The how to schedule h filling out procedure is simple. Our PDF tool lets you work with any PDF form.

Step 1: Look for the button "Get Form Here" and press it.

Step 2: You'll notice all of the functions that you can use on your template once you've got accessed the how to schedule h editing page.

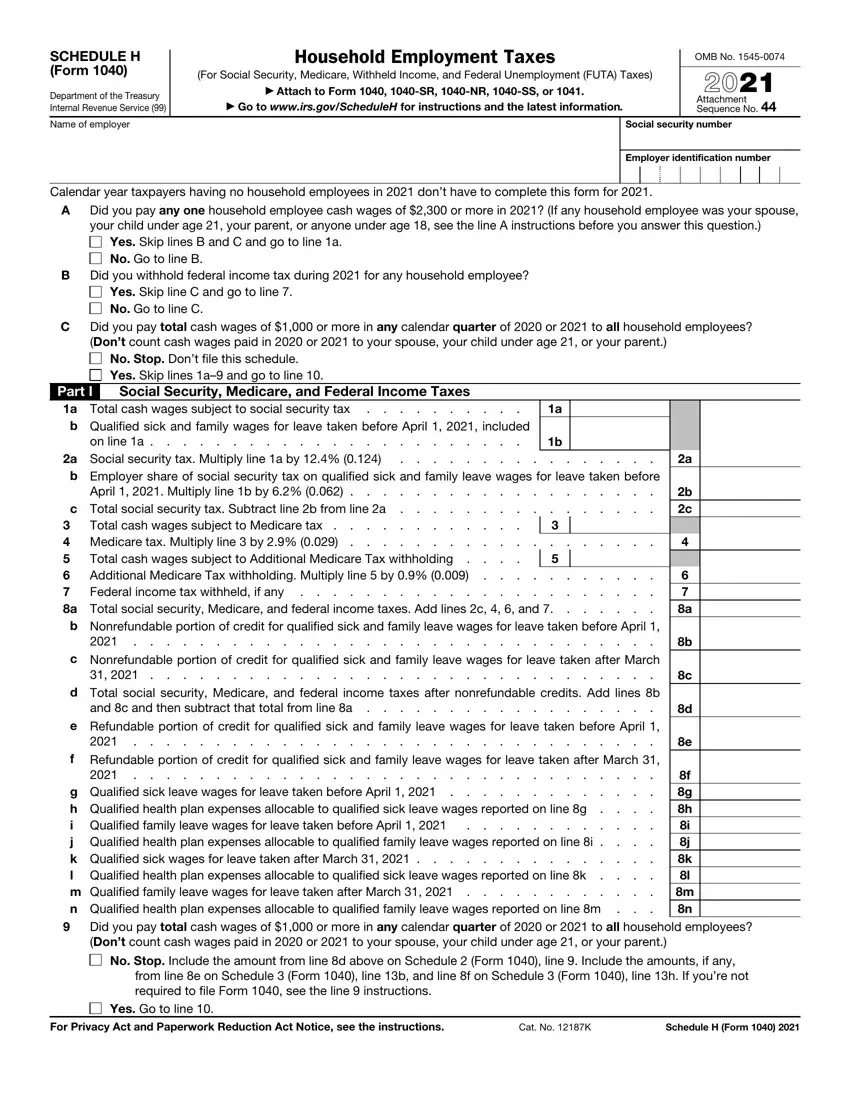

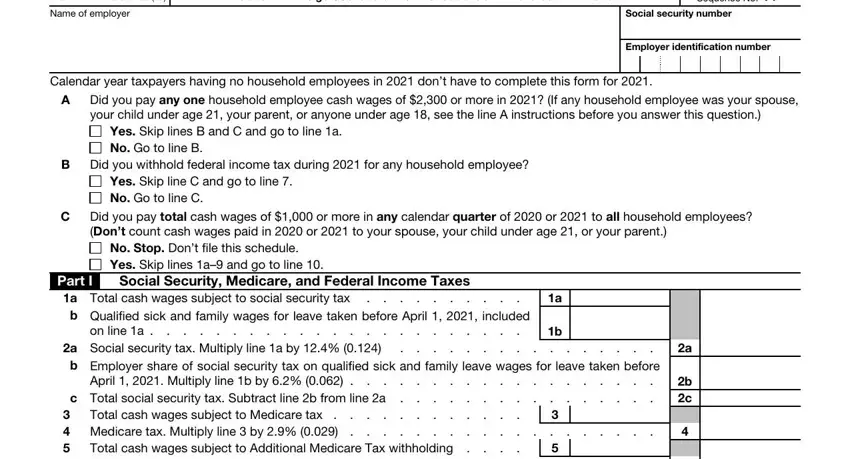

The next few parts are what you will need to create to get your finished PDF form.

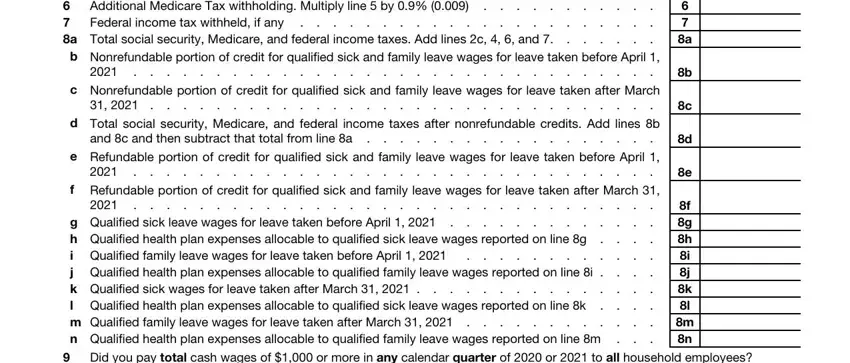

Complete the Total cash wages subject, Medicare tax Multiply line, Nonrefundable portion of credit, g Qualified sick leave wages, f g h i j k l m n, and Did you pay total cash wages of area with the data asked by the application.

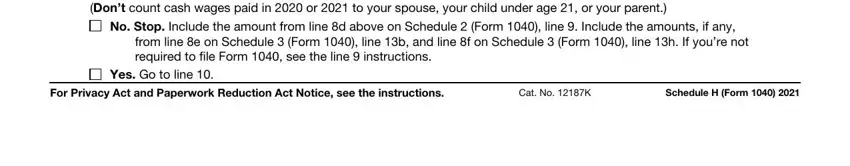

Focus on the main data the Did you pay total cash wages of, No Stop Include the amount from, from line e on Schedule Form, Yes Go to line, For Privacy Act and Paperwork, Cat No K, and Schedule H Form section.

