Handling PDF files online is always super easy with this PDF editor. You can fill out notice form d here effortlessly. The tool is continually updated by us, getting additional functions and becoming a lot more versatile. With some simple steps, you are able to begin your PDF editing:

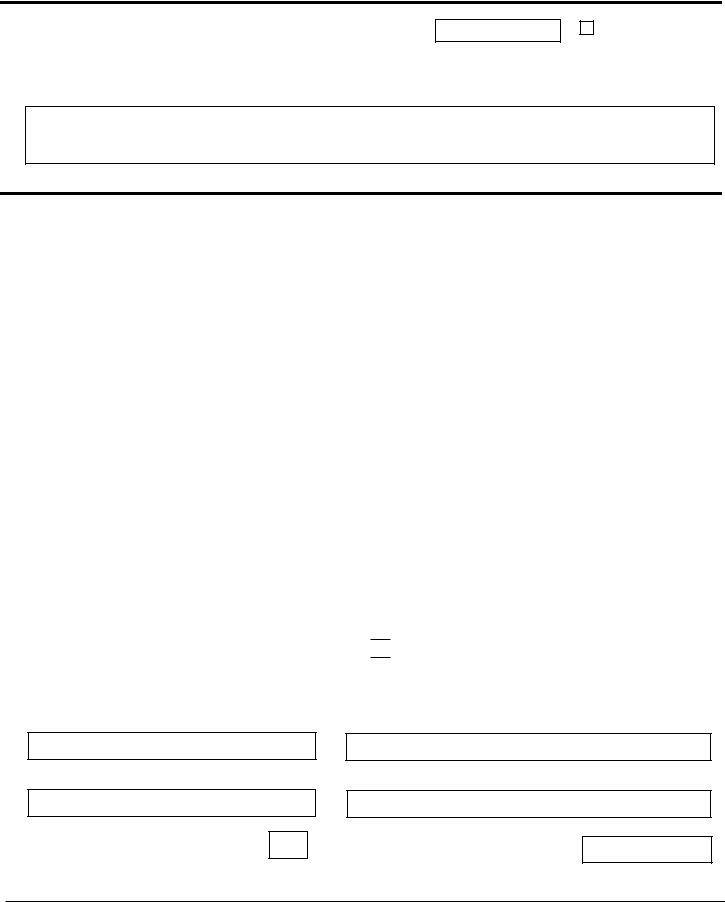

Step 1: Simply hit the "Get Form Button" in the top section of this site to see our pdf file editor. Here you will find everything that is required to fill out your document.

Step 2: With the help of this online PDF editor, you can accomplish more than simply complete blanks. Express yourself and make your documents look faultless with custom textual content added, or optimize the file's original input to excellence - all that comes with an ability to incorporate your own pictures and sign it off.

This PDF doc will require some specific details; to ensure consistency, you need to heed the next tips:

