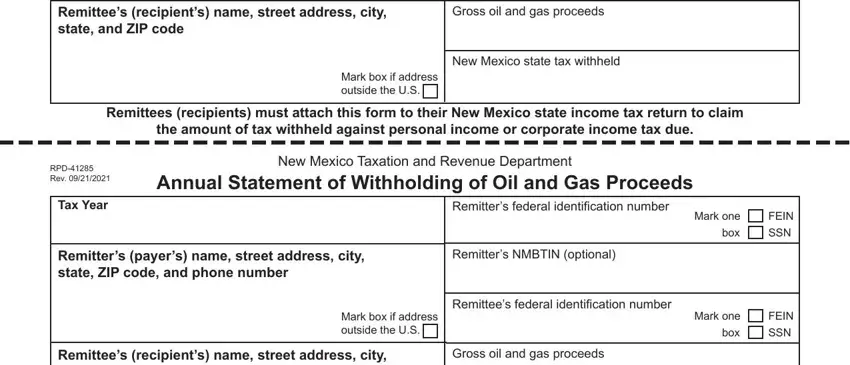

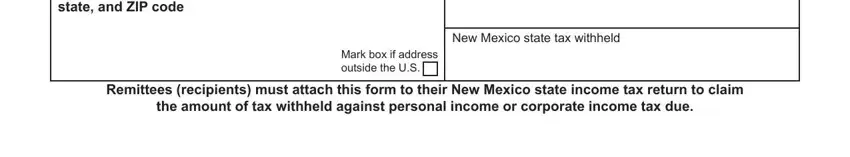

2. Soon after filling out this part, go to the next step and fill out all required particulars in these blank fields - Remittees recipients name street, Gross oil and gas proceeds, New Mexico state tax withheld, Mark box if address outside the US, Remittees recipients must attach, the amount of tax withheld against, RPD Rev, Tax Year, New Mexico Taxation and Revenue, Annual Statement of Withholding of, Remitters federal identification, Mark one box, FEIN SSN, Remitters payers name street, and Remitters NMBTIN optional.

When it comes to Remitters payers name street and New Mexico Taxation and Revenue, be sure you get them right in this current part. Those two could be the key ones in the file.

3. This stage is going to be hassle-free - fill out every one of the fields in Remittees recipients name street, New Mexico state tax withheld, Mark box if address outside the US, Remittees recipients must attach, and the amount of tax withheld against in order to complete this process.

Step 3: Be certain that your information is accurate and just click "Done" to progress further. Right after starting afree trial account with us, you will be able to download rpd 41285 or send it through email immediately. The PDF form will also be available in your personal cabinet with your every single change. FormsPal is focused on the confidentiality of all our users; we make sure all personal data going through our tool is protected.