Our PDF editor makes it easy to complete forms. You should not undertake much to enhance st 3 tax return documents. Just simply follow the following steps.

Step 1: Press the button "Get form here" to access it.

Step 2: So you will be within the form edit page. You'll be able to add, adjust, highlight, check, cross, insert or erase areas or phrases.

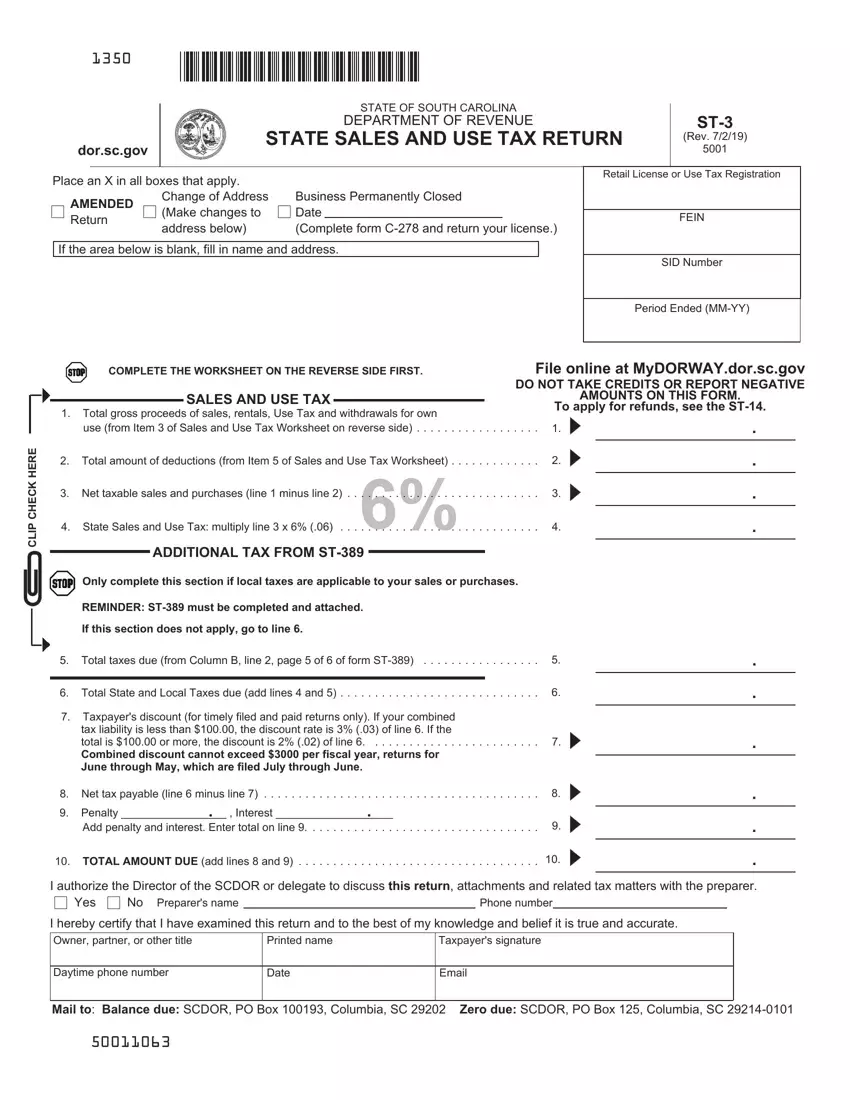

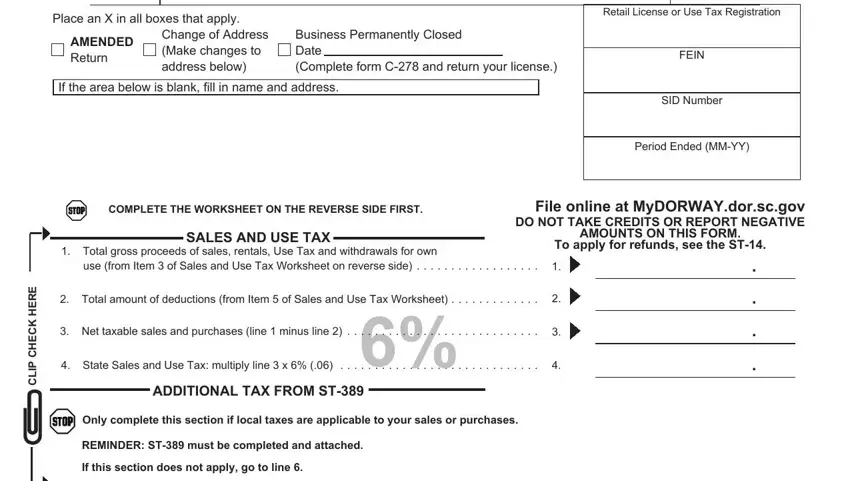

In order to fill in the form st3 PDF, provide the details for each of the segments:

