It is possible to fill in OMB instantly by using our online editor for PDFs. Our editor is consistently developing to give the best user experience achievable, and that is thanks to our dedication to continuous improvement and listening closely to feedback from users. Getting underway is effortless! All you need to do is take the next simple steps down below:

Step 1: Click on the orange "Get Form" button above. It'll open up our tool so you could begin filling in your form.

Step 2: Once you open the file editor, you will notice the document made ready to be filled out. Besides filling in various blanks, you may as well do various other things with the form, including adding any text, modifying the initial text, inserting illustrations or photos, affixing your signature to the PDF, and much more.

Concentrate when filling out this document. Ensure every blank field is filled in accurately.

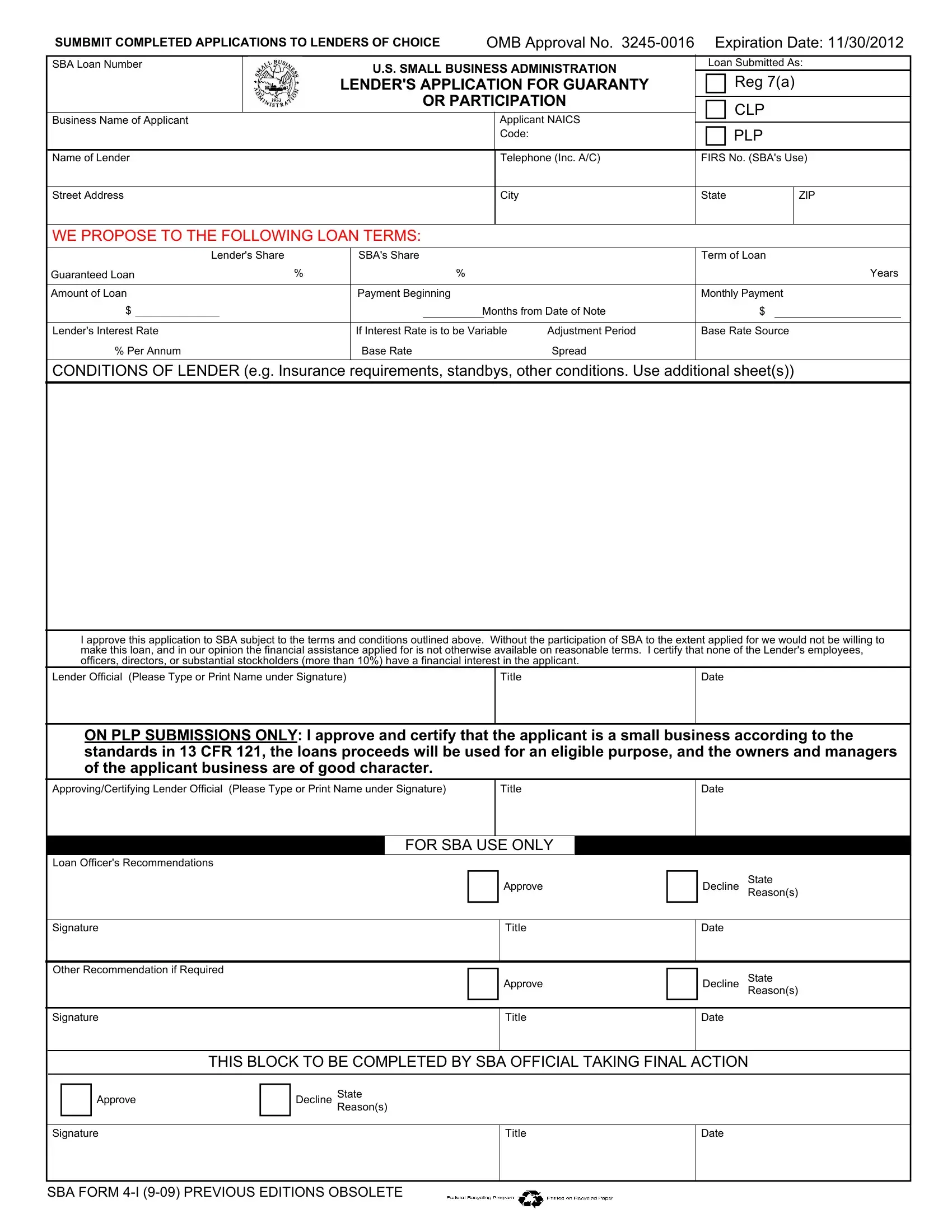

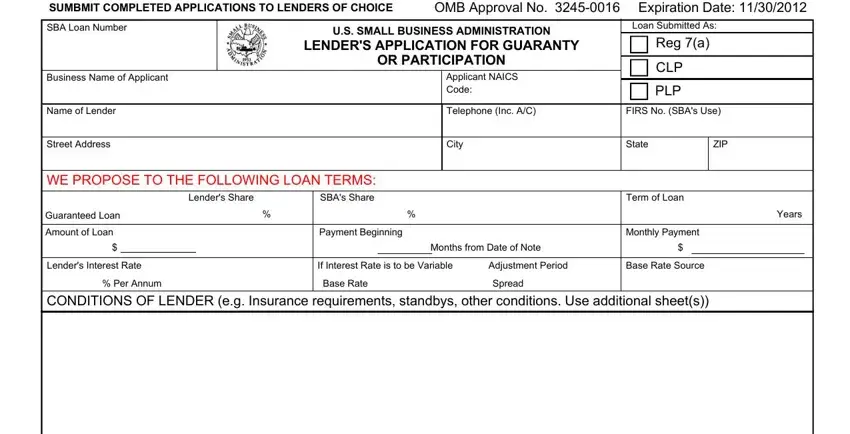

1. To start off, when completing the OMB, beging with the area that features the next blanks:

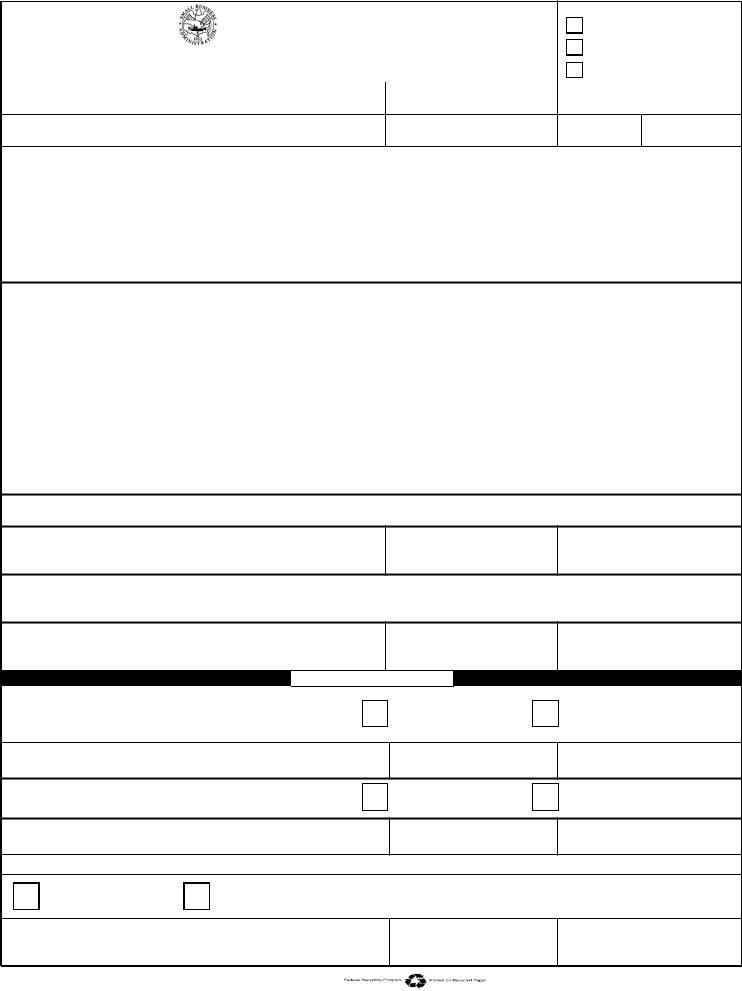

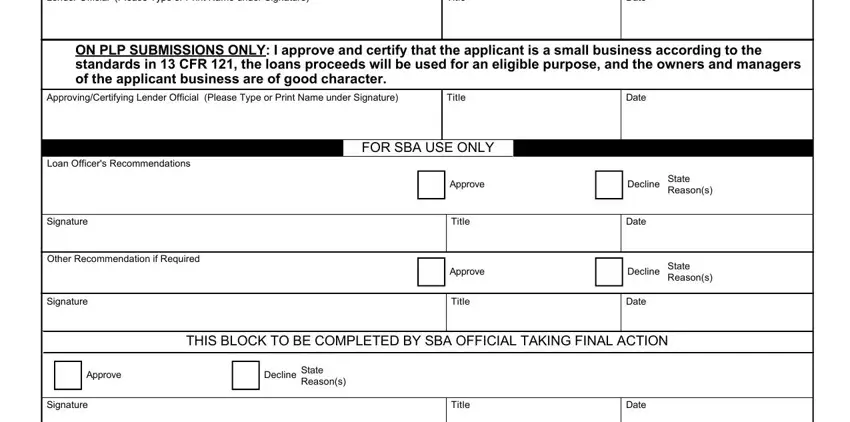

2. Your next stage would be to fill out the next few blanks: Lender Official Please Type or, Title, Date, ON PLP SUBMISSIONS ONLY I approve, ApprovingCertifying Lender, Title, Date, FOR SBA USE ONLY, Approve, Title, Approve, Title, Decline, State Reasons, and Date.

3. Through this step, look at SBA FORM I PREVIOUS EDITIONS. Each of these will have to be completed with utmost awareness of detail.

