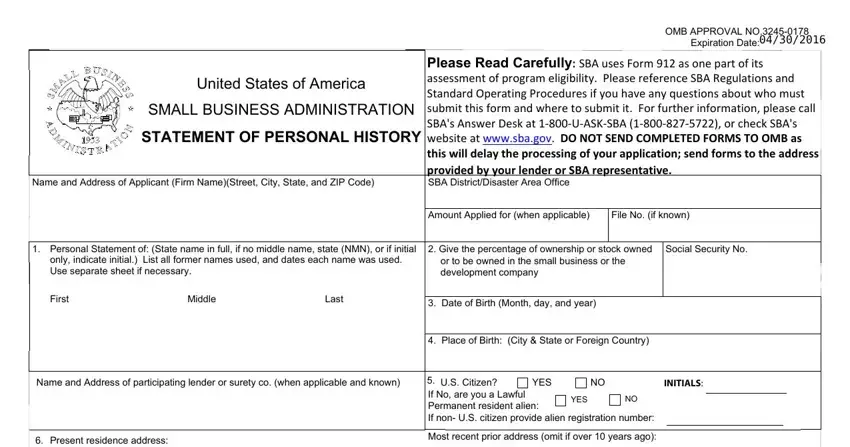

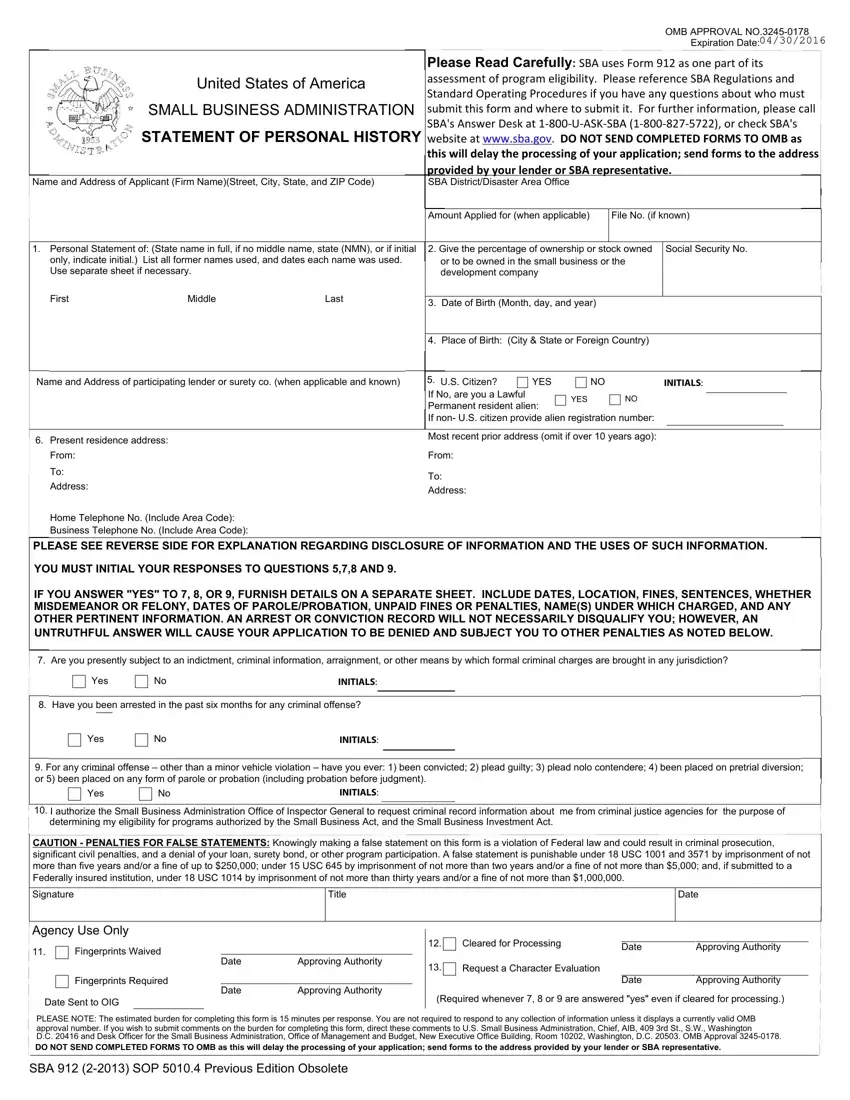

OMB APPROVAL NO.3245-0178

|

|

|

|

Expiration Date:04/30/2016 |

|

|

|

Please Read Carefully: SBA uses Form 912 as one part of its |

|

United States of America |

assessment of program eligibility. Please reference SBA Regulations and |

|

Standard Operating Procedures if you have any questions about who must |

|

SMALL BUSINESS ADMINISTRATION |

|

submit this form and where to submit it. For further information, please call |

|

|

|

SBA's Answer Desk at 1-800-U-ASK-SBA (1-800-827-5722), or check SBA's |

|

STATEMENT OF PERSONAL HISTORY website at www.sba.gov. DO NOT SEND COMPLETED FORMS TO OMB as |

