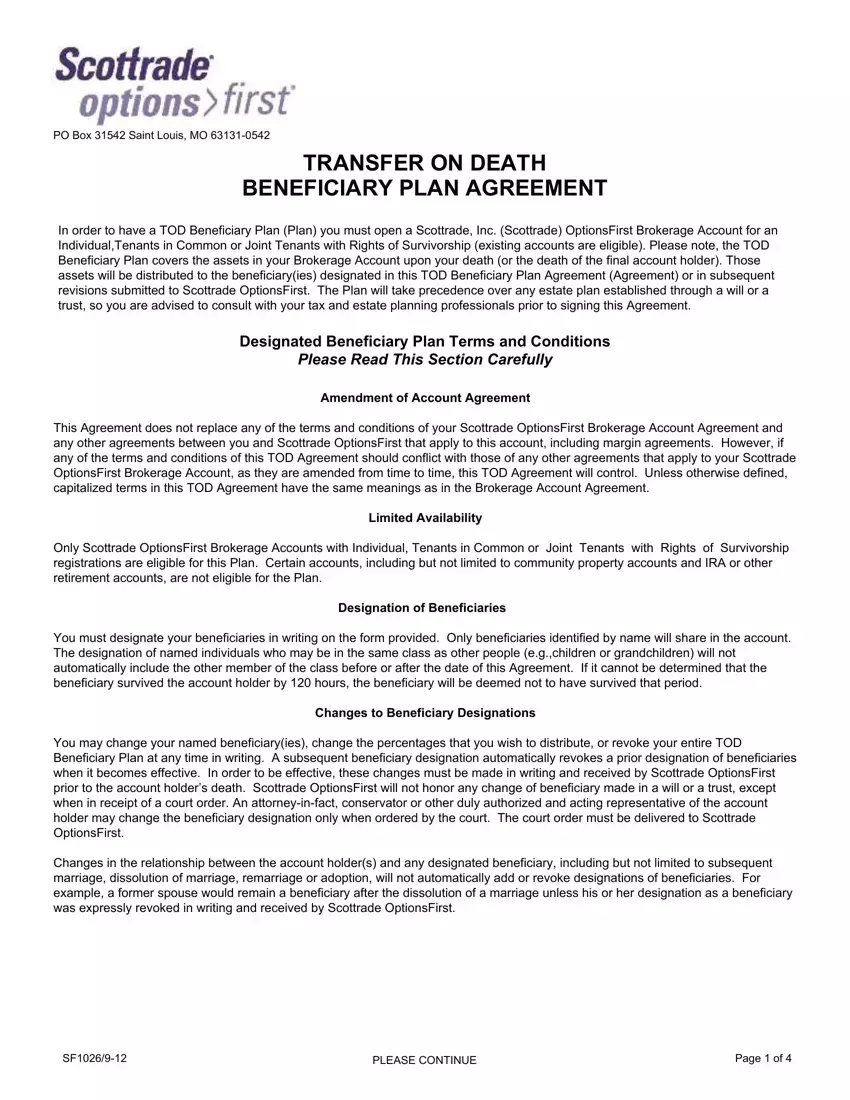

It's easy to prepare the nz chassis request powered vehicles online file using our PDF editor. The following actions will help you easily create your document.

Step 1: The following web page has an orange button stating "Get Form Now". Select it.

Step 2: Now, you're on the document editing page. You may add content, edit existing data, highlight particular words or phrases, insert crosses or checks, insert images, sign the file, erase unneeded fields, etc.

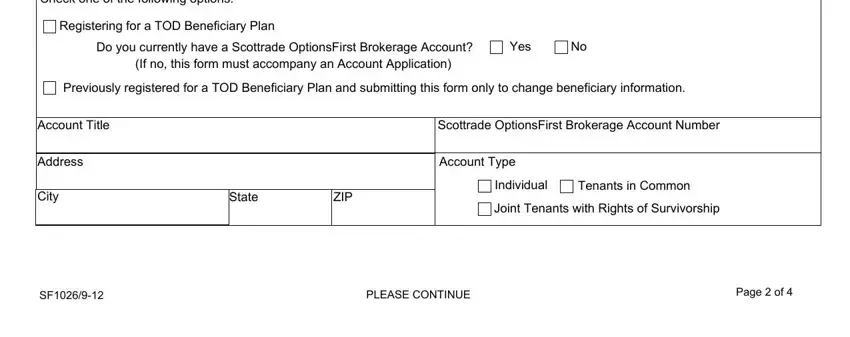

Enter the requested details in each section to prepare the PDF nz chassis request powered vehicles online

