Our top level web programmers worked hard to make the PDF editor we are excited to deliver to you. This software makes it possible to simply complete pay denver sales tax online and will save you valuable time. You need to simply stick to this guide.

Step 1: Select the orange button "Get Form Here" on this website page.

Step 2: Now, you can start editing the pay denver sales tax online. The multifunctional toolbar is at your disposal - insert, eliminate, modify, highlight, and carry out several other commands with the content material in the document.

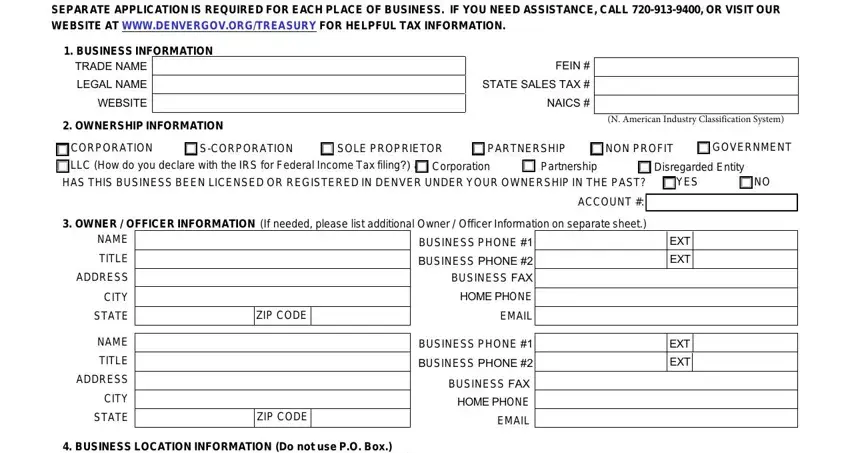

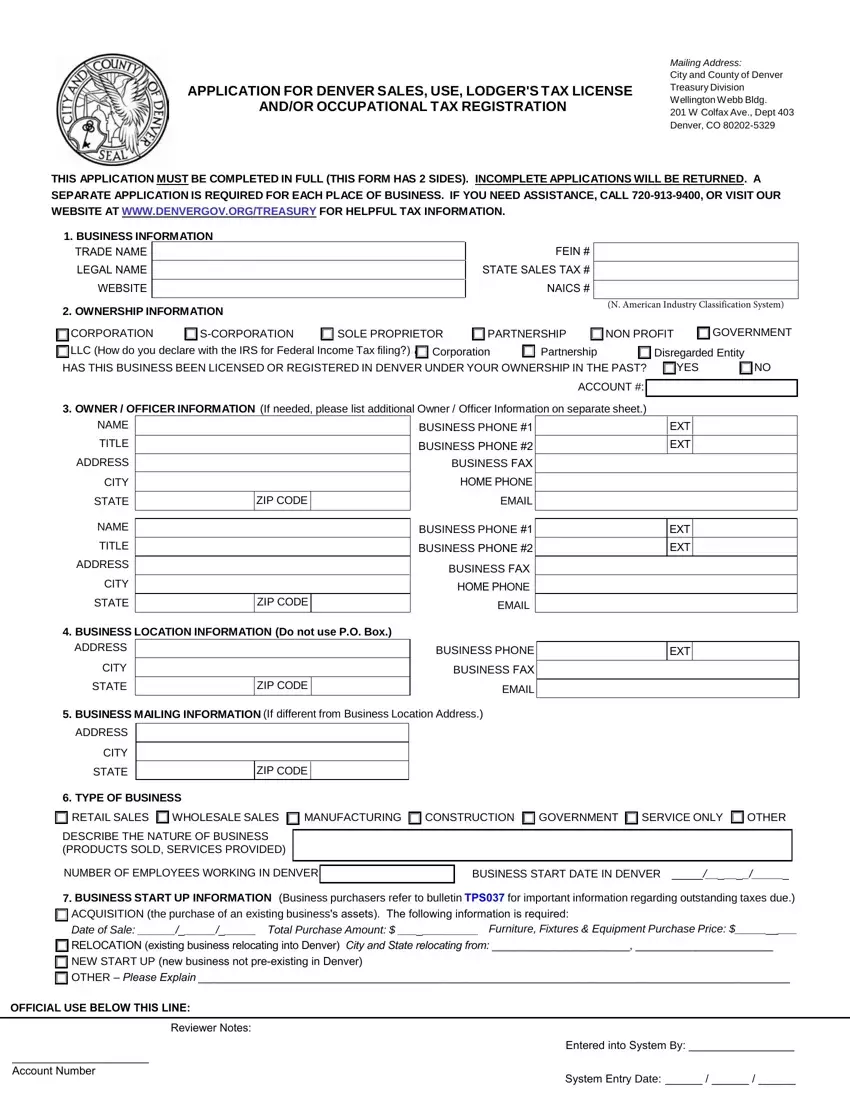

These parts will constitute the PDF template that you will be filling out:

