You could complete sba form 770 download easily with the help of our PDF editor online. To make our tool better and simpler to use, we constantly come up with new features, taking into consideration feedback from our users. All it takes is several basic steps:

Step 1: Open the PDF inside our tool by clicking on the "Get Form Button" above on this page.

Step 2: The editor will give you the ability to modify your PDF form in many different ways. Change it with any text, correct what's already in the file, and place in a signature - all close at hand!

This PDF will need particular information to be typed in, thus you need to take whatever time to fill in exactly what is asked:

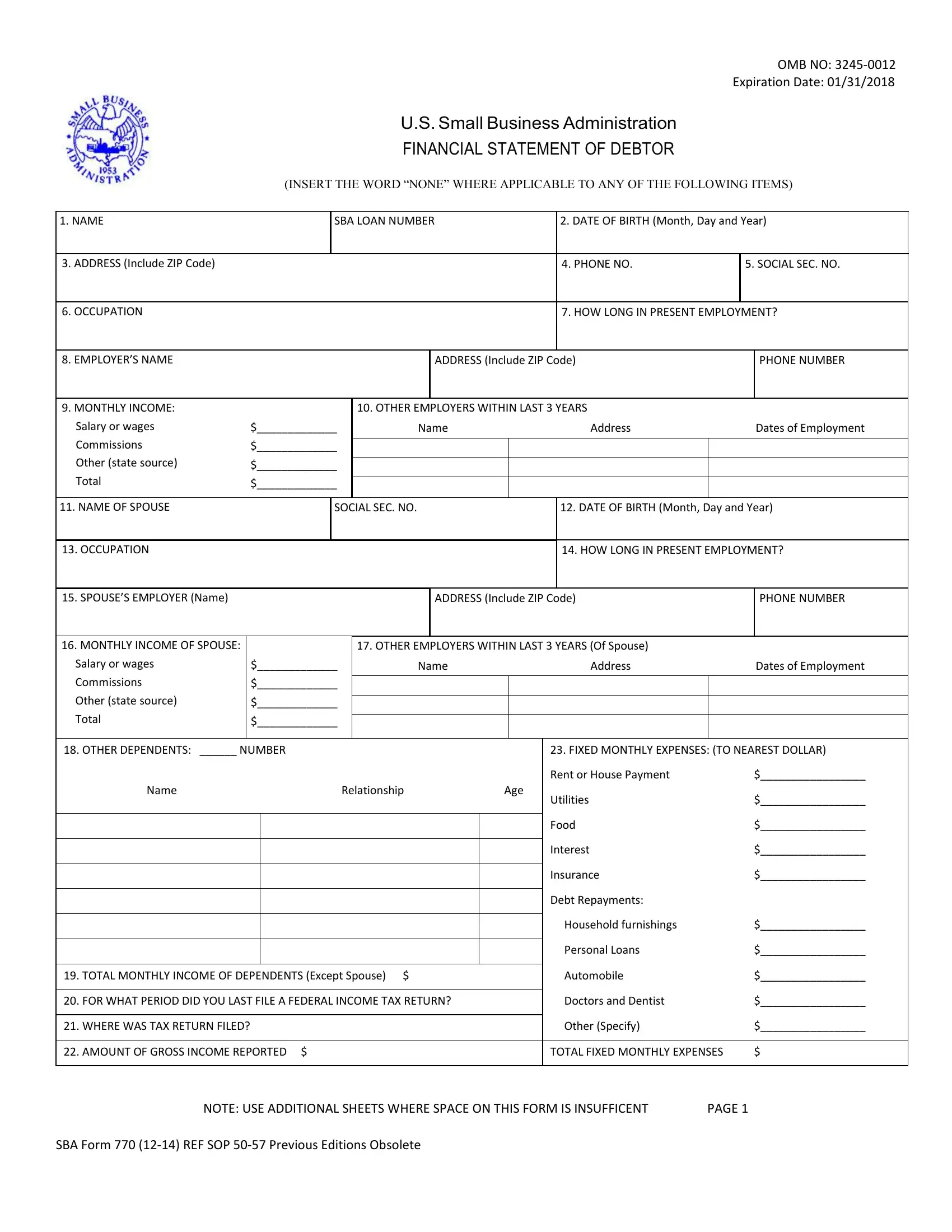

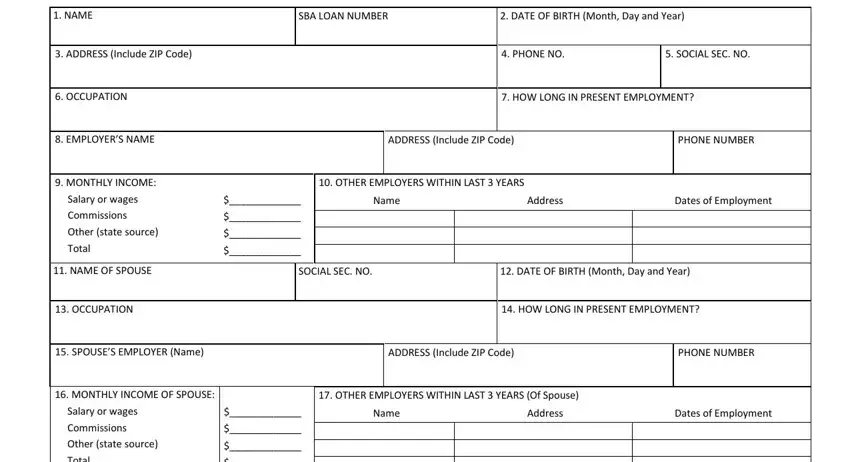

1. Whenever completing the sba form 770 download, make certain to incorporate all of the important fields in the corresponding part. This will help speed up the process, which allows your information to be handled promptly and properly.

