sba form 1920 sx can be filled in online without difficulty. Simply use FormsPal PDF editor to do the job right away. Our tool is constantly developing to deliver the best user experience attainable, and that's due to our dedication to continuous development and listening closely to testimonials. This is what you'll need to do to get started:

Step 1: First of all, access the pdf editor by pressing the "Get Form Button" above on this site.

Step 2: When you access the PDF editor, you will see the form all set to be filled in. Besides filling out various blank fields, you may as well do many other actions with the form, such as writing any text, editing the original text, adding illustrations or photos, affixing your signature to the document, and more.

This PDF doc will involve some specific information; to guarantee correctness, you should take note of the subsequent recommendations:

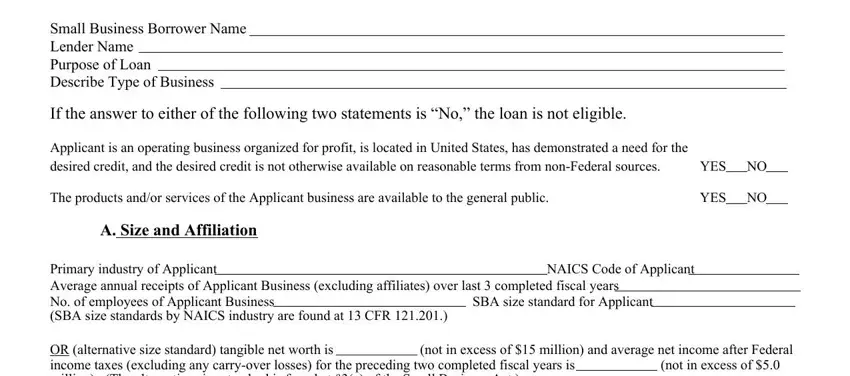

1. You have to fill out the sba form 1920 sx properly, hence take care when working with the parts comprising these blank fields:

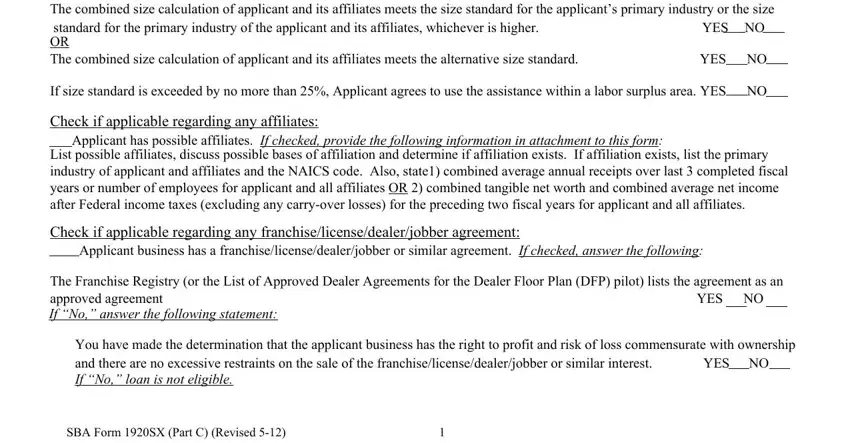

2. Your next part is usually to fill in these particular blank fields: The combined size calculation of, YES, If size standard is exceeded by no, Check if applicable regarding any, Applicant has possible affiliates, List possible affiliates discuss, Check if applicable regarding any, Applicant business has a, The Franchise Registry or the List, YES, You have made the determination, YES NO, and SBA Form SX Part C Revised.