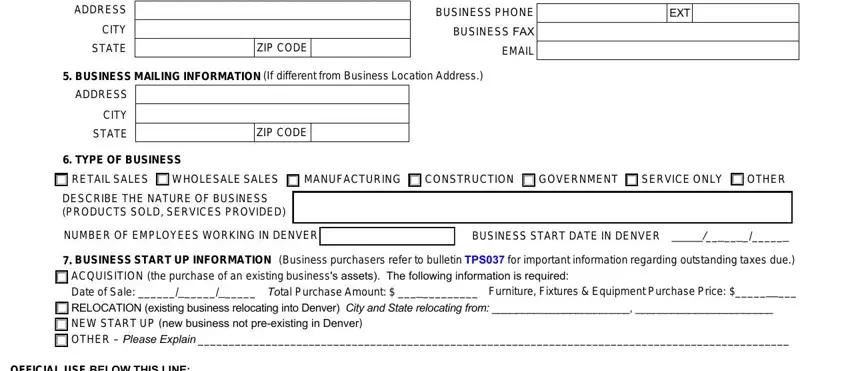

You should put down your particulars within the part BUSINESS LOCATION INFORMATION Do, ADDRESS, CITY, STATE, ZIP CO, BUSINESS PHONE, BUSINESS, FAX, EMAIL, BUSINESS MAILING INFORMATION If, ADDRESS, CITY, STATE, TYPE OF BUSINESS, and ZIP CODE.

The application will demand you to note some significant information to instantly fill in the field FFICIAL USE BELOW THIS LINE, Reviewer Notes, ccount Number, Entered into System By, and System Entry Date.

