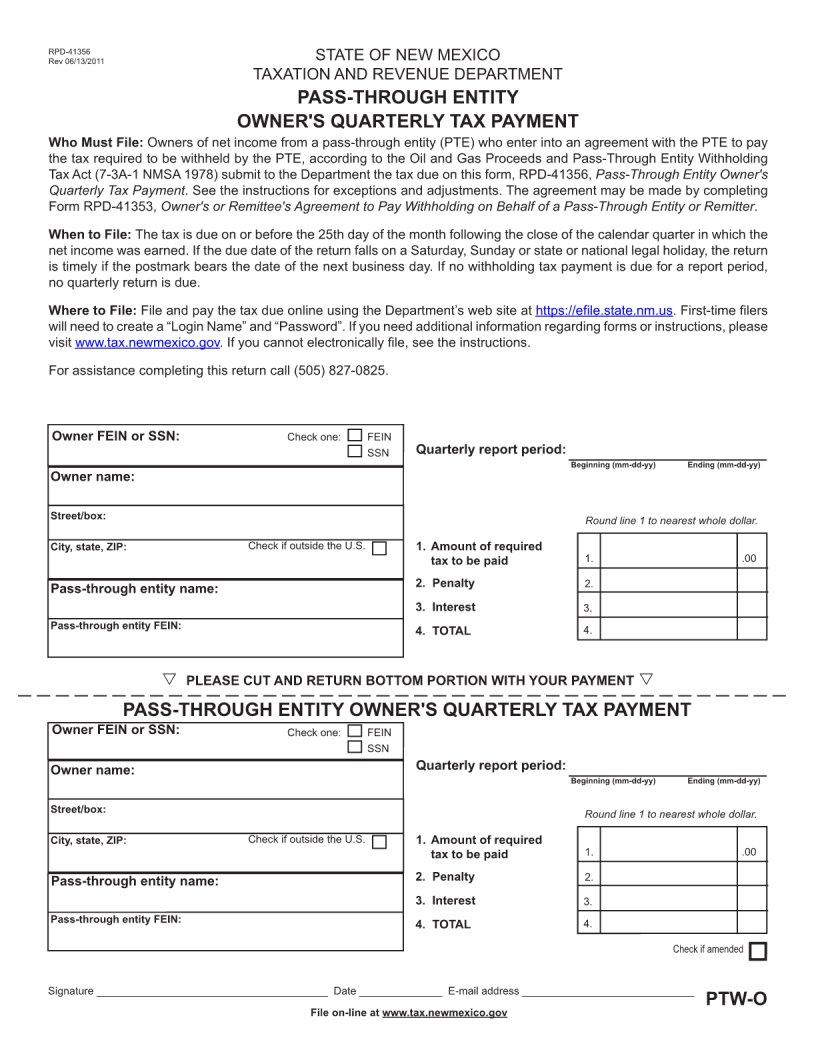

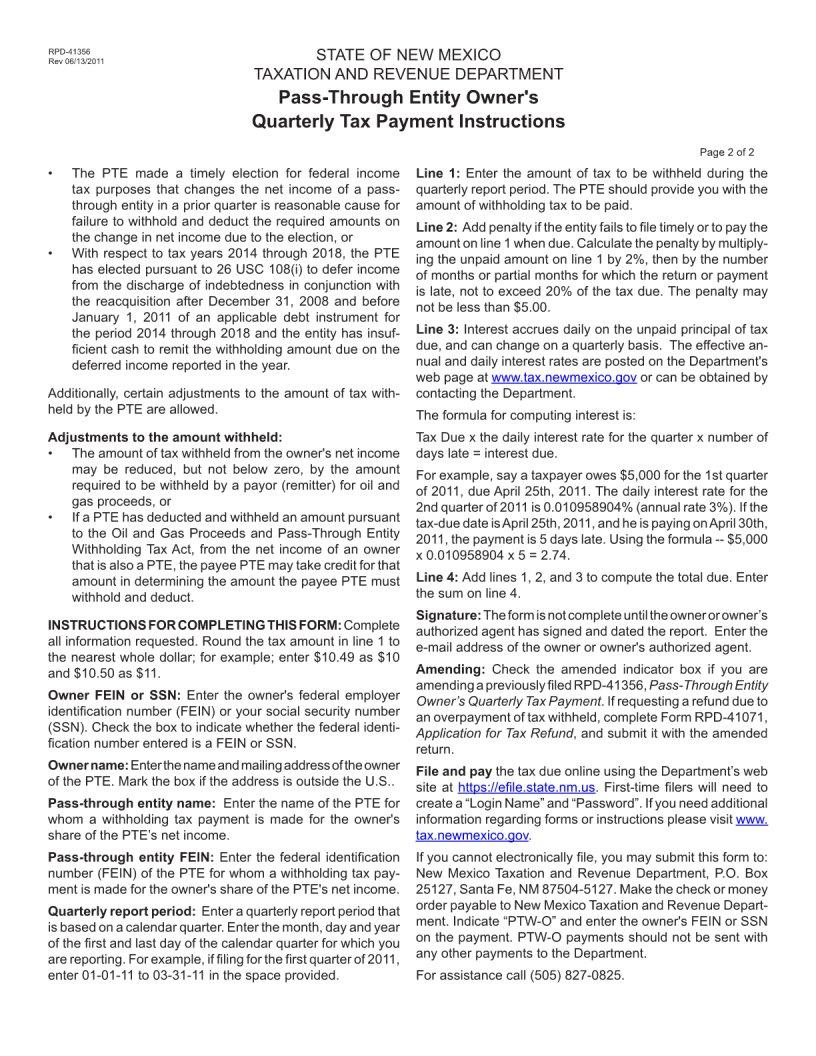

Navigating the labyrinth of tax documents is a daunting task that many find overwhelming. Among these myriad forms, the Rpd 41356 form surfaces as a crucial piece of documentation, yet it remains shrouded in obscurity for the uninitiated. This specific form plays a pivotal role in tax documentation, serving functions that impact individuals and businesses alike. Its relevance stretches across various tax situations, making it an indispensable tool in certain contexts. Understanding the Rpd 41356 form requires a dive into its purpose, the specific scenarios it addresses, and the implications it carries for tax submissions. Whether it's used for declaring particular types of income, claiming deductions, or fulfilling state-specific tax obligations, the nuances of the Rpd 41356 form can significantly influence the tax preparation process. By demystifying this form, taxpayers can uncover strategies to navigate their tax responsibilities more efficiently, ensuring compliance and potentially uncovering opportunities to optimize their financial outcomes.

| Question | Answer |

|---|---|

| Form Name | Rpd 41356 Form |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | rpd 41356 rpd 41356 fill in form |