The copy of tax return filling out course of action is quick. Our software lets you work with any PDF file.

Step 1: Get the button "Get Form Here" and select it.

Step 2: You are now able to modify copy of tax return. You possess plenty of options with our multifunctional toolbar - you can include, erase, or change the content material, highlight the particular components, and perform several other commands.

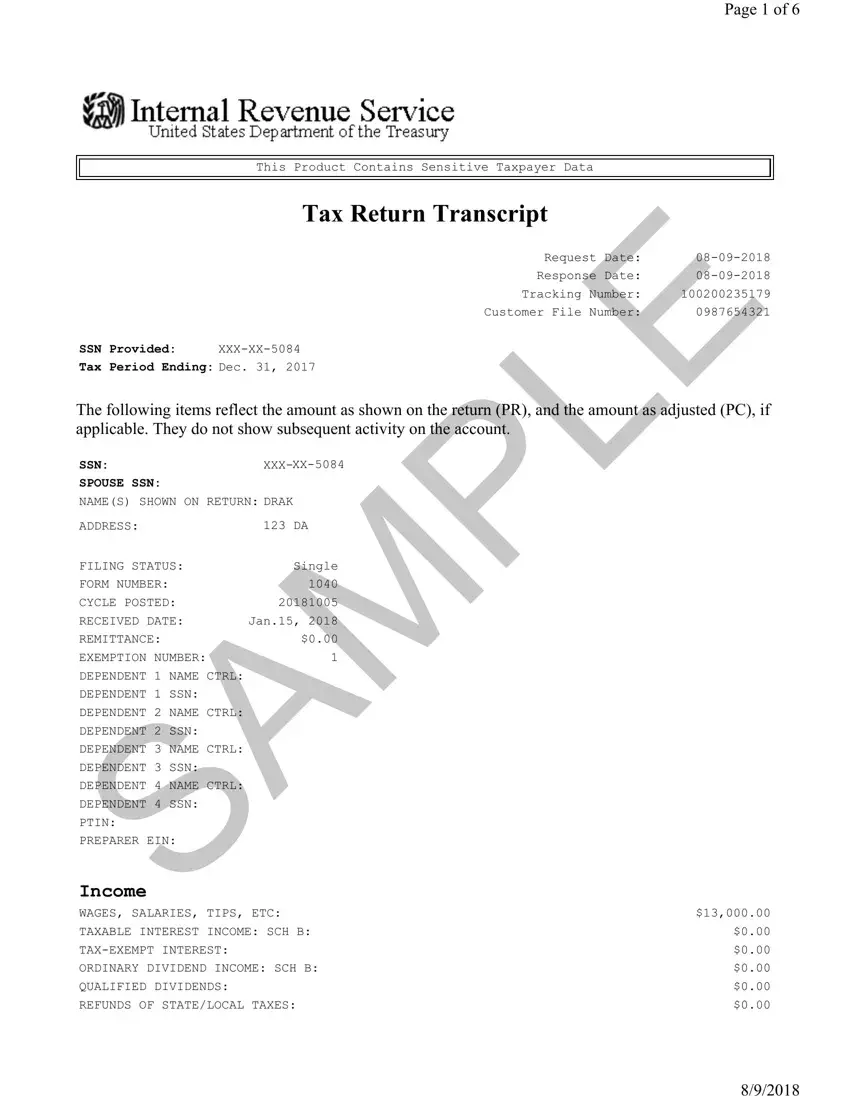

The next areas are included in the PDF form you'll be creating.

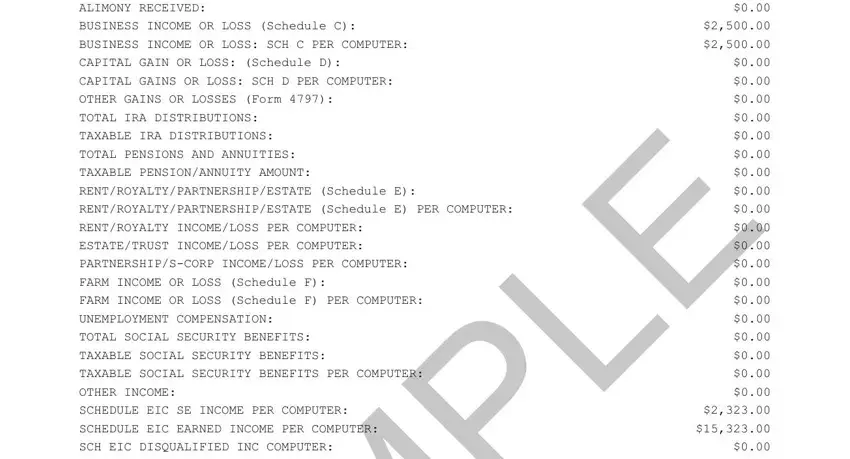

Provide the necessary data in the ALIMONY RECEIVED BUSINESS INCOME area.

