You could fill in report adjustment retirement instantly by using our PDFinity® online PDF tool. To maintain our tool on the cutting edge of convenience, we work to implement user-driven features and improvements on a regular basis. We're routinely looking for feedback - play a vital role in revampimg how you work with PDF docs. To get the process started, consider these basic steps:

Step 1: Open the PDF form in our editor by clicking on the "Get Form Button" at the top of this webpage.

Step 2: Once you open the tool, you'll notice the document prepared to be filled in. In addition to filling in various blank fields, you may also do other things with the form, particularly adding any textual content, modifying the original textual content, inserting images, placing your signature to the PDF, and a lot more.

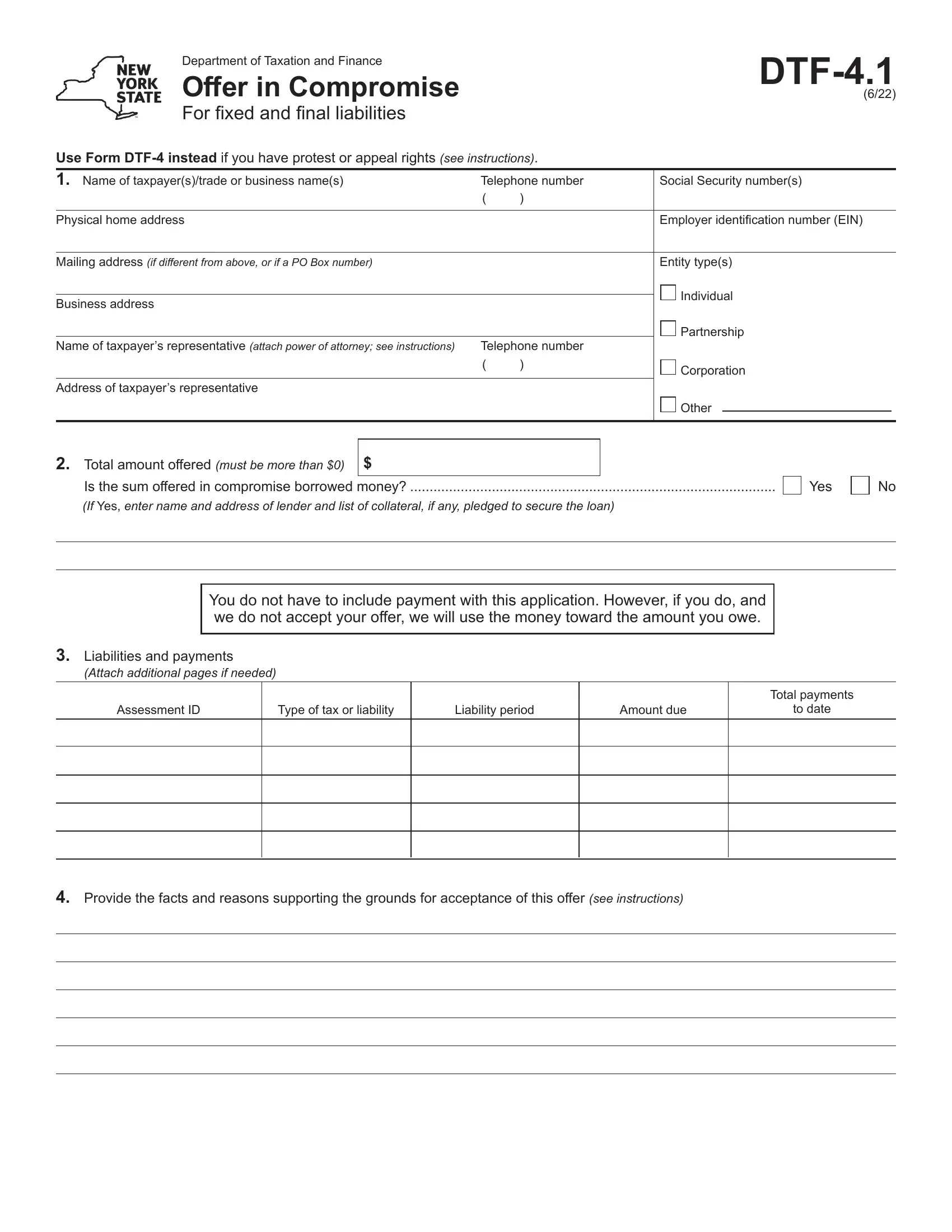

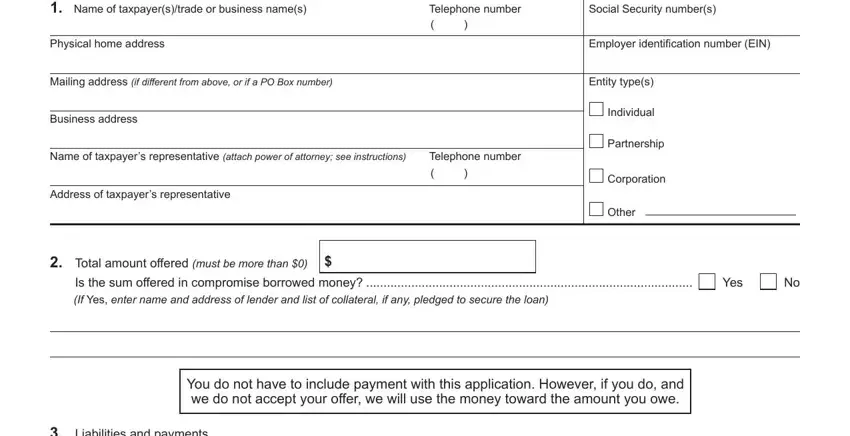

If you want to finalize this document, make certain you enter the right details in every single field:

1. Fill out your report adjustment retirement with a group of major blanks. Note all the required information and make sure not a single thing forgotten!

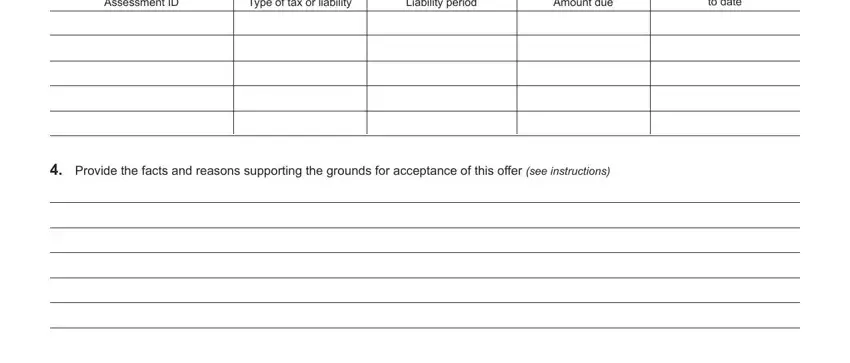

2. Just after the last part is filled out, go on to enter the suitable information in these - Assessment ID, Type of tax or liability, Liability period, Amount due, to date, and Provide the facts and reasons.

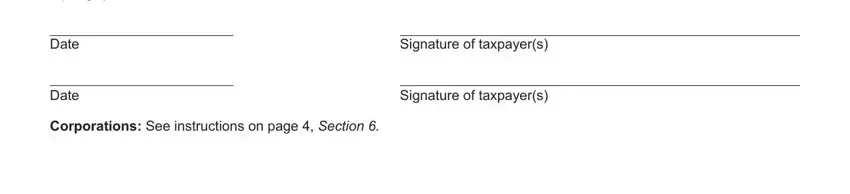

