Navigating the complexities of fiduciary income tax returns can be challenging for estates and trusts in South Carolina. The SC 1041 form, as revised on July 15, 2020, provides a structured framework for reporting income, deductions, and taxes due for both resident and nonresident entities for the fiscal year or calendar year 2020. It mandates the inclusion of the federal Form 1041 alongside all relevant schedules, ensuring that the state's Department of Revenue has a comprehensive view of the fiduciary's financial activities. Beyond its basic reporting function, the form delves into specifications such as estate or trust type, residency status, and the intricate details of income sources and modifications specific to South Carolina law. The form accommodates for various adjustments to federal taxable income, caters to nonresident estates or trusts with South Carolina sources of income, and requires detailed beneficiary reporting. This introduction to the SC 1041 form outlines the necessity for meticulous attention to detail and an understanding of both federal and state tax obligations, underscoring the importance of accuracy and compliance in fiduciary income tax filing.

| Question | Answer |

|---|---|

| Form Name | Sc Form 1041 |

| Form Length | 11 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min 45 sec |

| Other names | sc 1041 tax form, sc1041, sc form sc1041, how to south carolina fiduciary |

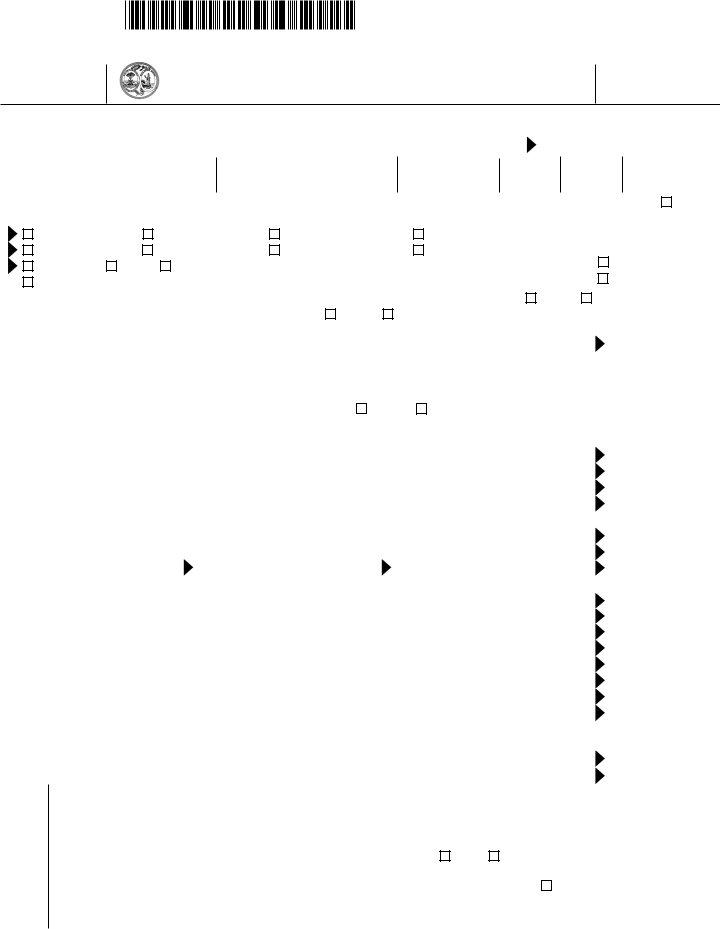

1350

dor.sc.gov

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

FIDUCIARY INCOME TAX RETURN

SC1041

(Rev. 7/15/20)

