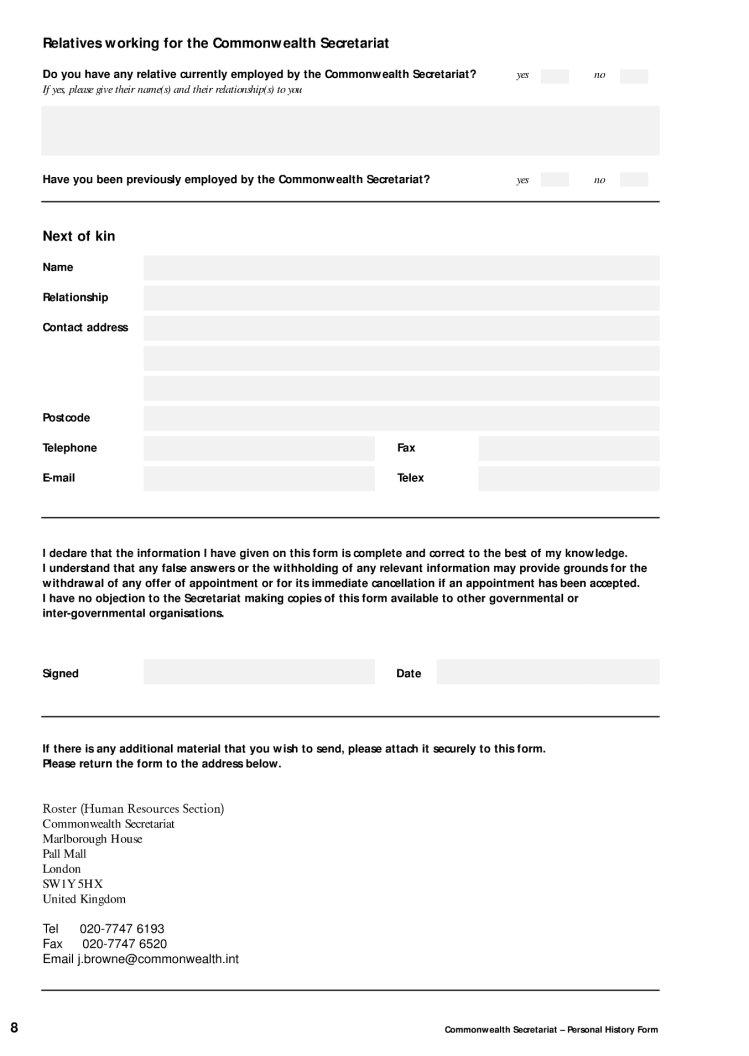

Embarking on the journey of small business ownership is a significant endeavor, laden with potential legal and financial implications. Central to navigating this complex landscape is the Small Business Administration (SBA) form, a document that plays a pivotal role in the life of aspiring entrepreneurs and established business owners alike. This form is instrumental in accessing a myriad of SBA programs, including business loans, disaster assistance, and contracting opportunities. It serves not only as a key to unlocking vital resources but also as a step towards ensuring compliance with the requisite regulatory frameworks. The SBA form encapsulates essential information about the business and its principals, facilitating a comprehensive evaluation by the SBA and other lending institutions. Understanding its components, eligibility criteria, and the submission process is crucial for those seeking to leverage SBA offerings to fuel their business ambitions. Moreover, the nuances of this form underscore the importance of meticulous attention to detail and the need for accuracy in depicting the business's financial health and operational strategy, laying a foundation for a successful partnership with the SBA.