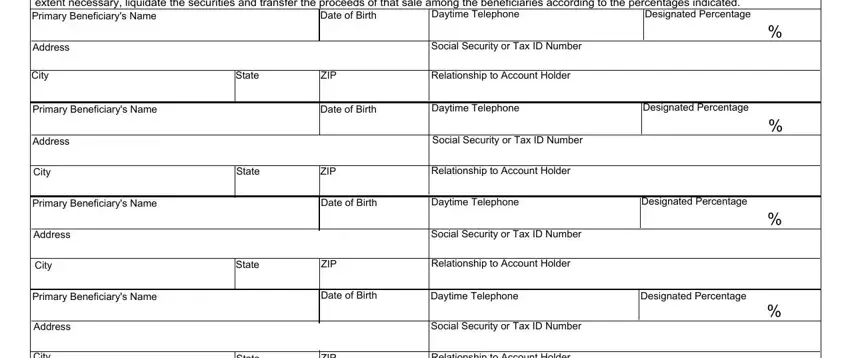

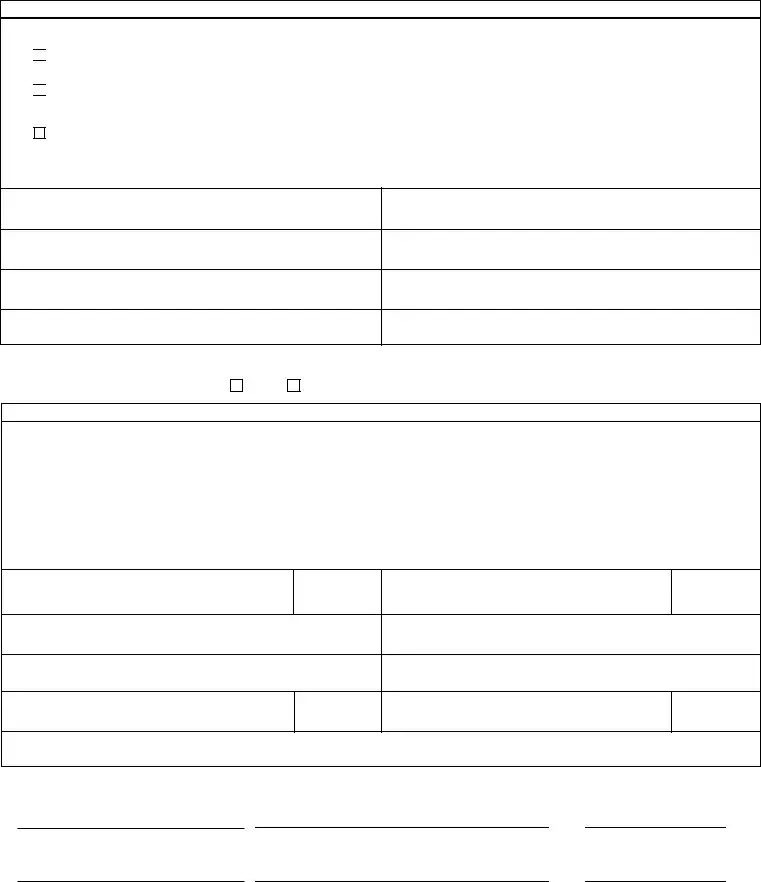

Provide the demanded particulars in the field PRIMARY BENEFICIARY DESIGNATION, Designated Percentage, Daytime Telephone, Date of Birth, Address, City, State, ZIP, Relationship to Account Holder, Social Security or Tax ID Number, Primary Beneficiarys Name, Date of Birth, Daytime Telephone, Designated Percentage, and Address.