3084

For the calendar year 2020 or Fiscal Taxable Year beginning |

- |

- |

and ending |

- - |

|

2020 |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||

Name of estate or trust |

|

|

|

|

|

|

|

|

|

|

|

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and title of fiduciary

Mailing address

City

State

ZIP

County Code

|

|

|

|

|

|

|

|

|

|

|

|

ATTACH COPY OF FEDERAL FORM 1041 AND ALL SCHEDULES, INCLUDING SCHEDULES |

|

Extension Requested: Yes |

|||||||||

|

|

|

|

|

|

|

|

|

|

||

A. Check all that apply: |

|

B. |

Trusts - check if: |

C. Check if: |

|

|

D. Was the final distribution |

||||

|

Address change |

|

Simple trust |

|

Testamentary |

Resident estate or trust |

|

of assets made during |

|||

|

Amended return |

|

Complex trust |

|

Inter vivos |

Nonresident estate or trust |

|

the year? |

|||

|

|

|

|

Yes |

|||||||

|

Final return |

Estate |

Grantor trust |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Electing small business trust |

|

|

|

|

|

|

|

No |

||

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

||||

E. During this taxable year, was this estate or trust notified of any federal change for any prior years? |

|

Yes |

|

No If yes, attach copy. |

|||||||

F. Is a federal Schedule |

Yes |

No If yes, how many? |

|

|

|

If no, attach explanation. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

If a nonresident estate or trust with income from both South Carolina and non South Carolina sources, complete and attach Part III, page 3 of SC1041.

1. |

...................................Federal Taxable Income (Residents: Federal 1041; Nonresidents: Part III, line 22, column D) |

|

00 |

||||||||||||||||

2. |

............................................................................Federal fiduciary exemption included in line 1 above |

|

|

|

|

|

|

2 |

|

00 |

|||||||||

3. |

South Carolina modifications relating to gains allocated to principal or relating to other items not affecting federal |

|

|

|

|||||||||||||||

|

distributable net income (attach explanation) |

..................................................................................... |

|

|

|

|

|

|

|

|

|

|

3 |

|

00 |

||||

4. |

Fiduciary's share of SC fiduciary adjustment (from Part II, line 1i) |

Addition |

.........................Subtraction |

4 |

|

00 |

|||||||||||||

5. |

........................................................................................................Net (add line 1 through line 4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

00 |

||

6. |

South Carolina fiduciary exemption (see instructions) |

|

|

|

|

|

............. |

6 |

< |

00 |

|||||||||

7. |

....................................................................South Carolina taxable income (subtract line 6 from line 5) |

|

|

|

|

|

|

7 |

|

00 |

|||||||||

8. |

..........................................................South Carolina tax (see instructions for tax computation schedule) |

|

|

|

|

|

|

8 |

|

00 |

|||||||||

9. |

................................Tax on Lump Sum Distribution (SC4972) and/or Active Trade or Business Income |

|

00 |

||||||||||||||||

10. |

Nonrefundable credits (attach SC1040TC) |

|

|

|

|

|

|

|

|

|

|

10 |

< |

00 |

|||||

11. |

........................................................Add line 8 through line 10 and enter the result but not less than zero |

|

|

|

|

|

|

11 |

|

00 |

|||||||||

12. |

South Carolina income tax withheld for nonresident beneficiaries (from Part IV) |

.......................................... |

|

|

12 |

|

00 |

||||||||||||

13. |

....................Total tax (add line 11 and line 12) |

|

|

|

............................................................................... |

|

|

|

|

|

|

|

|

|

13 |

|

00 |

||

14. |

Amount paid with: (a) Extension |

|

|

|

|

00 |

(b) SC withholding |

|

|

|

00 |

........................ |

14 |

|

00 |

||||

15. |

Estimated Tax Payments and Refundable Tax Credit |

|

|

|

|

|

|

|

|

|

|

||||||||

|

(a) Estimated Tax payments |

|

|

|

|

|

|

|

|

|

|

|

|

|

15a |

|

00 |

||

|

...............................................................................................(b) Amount applied from 2019 return |

|

|

|

|

|

|

|

|

|

|

|

|

|

15b |

|

00 |

||

|

.....................................................................................................(c) Motor Fuel Income Tax Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