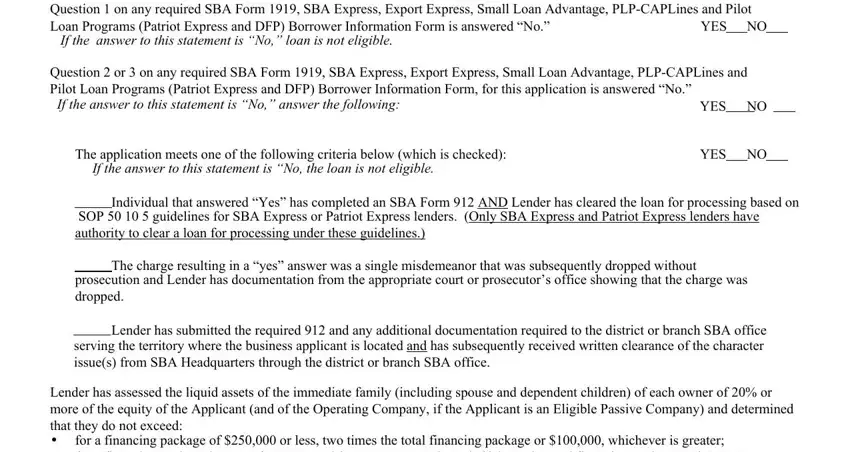

3. The third stage is generally hassle-free - fill out all the empty fields in Question on any required SBA Form, YES NO, YES, The application meets one of the, YES, Individual that answered Yes has, SOP guidelines for SBA Express, The charge resulting in a yes, prosecution and Lender has, Lender has submitted the required, Lender has assessed the liquid, and for a financing package of or in order to complete this part.

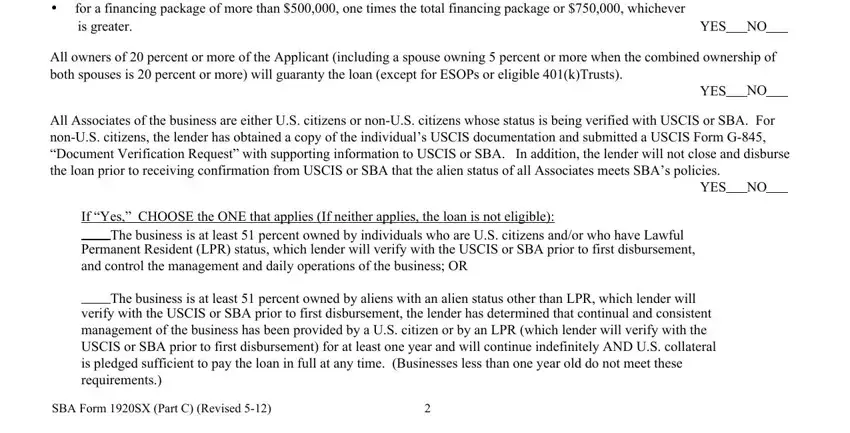

4. This next section requires some additional information. Ensure you complete all the necessary fields - for a financing package of or, is greater, YES, All owners of percent or more of, YES, All Associates of the business are, The business is at least percent, If Yes CHOOSE the ONE that applies, The business is at least percent, verify with the USCIS or SBA prior, and SBA Form SX Part C Revised - to proceed further in your process!

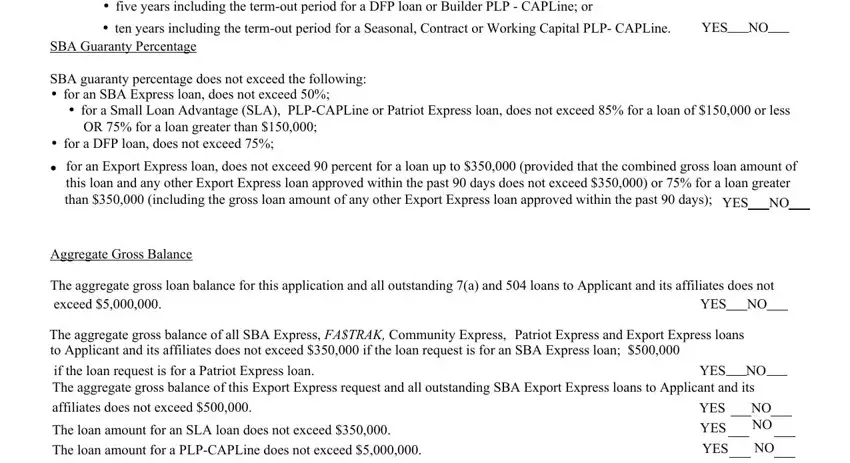

5. Because you draw near to the last parts of this document, there are a few extra requirements that need to be fulfilled. Particularly, seven years including the termout, YES, SBA Guaranty Percentage, SBA guaranty percentage does not, OR for a loan greater than, for a DFP loan does not exceed, YES, Aggregate Gross Balance, The aggregate gross loan balance, YES, The aggregate gross balance of all, if the loan request is for a, YES, affiliates does not exceed, and The loan amount for an SLA loan should be done.

Be extremely mindful while filling in YES and YES, as this is the section where a lot of people make a few mistakes.

Step 3: Right after you have reviewed the information provided, press "Done" to conclude your document creation. Try a 7-day free trial account with us and get immediate access to sba form 1920 sx - downloadable, emailable, and editable from your personal account. Here at FormsPal.com, we do our utmost to ensure that all of your information is kept secure.