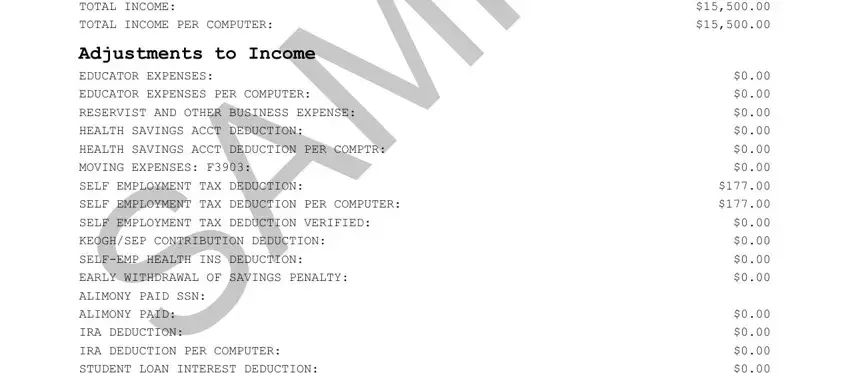

The application will ask for more information with the intention to quickly fill in the part ALIMONY RECEIVED BUSINESS INCOME, and Adjustments to Income EDUCATOR.

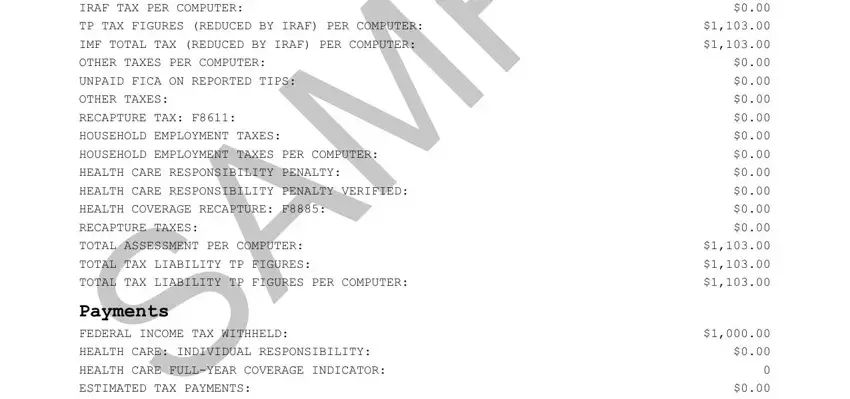

In the box Other Taxes SE TAX SE TAX PER, and Payments FEDERAL INCOME TAX, specify the rights and responsibilities of the parties.

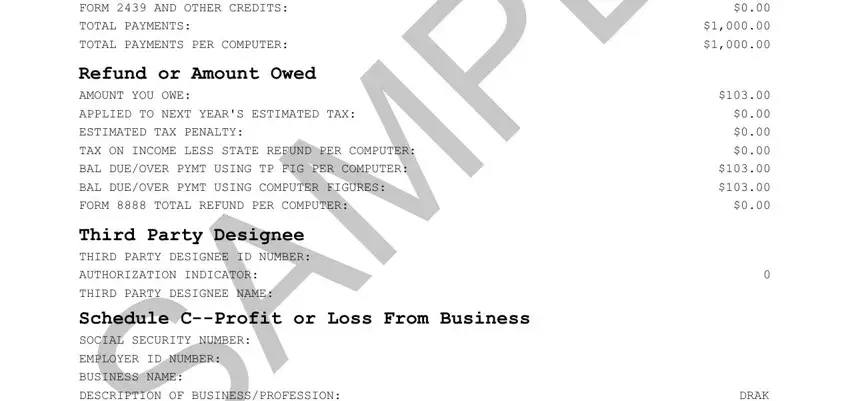

Finish by reviewing the following sections and completing them as needed: SCHEDULE NONTAXABLE COMBAT PAY, Refund or Amount Owed AMOUNT YOU, Third Party Designee THIRD PARTY, Schedule CProfit or Loss From, and DRAK.

Step 3: Choose the Done button to save your form. At this point it is obtainable for export to your device.

Step 4: To prevent different hassles in the foreseeable future, be sure to generate up to two or three duplicates of the file.