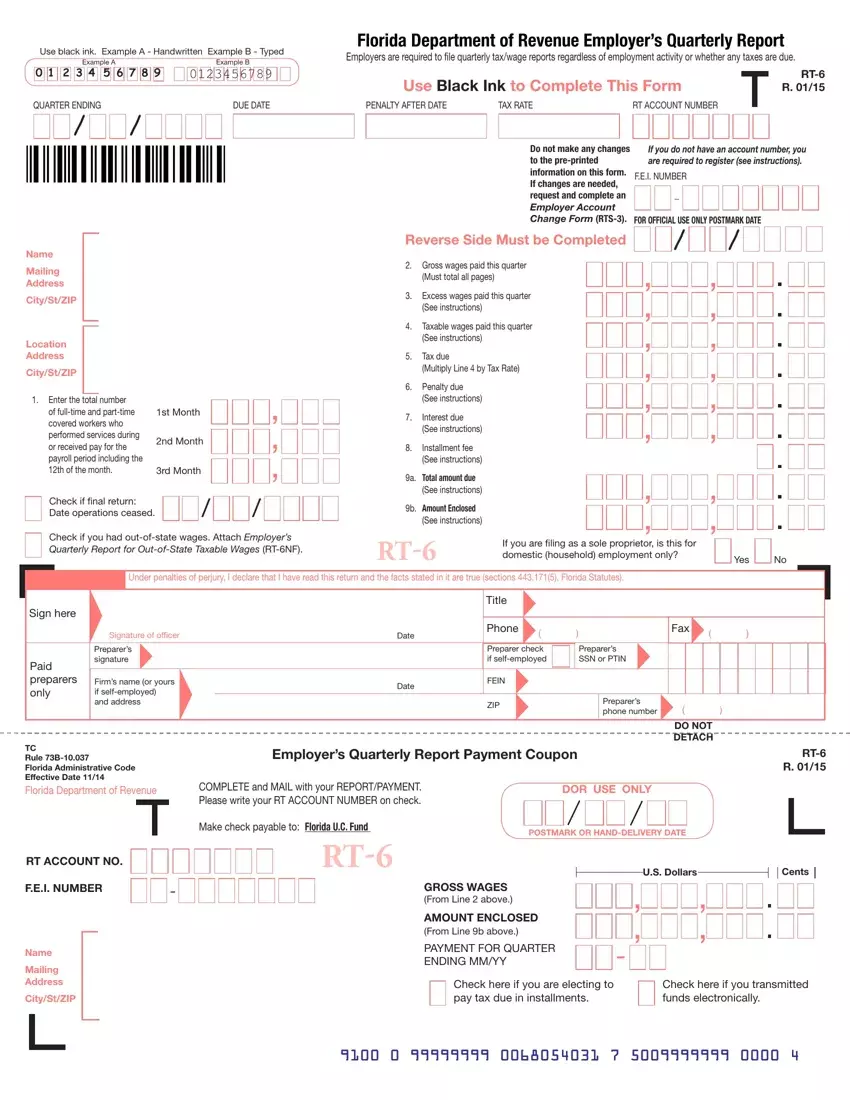

You can easily complete documents with the help of our PDF editor. Updating the florida department of revenue employer's quarterly report file is a breeze in case you keep to the next steps:

Step 1: Search for the button "Get Form Here" on this webpage and click it.

Step 2: Once you've got entered the editing page florida department of revenue employer's quarterly report, you will be able to discover all of the functions available for the document at the top menu.