15c |

|

00 |

||

|

..................................................................................................Total (add line 15a through line 15c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

|

00 |

||

16. |

..........................................................................................Total payments (add line 14 and line 15) |

|

|

|

|

|

|

|

|

|

|

16 |

|

00 |

|||||

17. |

.......................................................................................Overpayment (subtract line 13 from line 16) |

|

|

|

|

|

|

|

|

|

|

17 |

|

00 |

|||||

18. |

Late file/pay penalty |

|

00 |

|

Interest |

|

|

00 |

.............................................. |

|

|

18 |

|

00 |

|||||

19. |

Penalty for underpayment of Estimated Tax (Attach SC2210) |

|

|

|

|

|

.................. |

19 |

|

00 |

|||||||||

20. |

Balance (subtract line 16 from line 13. Add line 18 and line 19, if applicable) |

|

BALANCE DUE |

20 |

|

00 |

|||||||||||||

21. |

........................................................................Amount of line 17 to be credited to 2021 Estimated Tax |

|

|

|

|

|

|

21 |

|

00 |

|||||||||

22. |

Net refund (subtract line 21 from line 17) |

|

|

|

|

|

|

|

|

|

REFUND |

22 |

|

00 |

|||||

I declare that this return and all attachments are true, correct, and complete to the best of my knowledge and belief.

Sign |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Here |

|

|

|

|

|

|

|

|

|

|

Signature of fiduciary or officer representing fiduciary |

|

|

Date |

Taxpayer's email |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

I authorize the Director of the SCDOR or delegate to discuss |

this return, |

Yes |

No |

|

Preparer's printed name |

||||

|

attachments, and related tax matters with the preparer. |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Paid |

Preparer's |

|

Date |

Check if |

|

|

Preparer's phone number |

|||

Preparer's |

signature |

|

|

|

|

|

||||

Use Only |

Firm's name (or |

|

|

|

|

|

PTIN or FEIN |

|||

|

yours if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ZIP |

|||

|

and address |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||

>

>

30841209

2020

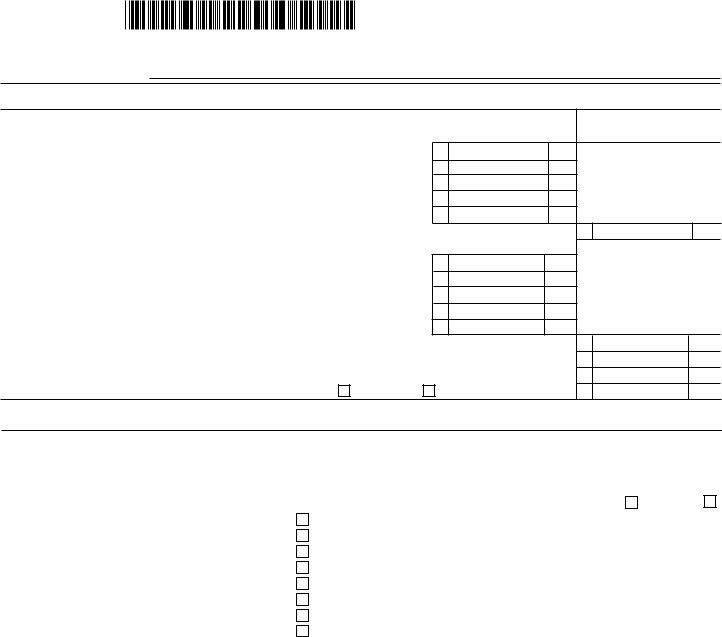

Page 2

Name and FEIN on page 1

PART I - SOUTH CAROLINA FIDUCIARY ADJUSTMENT

1.Additions to federal taxable income:

a. State and local interest

b. State or local taxes measured by income deducted on the federal return c. Federal net operating loss carryover

d.

e. Other additions to income (attach schedule)

f.Total additions to federal income (add line 1a through line 1e)