|

|

|

this will delay the processing of your application; send forms to the address |

|

|

|

provided by your lender or SBA representative. |

Name and Address of Applicant (Firm Name)(Street, City, State, and ZIP Code) |

SBA District/Disaster Area Office |

|

|

|

|

Amount Applied for (when applicable) |

File No. (if known) |

1. Personal Statement of: (State name in full, if no middle name, state (NMN), or if initial |

2. Give the percentage of ownership or stock owned Social Security No. |

only, indicate initial.) |

List all former names used, and dates each name was used. |

or to be owned in the small business or the |

Use separate sheet if necessary. |

|

development company |

|

First |

Middle |

Last |

3. Date of Birth (Month, day, and year) |

|

|

|

|

|

|

|

|

4. Place of Birth: (City & State or Foreign Country) |

Name and Address of participating lender or surety co. (when applicable and known)

6.Present residence address: From:

To:

Address:

Home Telephone No. (Include Area Code): Business Telephone No. (Include Area Code):

|

5. U.S. Citizen? |

YES |

NO |

INITIALS: |

|

If No, are you a Lawful |

|

YES |

NO |

|

Permanent resident alien: |

|

|

|

If non- U.S. citizen provide alien registration number:

Most recent prior address (omit if over 10 years ago): From:

To:

Address:

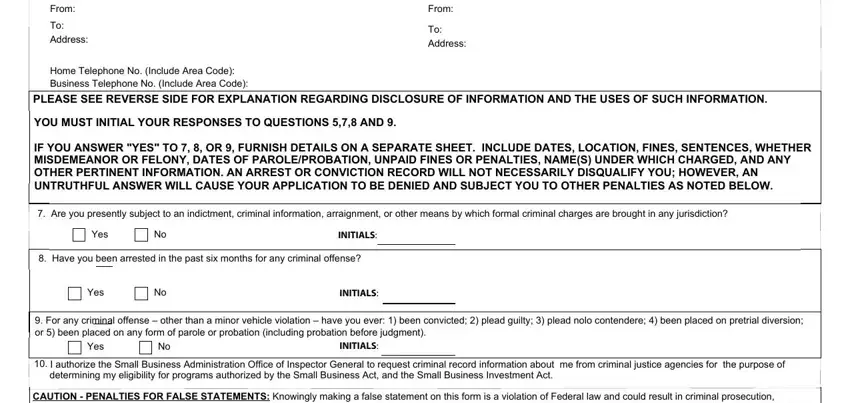

PLEASE SEE REVERSE SIDE FOR EXPLANATION REGARDING DISCLOSURE OF INFORMATION AND THE USES OF SUCH INFORMATION.

YOU MUST INITIAL YOUR RESPONSES TO QUESTIONS 5,7,8 AND 9.

IF YOU ANSWER "YES" TO 7, 8, OR 9, FURNISH DETAILS ON A SEPARATE SHEET. INCLUDE DATES, LOCATION, FINES, SENTENCES, WHETHER MISDEMEANOR OR FELONY, DATES OF PAROLE/PROBATION, UNPAID FINES OR PENALTIES, NAME(S) UNDER WHICH CHARGED, AND ANY OTHER PERTINENT INFORMATION. AN ARREST OR CONVICTION RECORD WILL NOT NECESSARILY DISQUALIFY YOU; HOWEVER, AN UNTRUTHFUL ANSWER WILL CAUSE YOUR APPLICATION TO BE DENIED AND SUBJECT YOU TO OTHER PENALTIES AS NOTED BELOW.

7. Are you presently subject to an indictment, criminal information, arraignment, or other means by which formal criminal charges are brought in any jurisdiction?

8. Have you been arrested in the past six months for any criminal offense?

9.For any criminal offense – other than a minor vehicle violation – have you ever: 1) been convicted; 2) plead guilty; 3) plead nolo contendere; 4) been placed on pretrial diversion; or 5) been placed on any form of parole or probation (including probation before judgment).

10.I authorize the Small Business Administration Office of Inspector General to request criminal record information about me from criminal justice agencies for the purpose of determining my eligibility for programs authorized by the Small Business Act, and the Small Business Investment Act.

