It's a breeze to fill out the form rt 8a. Our PDF editor was built to be assist you to prepare any document easily. These are the actions to follow:

Step 1: On this web page, select the orange "Get form now" button.

Step 2: Right now, you can begin editing your form rt 8a. The multifunctional toolbar is readily available - add, erase, modify, highlight, and carry out several other commands with the content material in the file.

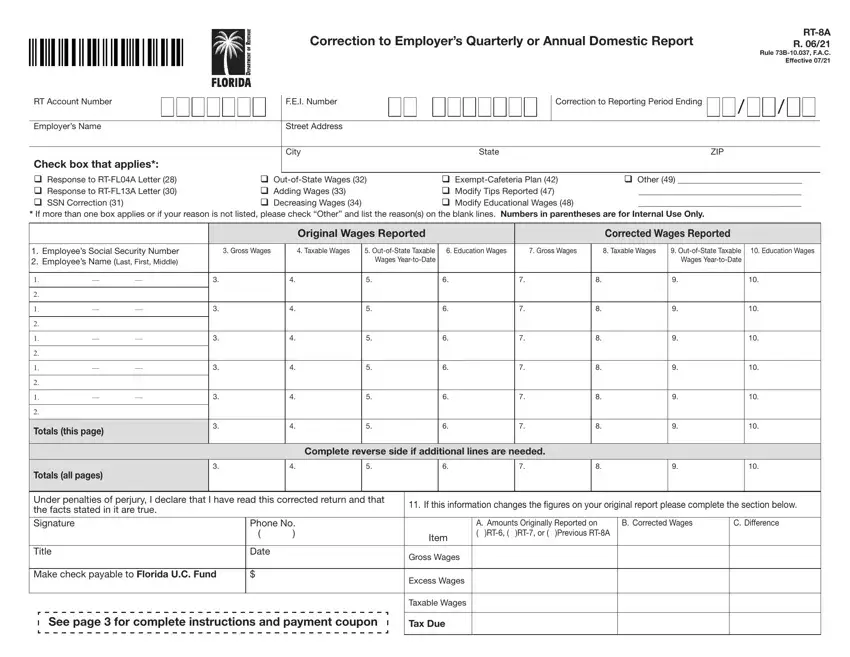

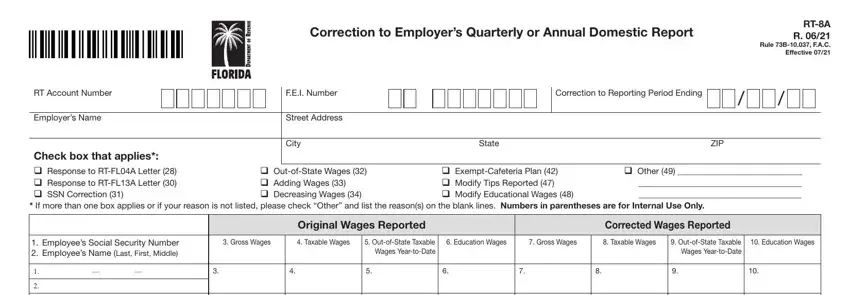

The PDF file you are about to fill out will consist of the following areas:

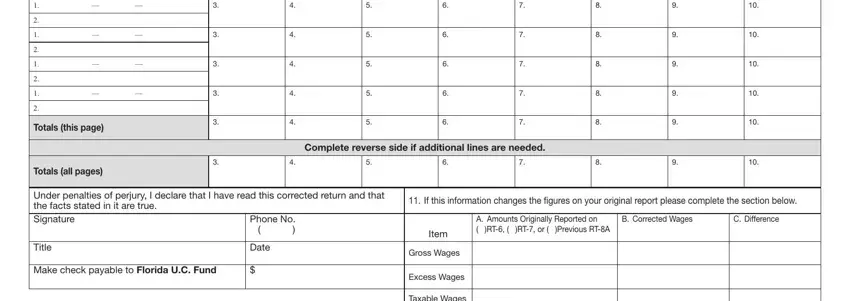

Feel free to complete the Check box that applies q Response, q ExemptCafeteria Plan q Modify, q OutofState Wages q Adding Wages, q Other, Employees Social Security Number, Gross Wages, Taxable Wages, OutofState Taxable Wages, Education Wages, Gross Wages, Taxable Wages, OutofState Taxable Wages, Education Wages, Original Wages Reported, and Corrected Wages Reported area with the appropriate details.