2.Subtractions from federal taxable income:

a. Interest on US obligations

b. State Income Tax refunds reported as income on federal return c. South Carolina net operating loss carryover (attach schedule) d. Active Trade or Business Income Deduction

e. Other subtractions from income (attach schedule)

f.Total subtractions from federal taxable income (add line 2a through line 2e)

3.Total (subtract line 2f from line 1f)

4.Fiduciary adjustment from other estates or trusts and partnership adjustment (attach schedule)

5. South Carolina fiduciary adjustment (add line 3 and line 4) Addition |

or Subtraction |

Adjustments to amount

included in federal

distributable net income

1f

2f

3

4

5

PART II - ALLOCATION OF SOUTH CAROLINA FIDUCIARY ADJUSTMENT

Complete ONLY if Part I indicates a South Carolina fiduciary adjustment. It is allocated among all beneficiaries and the fiduciary in the same ratio as their relative shares of federal distributable net income. Nonresident beneficiaries see Parts III and IV for computation of income.

1. Name of each beneficiary. Check box if beneficiary is a nonresident. All beneficiaries |

Shares of Federal |

4. Shares of South Carolina |

|||

Distributable Net Income |

Fiduciary Adjustment |

||||

|

receiving a federal |

||||

|

Social Security Number |

2. Amount |

3. Percent |

Addition or Subtraction |

|

a. |

|

% |

|

||

|

|

|

|

|

|

b. |

|

% |

|

||

c. |

|

% |

|

||

d. |

|

% |

|

||

e. |

|

% |

|

||

f. |

|

% |

|

||

g. |

|

% |

|

||

h. |

|

% |

|

||

i. Fiduciary |

|

% |

|

||

|

Totals |

|

100% |

|

|

COLUMN 2: Total federal distributable net income must be equal to the federal 1041, Schedule B, line 7.

COLUMN 3: Indicate percentages with two numbers, such as 32%, 3.2% and .32%.

COLUMN 4: Enter South Carolina fiduciary adjustment from Part I, line 5 as the total of Column 4. Multiply each percentage in Column 3 times the total in Column 4. Indicate at the top of Column 4 whether the adjustments are additions or subtractions. If the adjustment is a subtraction, it may not offset more than the amount reportable from the fiduciary for federal tax purposes (except in the final or termination year).

COLUMNS 2, 3, AND 4: Attach a detailed explanation of the allocation method used if there is no federal distributable net income or if the percentages do not agree with the relative shares indicated on the federal 1041, Schedule B and Schedule

COLUMN 4: The amount after each name is reported as a modification, either an addition to or subtraction from federal taxable income. Each resident

beneficiary should add the explanation: Fiduciary adjustment - (name of estate or trust). A copy of this schedule (or its information) must be provided to each resident beneficiary. The fiduciary's share of the adjustment is entered on page 1, line 4.