CAUTION - PENALTIES FOR FALSE STATEMENTS: Knowingly making a false statement on this form is a violation of Federal law and could result in criminal prosecution, significant civil penalties, and a denial of your loan, surety bond, or other program participation. A false statement is punishable under 18 USC 1001 and 3571 by imprisonment of not more than five years and/or a fine of up to $250,000; under 15 USC 645 by imprisonment of not more than two years and/or a fine of not more than $5,000; and, if submitted to a Federally insured institution, under 18 USC 1014 by imprisonment of not more than thirty years and/or a fine of not more than $1,000,000.

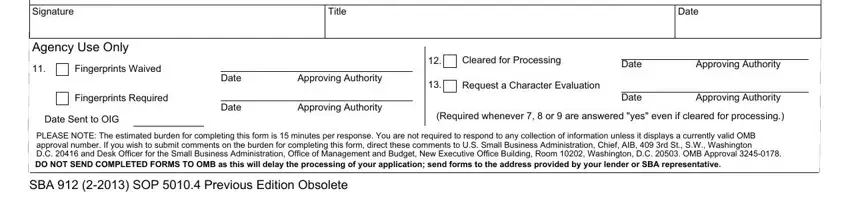

Agency Use Only

|

11. |

Fingerprints Waived |

|

|

|

Date |

Approving Authority |

|

|

|

|

|

Fingerprints Required |

|

|

|

|

Date |

Approving Authority |

|

|

|

Date Sent to OIG

|

12. |

Cleared for Processing |

|

|

|

|

Date |

Approving Authority |

|

|

|

|

13. |

Request a Character Evaluation |

|

|

|

|

|

|

Date |

|

Approving Authority |

(Required whenever 7, 8 or 9 are answered "yes" even if cleared for processing.)

PLEASE NOTE: The estimated burden for completing this form is 15 minutes per response. You are not required to respond to any collection of information unless it displays a currently valid OMB approval number. If you wish to submit comments on the burden for completing this form, direct these comments to U.S. Small Business Administration, Chief, AIB, 409 3rd St., S.W., Washington

D.C. 20416 and Desk Officer for the Small Business Administration, Office of Management and Budget, New Executive Office Building, Room 10202, Washington, D.C. 20503. OMB Approval 3245-0178.

DO NOT SEND COMPLETED FORMS TO OMB as this will delay the processing of your application; send forms to the address provided by your lender or SBA representative.

SBA 912 (2-2013) SOP 5010.4 Previous Edition Obsolete

NOTICES REQUIRED BY LAW

The following is a brief summary of the laws applicable to this solicitation of information.

Paperwork Reduction Act (44 U.S.C. Chapter 35)

SBA is collecting the information on this form to make a character and credit eligibility decision to fund or deny you a loan or other form of assistance. The information is required in order for SBA to have sufficient information to determine whether to provide you with the requested assistance. The information collected may be checked against criminal history indices of the Federal Bureau of Investigation.

Privacy Act (5 U.S.C. § 552a)

Any person can request to see or get copies of any personal information that SBA has in his or her file, when that file is retrieved by individual identifiers, such as name or social security numbers. Requests for information about another party may be denied unless SBA has the written permission of the individual to release the information to the requestor or unless the information is subject to disclosure under the Freedom of Information Act.

Under the provisions of the Privacy Act, you are not required to provide your social security number. Failure to provide your social security number may not affect any right, benefit or privilege to which you are entitled. Disclosures of name and other personal identifiers are, however, required for a benefit, as SBA requires an individual seeking assistance from SBA to provide it with sufficient information for it to make a character determination. In determining whether an individual is of good character, SBA considers the person's integrity, candor, and disposition toward criminal actions. In making loans pursuant to section 7(a)(6) the Small Business Act (the Act), 15 USC § 636 (a)(6), SBA is required to have reasonable assurance that the loan is of sound value and will be repaid or that it is in the best interest of the Government to grant the assistance requested. Additionally, SBA is specifically authorized to verify your criminal history, or lack thereof, pursuant to section 7(a)(1)(B), 15 USC § 636(a)(1)(B). Further, for all forms of assistance, SBA is authorized to make all investigations necessary to ensure that a person has not engaged in acts that violate or will violate the Act or the Small Business Investment Act,15 USC §§ 634(b)(11) and 687b(a). For these purposes, you are asked to voluntarily provide your social security number to assist SBA in making a character determination and to distinguish you from other individuals with the same or similar name or other personal identifier.

When the information collected on this form indicates a violation or potential violation of law, whether civil, criminal, or administrative in nature, SBA may refer it to the appropriate agency, whether Federal, State, local, or foreign, charged with responsibility for or otherwise involved in investigation, prosecution, enforcement or prevention of such violations. See 74 Fed. Reg. 14890 (2009) for other published routine uses.