Only a few things are simpler than managing documentation making use of our PDF editor. There isn't much for you to do to modify the sba application lowdoc administration form file - just simply follow these steps in the next order:

Step 1: The initial step requires you to select the orange "Get Form Now" button.

Step 2: Once you have entered the sba application lowdoc administration form editing page you can discover all the options you may conduct concerning your template from the upper menu.

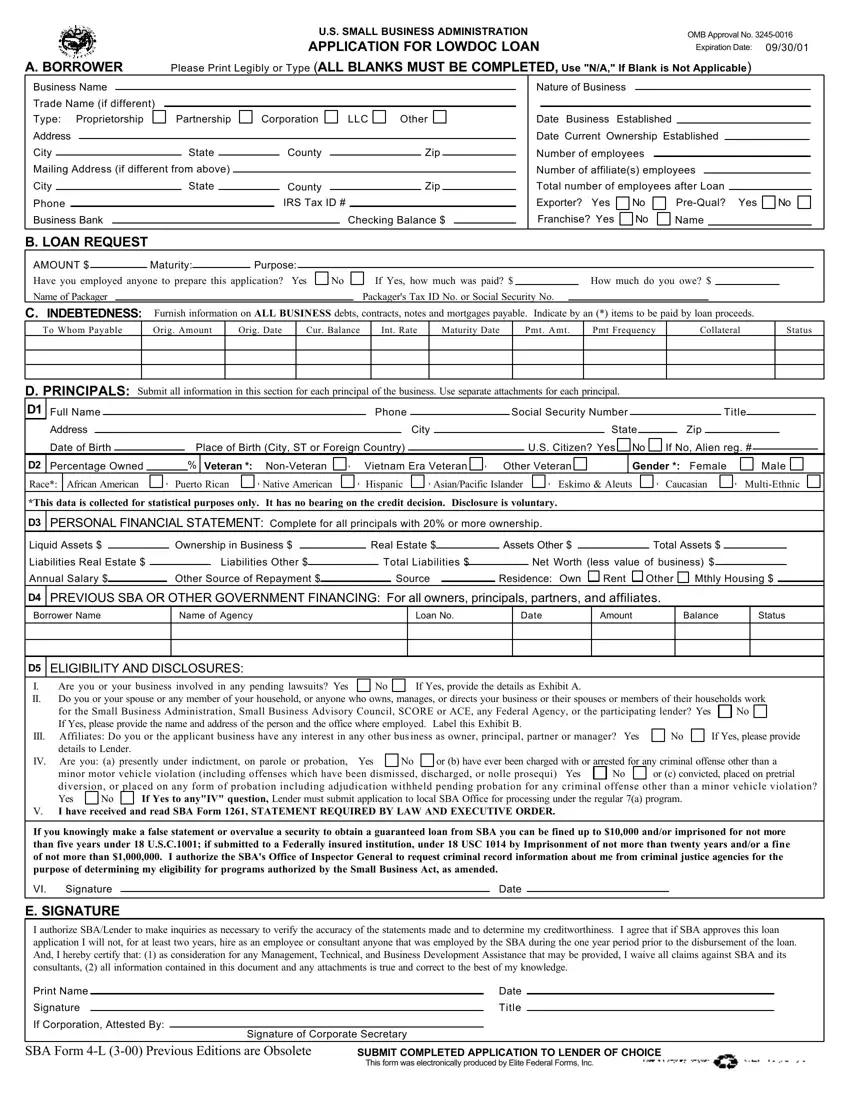

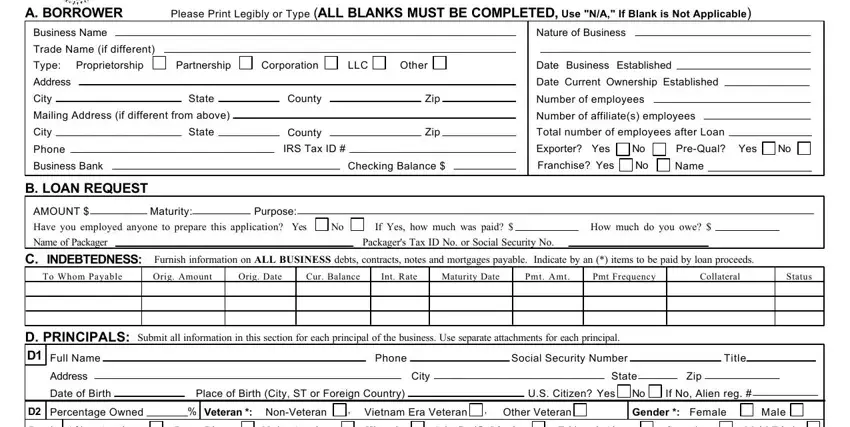

Prepare the sba application lowdoc administration form PDF by providing the details required for each section.