| Question | Answer |

|---|---|

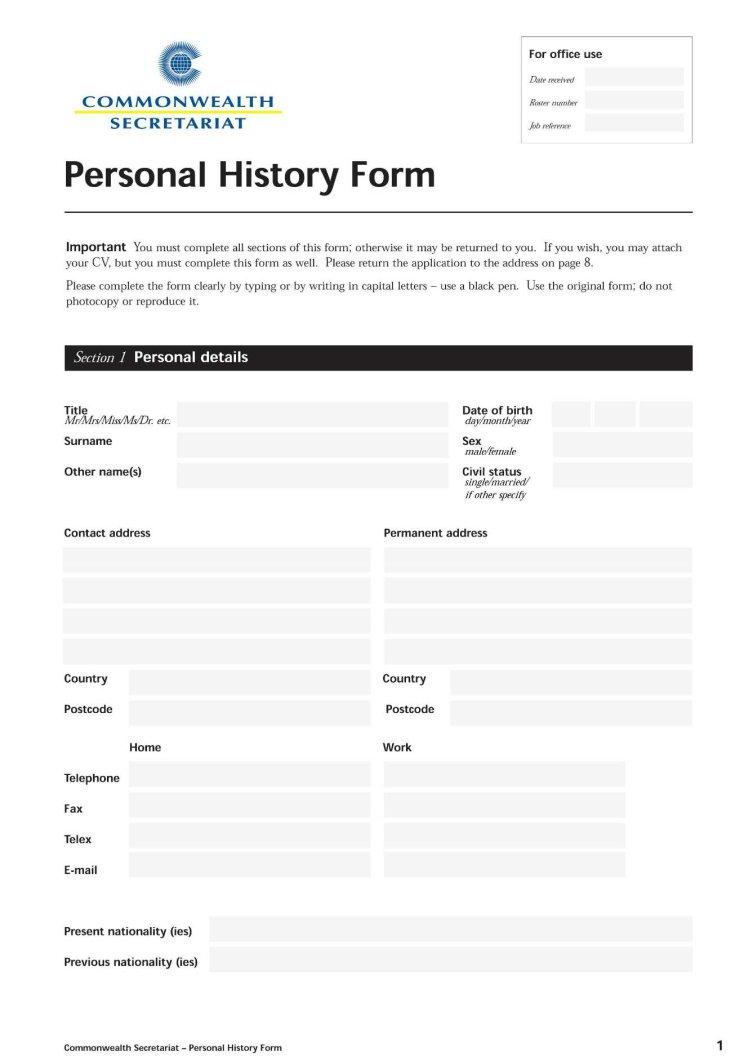

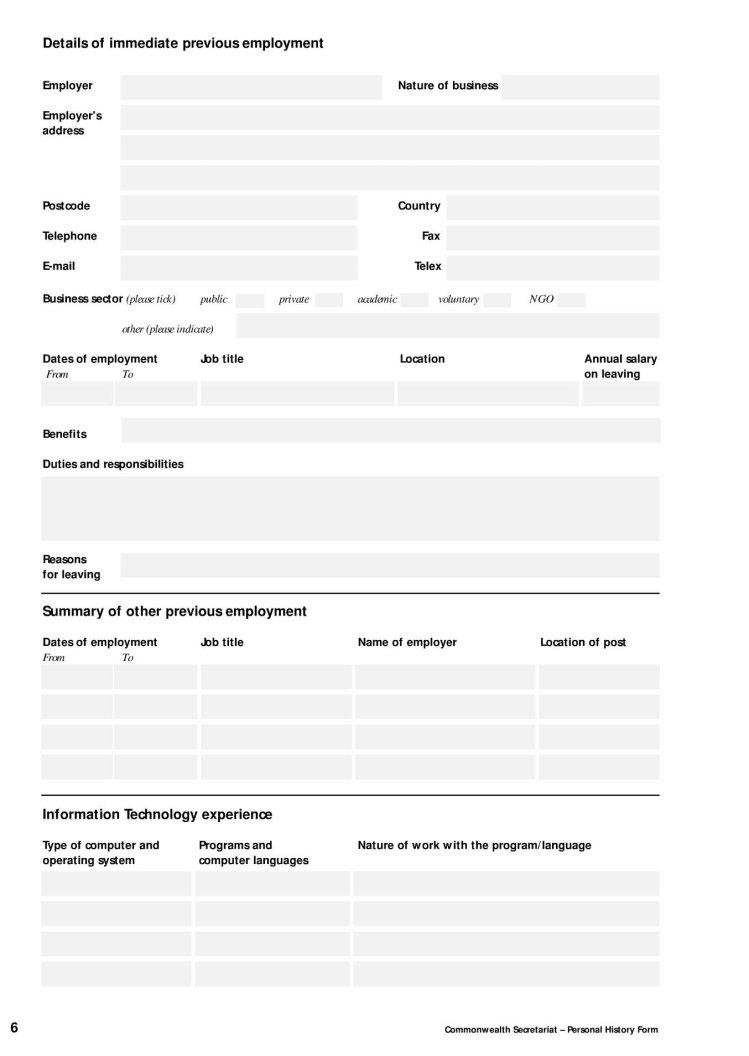

| Form Name | Sba Form 1912 |

| Form Length | 8 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min |

| Other names | specialisation, specialisations, shortlist, SW1Y |