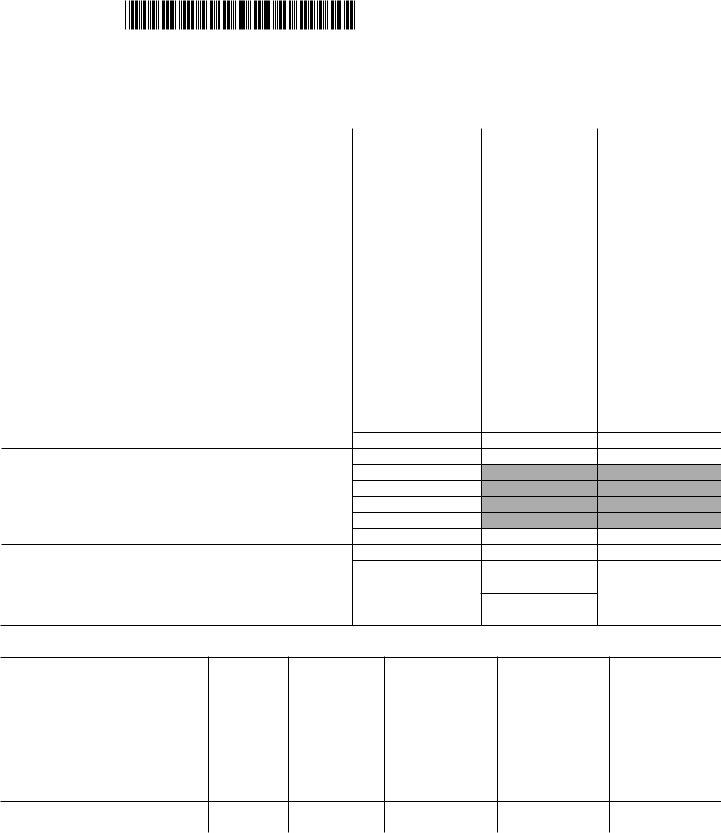

30842207

FOR NONRESIDENT ESTATES AND TRUSTS OR RESIDENT ESTATES AND TRUSTS

WITH NONRESIDENT BENEFICIARIES

|

|

|

PART III - COMPUTATION OF FEDERAL TAXABLE INCOME OF THE ESTATE OR TRUST FROM |

2020 |

||||

|

|

|

|

|||||

|

|

|

SOUTH CAROLINA SOURCES |

|

|

Page 3 |

||

|

|

|

|

|

|

|

||

A. These items correspond to page 1 of the federal 1041. |

B. Total income as |

C. Portion of |

D. Nonresident fiduciary's |

|||||

reported on |

Column B |

portion of Column C and |

||||||

|

|

|

|

|||||

|

|

|

|

federal 1041 |

from South Carolina |

capital gains not |

||

|

|

|

|

|

sources |

distributed |

||

|

|

|

|

|

|

|

||

1. |

Interest income |

|

|

|

|

|||

2. |

Dividends |

|

|

|

|

|||

3. |

Business income or (loss) |

|

|

|

|

|||

4. |

Capital gain or (loss) |

|

|

|

|

|||

INCOME |

Rents, royalties, partnerships, other estates and trusts, etc. |

|

|

|

|

|||

|

|

|

|

|||||

5. |

|

|

|

|

||||

6. |

Farm income or (loss) |

|

|

|

|

|||

7. |

Ordinary gain or (loss) |

|

|

|

|

|||

8. |

Other income |

|

|

|

|

|||

|

9. |

Total income (add line 1 through line 8) |

|

|

|

|

||

10. |

Interest |

|

|

|

|

|||

11. |

Taxes |

|

|

|

|

|||

DEDUCTIONS |

Fiduciary fees |

|

|

|

|

|||

|

|

|

|

|||||

12. |

|

|

|

|

||||

13. |

Charitable deduction |

|

|

|

|

|||

14. |

Attorney, accountant, and return preparer fees |

|

|

|

|

|||

|

|

15a. |

Other deductions NOT subject to the 2% floor |

|

|

|

|

|

|

|

15b. |

Net operating loss deduction |

|

|

|

|

|

16.Total (add line 10 through line 15b)

17.Subtract line 16 from line 9

18.Distributions to beneficiaries

19.Federal Estate Tax (fiduciary) Federal Estate Tax (beneficiary)

20.Exemption

21.Total (add line 18 through line 20)

22.Taxable income (subtract line 21 from line 17)

23.Total percent of all nonresident beneficiaries

(from Part II, page 2) |

% |

24.Total South Carolina income of nonresident beneficiaries (multiply line 22 by line 23)

