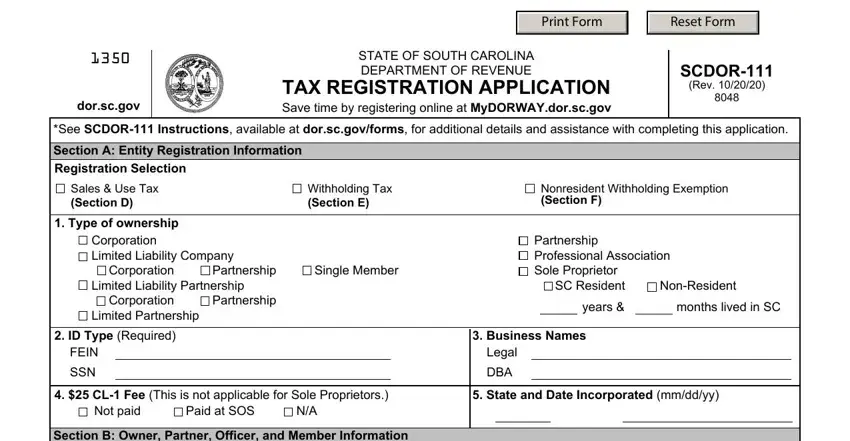

The entire process of filling out the retail license south carolina is rather straightforward. Our team made sure our software is not hard to use and helps fill in virtually any PDF without delay. Below are a couple of simple steps you will have to take:

Step 1: The first task is to choose the orange "Get Form Now" button.

Step 2: So, you can start modifying the retail license south carolina. Our multifunctional toolbar is at your disposal - add, remove, transform, highlight, and carry out several other commands with the content in the file.

