Any time you need to fill out Sc1040X Form, it's not necessary to download any kind of programs - just try using our online PDF editor. Our team is devoted to making sure you have the best possible experience with our editor by consistently adding new functions and upgrades. With these improvements, working with our tool becomes better than ever! Getting underway is effortless! Everything you need to do is take the next basic steps directly below:

Step 1: Click on the "Get Form" button above. It is going to open up our editor so that you could start completing your form.

Step 2: The tool grants the ability to customize PDF files in many different ways. Enhance it with personalized text, adjust what's already in the file, and add a signature - all when you need it!

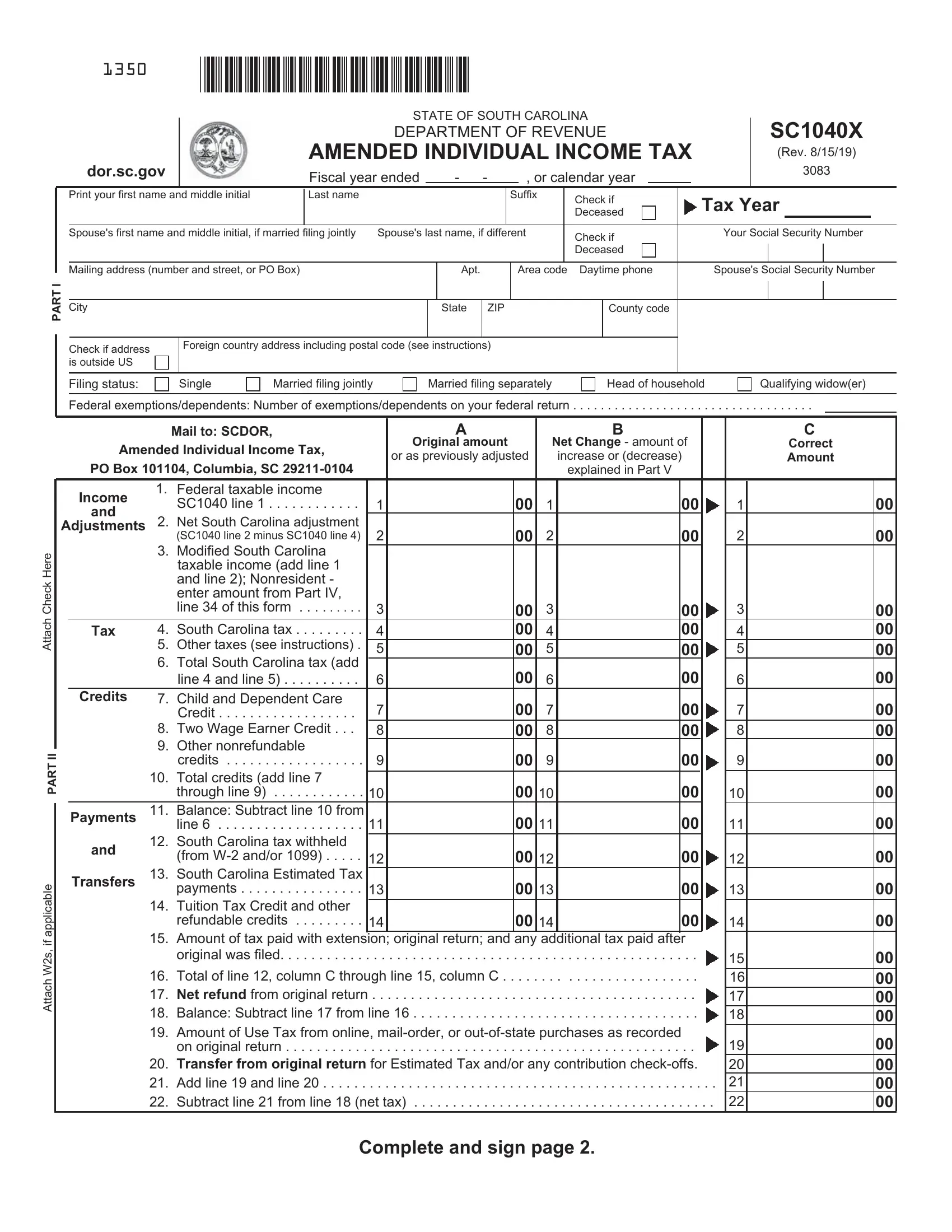

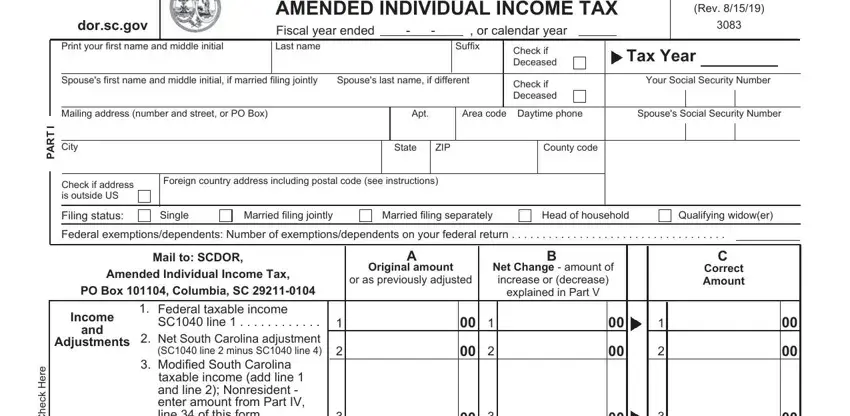

Filling out this document demands care for details. Make sure all necessary areas are filled in properly.