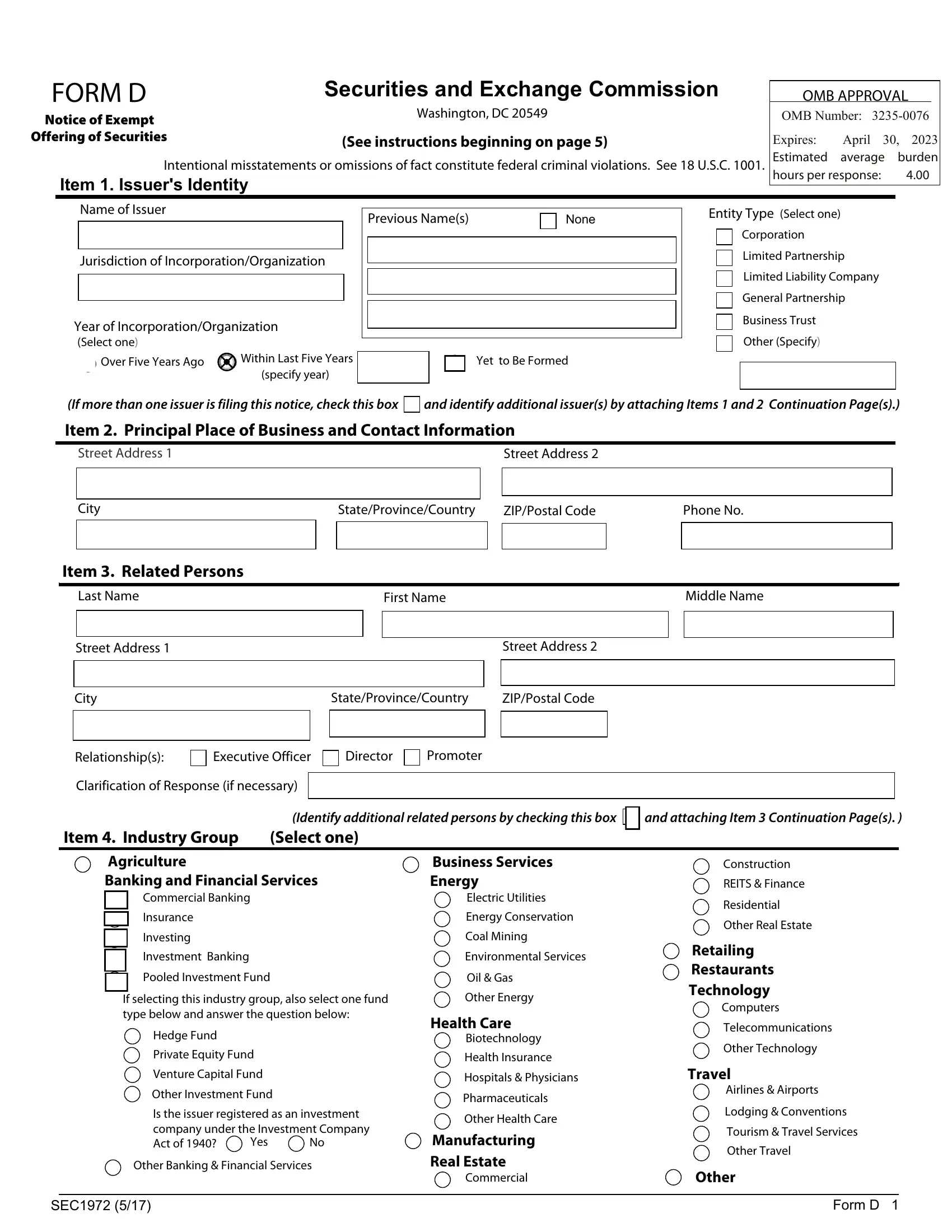

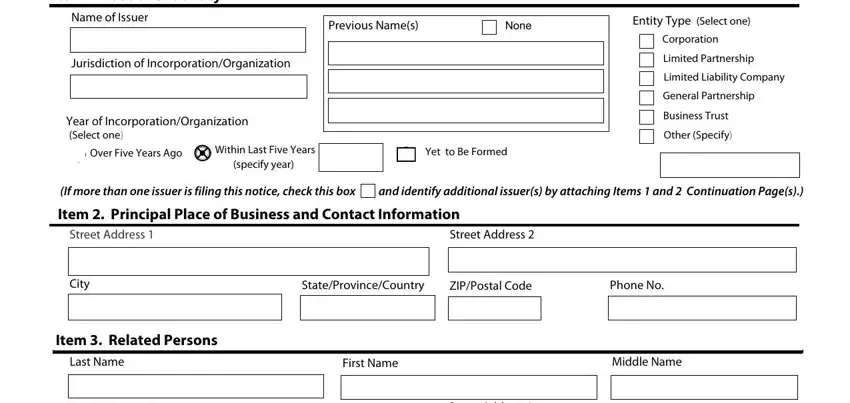

1. It is very important complete the notice form d correctly, therefore be careful when filling in the sections containing these blank fields:

