U.S. Small Business Administration

CDC CERTIFICATION

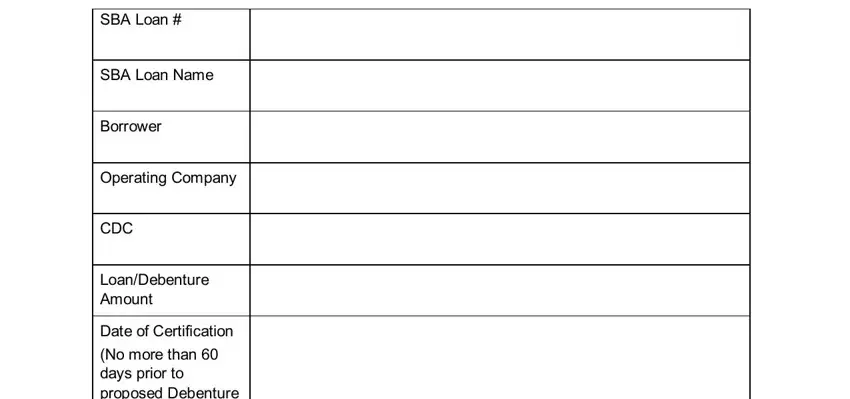

SBA Loan #

SBA Loan Name

Borrower

Operating Company

CDC

Loan/Debenture

Amount

Date of Certification

(No more than 60 days prior to proposed Debenture funding)

To induce the U.S. Small Business Administration (SBA) to guarantee payment of a debenture to be issued by the Certified Development Company (CDC), the proceeds of which the CDC will use to fund a 504 Loan (Loan) to the Borrower and/or Operating Company, CDC certifies, to the best of its knowledge after diligent inquiry, that:

1.CDC has obtained and will retain originals or copies of all evidence required by the Authorization for Debenture Guarantee (Authorization).

2.CDC has obtained all necessary agreements and certifications set forth in the Authorization, which have been properly completed, and executed without modification, including but not limited to: the original Third Party Lender Agreement (SBA Form 2287) between CDC and

__________(Third Party Lender) dated ________ wherein the Third Party Lender agrees to provide term financing in the amount of $ ________ with a term of ______ years secured by a lien on real estate located at___________ and personal property (if any) located at _______, which has been properly completed, executed and recorded, if appropriate; and the original,

SBA Form 2101 (4-2013) Previous editions obsolete |

1 |

executed Interim Lender Certification between CDC and __________(Interim Lender) dated

_____ wherein Interim Lender certifies that it has provided financing to the Borrower in the

amount of $_______(SBA Form 2288) and that Interim Lender has no knowledge of any

unremedied adverse change in the condition of the Borrower and Operating Company, if any, since the date of the loan application to the Interim Lender.

3.All Project costs have been paid in full, or, in the case of an escrow closing, all requirements of the Authorization relating to escrow closing have been fully satisfied. Interim Lender, Third Party Lender, Borrower and CDC have contributed to the Project in the amounts and manner authorized by SBA. Actual project costs are accurately reflected on the Servicing Agent Agreement, which is consistent with the Authorization, including any amendments to the Authorization.

4.The amount of the Debenture stated above is correct and is consistent with the terms of the Authorization, including any amendments to the Authorization.

5.The disbursement deadline of the Authorization, including any extensions, will not expire prior to the funding date selected for the Debenture.

6.CDC has caused the Borrower and Operating Company, if any, to execute the Borrower and Operating Company Certification (Form 2289) without modification, certifying that there has been no unremedied adverse change in the financial condition of the Borrower and Operating Company, if any, including their ability to repay the Project financing, including the Note.

7.Since the date of Borrower’s application to CDC for this loan, there has been no:

a.Unremedied substantial adverse change in the financial condition of Borrower or Operating Company;

b.Change in the ownership of Borrower or Operating Company (including the number and identity of the owners or their percentage of ownership), unless approved by SBA in writing;

c.Change in the form of business organization of the Borrower or Operating Company, unless approved by SBA in writing; and

d.Change in the operation or assets of Borrower and/or Operating Company, including the type of business or affiliation with other businesses, which would render it ineligible for SBA assistance.

8.The requirements of the Authorization regarding environmental laws, regulations and investigation have been fully satisfied.

9.The Project has been completed substantially in accordance with the plans and specifications which formed the basis for the appraisal used in the application.

10.Borrower or Operating Company currently occupies, or with the prior approval of SBA, will occupy within a reasonable period of time, the percentage of the Project required by the Authorization.