PART IV - NONRESIDENT BENEFICIARIES' SHARES OF INCOME AND CREDITS

A. Name |

B. Beneficiary's |

C. South Carolina |

D. South Carolina |

E. Less amounts |

F. Tax to be withheld |

|

percentage |

capital gain (Part III, ordinary income (Part III, |

exempt from |

(net amount of |

|

|

from Part II |

line 4, column C |

line 22, column C |

withholding by |

column C, column D, |

|

|

x column B) |

less capital gains |

and column E |

|

|

|

|

x Column B) |

|

x 7%) |

|

|

|

|

|

|

a. |

|

|

|

|

|

b. |

|

|

|

|

|

c. |

|

|

|

|

|

d. |

|

|

|

|

|

e. |

|

|

|

|

|

TOTALS |

% |

|

|

|

|

|

|

|

|

|

|

|

|

PART V - NONRESIDENT EXEMPTION ALLOWANCE FOR FIDUCIARY |

|

||

|

|

|

|

|

|

1. |

Exemption allowance claimed on federal 1041 |

1 |

|

|

|

2. |

Ratio of total South Carolina income (Part III, line 9, column D) to total federal income (Part III, line 9, column B) |

2 |

|

% |

|

3. |

South Carolina nonresident fiduciary exemption (multiply line 1 by line 2) Enter on page 1, line 6 |

3 |

|

|

|

30843205

INSTRUCTIONS

SC1041

The SC1041

REMINDERS

•You must add back the federal deduction for qualified business income provided in IRC Section 199A.

•You must add back any charitable deduction for a gift of land under IRC Section 170 unless the intent of the donor meets the requirements of SC Code Section

•South Carolina specifically does not recognize IRC Section 168(k) bonus depreciation.

•SC8736 is the extension form for partnership and fiduciary returns.

•An amended SC1041 must be filed whenever the IRS adjusts a federal 1041.

•Attach

FILING REQUIREMENTS

The fiduciary of a resident estate or trust must file a South Carolina Fiduciary return (SC1041) if the estate or trust:

•is required to file a federal Fiduciary Income Tax return for the taxable year

•had any South Carolina taxable income for the taxable year

•had a beneficiary who is a nonresident

The fiduciary of a nonresident estate or trust must file a South Carolina Fiduciary Income Tax return if the estate or trust had income or gain that came from South Carolina sources.

Income from South Carolina sources includes income or gain from:

•real or tangible personal property located within South Carolina

•a business, profession, or occupation carried on in South Carolina

•services performed within South Carolina

For a nonresident estate or trust, income from the following is not considered to come from South Carolina sources unless it is part of the income from a business, trade, profession, or occupation carried on within South Carolina:

•annuities

•interest

•dividends

•gain from the sale or exchange of intangible personal property

RESIDENT AND NONRESIDENT ESTATES AND TRUSTS

A resident estate is the estate of a person who was a South Carolina resident at the time of death. All other estates are nonresident estates.

A resident trust is any trust administered in South Carolina. All other trusts are nonresident trusts, including a trust administered outside of South Carolina that is required to follow the laws of South Carolina for administration of the trust.

WHEN AND WHERE TO FILE

The South Carolina Fiduciary Income Tax return is due by the 15th day of the fourth month after the close of the taxable year. Failure to file the return by the due date may result in a penalty. If you need additional time to file your SC1041, request an extension using the SC8736. The extension request must be made by the due date of the return.

Request your extension to file by paying your balance due on our free tax portal, MyDORWAY, at dor.sc.gov/pay. Select Business Income Tax Payment to get started. Your payment automatically submits your filing extension request. No additional form or paperwork is required.

SCDOR will accept a federal extension instead of the SC8736 if the South Carolina Income Tax return does not have a balance due when the return is filed. If you use the federal extension instead of the SC8736, it is not necessary to send South Carolina a copy of the federal extension form. Attach a copy of the federal extension when you file the tax return within the extended period. Mark the Extension Requested box on the SC1041.

Taxpayers can file their SC1041 (along with their federal fiduciary return) electronically through Modernized Electronic Filing (MeF) in a single transmission using third party tax preparation software.

If filing by paper, mail balance due returns to SCDOR, TAXABLE FIDUCIARY, PO BOX 125, COLUMBIA, SC

1

PAYMENT OF TAX

The balance of tax due on page 1, line 20 of SC1041 must be paid in full. Failure to pay your tax on time can result in penalty and interest. Pay online using our free tax portal, MyDORWAY, at dor.sc.gov/pay. Select Business Income Tax Payment to get started. To file by paper, attach a check or money order to the SC1041. Include the name and FEIN of the estate or trust, SC1041, and the tax year in the memo.

