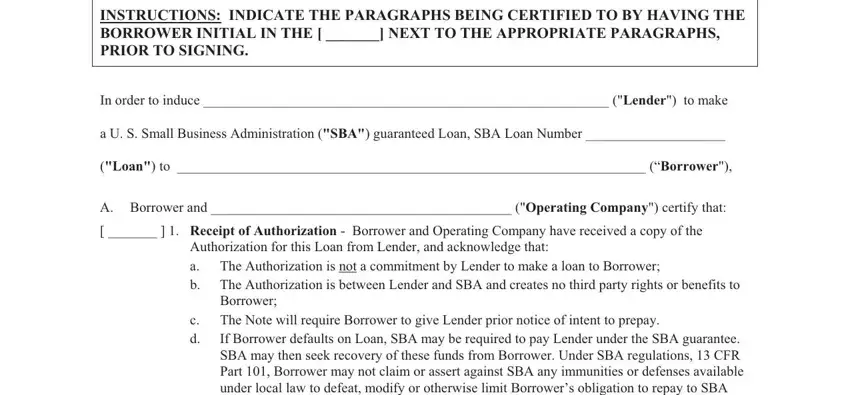

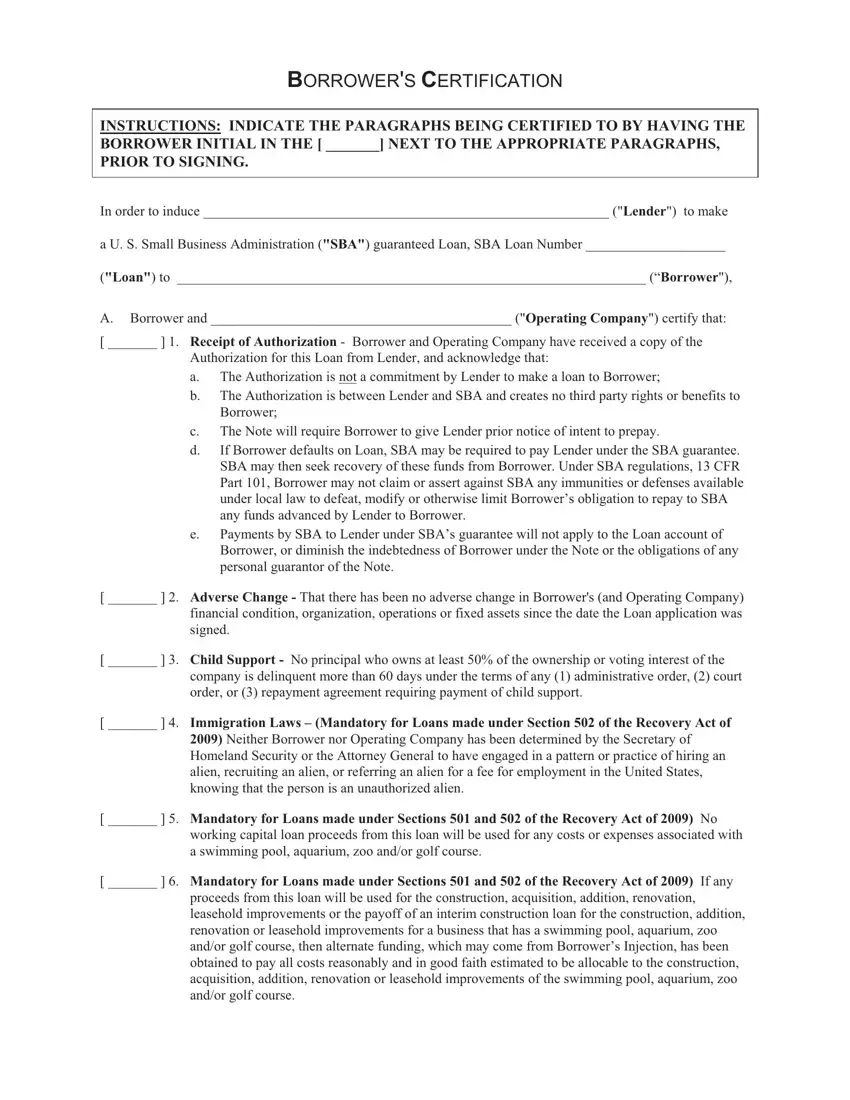

BORROWER'S CERTIFICATION

INSTRUCTIONS: INDICATE THE PARAGRAPHS BEING CERTIFIED TO BY HAVING THE BORROWER INITIAL IN THE [ _______] NEXT TO THE APPROPRIATE PARAGRAPHS,

PRIOR TO SIGNING.

