Understanding the intricacies of the Saif Reimbursement Request form is essential for individuals seeking compensation for expenses incurred due to workplace injuries or conditions. This form, designed by the SAIF Corporation, requires detailed documentation including a claim number, with the purpose of facilitating the reimbursement process for various expenses. The form covers reimbursements for prescription medications, transportation, meals, and lodging, each with specific instructions. For medications, it specifies that the pharmacy slip must be submitted, not just a cash register receipt, ensuring that the details of the physician, medication, date filled, and amount paid are accurately recorded. Transportation claims necessitate details about the journey, including start and end locations, miles traveled, and the total cost, while meal and lodging reimbursements require information on the amounts spent, with the understanding that these are only covered if the claimant has to travel a significant distance for treatment. Notably, the form stipulates a two-year deadline from the date of service for submitting reimbursement requests. It includes a certification by the claimant that all information provided is truthful, under penalty of law, underscoring the legal obligations involved. Additionally, the form details the reimbursement rates for meals, lodging, and mileage, highlighting variations for specific locations within Oregon, which acknowledges the differing costs associated with different areas. This comprehensive document underscores SAIF Corporation’s commitment to supporting individuals in their recovery process, while also implementing measures to ensure the accuracy and integrity of claims.

| Question | Answer |

|---|---|

| Form Name | Saif Reimbursement Request Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | Jan, Washington, 2011, saif reimbursement of expenses form |

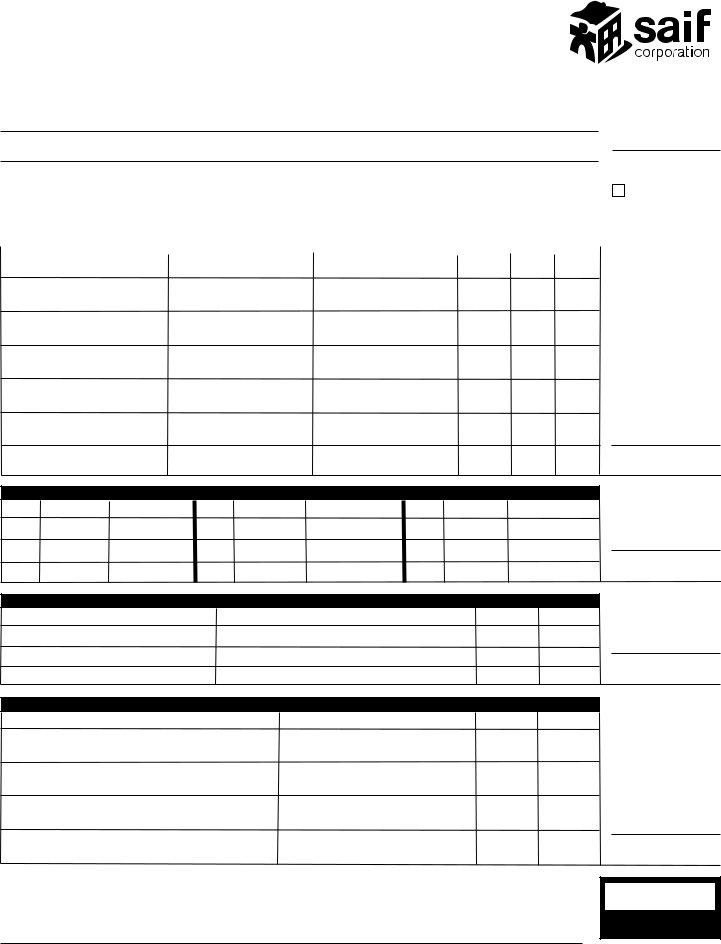

Request for Reimbursement of Expenses

Complete form, including claim number, and send to SAIF Corporation. Itemized receipts for each item must accompany this completed form. For prescription medication, please include the pharmacy slip with the name of the physician, medication, date filled, and amount paid, rather than the cash register receipt. Incomplete requests will be returned for additional information. Reimbursement must be requested within 2 (two) years from date of service.

400 High St. SE, Salem, OR 97312 1.800.285.8525

Name

Claim Number

Street address |

|

|

|

Apt. # |

|

|

|

|

|

|

|

|

This is a new address |

City |

State |

Zip |

|

Phone |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TRANSPORTATION |

|

|

|

|

|

|

Start Location |

End Location |

|

Doctor or Hospital |

|

Trip Miles Date $ Amount |

|

$

TOTAL Transportation

Reimbursement

MEALS

Date $ Breakfast |

City |

Date |

$ Lunch |

City |

Date |

$ Dinner |

City |

$

TOTAL Meals

Reimbursement

LODGING

Hotel/Motel Name |

Location |

Date |

$ Cost |

$

TOTAL Lodging

Reimbursement

PRESCRIPTIONS

Name of Medication |

Doctor |

Date |

$ Cost |

$

TOTAL Prescription

Reimbursement

As attested to by my signature and under penalty of law, I certify that all information I have given in this request for reimbursement is true and contains no false statements and/or misrepresentation.

$

GRAND TOTAL

Reimbursement

Signature of worker: |

Date: |

F3056 C+D, 4/17/12 |

|

|

Meals and lodging will be reimbursed if you are required to travel a distance for medical treatment that would prohibit you from returning to your local area within a reasonable time frame. An example would be travel in excess of 75 miles each way for meals or a required overnight stay for lodging and meals.

Standard rates for the continental United States:

Lodging and meal rates |

ALL Private Vehicle Mileage effective |

||

effective Oct. 1, 2011 |

April 17, 2012 = 55.5 cents per mile |

||

|

|

||

|

|

|

|

Breakfast |

$11.50 |

Previous mileage rates: |

|

Lunch |

$11.50 |

01/01/11 = 51.0 cents per mile |

|

Dinner |

$23.00 |

01/01/10 = 50.0 cents per mile |

|

Lodging |

$77.00 |

||

|

|||

|

|

|

|

Room tax is reimbursable in addition to the lodging allowance.

Per day rates exceed the standard rate

in the following Oregon locations:

County/City |

Effective |

Max. lodging rate |

Meal rate* |

|

dates |

|

|

Clackamas |

All year |

$88 |

$61 |

Clatsop |

10/1 – 6/30 |

$96 |

$51 |

|

7/1 – 8/31 |

$131 |

$51 |

|

9/1 – 9/30 |

$96 |

$51 |

Deschutes |

10/1 – 6/30 |

$89 |

$61 |

|

|

|

|

|

7/1 – 8/31 |

$114 |

$61 |

|

|

|

|

|

9/1 – 9/30 |

$89 |

$61 |

Jackson/Klamath |

All year |

$82 |

$56 |

Lane |

All year |

$97 |

$51 |

Lincoln |

10/1 – 6/30 |

$84 |

$56 |

|

7/1 – 8/31 |

$105 |

$56 |

|

9/1 – 9/30 |

$84 |

$56 |

Multnomah |

All year |

$113 |

$66 |

Washington |

All year |

$93 |

$51 |

*For meals, the following percentages shall be used: breakfast 25%; lunch 25%; dinner 50%