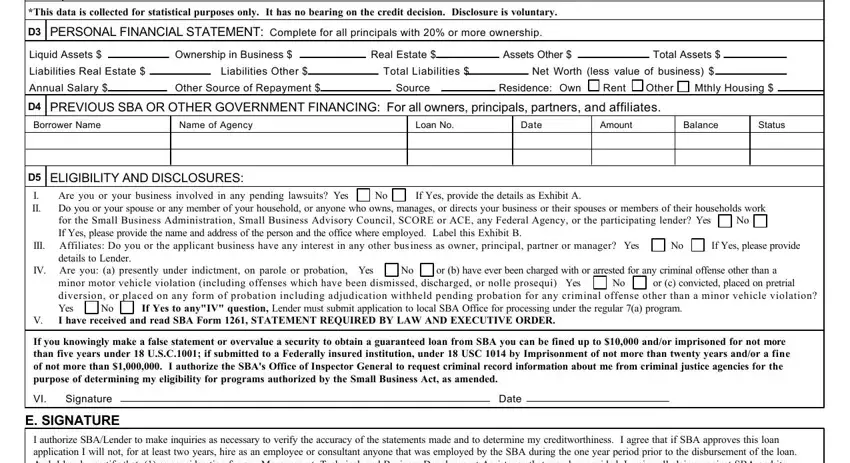

In the area This data is collected for, D PERSONAL FINANCIAL STATEMENT, Liquid Assets, Ownership in Business, Real Estate, Assets Other, Total Assets, Liabilities Real Estate, Liabilities Other, Total Liabilities, Net Worth less value of business, Annual Salary, Other Source of Repayment, Source, and Residence Own provide the particulars that the platform requests you to do.

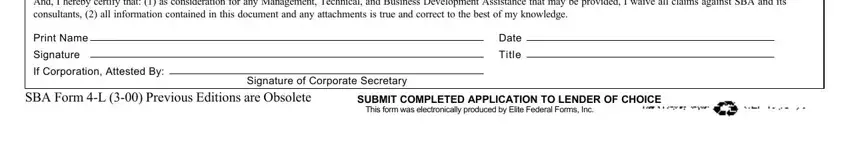

The system will request for more details as a way to automatically complete the area I authorize SBALender to make, Print Name, Signature, If Corporation Attested By, Signature of Corporate Secretary, Date, Title, SBA Form L Previous Editions are, SUBMIT COMPLETED APPLICATION TO, and This form was electronically.

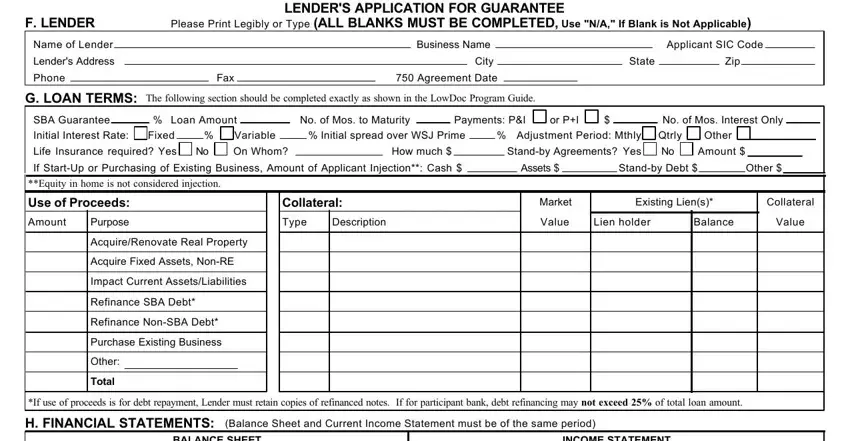

Through section F LENDER, Please Print Legibly or Type ALL, LENDERS APPLICATION FOR GUARANTEE, Name of Lender, Lenders Address, Phone, Fax, Business Name, City, Agreement Date, G LOAN TERMS The following section, Applicant SIC Code, State, Zip, and SBA Guarantee, state the rights and responsibilities.

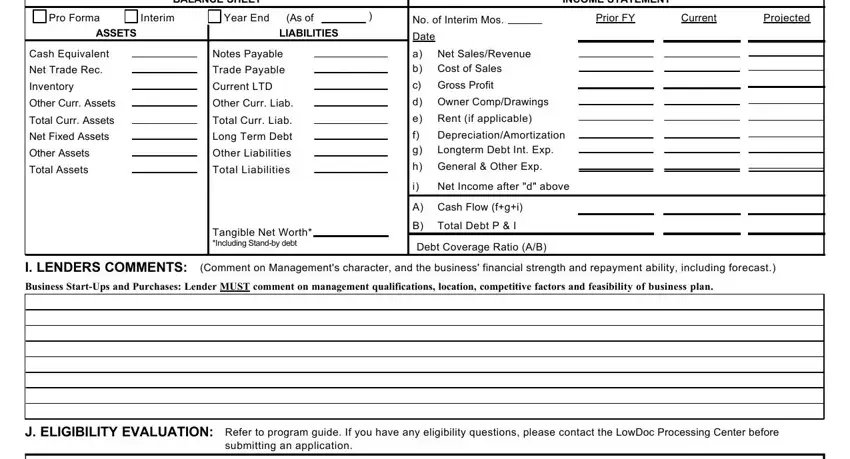

Finish by looking at these sections and filling them out accordingly: BALANCE SHEET, INCOME STATEMENT, Pro Forma, Interim, Year End, As of, No of Interim Mos, Prior FY, Current, Projected, ASSETS, LIABILITIES, Cash Equivalent, Net Trade Rec, and Inventory.

Step 3: As soon as you click the Done button, the completed document is easily transferable to all of your devices. Alternatively, you can easily send it by means of mail.

Step 4: It could be more convenient to maintain copies of your form. You can rest easy that we are not going to reveal or check out your particulars.