Completing documents using our PDF editor is more straightforward in comparison with most things. To edit form dr 15ez tax the form, there's nothing you have to do - simply adhere to the steps below:

Step 1: To begin with, select the orange "Get form now" button.

Step 2: After you have entered the form dr 15ez tax editing page you may see all the actions you may undertake about your file in the top menu.

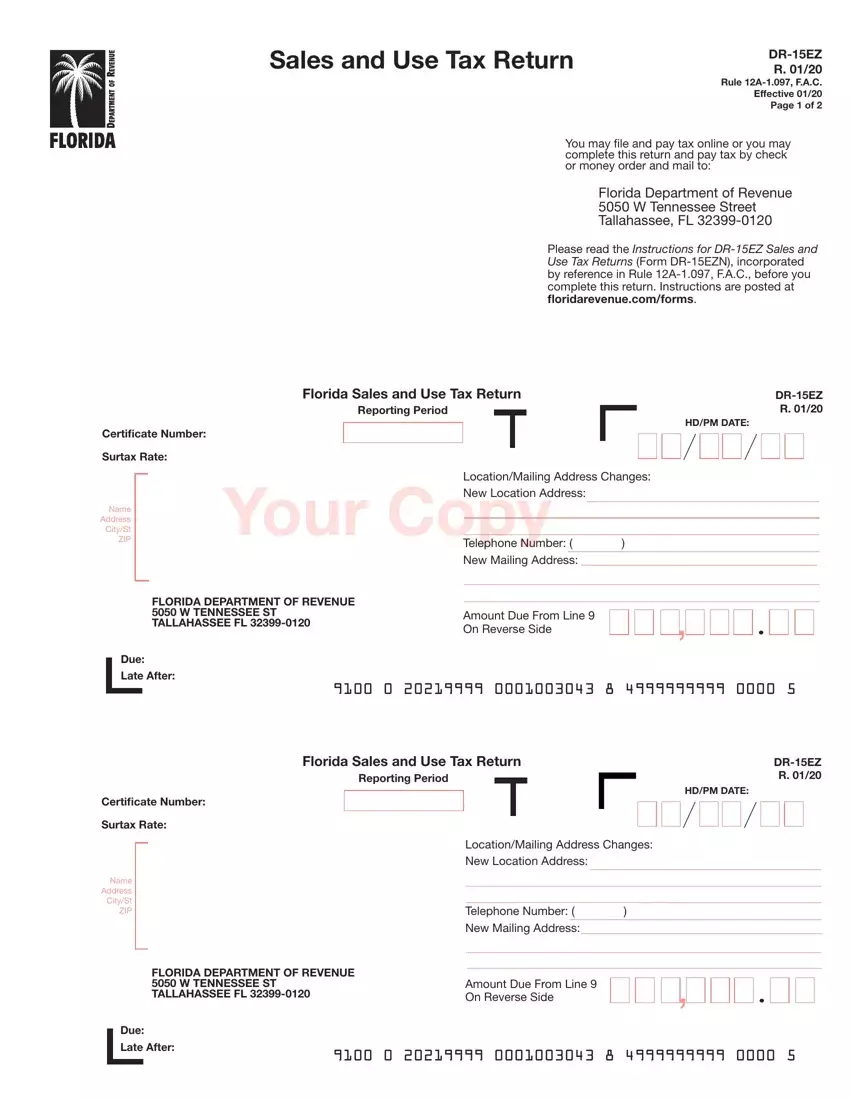

Feel free to provide the following details to complete the form dr 15, ez tax PDF:

