In understanding the intricacies of business operations within South Carolina, especially for entities structured as S corporations, the SC1120S-WH form stands out as a critical document. It primarily addresses the need for withholding tax on income attributed to nonresident shareholders. As the document outlines, the starting point for calculations is the South Carolina taxable income, which undergoes adjustments including reductions for directly allocated income. Further stipulations include the estimation of income for those who request an extension of filing time, thus affecting the initial line of the form. The form meticulously details the process to calculate the total income that needs to be allocated to nonresident shareholders, with subtractions for income exempt from withholding under certain conditions. It's also notable for its administrative requirements, such as the stipulation for filing and payment deadlines, essentially by the fifteenth day of the third month following the S corporation's taxable year end. Submission details, including the use of black ink and mailing instructions, emphasize the procedural nature of compliance. This form is a testament to the mechanisms set in place to ensure that nonresident shareholders contribute their fair share to South Carolina's revenue, encapsulating both the complexity and the necessity of tax compliance for businesses operating within the state.

| Question | Answer |

|---|---|

| Form Name | Sc1120S Wh Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | sc1120s wh fillable pdf, South_Carolina, form sc1120s wh, taxable |

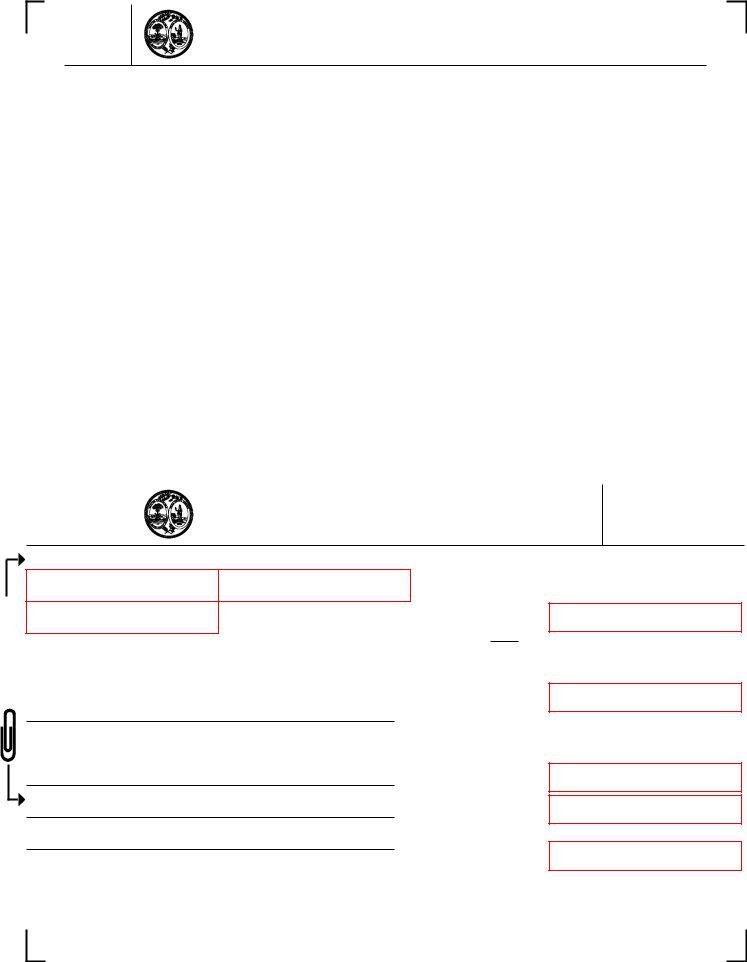

1350

STATE OF SOUTH CAROLINA |

|

DEPARTMENT OF REVENUE |

|

WITHHOLDING TAX ON INCOME OF |

(Rev. 8/13/10) |

NONRESIDENT SHAREHOLDERS |

3312 |

|

|

Line by Line Instructions

Line 1 The amount from line 5 of SC1120S is South Carolina taxable income. Reduce the amount from line 5 of SC1120S by the amount of directly allocated income. (Taxpayers requesting an extension of time to file SC1120S must estimate an amount of income subject to withholding. Enter this estimated amount on Line 1).

Line 2 The amount on this line is total income allocated to nonresident shareholders.

Line 3 Reduce line 2 by amounts exempt from withholding by affidavit, by composite filing, or real estate gain subject to buyer withholding. Include affidavits if not previously filed.

File this return and pay withholding tax due by the fifteenth day of the third month following taxable year end of the S corporation.

Mail to: South Carolina Department of Revenue, Corporation, Columbia, SC

|

|

USE BLACK INK ONLY |

|

|

PLEASE DO NOT CUT, SUBMIT ENTIRE PAGE |

1350 |

|

STATE OF SOUTH CAROLINA |

|

||

|

|

DEPARTMENT OF REVENUE |

|

|

WITHHOLDING TAX ON INCOME OF |

|

|

NONRESIDENT SHAREHOLDERS |

|

|

|

(Rev. 8/13/10)

3312

CLIP CHECK HERE

SC CORPORATE FILE # INCOME ACCT PERIOD END

FEIN

(Signature of duly authorized officer / taxpayer) |

Date |

Corporate Name and Address

1.Amount from line 5 of SC1120S (less allocated

income). . . . . . . . . . 1.

2. Line 1 times % of income allocated to non- resident shareholders. . . . . . 2.

3.Amount of line 2 exempt from withholding. Attach statement. See instructions . . . 3.

4.Subtract line 3

from line 2. . . . . . . . 4.

5.Withholding tax

due

. 00

. 00

. 00

. 00

. 00

33121021