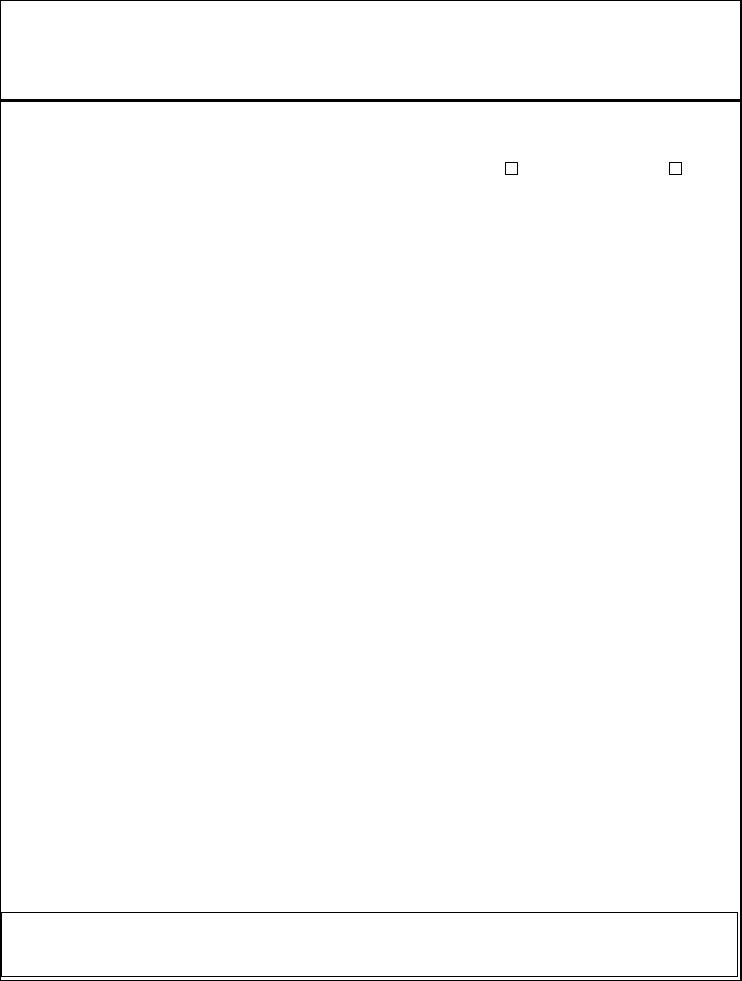

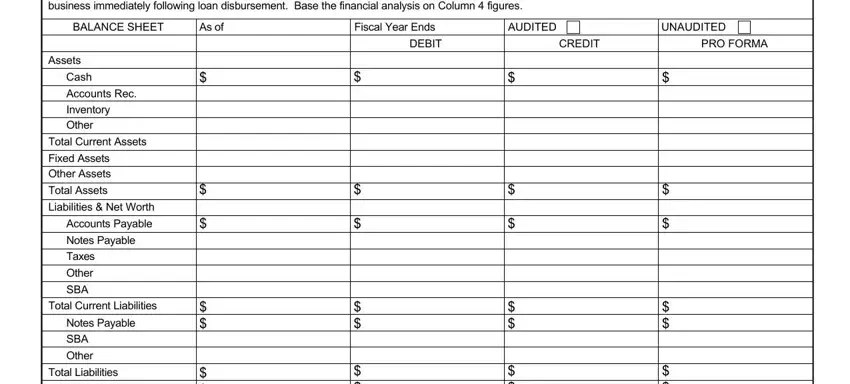

4. This next section requires some additional information. Ensure you complete all the necessary fields - In Column please show the most, BALANCE SHEET, As of, Fiscal Year Ends, AUDITED, UNAUDITED, DEBIT, CREDIT, PRO FORMA, Assets, Cash, Accounts Rec Inventory Other, Total Current Assets Fixed Assets, Total Current Liabilities, and Notes Payable SBA Other - to proceed further in your process!

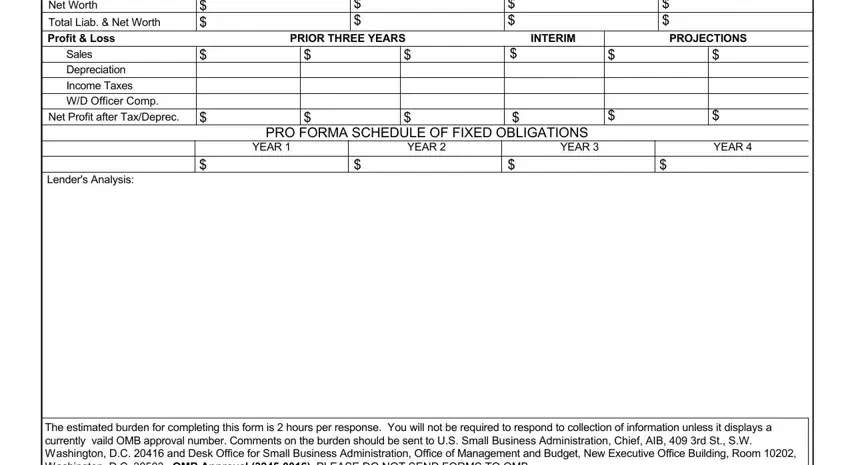

5. Last of all, this last portion is precisely what you should wrap up prior to using the document. The blank fields in question include the following: Net Worth, Total Liab Net Worth, Profit Loss, Sales Depreciation Income Taxes WD, Net Profit after TaxDeprec, Lenders Analysis, PRIOR THREE YEARS, INTERIM, PROJECTIONS, PRO FORMA SCHEDULE OF FIXED, YEAR, YEAR, YEAR, YEAR, and The estimated burden for.

It is easy to make an error while filling out your The estimated burden for, for that reason make sure that you look again prior to when you submit it.

Step 3: As soon as you have looked again at the details entered, click on "Done" to complete your form. Make a free trial plan at FormsPal and obtain direct access to OMB - downloadable, emailable, and editable from your FormsPal account page. When you use FormsPal, it is simple to complete forms without stressing about information breaches or data entries getting distributed. Our protected system ensures that your personal details are stored safely.