Are you a small business owner who needs to report information for the IRS? Then you may be familiar with filling out the SC 1120S form. Filing this form can seem intimidating, and there are many questions that come up when it's time to submit your taxes to the IRS. In this blog post, we'll break down exactly what is on the SC 1120S Form and explain how it helps ensure that your business files its taxes correctly. We'll then provide tips for navigating the process more smoothly and making sure all of your information is up-to-date. If you're ready to tackle filing your tax return head on - let's get started!

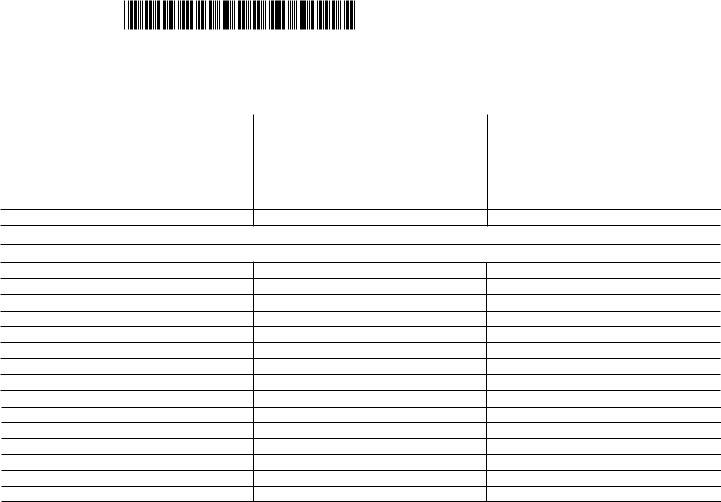

| Question | Answer |

|---|---|

| Form Name | Sc 1120S Form |

| Form Length | 7 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 45 sec |

| Other names | sc 1120s 1120, sc 1120s instructions, sc form 1120, sc 1120 south carolina form |

1350

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STATE OF SOUTH CAROLINA |

|

|

SC 1120S |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

dor.sc.gov |

|

|

|

|

|

|

|

|

S CORPORATION INCOME TAX RETURN |

|

(Rev. 8/27/20) |

|||||||||||

|

|

|

|

|

|

|

|

|

Due by the 15th day of the third month following the close of the taxable year. |

|

|

3095 |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

SC file # |

|

|

|

|

|

|

|

|

|

|

|

|

|

County or counties in SC where property is located |

|

|

|

|||||

|

Income Tax period ending |

- |

- |

|

|

|

|

|

|

|

|

|

|||||||||||

|

License Fee period ending |

- |

- |

|

|

Audit location: Street address |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

ZIP |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

Audit contact |

|

Phone number |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

City |

|

|

|

|

|

|

|

State |

|

|

|

ZIP |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Does the corporation have any shareholders who are nonresidents |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Change of |

|

|

Address |

|

|

Accounting Period |

of South Carolina? |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

Officers |

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check if you filed a federal or state extension |

Number of nonresident shareholders |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Check if: |

Initial Return |

|

|

Amended Return |

|

Number of nonresident shareholders with an |

||||||||||||||||

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

Includes QSSSs and/or Disregarded LLCs (See Schedule L) |

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Check if: |

|

|

|

|

|

|

|

|

|

|

|

|

Number of nonresident shareholders included in a composite return |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Merged |

|

|

Reorganized |

|

|

|

Final |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Total gross receipts |

|

Total cost of depreciable personal property in SC |

|

Attach complete copy of federal return |

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART I COMPUTATION OF INCOME TAX LIABILITY

1. |

. . . . . . . . . .Total of line 1 through 10, Schedule K of the federal 1120S . . . . |

. . . . . . . . . . . . . |

1. |

|

00 |

|

2. |

. . . . . . . . . .Net adjustment from Schedule A and B, line 15 |

. . . . . . . . . . . . . |

2. |

|

00 |

|

3. |

. . . . . . . . . .Total net income as reconciled (add line 1 and line 2) |

. . . . . . . . . . . . . |

3. |

|

00 |

|

4. |

If |

4. |

|

00 |

> |

|

5. |

Income on line 4 taxed to shareholders of S Corporation |

. . . . . . . . . . . . . |

5. |

< |

00 |

|

6. |

. . . . . . . . .South Carolina net income subject to tax (subtract line 5 from line 4) |