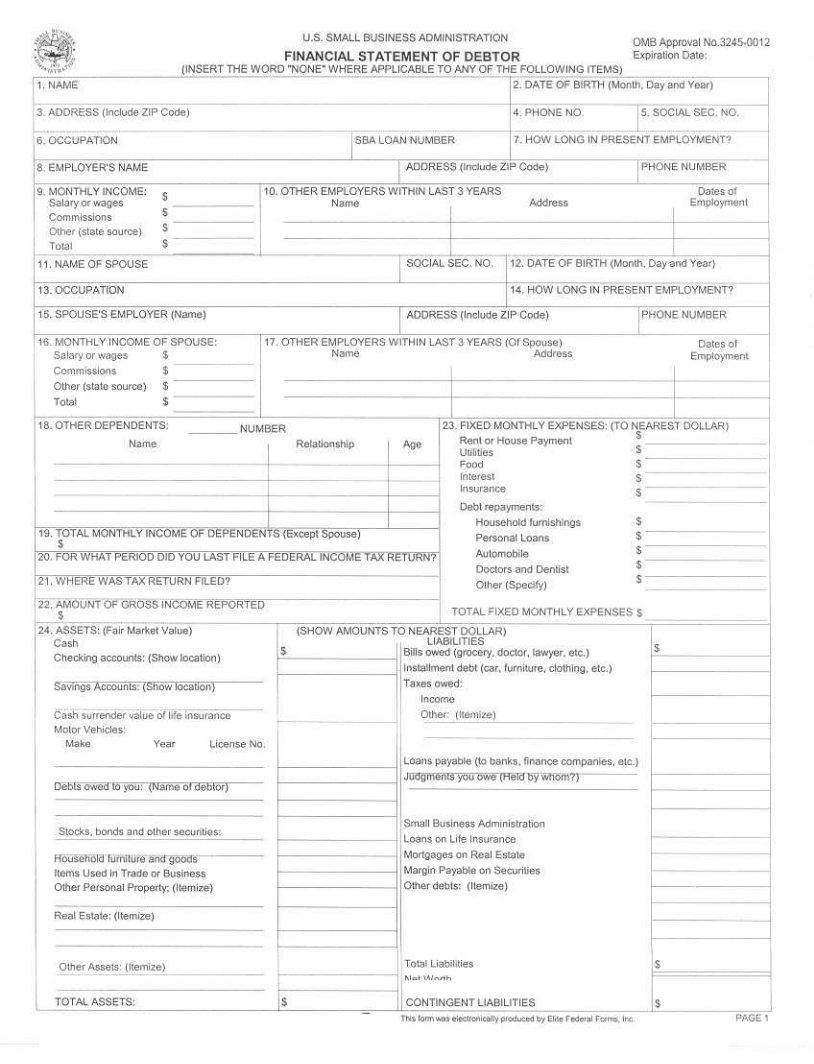

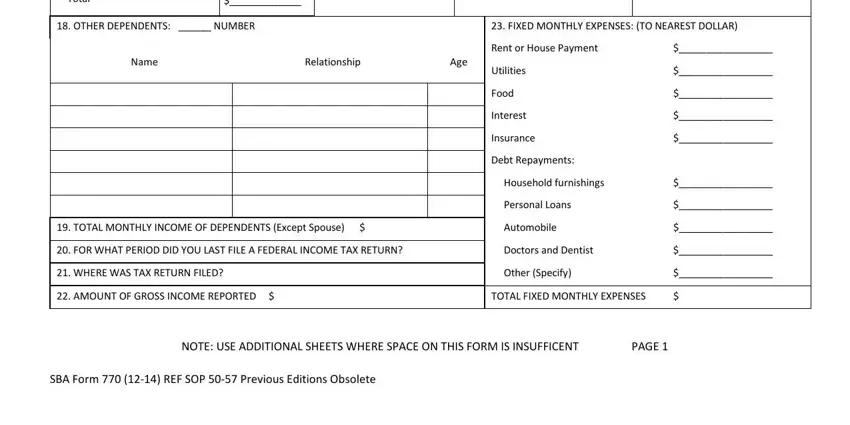

2. Once your current task is complete, take the next step – fill out all of these fields - Total, OTHER DEPENDENTS NUMBER, FIXED MONTHLY EXPENSES TO NEAREST, Name, Relationship, Age, TOTAL MONTHLY INCOME OF, FOR WHAT PERIOD DID YOU LAST FILE, WHERE WAS TAX RETURN FILED, AMOUNT OF GROSS INCOME REPORTED, Rent or House Payment, Utilities, Food, Interest, and Insurance with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