If you owe $15,000 or more in connection with any SCDOR return, you must file and pay electronically according to SC Code Section

ACCOUNTING PERIOD

The accounting period and the method of accounting used for the SC1041 must be the same as that used for federal tax purposes. If the estate's or trust's taxable year method of accounting is changed for federal purposes, the change applies to the SC1041.

FEDERAL ADJUSTMENTS

Any taxpayer whose income has been adjusted by the IRS should report the adjustments to the SCDOR after the federal adjustments become final between the taxpayer and the IRS. File an amended SC1041 for the appropriate tax year to report the federal adjustment to the SCDOR. Attach a copy of the IRS revenue agent's report showing the adjustments.

FIDUCIARY REPORTING OBLIGATIONS TO BENEFICIARIES

Fiduciaries must provide to each resident beneficiary the amount of fiduciary adjustment to be reported on the beneficiary's South Carolina Individual Income Tax return. (See column 4, Part II, page 2 of the SC1041.) Fiduciaries must also provide to each nonresident beneficiary the amount of the nonresident beneficiary's share of income and credits from Part IV, page 3 of the SC1041. Fiduciary adjustments, beneficiaries' shares of fiduciary adjustments, and beneficiaries' shares of income and credits are computed in Parts I, II, III, and IV, pages 2 and 3 of the SC1041. The following rules explain which of these parts should be completed.

•If a resident estate or trust has only resident beneficiaries, or if no amounts are distributable to nonresident beneficiaries, only complete Parts I and II.

•If a resident estate or trust has nonresident beneficiaries, it is generally necessary to complete all parts. You do not have to complete Part IV if amounts distributed to nonresidents are not taxable.

•If all income of a resident estate or trust is taxable to the fiduciary and no distributions are made, or required to be made, only Part I must be completed.

•If a nonresident estate or trust has resident and/or nonresident beneficiaries, all parts must be completed. If all the income is taxable to the fiduciary, only Parts III and V must be completed.

DEDUCTIBILITY OF EXPENSES OF ADMINISTRATION

Expenses of administering an estate must be deducted in the same way they are deducted for federal tax purposes. If these expenses are deducted on the federal 1041, they may be deducted on the SC1041 South Carolina Fiduciary Income Tax return. If these expenses are deducted for federal Estate Tax purposes they may not be deducted on the SC1041.

EXEMPT TRUST

A trust exempt from federal Income Tax because of its purpose or activities is also exempt from South Carolina Income Tax.

CHARITABLE REMAINDER TRUSTS

South Carolina has adopted IRC Section 664, which outlines the basic rules for charitable remainder trusts. This means the South Carolina Income Tax treatment of these trusts is generally the same as for federal Income Tax. After preparing the required annual federal filing forms including Form 5227

This is a charitable remainder trust as described in IRC Section 664. See attached Form 5227 for South Carolina income.

To prepare federal Form 5227 for South Carolina income, prepare a separate federal Form 5227 taking into account the differences in federal and state taxable income. For a summary of these differences, see the instructions for Part I of the SC1041. Divide the South Carolina taxable income by the federal taxable income. Use that fraction to prorate the beneficiaries' South Carolina fiduciary adjustment. Indicate the proration on each SC1041

LINE INSTRUCTIONS

Heading: Enter the name, address, FEIN, and county code of the estate or trust in the fields on page 1. Answer all questions at the top of the SC1041. County codes are listed in these instructions.

Line 1 - Federal taxable income of fiduciary: Enter on line 1 the federal taxable income shown on page 1 of the federal 1041. Nonresident estates and trusts should enter on line 1 the amount reported on Part III, line 22, column D of the SC1041. See instructions for Part III - Computation of the Federal Taxable Income of the Estate or Trust from South Carolina Sources.

2