1. While submitting the Sc1040X Form, make sure to include all essential blanks in its relevant part. It will help to facilitate the process, allowing for your information to be processed quickly and accurately.

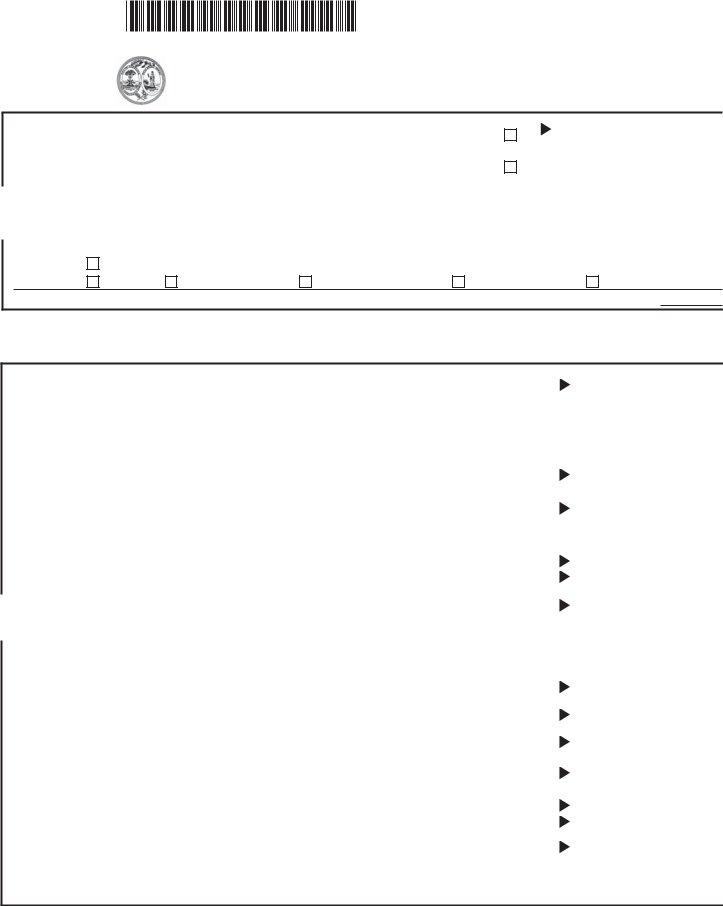

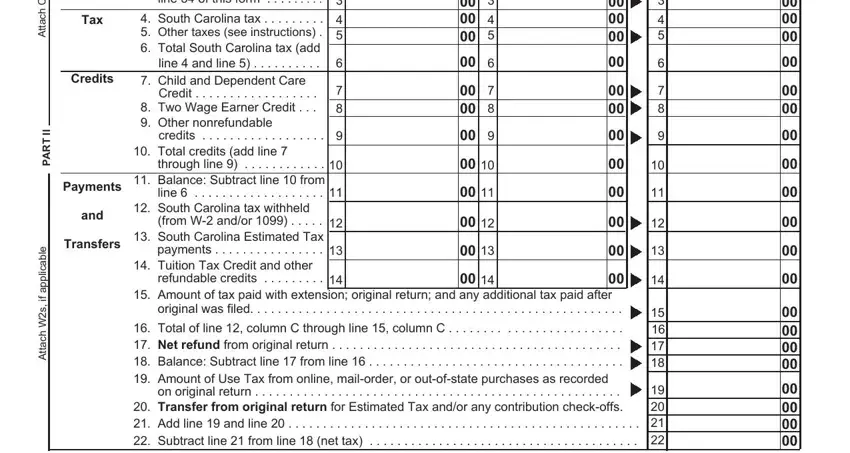

2. Soon after performing the previous section, go on to the subsequent stage and complete the necessary details in all these fields - Tax, Credits, Payments, and, Transfers, e r e H k c e h C h c a t t, I I, T R A P, e b a c, i l, p p a, f i s W h c a, t t, Modified South Carolina taxable, and credits.