11.The requirements of the Authorization regarding flood insurance have been fully satisfied.

SBA Form 2101 (4-2013) Previous editions obsolete |

2 |

12.Hazard insurance on collateral and any liability insurance are paid for and in effect, as required by the Authorization. The hazard insurance is in the amount of full replacement cost, or if that is not available, the maximum insurable value of the property. The insurance contains a mortgagee clause (or substantial equivalent) for real property or Lender’s Loss Payable Clause for personal property which provides that any action or failure to act by the mortgagor or owner of the insured property will not invalidate the interest of CDC and SBA. The insurance policy or an endorsement provides for at least 10 days’ notice to CDC/SBA prior to cancellation.

13.Any life insurance coverage has been obtained and paid for, remains in effect, and names SBA as assignee, as required by the Authorization.

14.Any new Project construction or addition conforms with the National Earthquake Hazards Reduction Program Recommended Provisions (NEHRP) for the Development of Seismic Regulations for New Buildings, or its equivalent.

15.CDC has verified the accuracy of the financial information submitted with the Loan application as required by the Authorization.

16.CDC has disclosed to SBA all material information known by CDC and necessary to ensure that this Certification is not misleading.

17.CDC has inquired of Borrower and disclosed in writing to SBA all bankruptcy or insolvency proceedings involving, or pending lawsuits against, Borrower, Operating Company or any of their principals.

18.CDC either has verified that Third Party Lender has performed the specific requirements for that lender’s Customer Identification Program (CIP), governed by the Joint Final Rule on CIP in 31 C.F.R. 103.121, or CDC has performed the requirements of CDC’s own CIP.

19.The 504 Debenture Closing Checklist is complete, and all documents listed on the Checklist have been completed in accordance with all 504 Loan Program Requirements.

20.If CDC is designated as a “Priority CDC,” CDC currently has in effect the insurance coverage required by SOP 50 10.

This certification is made with the knowledge, intent and understanding that SBA will rely upon it in proceeding with the sale of a Debenture to fund this Loan. CDC warrants and represents that all information above, and all information provided to SBA, including without limitation, all information regarding the Borrower’s and Operating Company’s, if any, financial condition, is accurate to the best of its knowledge and that it has not withheld any material information from SBA. CDC further warrants and represents that it is unaware of any information that would indicate that any information submitted by Third Party Lender, Interim Lender, Borrower or Operating Company, if any, is incorrect, or that Third Party Lender, Interim Lender, Borrower or Operating Company, if any, have withheld any material information from CDC. CDC acknowledges that submission of false information to SBA, or the withholding of material information from SBA, can result in criminal prosecution under 18 U.S.C. § 1001 and other provisions, liability for treble damages under the False Claims Act, 31 U.S.C. §§ 3729-3733, debarment and suspension, lender enforcement remedies under 13 C.F.R. Part 120, and other

SBA Form 2101 (4-2013) Previous editions obsolete |

3 |

consequences.

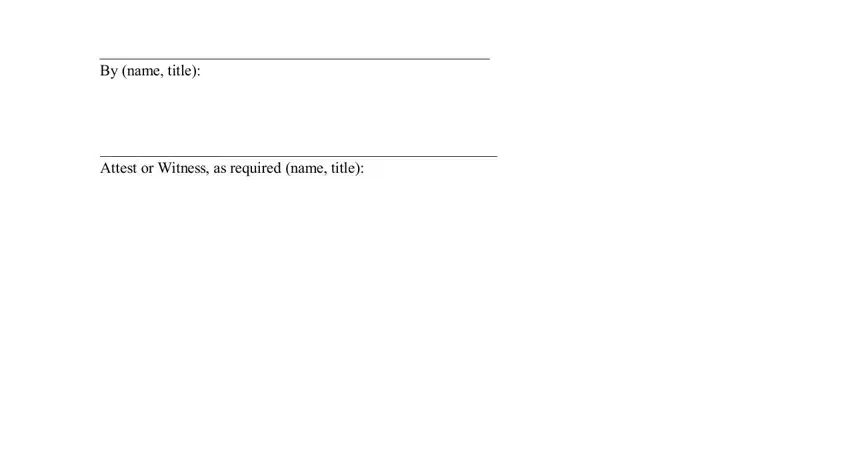

Certified Development Company (CDC) |

(Corporate Seal if required) |

___________________________________________________

By (name, title):

____________________________________________________

Attest or Witness, as required (name, title):

SBA Form 2101 (4-2013) Previous editions obsolete |

4 |