You are able to work with south carolina excess effortlessly with our PDFinity® online tool. Our editor is continually developing to provide the very best user experience achievable, and that is due to our dedication to constant enhancement and listening closely to feedback from users. This is what you'll have to do to get started:

Step 1: Access the form inside our tool by clicking the "Get Form Button" at the top of this page.

Step 2: After you access the tool, you will notice the form made ready to be filled out. Other than filling in various blanks, you may also do various other actions with the PDF, including adding custom text, changing the initial text, inserting graphics, affixing your signature to the PDF, and more.

This PDF will need particular details to be entered, so ensure you take your time to type in what's asked:

1. First of all, once completing the south carolina excess, start in the area that includes the next fields:

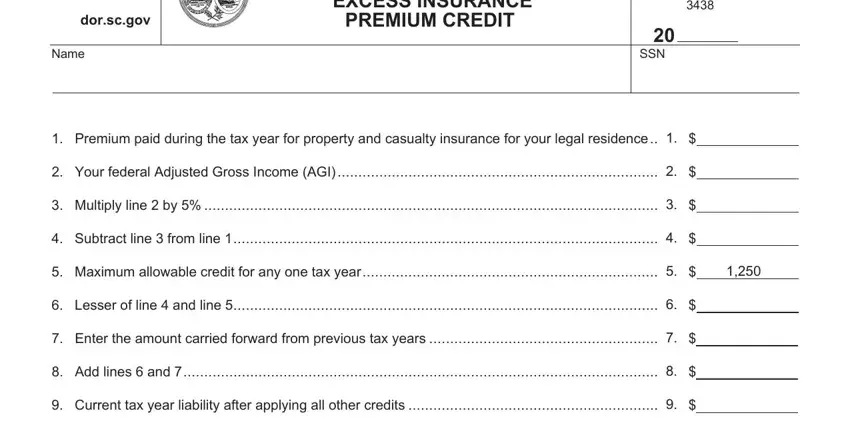

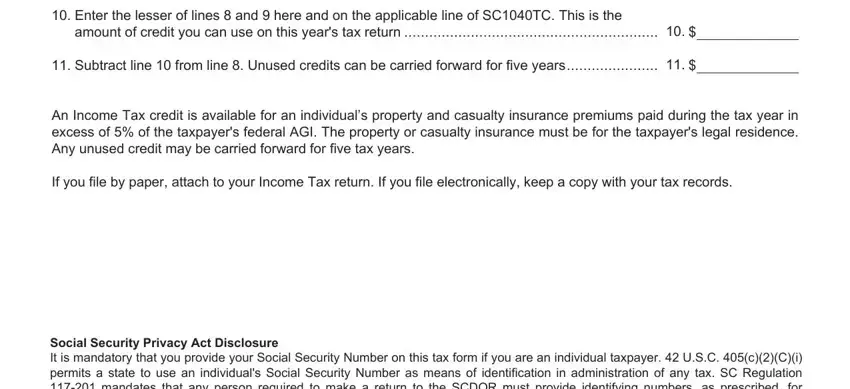

2. Once your current task is complete, take the next step – fill out all of these fields - Premium paid during the tax, and Social Security Privacy Act with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

People who use this form generally get some things wrong while filling in Social Security Privacy Act in this part. Remember to revise whatever you type in here.

Step 3: Spell-check all the details you've inserted in the blank fields and hit the "Done" button. Right after creating a7-day free trial account here, you will be able to download south carolina excess or email it promptly. The PDF document will also be available from your personal account with your each change. If you use FormsPal, you'll be able to fill out forms without stressing about data incidents or data entries getting distributed. Our protected system helps to ensure that your personal information is maintained safe.