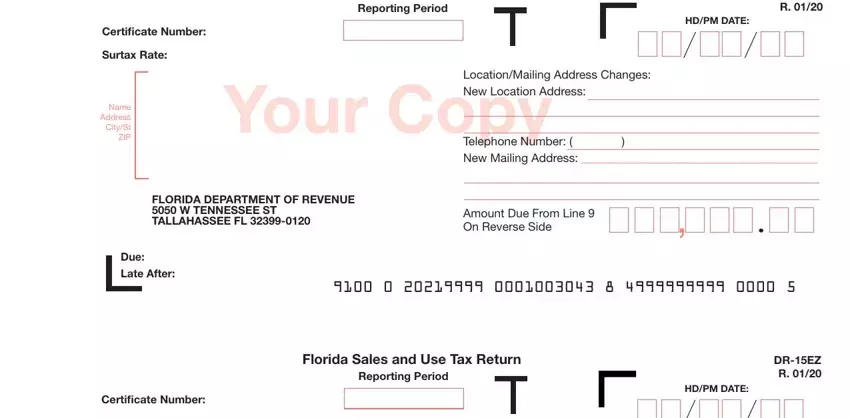

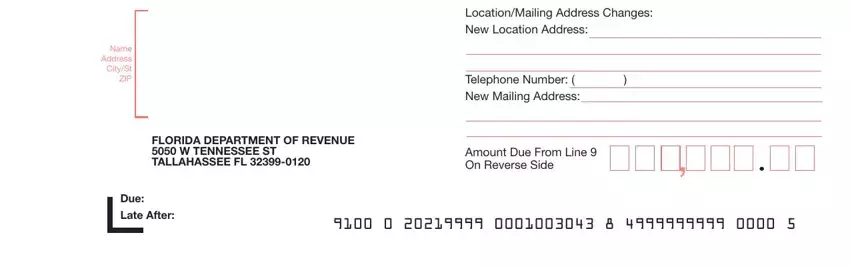

In the segment Name, Address, City, St, ZIP Telephone, Number, New, Mailing, Address Amount, Due, From, Line, On, Reverse, Side and Due, Late, After enter the information the software asks you to do.

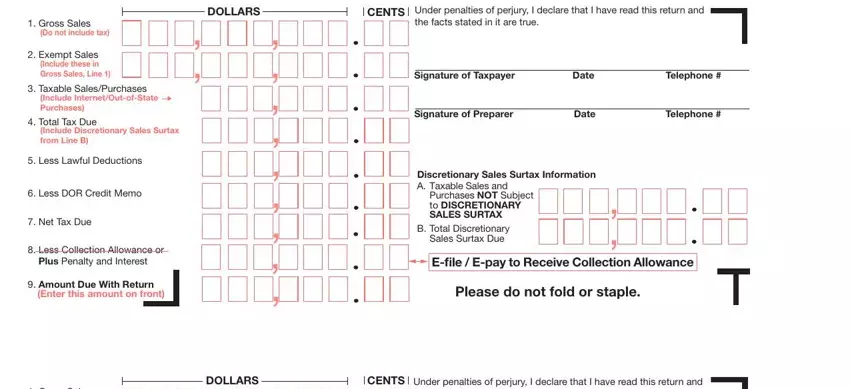

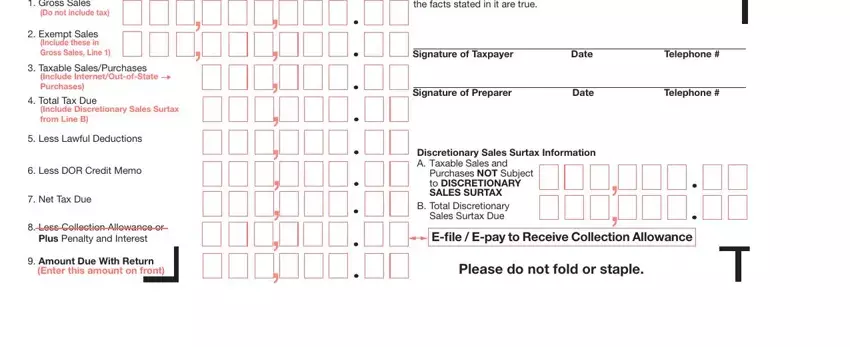

It is vital to record specific particulars in the box Gross, Sales Do, not, include, tax Include, Internet, Out, of, State Less, Lawful, Deductions Less, DOR, Credit, Memo Net, Tax, Due Amount, Due, With, Return Enter, this, amount, on, front Gross, Sales DOLLARS, DOLLARS, CENTS, Signature, of, Taxpayer Date, and Telephone.

The Gross, Sales Do, not, include, tax Include, Internet, Out, of, State Less, Lawful, Deductions Less, DOR, Credit, Memo Net, Tax, Due Amount, Due, With, Return Enter, this, amount, on, front Signature, of, Taxpayer Date, Telephone, Signature, of, Preparer Date, Telephone, and to, DISCRETIONARY, SALES, SURTAX area has to be applied to put down the rights or responsibilities of both sides.

Step 3: Click the Done button to save the document. Now it is at your disposal for upload to your device.

Step 4: In order to avoid any kind of hassles down the road, you will need to make a minimum of a few copies of your document.

,

,