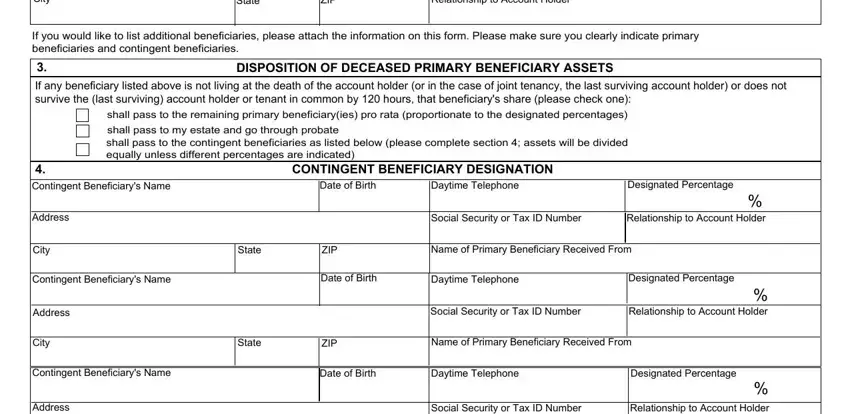

Jot down the necessary data in City, State, ZIP, Relationship to Account Holder, If you would like to list, DISPOSITION OF DECEASED PRIMARY, If any beneficiary listed above is, shall pass to the remaining, shall pass to my estate and go, Contingent Beneficiarys Name, CONTINGENT BENEFICIARY DESIGNATION, Date of Birth, Daytime Telephone, Social Security or Tax ID Number, and Designated Percentage part.

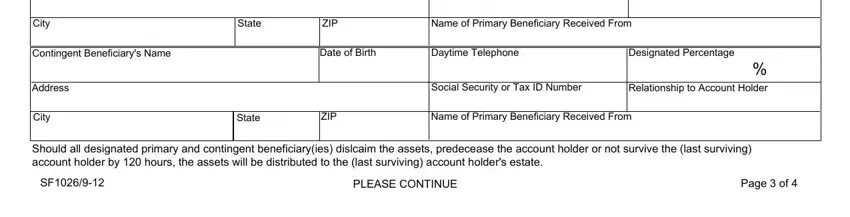

Within the part State, ZIP, Name of Primary Beneficiary, Contingent Beneficiarys Name, Date of Birth, Daytime Telephone, State, ZIP, Name of Primary Beneficiary, Social Security or Tax ID Number, Designated Percentage, Relationship to Account Holder, Should all designated primary and, PLEASE CONTINUE, and Page of, include the rights and obligations of the sides.

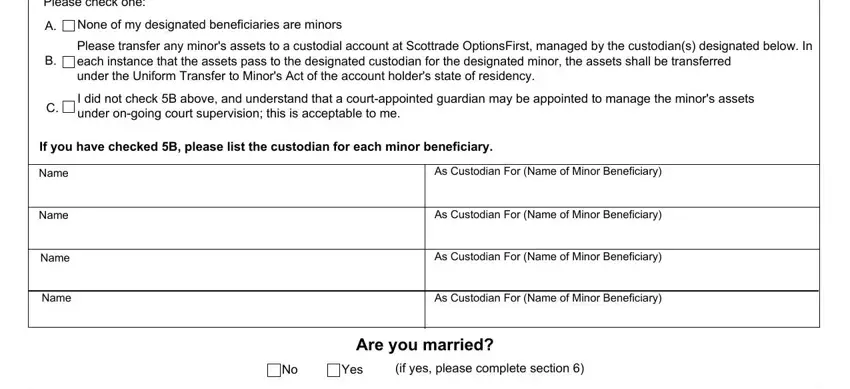

Look at the fields Please check one, None of my designated, Please transfer any minors assets, I did not check B above and, If you have checked B please list, Name, Name, Name, Name, As Custodian For Name of Minor, As Custodian For Name of Minor, As Custodian For Name of Minor, As Custodian For Name of Minor, Are you married, and Yes and then fill them in.

Step 3: After you select the Done button, your finished file can be simply exported to all of your gadgets or to email stated by you.

Step 4: In order to avoid probable forthcoming challenges, be sure to get as much as a few copies of any form.

Previously registered for a TOD Beneficiary Plan and submitting this form only to change beneficiary information.

Previously registered for a TOD Beneficiary Plan and submitting this form only to change beneficiary information.

None of my designated beneficiaries are minors

None of my designated beneficiaries are minors

each instance that the assets pass to the designated custodian for the designated minor, the assets shall be transferred under the Uniform Transfer to Minor's Act of the account holder's state of residency.

each instance that the assets pass to the designated custodian for the designated minor, the assets shall be transferred under the Uniform Transfer to Minor's Act of the account holder's state of residency.