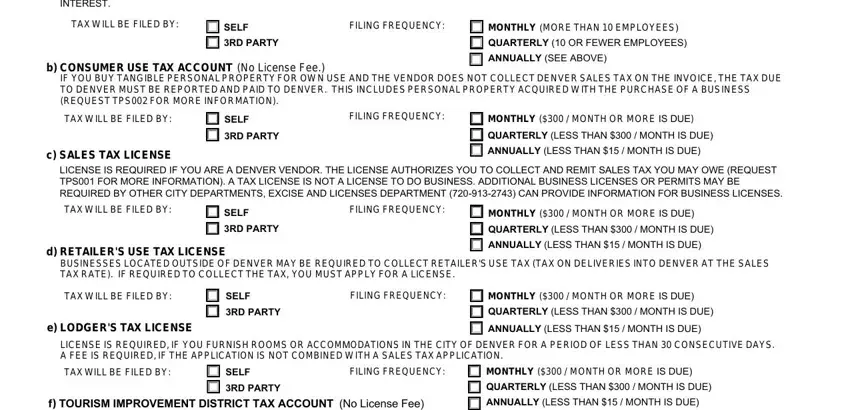

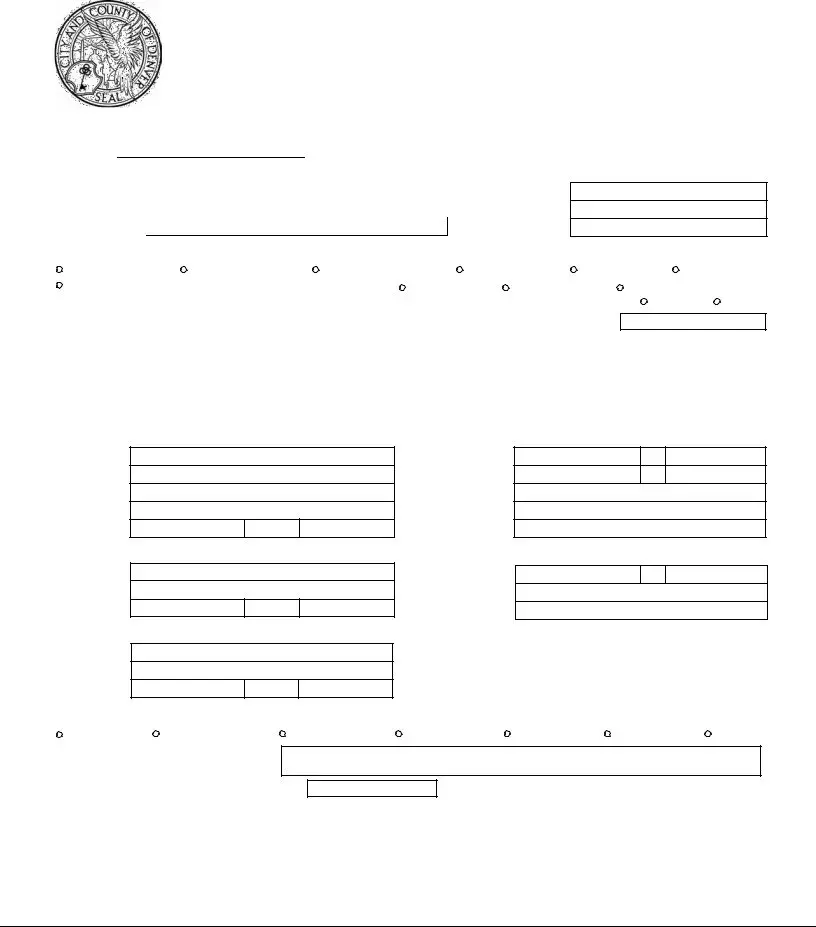

Through box THE CITY AND COUNTY OF DENVER, TAX W ILL BE FILED BY, SELF RD PARTY, FILING FREQUENCY, MONTHLY MORE THAN EMPLOYEES, b CONSUMER USE TAX ACCOUNT No, IF YOU BUY TANGIBLE PERSONAL, TAX W ILL BE FILED BY, SELF RD PARTY, c SALES TAX LICENSE, FILING FREQUENCY, MONTHLY MONTH OR MORE IS DUE, LICENSE IS REQUIRED IF YOU ARE A, TAX W ILL BE FILED BY, and SELF RD PARTY, define the rights and obligations.

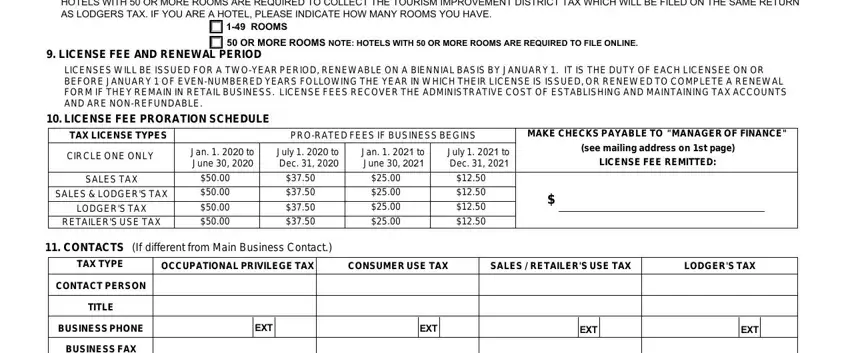

Finalize by reviewing these sections and filling out the required data: HOTELS WITH OR MORE ROOMS ARE, ROOMS OR MORE ROOMS NOTE HOTELS, LICENSE FEE AND RENEWAL PERIOD, LICENSES W ILL BE ISSUED FOR A, LICENSE FEE PRORATION SCHEDULE, TAX LICENSE TYPES, CIRCLE ONE ONLY, PRORATED FEES IF BUSINESS BEGINS, Jan to June, July to Dec, Jan to June, July to Dec, MAKE CHECKS PAYABLE TO MANAGER OF, LICENSE FEE REMITTED, and SALES TAX.

Step 3: When you are done, choose the "Done" button to export the PDF file.

Step 4: Get minimally several copies of your file to refrain from all of the potential problems.

ACQUISITION (the purchase of an existing business's assets). The following information is required:

ACQUISITION (the purchase of an existing business's assets). The following information is required: RELOCATION (existing business relocating into Denver)

RELOCATION (existing business relocating into Denver)  NEW START UP (new business not

NEW START UP (new business not  OTHER –

OTHER –