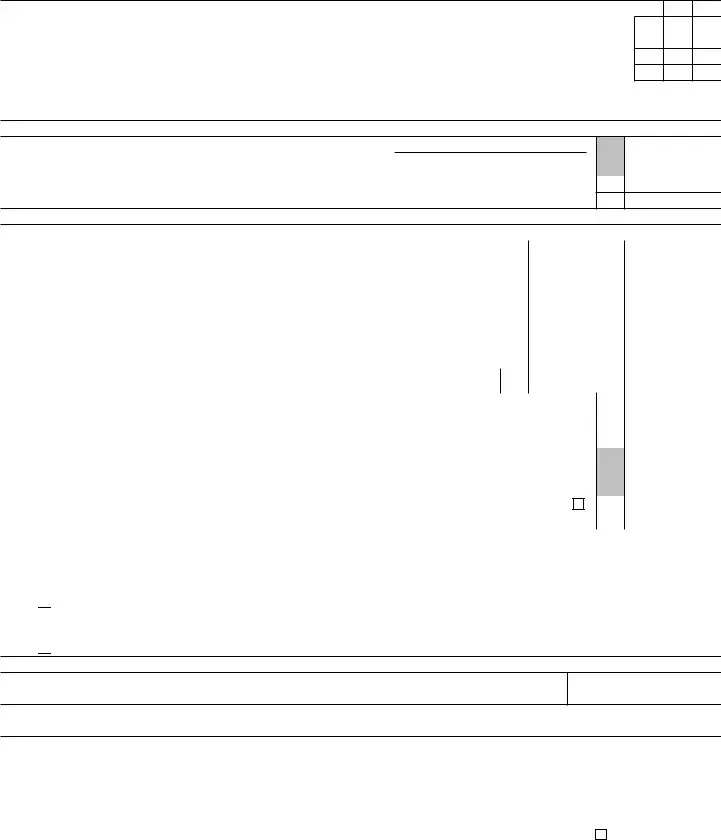

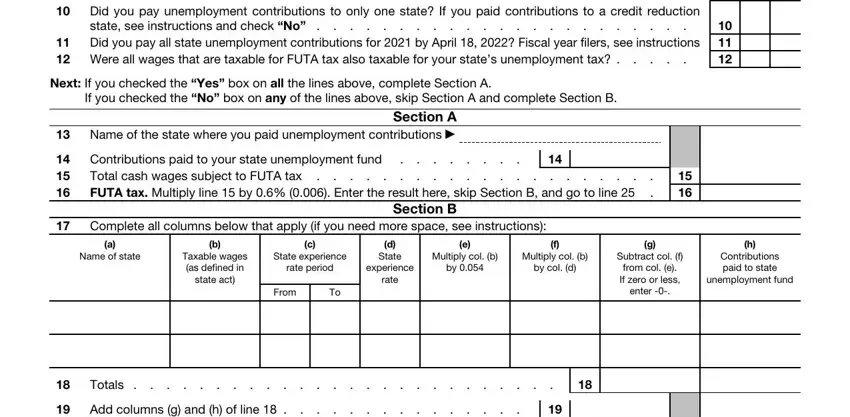

Please be sure to list the rights and responsibilities of the sides inside the Did you pay unemployment, Were all wages that are taxable, Next If you checked the Yes box on, If you checked the No box on any, Section A Name of the state where, Contributions paid to your state, Total cash wages subject to FUTA, Complete all columns below that, Section B, a Name of state, b Taxable wages as defined in, c State experience rate period, From, State experience rate, and e Multiply col b by paragraph.

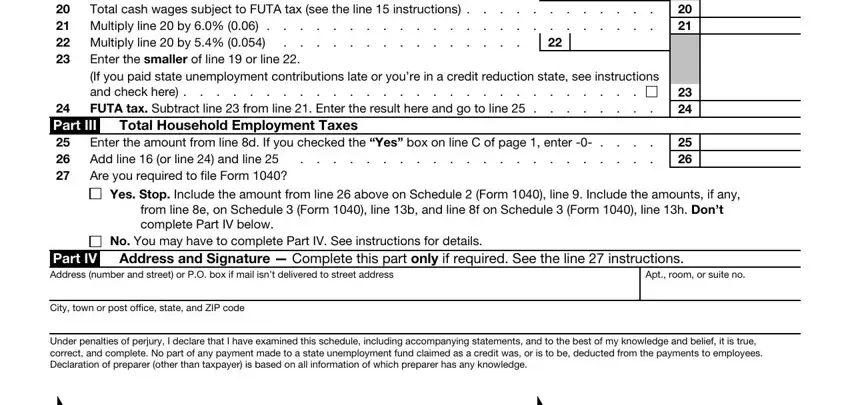

End by looking at the following fields and filling out the proper information: Add columns g and h of line, Multiply line by Multiply, Enter the smaller of line or, Total Household Employment Taxes, Enter the amount from line d If, Part III, Yes Stop Include the amount from, from line e on Schedule Form, No You may have to complete Part, Part IV Address and Signature, Apt room or suite no, City town or post office state and, Under penalties of perjury I, Employers signature Paid Preparer, and Date.

Step 3: Select the "Done" button. Now, you can transfer your PDF document - save it to your device or forward it through email.

Step 4: You can also make copies of your form tokeep clear of any kind of future worries. Don't be concerned, we do not distribute or monitor your data.