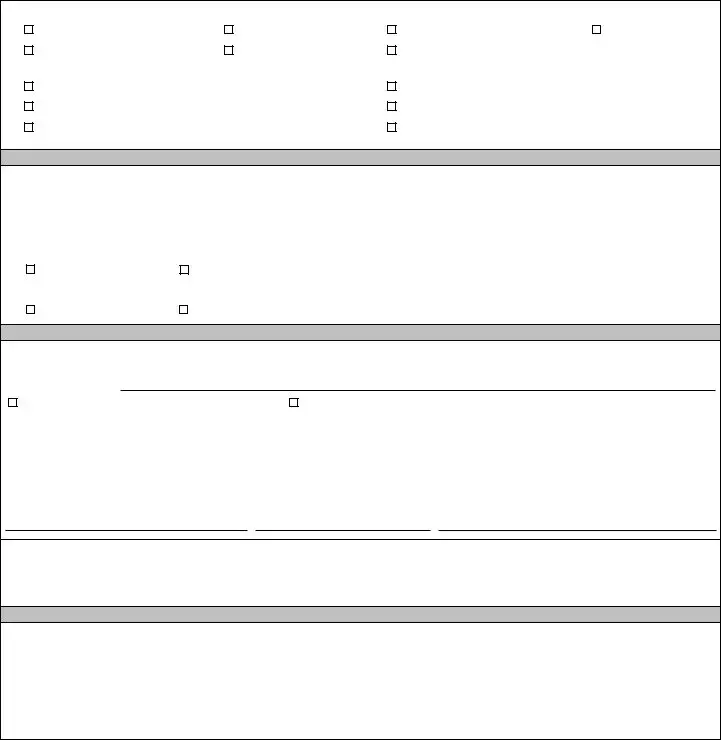

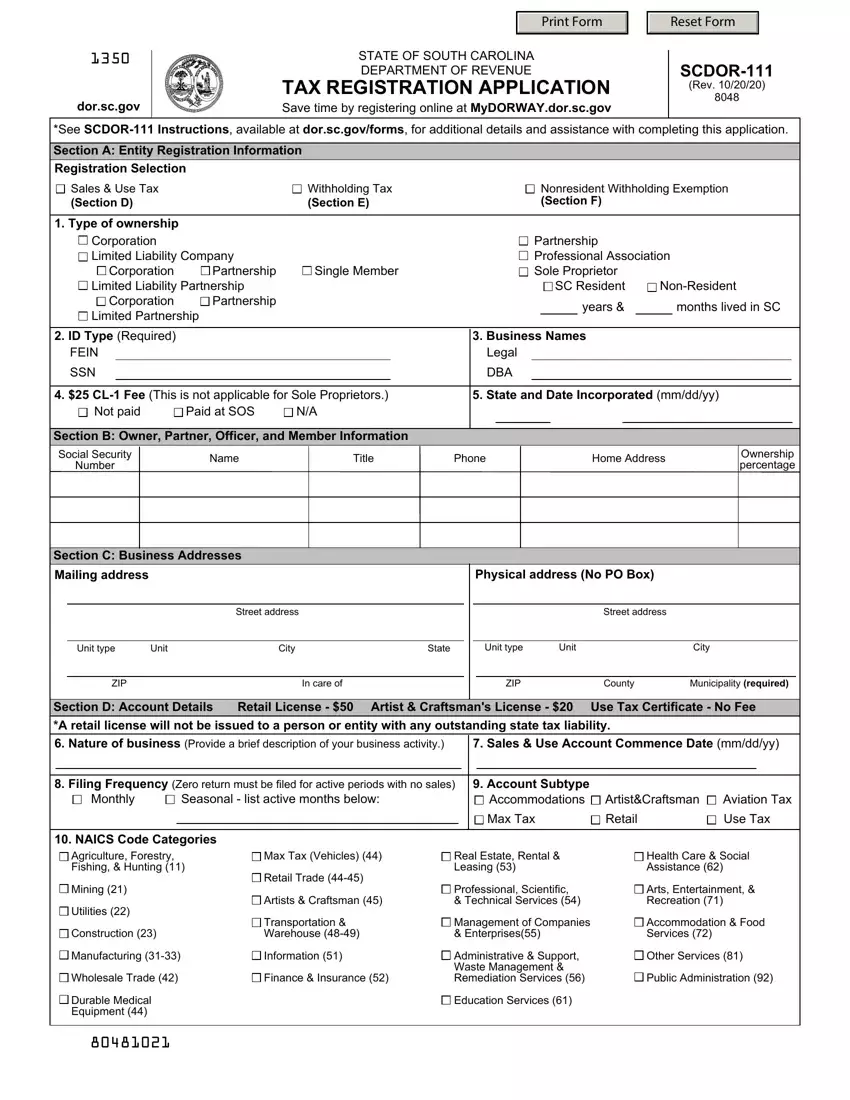

Enter the appropriate data in every area to fill in the PDF retail license south carolina

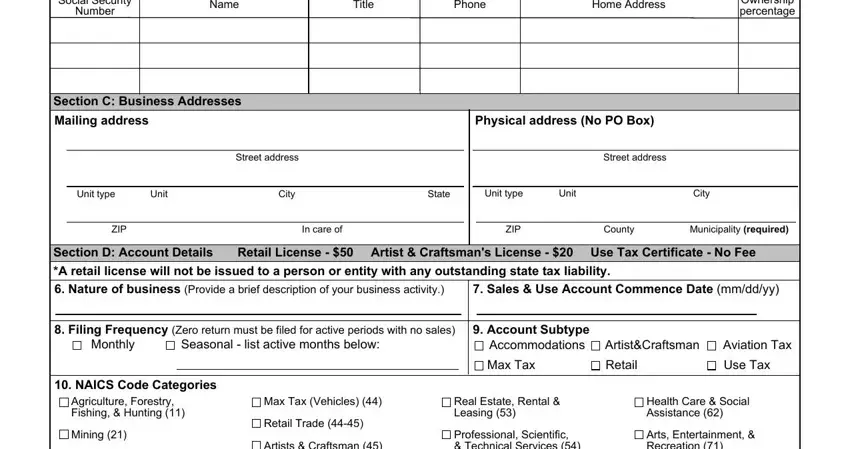

Type in the details in the Social Security Number, Name, Title, Phone, Home Address, Ownership percentage, Section C Business Addresses, Mailing address, Physical address No PO Box, Street address, Street address, Unit type Unit City State, Unit type, Unit, and City area.

