sbli beneficiary can be completed with ease. Simply make use of FormsPal PDF editor to get it done without delay. To keep our tool on the leading edge of practicality, we strive to adopt user-driven capabilities and improvements regularly. We are always looking for suggestions - join us in revolutionizing how you work with PDF files. Here's what you will need to do to begin:

Step 1: Access the form in our editor by pressing the "Get Form Button" above on this page.

Step 2: With the help of our state-of-the-art PDF editing tool, it is easy to do more than just complete blank fields. Edit away and make your docs appear faultless with customized text put in, or adjust the original input to excellence - all supported by the capability to incorporate your own images and sign it off.

Completing this form typically requires care for details. Ensure every blank is filled in accurately.

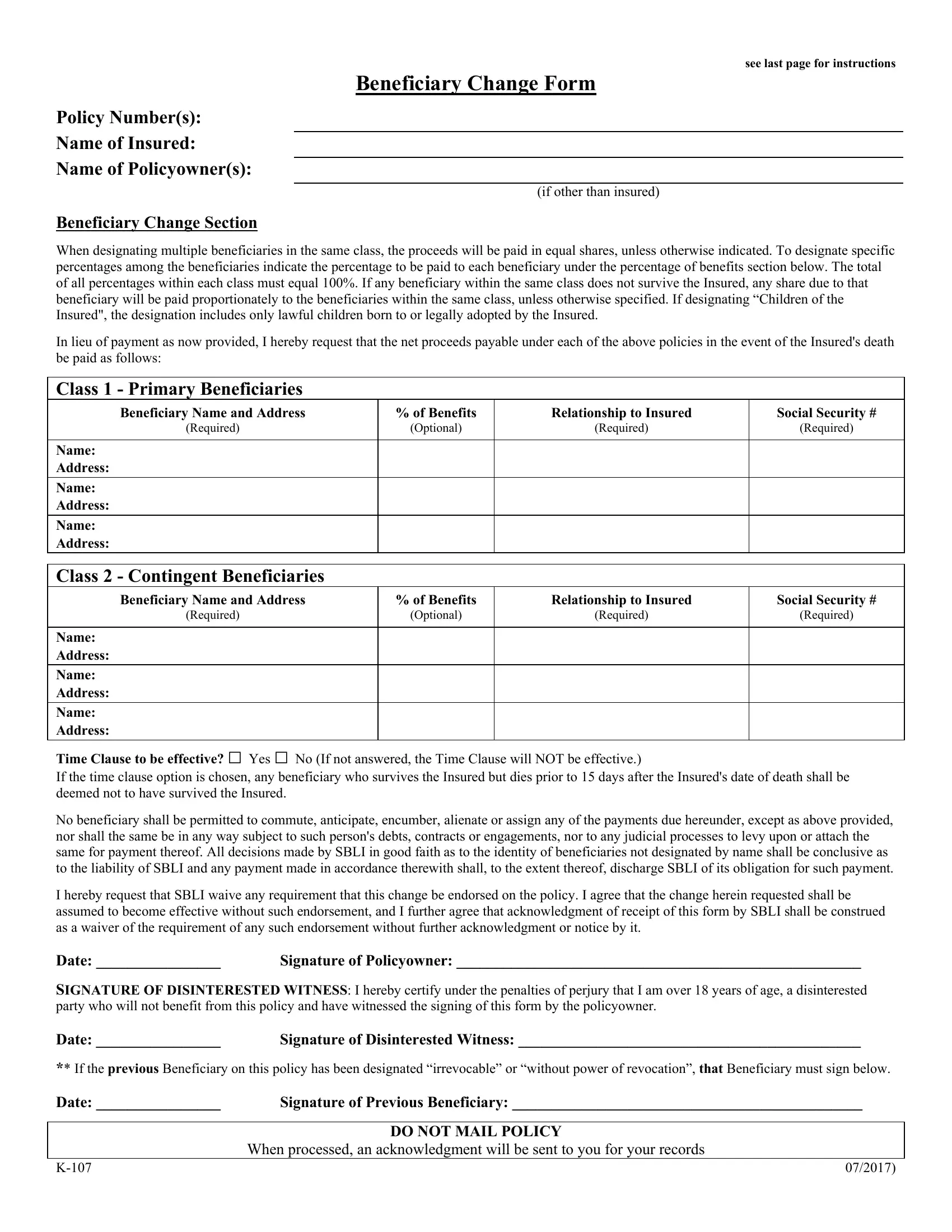

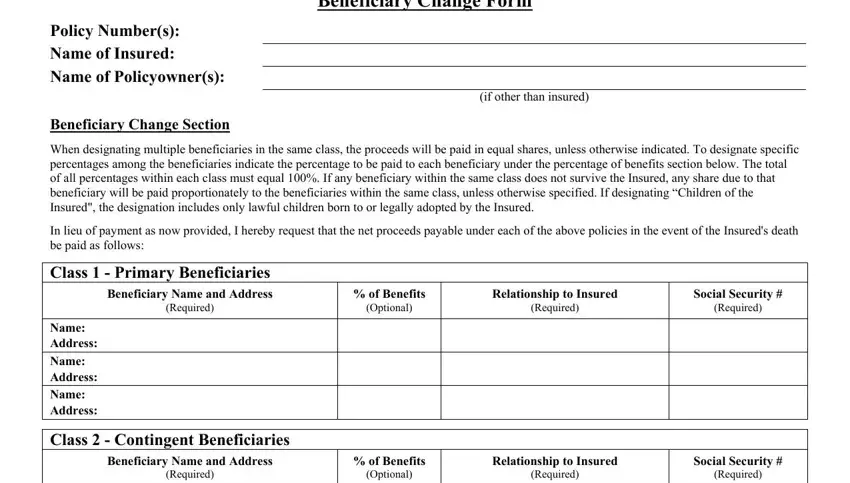

1. Fill out the sbli beneficiary with a number of major blank fields. Gather all the necessary information and make sure there's nothing forgotten!

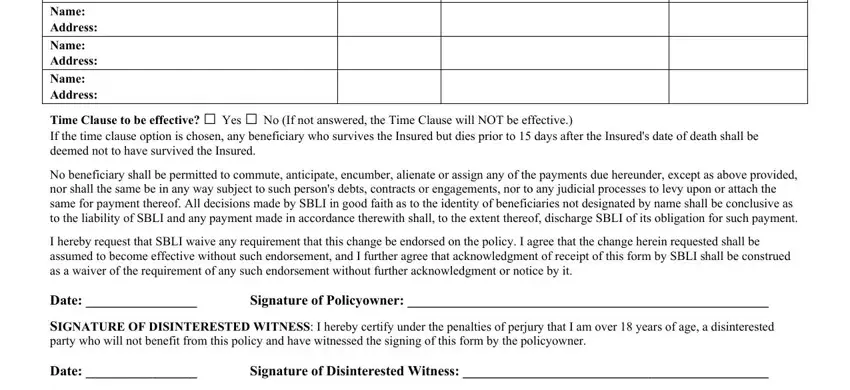