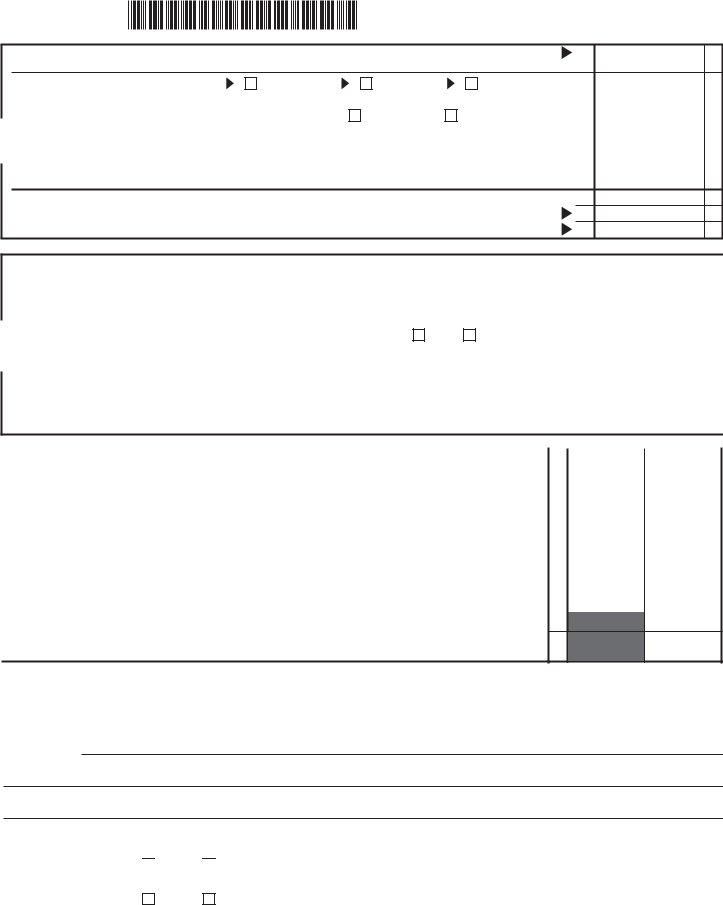

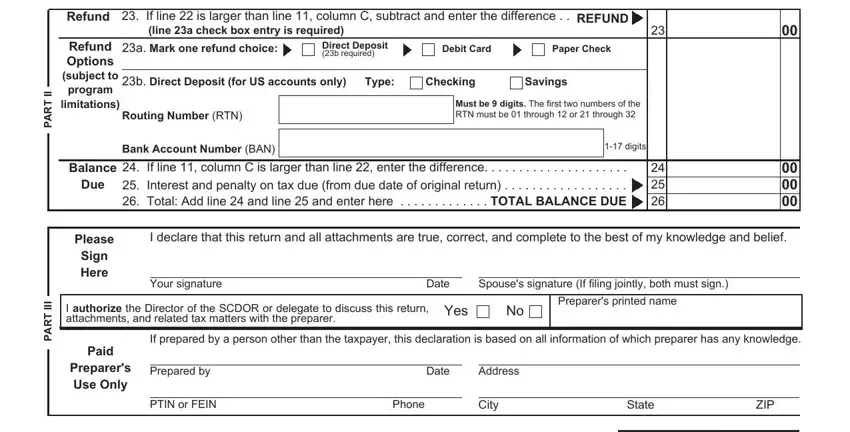

3. In this stage, have a look at Refund, Refund Options subject to program, Balance, Due, Please Sign Here, If line is larger than line, line a check box entry is required, REFUND, Debit Card, Paper Check, Direct Deposit b required, a Mark one refund choice b Direct, Must be digits The first two, digits, and I declare that this return and all. Each one of these have to be taken care of with highest precision.

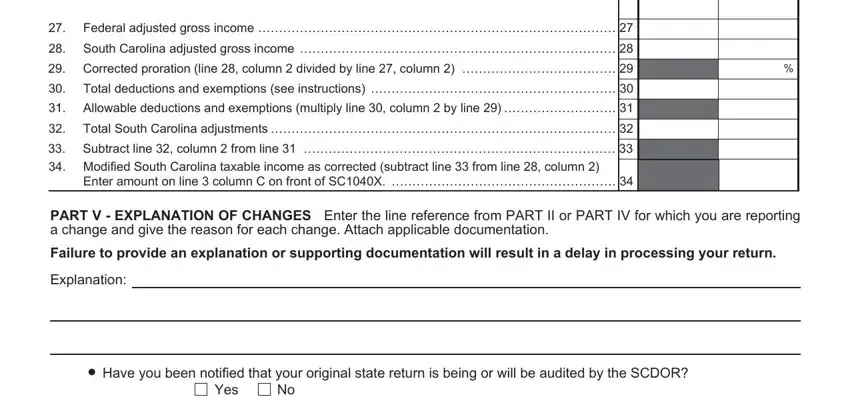

4. Completing PART IV NONRESIDENT It is best to, Federal adjusted gross income, PART V EXPLANATION OF CHANGES, and Have you been notified that your is vital in this stage - make certain that you take your time and take a close look at each empty field!

5. To wrap up your form, the particular area involves several additional fields. Filling in Have you been notified that your is going to finalize the process and you'll be done in an instant!

In terms of Have you been notified that your and Have you been notified that your, be sure that you review things in this section. The two of these could be the most significant ones in the PDF.

Step 3: Make sure the details are right and click "Done" to complete the task. Go for a free trial account with us and acquire direct access to Sc1040X Form - download, email, or change in your FormsPal cabinet. FormsPal offers secure form editor without personal information recording or distributing. Rest assured that your information is secure here!