3. Completing Under penalties of perjury I, Date, Date, Signature of taxpayers, Signature of taxpayers, and Corporations See instructions on is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

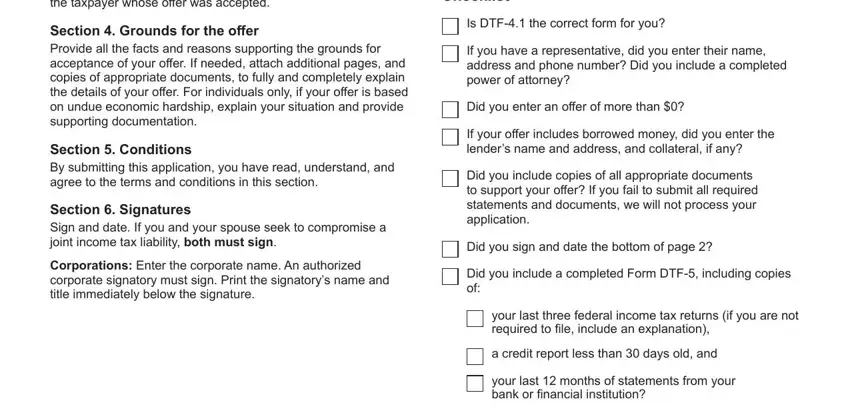

4. Your next paragraph requires your details in the subsequent places: Section Liabilities and payments, Section Conditions By submitting, Section Signatures Sign and date, More information These, Is DTF the correct form for you If, Did you include copies of all, Did you sign and date the bottom, your last three federal income tax, a credit report less than days, and your last months of statements. Be sure you provide all of the requested details to move further.

You can certainly make a mistake when filling in your More information These, therefore make sure to reread it before you decide to finalize the form.

5. This form should be finalized by going through this area. Below you will notice a full set of blanks that need appropriate details in order for your form usage to be accomplished: Are you compliant with all of your.

Step 3: Before moving on, it's a good idea to ensure that all form fields have been filled in correctly. As soon as you are satisfied with it, press “Done." Go for a free trial account with us and obtain direct access to report adjustment retirement - download, email, or change inside your personal account. FormsPal guarantees safe form tools with no data recording or any kind of sharing. Feel safe knowing that your data is secure here!