2. Soon after filling out the last section, go on to the subsequent part and complete all required particulars in these fields - Name Address Name Address Name, Time Clause to be effective Yes, If the time clause option is, Signature of Policyowner, and Signature of Disinterested Witness.

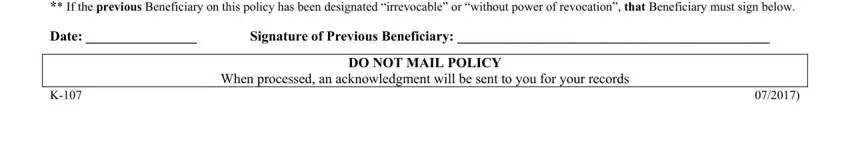

3. The following segment is focused on If the time clause option is, Signature of Previous Beneficiary, When processed an acknowledgment, and DO NOT MAIL POLICY - fill in these blanks.

It's very easy to get it wrong when filling out your Signature of Previous Beneficiary, therefore you'll want to look again prior to deciding to finalize the form.

Step 3: Prior to finalizing this document, make certain that all blanks were filled in the correct way. As soon as you think it is all good, click on “Done." Join FormsPal right now and easily gain access to sbli beneficiary, all set for download. All modifications made by you are kept , enabling you to change the form at a later time when necessary. FormsPal ensures your information confidentiality by having a secure system that in no way records or shares any private information used in the file. Rest assured knowing your files are kept protected any time you work with our services!