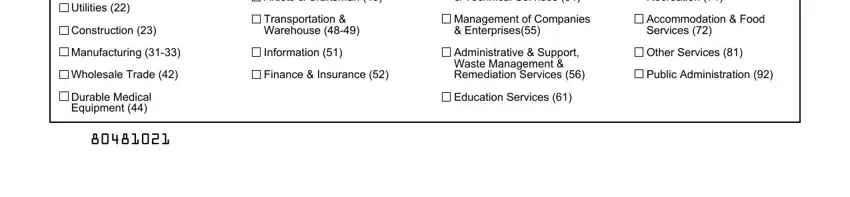

The system will demand you to include some relevant details to instantly fill out the segment Utilities, Construction, Artists Craftsman, Transportation Warehouse, Manufacturing, Information, Wholesale Trade, Finance Insurance, Durable Medical Equipment, Professional Scientific Technical, Arts Entertainment Recreation, Management of Companies, Accommodation Food Services, Administrative Support Waste, and Education Services.

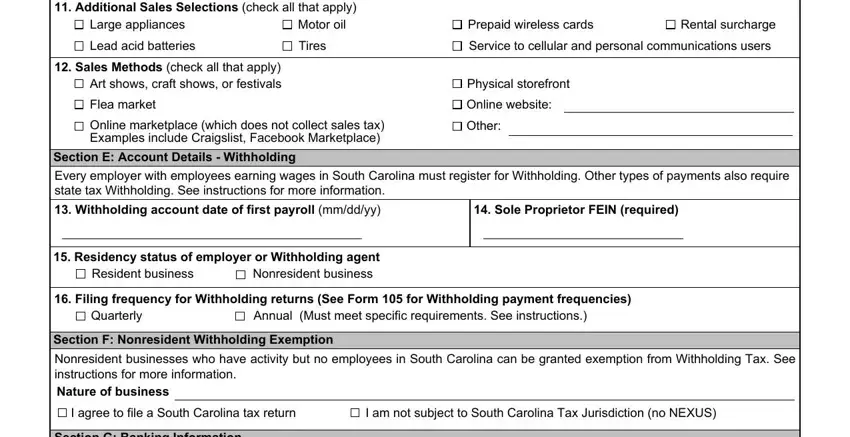

The Additional Sales Selections check, Large appliances, Lead acid batteries, Motor oil, Tires, Sales Methods check all that, Flea market, Online marketplace which does not, Prepaid wireless cards, Rental surcharge, Service to cellular and personal, Physical storefront, Online website, Other, and Section E Account Details box can be used to indicate the rights and responsibilities of both sides.

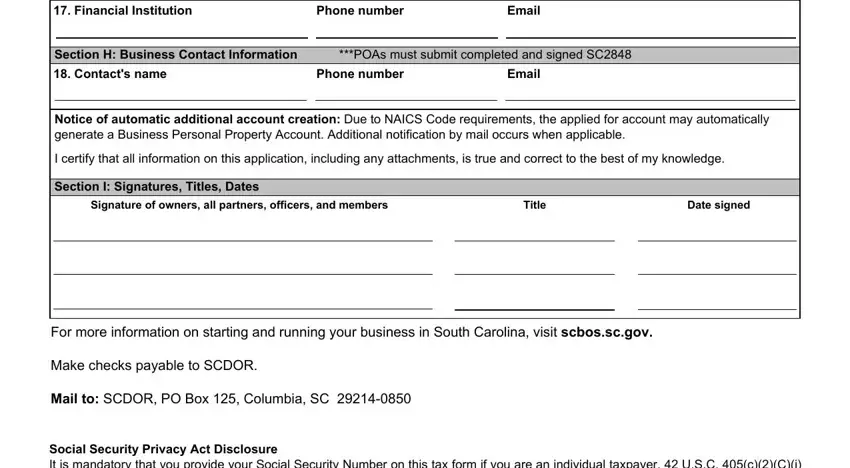

Complete the file by analyzing the following areas: Section G Banking Information, Financial Institution, Phone number, Email, Section H Business Contact, Contacts name, Phone number, Email, Notice of automatic additional, I certify that all information on, Section I Signatures Titles Dates, Signature of owners all partners, Title, Date signed, and For more information on starting.

Step 3: Select the "Done" button. So now, it is possible to transfer your PDF file - upload it to your device or deliver it by means of electronic mail.

Step 4: Get duplicates of your document. This may save you from potential future misunderstandings. We cannot watch or reveal your data, hence feel comfortable knowing it is secure.

Arts, Entertainment, &

Arts, Entertainment, &

Accommodation & Food

Accommodation & Food

Other Services (81)

Other Services (81)

Public Administration (92)

Public Administration (92)