It's essential to provide the fundamental details in the Taxable Wages, See page for complete, and Tax Due segment.

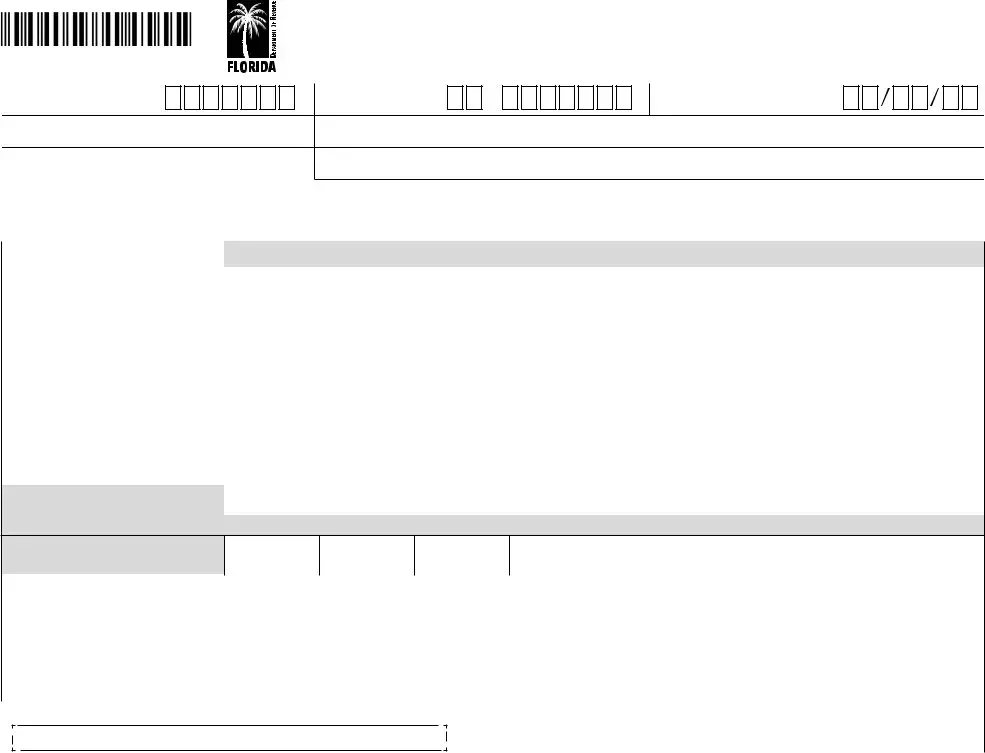

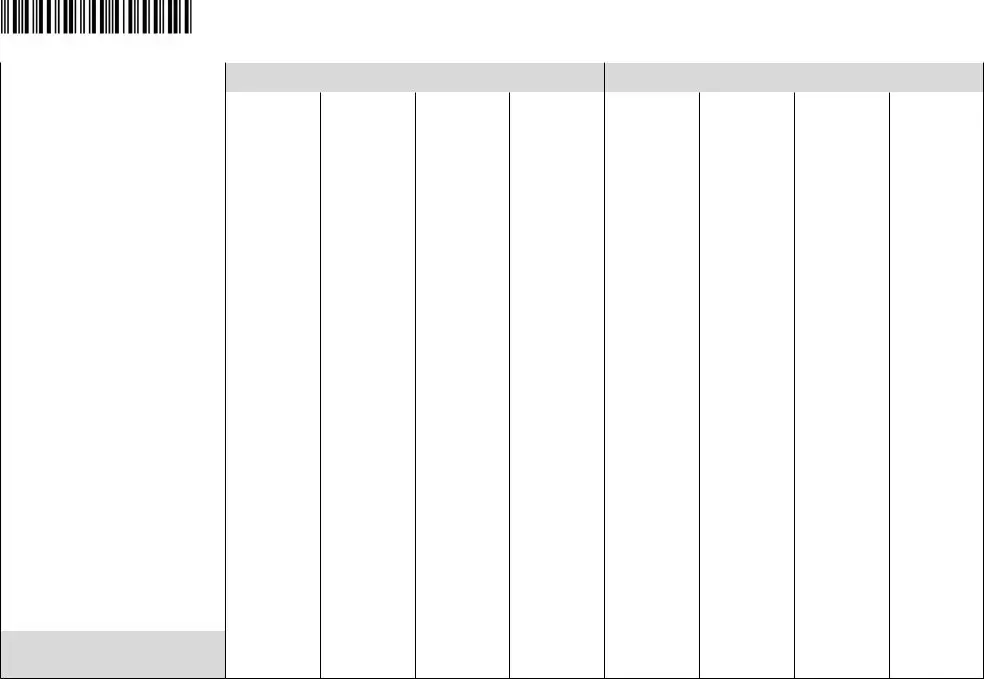

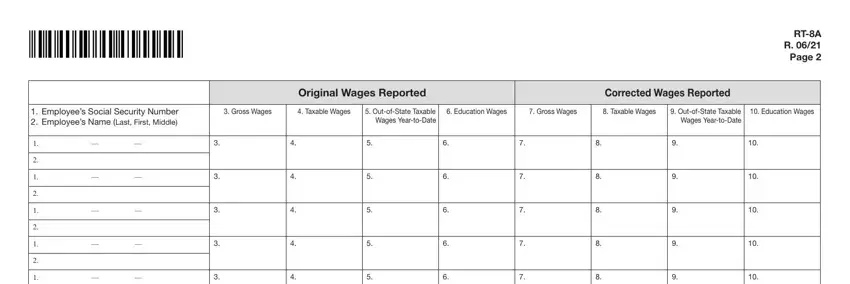

As part of part RTA R Page, Employees Social Security Number, Gross Wages, Taxable Wages, OutofState Taxable Wages, Education Wages, Gross Wages, Taxable Wages, OutofState Taxable Wages, Education Wages, Original Wages Reported, and Corrected Wages Reported, state the rights and responsibilities.

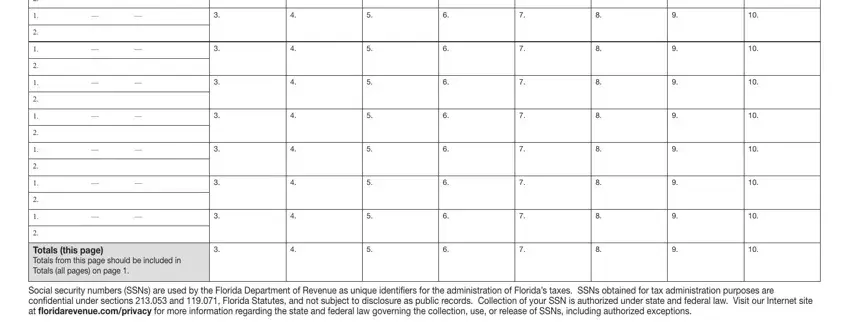

Finish by reviewing all of these sections and typing in the relevant particulars: Totals this page Totals from this, and Social security numbers SSNs are.

Step 3: Choose the Done button to make certain that your completed file could be exported to every electronic device you use or mailed to an email you specify.

Step 4: Be certain to avoid upcoming challenges by making no less than 2 duplicates of the file.