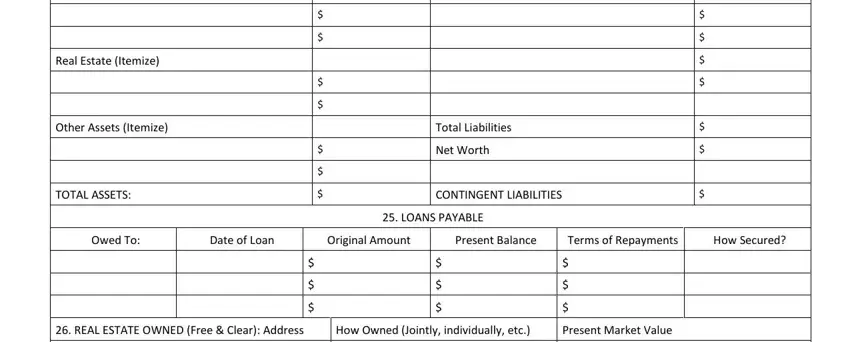

3. The following section is mostly about ASSETS Fair Market Value, LIABILITIES, Cash, Checking Accounts Show location, Savings Accounts Show location, Cash Surrender Value of Life, Motor Vehicles, Make Year License No, Debts owed to you Name of debtor, Stocks bonds and other securities, Household furniture and goods, Items Used in Trade or Business, Other Personal Property Itemize, Bills owed grocery doctor lawyer, and Installment debt car furniture - complete every one of these blank fields.