In order to induce __________________________________________________________ ("Lender") to make

a U. S. Small Business Administration ("SBA") guaranteed Loan, SBA Loan Number ____________________

("Loan") to ___________________________________________________________________ (“Borrower"),

A.Borrower and ___________________________________________ ("Operating Company") certify that:

[ _______ ] 1. Receipt of Authorization - Borrower and Operating Company have received a copy of the

Authorization for this Loan from Lender, and acknowledge that:

a.The Authorization is not a commitment by Lender to make a loan to Borrower;

b.The Authorization is between Lender and SBA and creates no third party rights or benefits to Borrower;

c.The Note will require Borrower to give Lender prior notice of intent to prepay.

d.If Borrower defaults on Loan, SBA may be required to pay Lender under the SBA guarantee. SBA may then seek recovery of these funds from Borrower. Under SBA regulations, 13 CFR Part 101, Borrower may not claim or assert against SBA any immunities or defenses available under local law to defeat, modify or otherwise limit Borrower’s obligation to repay to SBA any funds advanced by Lender to Borrower.

e.Payments by SBA to Lender under SBA’s guarantee will not apply to the Loan account of Borrower, or diminish the indebtedness of Borrower under the Note or the obligations of any personal guarantor of the Note.

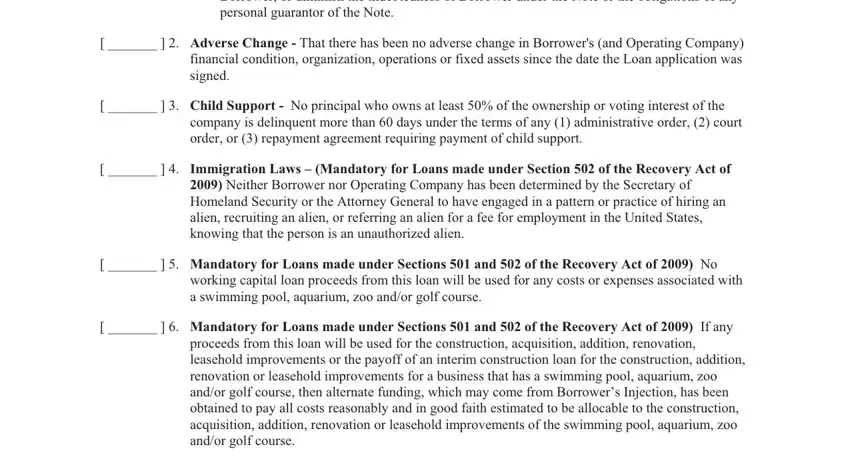

[ _______ ] 2. Adverse Change - That there has been no adverse change in Borrower's (and Operating Company)

financial condition, organization, operations or fixed assets since the date the Loan application was signed.

[ _______ ] 3. Child Support - No principal who owns at least 50% of the ownership or voting interest of the

company is delinquent more than 60 days under the terms of any (1) administrative order, (2) court order, or (3) repayment agreement requiring payment of child support.

[ _______ ] 4. Immigration Laws – (Mandatory for Loans made under Section 502 of the Recovery Act of

2009) Neither Borrower nor Operating Company has been determined by the Secretary of Homeland Security or the Attorney General to have engaged in a pattern or practice of hiring an alien, recruiting an alien, or referring an alien for a fee for employment in the United States, knowing that the person is an unauthorized alien.

[ _______ ] 5. Mandatory for Loans made under Sections 501 and 502 of the Recovery Act of 2009) No

working capital loan proceeds from this loan will be used for any costs or expenses associated with a swimming pool, aquarium, zoo and/or golf course.

[ _______ ] 6. Mandatory for Loans made under Sections 501 and 502 of the Recovery Act of 2009) If any

proceeds from this loan will be used for the construction, acquisition, addition, renovation, leasehold improvements or the payoff of an interim construction loan for the construction, addition, renovation or leasehold improvements for a business that has a swimming pool, aquarium, zoo and/or golf course, then alternate funding, which may come from Borrower’s Injection, has been obtained to pay all costs reasonably and in good faith estimated to be allocable to the construction, acquisition, addition, renovation or leasehold improvements of the swimming pool, aquarium, zoo and/or golf course.

