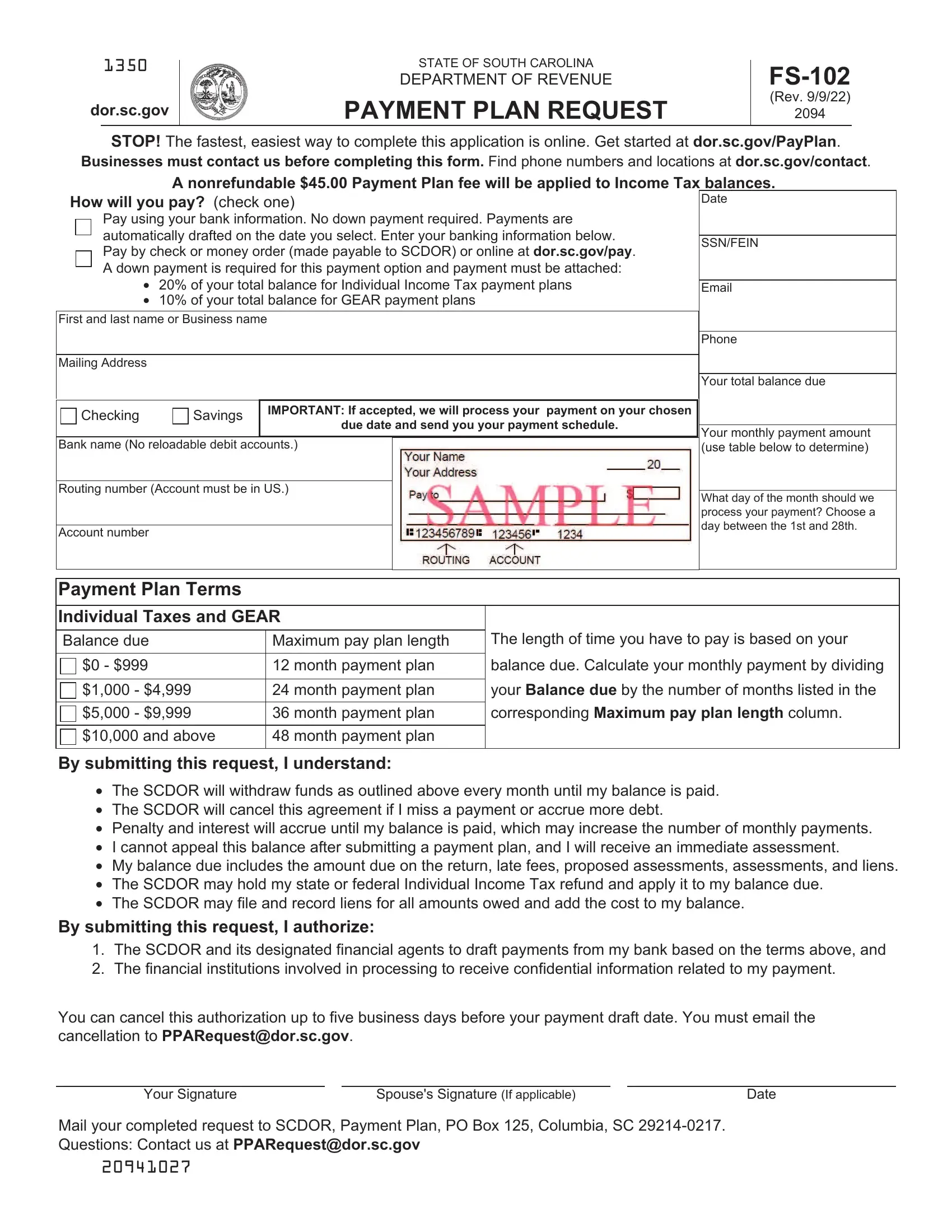

Working with PDF forms online is actually easy with this PDF editor. Anyone can fill out Sc Form Fs 102 here effortlessly. The editor is constantly updated by our staff, getting new awesome functions and becoming even more convenient. By taking a few easy steps, it is possible to begin your PDF journey:

Step 1: Open the PDF form inside our tool by pressing the "Get Form Button" at the top of this webpage.