. . . . . . . . . . . . . |

6. |

|

00 |

|

7. |

. . . . . . . . . .Tax (multiply line 6 by 5%) |

. . . . . . . . . . . . . |

7. |

|

00 |

|

8. |

. . . . . . . . . .Payments: (a) Tax withheld (attach 1099s, |

. . . . . . . . . . . . . |

8a. |

|

00 |

|

|

. . . . . . . . . .(b) Paid by declaration |

. . . . . . . . . . . . . |

8b. |

|

00 |

|

|

. . . . . . . . . .(c) Paid with extension |

. . . . . . . . . . . . . |

8c. |

|

00 |

|

|

. . . . . . . . . .(d) Credit from Line 23b |

. . . . . . . . . . . . . |

8d. |

|

00 |

|

|

. . . . . . . . . .Refundable Credits: (e) Ammonia Additive |

. . . . . . . . . . . . . |

8e. |

|

00 |

|

|

. . . . . . . . . .(f) Milk Credit |

. . . . . . . . . . . . . |

8f. |

|

00 |

|

|

(g) Motor Fuel Income Tax Credit |

. . . . . . . . . . . . . |

8g. |

|

00 |

|

9. |

. . . . . . . . . .Total payments and refundable credits (add line 8a through line 8g) |

. . . . . . . . . . . . . |

9. |

|

00 |

|

10. |

. . . . . . . . . .Balance of tax (subtract line 9 from line 7) |

. . . . . . . . . . . . . |

10. |

|

00 |

|

11. |

. . . . . . . . . .(a) Interest |

. . . . . . . . . . . . . |

11a. |

|

00 |

|

|

. . . . . . . . . .(b) Late file/pay penalty |

. . . . . . . . . . . . . |

11b. |

|

00 |

|

|

. . . . . . . . . .(c) Declaration penalty (attach SC2220) |

. . . . . . . . . . . . . |

11c. |

|

00 |

|

|

. . . . . . . . . .Total (add line 11a through line 11c) See penalty and interest in SC1120 Instructions |

11. |

|

00 |

|

|

12. |

. . . . . . . . . .Total Income Tax, interest and penalty (add line 10 and line 11) . . . |

BALANCE DUE |

12. |

|

00 |

|

13. |

. . . . . . . . . .Overpayment (subtract line 7 from line 9) |

. . . . . . . . . . . . . |

|

|

00 |

|

|

. . . . . . . . . .To be applied as follows: (a) Estimated Tax |

. . . . . . . . . . . . . |

13a. |

|

00 |

|

|

. . . . . . . . . .(b) License Fee |

. . . . . . . . . . . . . |

13b. |

|

00 |

|

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .(c) REFUND |

. . . . . . . . . . . . . |

13c. |

|

00 |

|

PART II COMPUTATION OF LICENSE FEE AND SCHEDULES A AND B PAGE 2

30951065

SC1120S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

|

. . . . . .Total capital and paid in surplus |

. . . |

. |

. . |

. . . . . . . |

14. |

|

||||||||||||||||||

FEE |

15. |

|

License Fee: multiply line 14 by .001, then add $15 (Fee cannot be less than $25) |

15. |

< |

||||||||||||||||||||||

16. |

|

Credits taken this year against License Fee from SC1120TC, Part II, Column C (attach SC1120TC). |