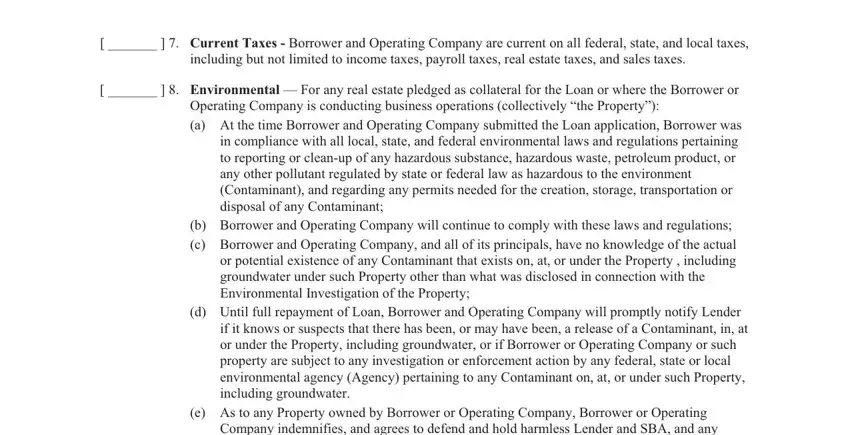

[ _______ ] 7. Current Taxes - Borrower and Operating Company are current on all federal, state, and local taxes,

including but not limited to income taxes, payroll taxes, real estate taxes, and sales taxes.

[ _______ ] 8. Environmental — For any real estate pledged as collateral for the Loan or where the Borrower or

Operating Company is conducting business operations (collectively “the Property”):

(a)At the time Borrower and Operating Company submitted the Loan application, Borrower was in compliance with all local, state, and federal environmental laws and regulations pertaining to reporting or clean-up of any hazardous substance, hazardous waste, petroleum product, or any other pollutant regulated by state or federal law as hazardous to the environment (Contaminant), and regarding any permits needed for the creation, storage, transportation or disposal of any Contaminant;

(b)Borrower and Operating Company will continue to comply with these laws and regulations;

(c)Borrower and Operating Company, and all of its principals, have no knowledge of the actual or potential existence of any Contaminant that exists on, at, or under the Property , including groundwater under such Property other than what was disclosed in connection with the Environmental Investigation of the Property;

(d)Until full repayment of Loan, Borrower and Operating Company will promptly notify Lender if it knows or suspects that there has been, or may have been, a release of a Contaminant, in, at or under the Property, including groundwater, or if Borrower or Operating Company or such property are subject to any investigation or enforcement action by any federal, state or local environmental agency (Agency) pertaining to any Contaminant on, at, or under such Property, including groundwater.

(e)As to any Property owned by Borrower or Operating Company, Borrower or Operating Company indemnifies, and agrees to defend and hold harmless Lender and SBA, and any assigns or successors in interest which take title to the Property, from and against all liabilities, damages, fees, penalties or losses arising out of any demand, claim or suit by any Agency or any other party relating to any Contaminant found on, at or under the Property, including groundwater, regardless of whether such Contaminant resulted from Borrower’s or Operating Company's operations. (Lender or SBA may require Borrower or Operating Company to execute a separate indemnification agreement).

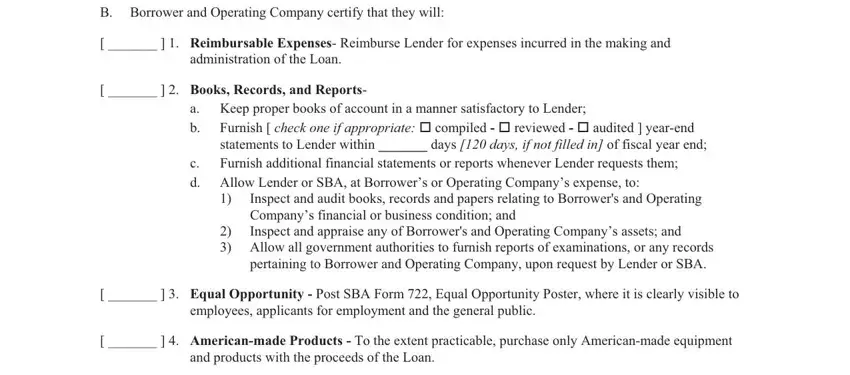

B.Borrower and Operating Company certify that they will:

[ _______ ] 1. Reimbursable Expenses- Reimburse Lender for expenses incurred in the making and

administration of the Loan.

[ _______ ] 2. Books, Records, and Reports-

a.Keep proper books of account in a manner satisfactory to Lender;

b.Furnish [ check one if appropriate: compiled - reviewed - audited ] year-end statements to Lender within _______ days [120 days, if not filled in] of fiscal year end;

c.Furnish additional financial statements or reports whenever Lender requests them;

d.Allow Lender or SBA, at Borrower’s or Operating Company’s expense, to:

1)Inspect and audit books, records and papers relating to Borrower's and Operating Company’s financial or business condition; and

2)Inspect and appraise any of Borrower's and Operating Company’s assets; and

3)Allow all government authorities to furnish reports of examinations, or any records pertaining to Borrower and Operating Company, upon request by Lender or SBA.