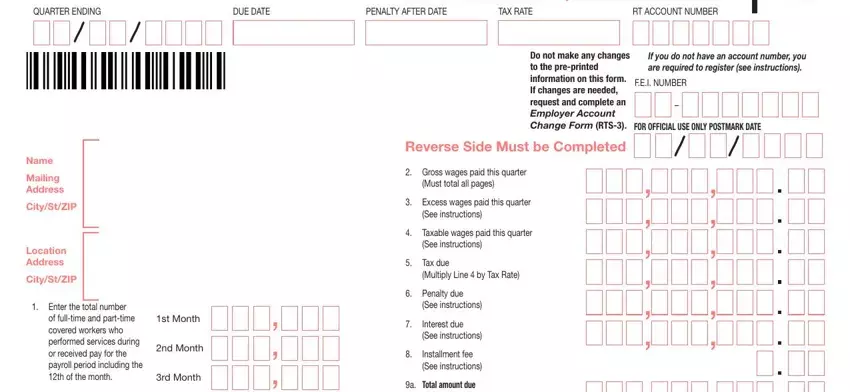

The next parts are what you are going to complete to obtain the finished PDF form.

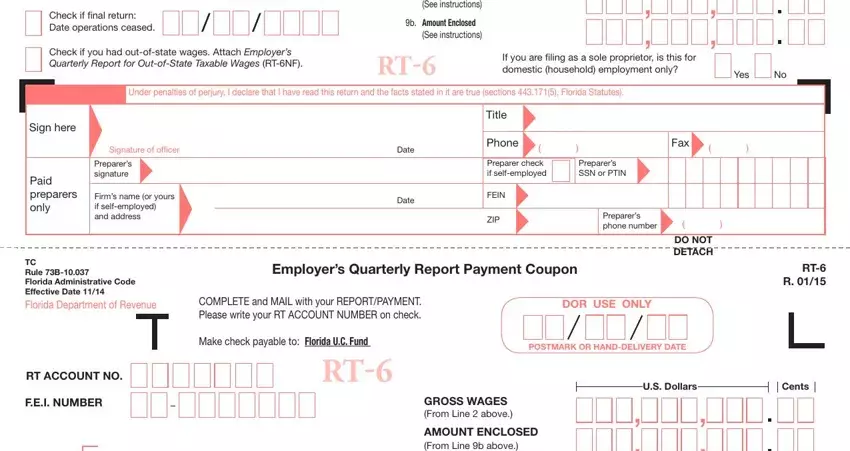

Fill out the a, Total, amount, due See, instructions b, Amount, Enclosed See, instructions Yes, Sign, here Paid, preparer, s, only Signature, of, of, ice, r Preparer, s, signature Date, Date, Title, Phone, Fax, and Preparer, check, if, self, employed fields with any data that can be asked by the software.

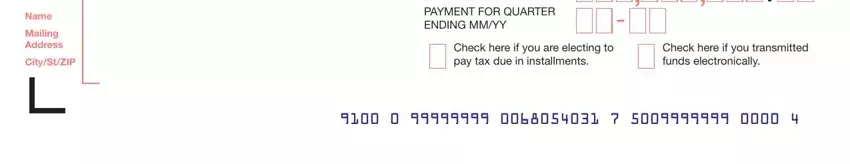

Write down the crucial information in Name, Mailing, Address City, St, ZIP AMOUNT, ENCLOSED, From, Line, b, above and PAYMENT, FOR, QUARTER, ENDING, MM, YY area.