Step 2: Using this state-of-the-art PDF file editor, it is possible to do more than just fill out blank form fields. Edit away and make your forms seem professional with customized text added in, or adjust the file's original input to excellence - all that comes with the capability to insert your own photos and sign the PDF off.

Filling out this document will require attention to detail. Make certain each blank field is completed properly.

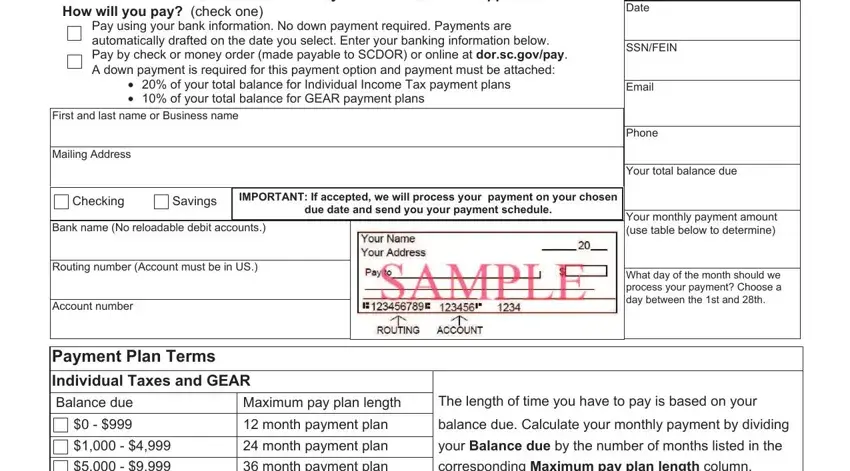

1. While completing the Sc Form Fs 102, ensure to complete all important blanks within the associated area. This will help facilitate the work, making it possible for your information to be handled swiftly and correctly.

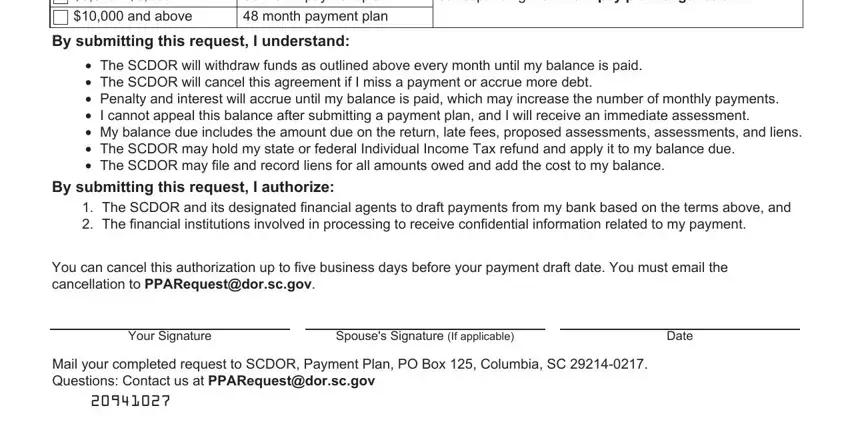

2. Just after this array of blank fields is done, proceed to enter the suitable details in all these - month payment plan, corresponding Maximum pay plan, and above, month payment plan, By submitting this request I, cid The SCDOR will withdraw funds, By submitting this request I, The SCDOR and its designated, You can cancel this authorization, Your Signature, Spouses Signature If applicable, Date, and Mail your completed request to.

As to By submitting this request I and month payment plan, ensure you take a second look here. These two are certainly the most significant ones in this file.

Step 3: Before addressing the next step, check that form fields have been filled out properly. When you think it is all good, press “Done." Find your Sc Form Fs 102 once you sign up for a free trial. Readily get access to the pdf in your FormsPal cabinet, with any modifications and adjustments being all preserved! FormsPal ensures your data confidentiality by using a secure system that never saves or distributes any type of private data involved. Rest assured knowing your files are kept safe whenever you use our editor!