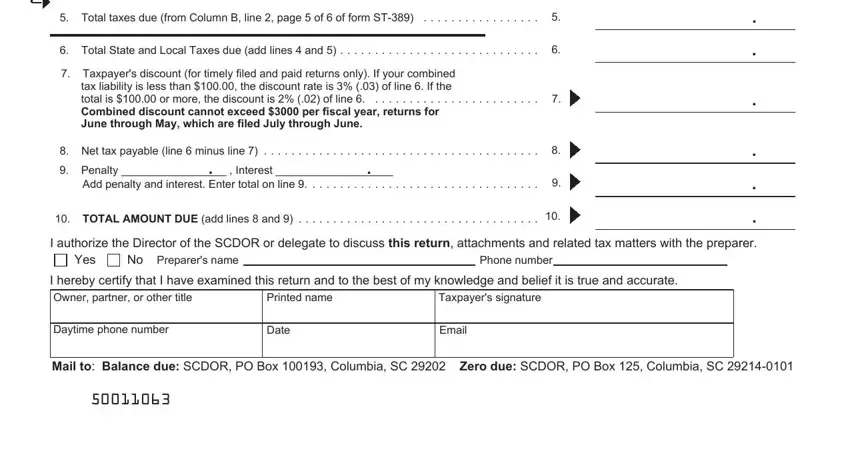

In the section Total taxes due from Column B, Total State and Local Taxes due, Taxpayers discount for timely, Net tax payable line minus line, Penalty Interest, Add penalty and interest Enter, TOTAL AMOUNT DUE add lines and, I authorize the Director of the, I hereby certify that I have, Taxpayers signature, Printed name, Daytime phone number, Date, Email, and Mail to Balance due SCDOR PO Box provide the particulars that the program requests you to do.

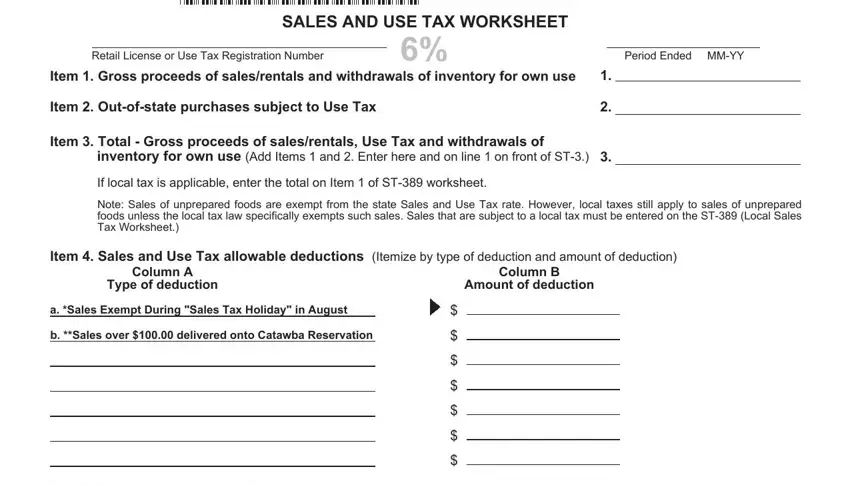

You may be expected to enter the details to help the platform fill in the part Retail License or Use Tax, Item Gross proceeds of, SALES AND USE TAX WORKSHEET, Item Outofstate purchases subject, Item Total Gross proceeds of, inventory for own use Add Items, If local tax is applicable enter, Period Ended MMYY, Note Sales of unprepared foods are, Item Sales and Use Tax allowable, Column A Type of deduction, Column B Amount of deduction, a Sales Exempt During Sales Tax, and b Sales over delivered onto.

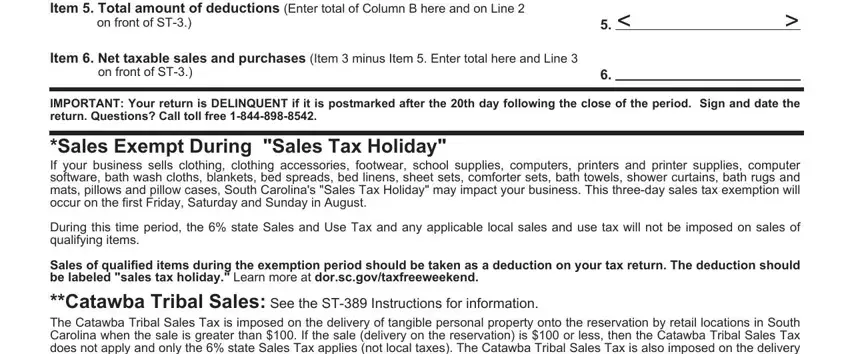

The Item Total amount of deductions, on front of ST, Item Net taxable sales and, on front of ST, IMPORTANT Your return is, Sales Exempt During Sales Tax, During this time period the state, Sales of qualified items during, and Catawba Tribal Sales See the ST field will be the place to insert the rights and obligations of all sides.

Step 3: As soon as you select the Done button, your prepared document can be simply transferred to any kind of your devices or to electronic mail specified by you.

Step 4: Create as much as two or three copies of the file to keep away from any specific upcoming issues.