16. |

||||||||||||||||||||||||

PART II COMPUTATIONOF LICENSE |

17. |

|

(a) Estimated Tax |

|

|

|

00 |

|

(b) Income Tax |

|

|

00 (c) REFUND |

|

||||||||||||||

|

|

Balance (subtract line 16 from line 15) |

|

. . . . . . . . . . . . . . |

. . |

. |

. . |

. . . . . |

. . . . . . |

. . . |

. |

. . |

. . . . . . . |

17. |

|

||||||||||||

|

18. |

|

Payments: (a) Paid with extension |

|

. . . . . . . . . . . . . . |

. . |

. |

. . |

. . . . . |

. . . . . . |

. . . |

. |

. . |

. . . . . . . |

18a. |

|

|||||||||||

|

|

|

|

|

(b) Credit from line 13b |

|

. . . . . . . . . . . . . . |

. . |

. |

. . |

. . . . . |

. . . . . . |

. . . |

. |

. . |

. . . . . . . |

18b. |

|

|||||||||

|

19. |

|

Total payments (add line 18a and line 18b) . |

. . . . . . . . . . . . . . |

. . |

. |

. . |

. . . . . |

. . . . . . |

. . . |

|

. . . |

. . . . . . . |

19. |

|

||||||||||||

|

20. |

|

Balance of License Fee (subtract line 19 from line 17) |

. . |

. . . . . . . |

20. |

|

||||||||||||||||||||

|

21. |

|

(a) Interest |

|

00 |

|

|

(b) Late file/pay penalty |

|

|

|

|

|

00 |

|

|

|

|

|||||||||

|

|

|

|

Total (add line 21a and line 21b.) See penalty and interest in SC1120 Instructions |

|||||||||||||||||||||||

|

22. |

|

Total License Fee, interest, and penalty (add line 20 and line 21) |

BALANCE DUE |

22. |

|

|||||||||||||||||||||

|

23. |

|

Overpayment (subtract line 17 from line 19) |

|

|

|

|

|

00 |

To be applied as follows: |

|

|

|

||||||||||||||

|

24. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GRAND TOTAL: INCOME TAX and LICENSE FEE DUE (add line 12 and line 22) |

24. |

|

|||||||||||||||||||||||

|

SCHEDULE A AND B |

ADDITIONS TO FEDERAL TAXABLE INCOME |

|

|

|

||||||||||||||||||||||

|

1. |

|

Taxes on or measured by income |

. . . |

. . . |

. |

. . . |

|

. . . . . . . . . . . . . . |

. . |

. |

. . |

. . . . . |

. |

1. |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

2. |

|

Excess net passive income subject to federal tax |

2. |

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

3. |

|

Taxable portion of certain |

3. |

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

6. |

|

Other additions (attach schedule) . |

. . . |

. . . |

. |

. . . |

|

. . . . . . . . . . . . . . |

. . |

. |

. . |

. . . . . |

. |

6. |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

7. |

|

Total additions (add line 1 through line 6) |

|

. . . . . . . . . . . . . . |

. . |

. |

. . |

. . . . . |

. . . . . . |

. . . |

. |

. . |

. . . . . . . . |

. . . 7. |

|

|||||||||||

|

|

|

|

|

|

|

DEDUCTIONS FROM FEDERAL TAXABLE INCOME |

|

|

|

|||||||||||||||||

|

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

|

|

|

|

|

|

|

|

|

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

|

|

|

|

|

|

|

|

|

10. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

|

|

|

|

|

|

|

|

|

11. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. |

|

|

|

|

|

|

|

|

|

12. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

|

|

|

|

|

|

|

|

|

13. |

Other deductions (attach schedule) |

. . |

. . . |

. . . |

. |

. . . . . . . . . . . . . . |

. . |

. |

. . |

. . . . . |

|

13. |

|

|

|

|

|

|

|

|

||||||

|

14. |

Total deductions (add line 8 through line 13) |

. . |

. |

. . . . . . . . . . . . . . |

. . |

. |

. . |

. . . . . |

. . . . . . |

. . . |

. |

. . |

. . . . . . . . |

14. |

|

|||||||||||

|

15. |

Net adjustment (subtract line 14 from line 7) Also enter on SC1120S, Part I, line 2 |

. . . . . |

. . . |

. |

. . |

. . . . . . . . |

15. |

|

||||||||||||||||||

00

00

00>

00

00

00

00

00

00

00

00

00

SCHEDULE C |

RESERVED |

Under penalty of law, I certify that I have examined this return, including accompanying annual report, statements, and schedules, and it is true and complete to the best of my knowledge.