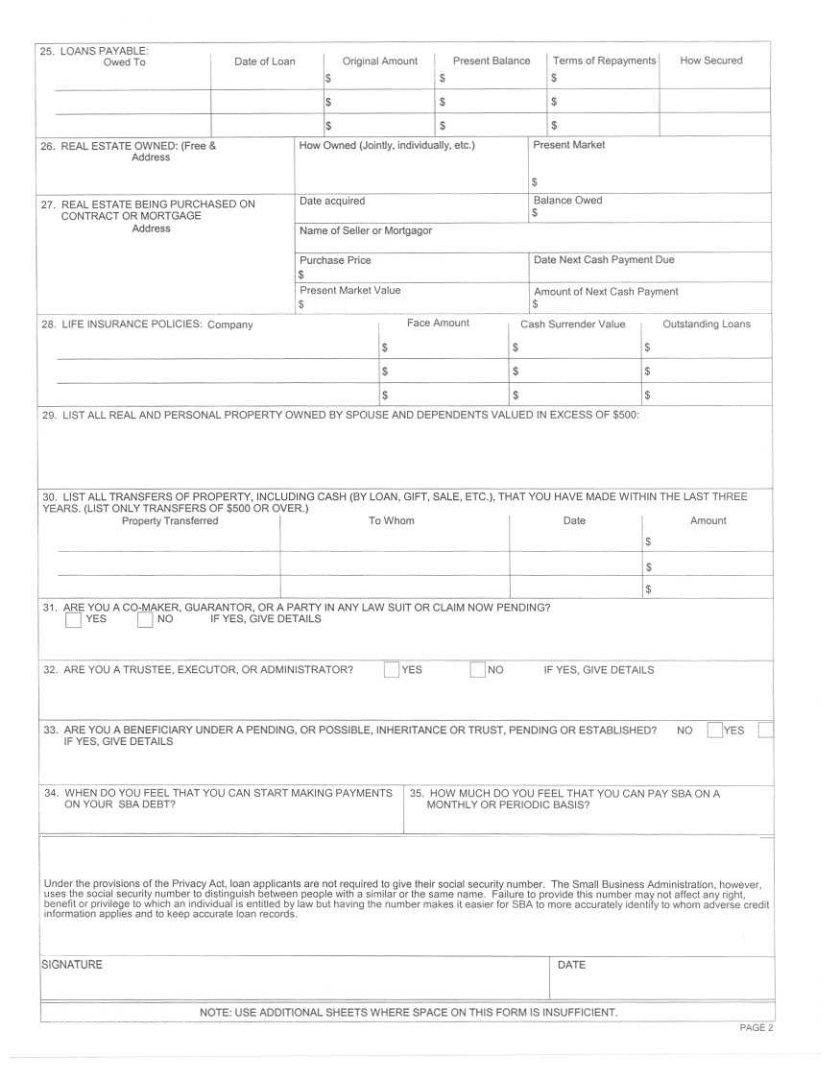

4. Completing Other Personal Property Itemize, Real Estate Itemize, Other Assets Itemize, TOTAL ASSETS, Total Liabilities, Net Worth, CONTINGENT LIABILITIES, LOANS PAYABLE, Owed To, Date of Loan, Original Amount, Present Balance, Terms of Repayments, How Secured, and REAL ESTATE OWNED Free Clear is crucial in this fourth step - ensure to don't rush and be mindful with each empty field!

It is possible to make an error when filling out your REAL ESTATE OWNED Free Clear, consequently be sure you go through it again prior to when you finalize the form.

5. To wrap up your document, the particular area incorporates a couple of additional fields. Filling in NOTE USE ADDITIONAL SHEETS WHERE, PAGE, and SBA Form REF SOP Previous should finalize everything and you will be done in a snap!

Step 3: Just after rereading your filled in blanks, press "Done" and you're good to go! Sign up with FormsPal now and immediately get sba form 770 download, prepared for download. Each edit you make is conveniently saved , which means you can change the document further as needed. Here at FormsPal, we do our utmost to be sure that all of your information is stored secure.