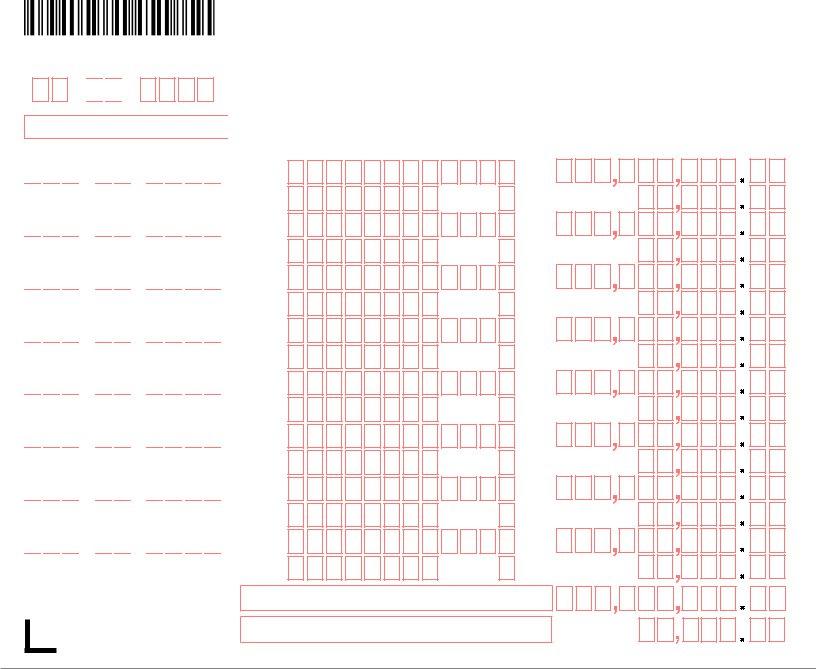

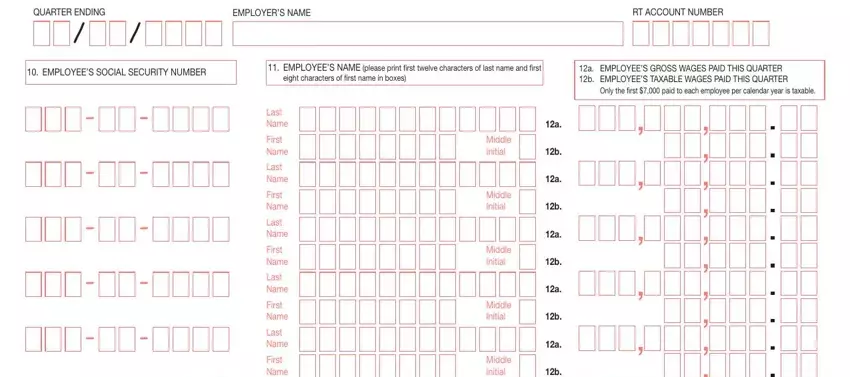

The QUARTER, ENDING EMPLOYERS, NAME RT, ACCOUNT, NUMBER EMPLOYEES, SOCIAL, SECURITY, NUMBER eight, character, so, first, name, in, boxes LastName, First, Name LastName, First, Name LastName, First, Name LastName, First, Name LastName, and First, Name segment should be applied to write down the rights or obligations of both parties.

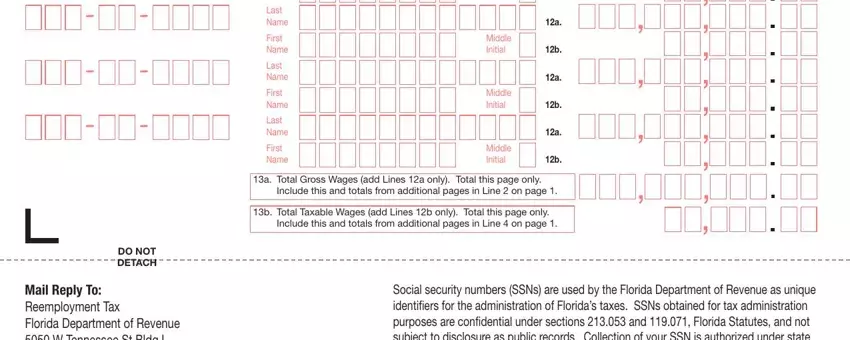

Finalize by checking the next sections and typing in the appropriate details: DO, NOT, DETACH First, Name LastName, First, Name LastName, First, Name LastName, First, Name Middle, Initial Middle, Initial Middle, Initial and Middle, Initial

Step 3: If you're done, click the "Done" button to transfer the PDF file.

Step 4: To prevent yourself from any kind of problems in the long run, you should generate at the very least a couple of copies of the document.