Sign |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of officer |

|

Officer's title |

|

|

|

|

|

||||||

|

|

Print officer's name |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

Date |

|

|

|

|

|

Phone number |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I authorize the Director of the SCDOR or delegate to discuss this return, |

|

|

|

|

Print preparer's name |

||||||||

|

|

attachments, and related tax matters with the preparer. |

|

|

|

Yes |

No |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid |

|

|

Preparer's |

|

|

Date |

Check if |

|

|

Preparer's phone number |

|||||

|

|

signature |

|

|

|

|

|

|

|||||||

Preparer's |

|

|

|

|

|

|

|||||||||

Use Only |

|

|

Firm's name (or |

|

|

|

|

|

|

PTIN or FEIN |

|||||

|

|

yours if |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

ZIP |

||||||

|

|

|

|

and address |

|

|

|

|

|

|

|||||

If this is a corporation's final return, signing here authorizes the SCDOR to disclose that information to the South Carolina Secretary of State (SCSOS). You must close with the SCSOS and the SCDOR.

|

|

Taxpayer's signature |

Date |

30952063

SC1120S |

Page 3 |

|

SCHEDULE D |

ANNUAL REPORT TO BE COMPLETED BY ALL CORPORATIONS |

|

1.Name

2.Incorporated under the laws of the state of

3.Location of the registered office of the corporation in South Carolina

In the city of |

|

Registered agent at this address |

4.Principal office address

Nature of principal business in South Carolina

5.Total number of authorized shares of capital stock, itemized by class and series, if any, within each class:

Number of sharesClassSeries

6. Total number of issued and outstanding shares of capital stock itemized by class and series, if any, within each class:

Number of shares |

Class |

Series |

7.Names and business addresses of the directors (or individuals functioning as directors) and principal officers in the corporation: Attach separate schedules if you need more space.

Name |

Title |

Business address |

|

|

|

|

|

|

|

|

|

|

|

|

8. |

Date incorporated |

|

|

Date commenced business in South Carolina |

|

||||||

9. |

Date of this report |

|

|

|

|

|

|

FEIN |

|

||

10. |

If foreign corporation, the date qualified to do business in South Carolina |

|

|

|

|

|

|

||||

11. |

Was the name of the corporation changed during the year? |

|

|

Previous name |

|

||||||

12.The corporation's books are in the care of Located at (street address)

13.The total amount of stated capital per balance sheet:

A.Total paid in capital stock (cannot be a negative amount) . . . . . . . . . . . . $

B.Total paid in capital surplus (cannot be a negative amount) . . . . . . . . . . $

C.Total amount of stated capital (cannot be a negative amount). . . . . . . . . $

Attach a complete copy of your federal return.

File electronically using Modernized Electronic Filing (MeF).

Payments: Pay online using our free tax portal, MyDORWAY, at dor.sc.gov/pay. Select Business Income Tax Payment to get started.

If you pay by check, make your check payable to SCDOR. Include your name, FEIN, tax year, and SC1120S in the memo.

Mail Balance Due returns to: |

Mail Refund or Zero Tax returns to: |

SCDOR |

SCDOR |

Corporate Taxable |

Corporate Refund |

PO Box 100151 |

PO Box 125 |

Columbia, SC 29202 |

Columbia, SC |

30953061

SC1120SPage 4

Only

SCHEDULE E |

COMPUTATION OF LICENSE FEE OF |

|

||||||||

1. |

Total capital and paid in surplus at end of year |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . |

$ |

|

|

|

|||

2. |

SC proportion (multiply line 1 by ratio from Schedule |

$ |

|

|

|

|||||

|

|

|

|

|

|

|

|

|||

SCHEDULE F |

|

INCOME SUBJECT TO DIRECT ALLOCATION |

|

|

|

|

||||

|

|

|

|

|

Less: |

Net Amounts |

|

|

|

Net Amounts |

|

|

|

|

Gross |

Related |

Allocated Directly |

|

Allocated |

||

|

|

|

|

Amounts |

Expenses |

to SC and Other States |

|

Directly to SC |

||

|

|

Allocated Income |

|

1 |

2 |

3 |

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Total income directly allocated |

|

|

|

|

|

|

|

|

|

|

2. Income directly allocated to SC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attach an explanation of each type of income listed above that is not allocated to South Carolina.

SCHEDULE G |

COMPUTATION OF TAXABLE INCOME OF |

1. Total net income as reconciled from SC1120S, page 1, line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. 2. Income subject to direct allocation to SC and other states from Schedule F, line 1 . . . . . . . . . . . . . . . . . . 2.