[ _______ ] 3. |

Equal Opportunity - Post SBA Form 722, Equal Opportunity Poster, where it is clearly visible to |

|

employees, applicants for employment and the general public. |

[ _______ ] 4. |

American-made Products - To the extent practicable, purchase only American-made equipment |

|

and products with the proceeds of the Loan. |

[ _______ ] 5. |

Taxes - Pay all federal, state, and local taxes, including income, payroll, real estate and sales taxes |

|

of the business when they come due. |

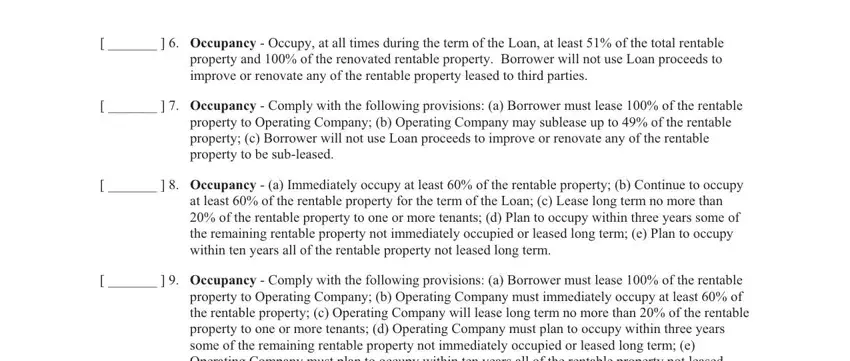

[ _______ ] 6. |

Occupancy - Occupy, at all times during the term of the Loan, at least 51% of the total rentable |

|

property and 100% of the renovated rentable property. Borrower will not use Loan proceeds to |

|

improve or renovate any of the rentable property leased to third parties. |

[ _______ ] 7. |

Occupancy - Comply with the following provisions: (a) Borrower must lease 100% of the rentable |

|

property to Operating Company; (b) Operating Company may sublease up to 49% of the rentable |

|

property; (c) Borrower will not use Loan proceeds to improve or renovate any of the rentable |

|

property to be sub-leased. |

[ _______ ] 8. |

Occupancy - (a) Immediately occupy at least 60% of the rentable property; (b) Continue to occupy |

|

at least 60% of the rentable property for the term of the Loan; (c) Lease long term no more than |

|

20% of the rentable property to one or more tenants; (d) Plan to occupy within three years some of |

|

the remaining rentable property not immediately occupied or leased long term; (e) Plan to occupy |

|

within ten years all of the rentable property not leased long term. |

[ _______ ] 9. |

Occupancy - Comply with the following provisions: (a) Borrower must lease 100% of the rentable |

|

property to Operating Company; (b) Operating Company must immediately occupy at least 60% of |

|

the rentable property; (c) Operating Company will lease long term no more than 20% of the rentable |

|

property to one or more tenants; (d) Operating Company must plan to occupy within three years |

|

some of the remaining rentable property not immediately occupied or leased long term; (e) |

|

Operating Company must plan to occupy within ten years all of the rentable property not leased |

|

long term. |

C.Borrower and Operating Company certify that they will not, without Lender’s prior written consent:

[ _______ ] 1. Distributions- Make any distribution of company assets that will adversely affect the financial

condition of Borrower and/or Operating Company.

[ _______ ] 2. Ownership Changes - Change the ownership structure or interests in the business during the term

of the Loan.

[ _______ ] 3. Transfer of Assets - Sell, lease, pledge, encumber (except by purchase money liens on property

acquired after the date of the Note), or otherwise dispose of any of Borrower’s property or assets, except in the ordinary course of business.

[ _______ ] 4. Fixed Asset Limitation - Acquire by purchase or lease agreement any fixed assets

(totaling more than $_____________ in any year).

[ _______ ] 5. Location Limitation - Acquire by purchase or by lease, any additional locations.

[ _______ ] 6. Limitation on Compensation - Allow total annual salaries, withdrawals or other forms of

remuneration to officers or owners of Borrower and Operating Company, and their immediate family members, to exceed $_____________.

[ _______ ] 7. _____________________________________________________________________________

_____________________________________________________________________________

_____________________________________________________________________________

_____________________________________________________________________________

_____________________________________________________________________________

_____________________________________________________________________________

_____________________________________________________________________________

_____________________________________________________________________________

_____________________________________________________________________________

_____________________________________________________________________________

_____________________________________________________________________________

______________________________________________ |

______________________________________________ |

(Borrower) |

Date |

(Operating Company) |

Date |

By:___________________________________________ |

By: ___________________________________________ |