3. Total net income subject to apportionment (subtract line 2 from line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

4. Multiply line 3 by appropriate ratio from Schedule

SCHEDULE |

COMPUTATION OF SALES RATIO |

|

|

||

|

|

|

Amount |

|

Ratio |

1. |

Total sales within South Carolina (see SC1120 instructions) |

|

|

|

|

2. |

Total sales everywhere (see SC1120 instructions) |

|

|

|

|

3. |

Sales ratio (line 1 divided by line 2) |

|

|

% |

|

Note: If there are no sales anywhere: Enter 100% on line 3 if South Carolina is the principal place of business |

|

|

|||

|

|

Enter 0% on line 3 if principal place of business is outside South Carolina. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE |

COMPUTATION OF GROSS RECEIPTS RATIO |

|

|

|

||

|

|

|

Amount |

|

|

Ratio |

1. |

South Carolina gross receipts |

|

|

|

|

|

2. |

Amounts allocated to South Carolina on Schedule F |

< |

> |

|

|

|

3. |

South Carolina adjusted gross receipts (subtract line 2 from line 1) |

|

|

|

|

|

4. |

Total gross receipts |

|

|

|

|

|

5. |

Total amounts allocated on Schedule F |

< |

> |

|

|

|

6. |

Total adjusted gross receipts (subtract line 5 from line 4) |

|

|

|

|

|

7. |

Gross receipts ratio (line 3 divided by line 6) |

|

|

% |

||

|

|

|

|

|

|

|

SCHEDULE |

COMPUTATION OF RATIO FOR SECTION |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Amount |

|

|

Ratio |

1. Total within South Carolina (see SC1120 instructions) |

|

|

|

|

||

2. Total everywhere |

|

|

|

|

|

|

3. Taxable ratio (line 1 divided by line 2) |

|

|

% |

|||

|

|

|||||

30954069

SC1120S |

Page 5 |

SCHEDULE

1

2

3

4

5

6

7

8

9

10

11

12a

12b

12c

12d

|

A |

B |

C |

D |

E |

F |

|

||||||

|

Description |

Amounts From |

Plus or Minus |

Federal Schedule K |

Amounts Not Allocated or |

Amounts Allocated |

|

|

Federal Schedule K |

South Carolina |

Amounts After SC |

Apportioned to SC |

or Apportioned to |

|

|

|

Adjustments |

Adjustments |

|

SC |

|

Ordinary business |

|

|

|

|

|

|

income (loss) |

|

|

|

|

|

|

Net rental real |

|

|

|

|

|

|

estate income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other net rental |

|

|

|

|

|

|

income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends |

|

|

|

|

|

|

|

|

|

|

|

|

|

Royalties |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net |

|

|

|

|

|

|

capital gain (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net |

|

|

|

|

|

|

capital gain (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net section |

|

|

|

|

|

|

1231 gain (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

Section 179 deduction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contributions |

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment |

|

|

|

|

|

|

interest expense |

|

|

|

|

|

|

Section 59(e)(2) |

|

|

|

|

|

|

expenditures |

|

|

|

|

|

|

Other deductions |

|

|

|

|

|

|

|

|

|

|

|

|

Nonrefundable Tax Credits: Enter total credits from SC1120TC . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

You must attach your SC1120TC to this return.

30955066

SC1120S |

Page 6 |

SCHEDULE L |

QSSSs AND DISREGARDED LLCs INCLUDED IN RETURN |

List each Qualified Subchapter S Subsidiary (QSSS) doing business in South Carolina or registered with the SCSOS.

Name |

|

FEIN |

SC file # (if applicable) |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

List each disregarded Limited Liability Company (LLC) doing business in South Carolina or registered with the SCSOS.

Name |

|

FEIN |

SC file # (if applicable) |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30956064

SC1120S |

|

Page 7 |

|

SCHEDULE N |

PROPERTY INFORMATION |

|

|

Property within South Carolina |

|

|

|

|

|

|

|

|

|

(a) Beginning Period |

(b) Ending Period |

|

|

|

|

1. |

Land |

|

|

2. |

Buildings |

|

|

3. |

Machinery and equipment |

|

|

4. |

Construction in progress |

|

|

5. |

Other property* |

|

|

Total

*Provide an explanation or listing of property from line 5 above.

Description of Property

(a) Beginning Period

(b) Ending Period

Total

30957062