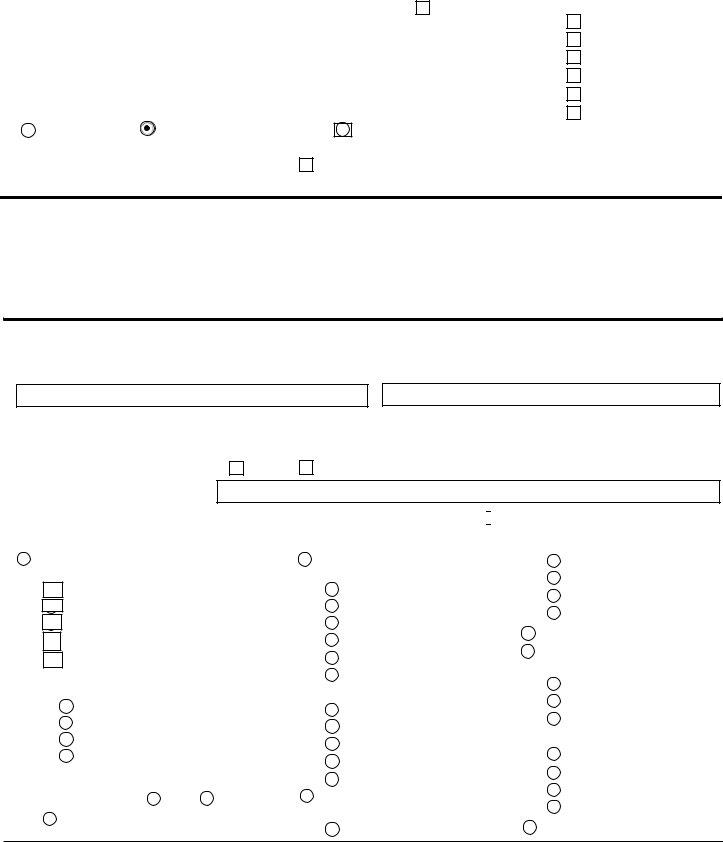

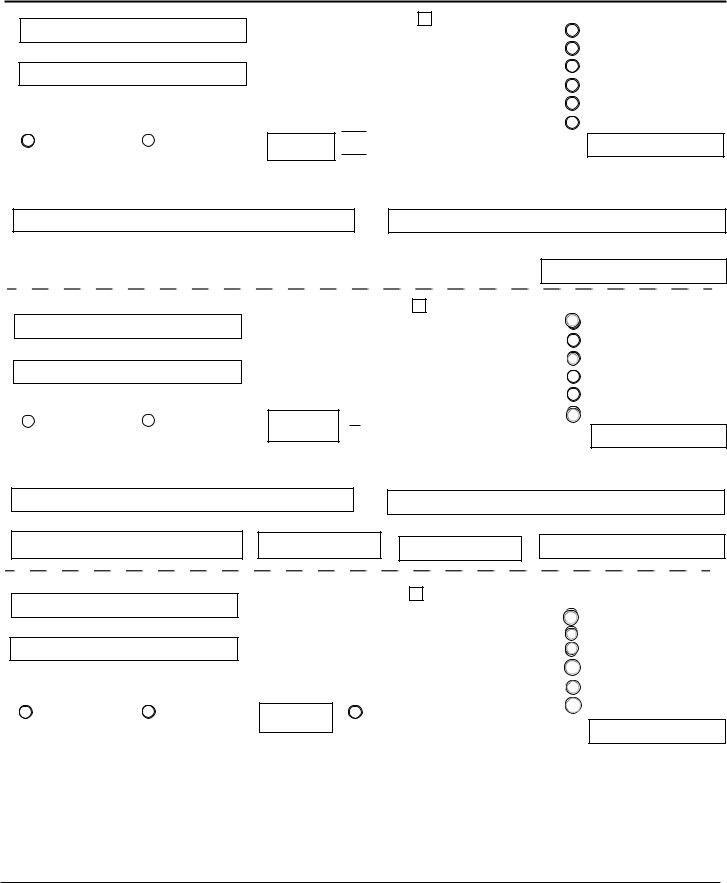

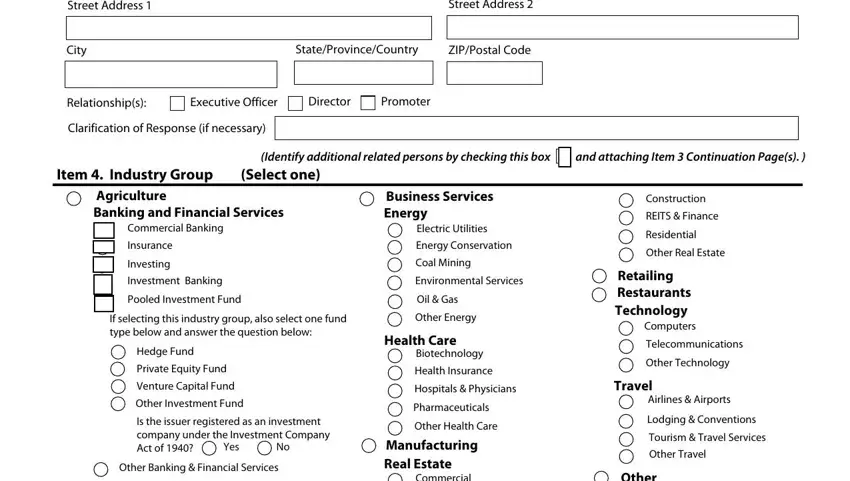

2. Once your current task is complete, take the next step – fill out all of these fields - Street Address, Street Address, City, StateProvinceCountry, ZIPPostal Code, Relationships, Executive Officer, Director, Promoter, Clarification of Response if, Identify additional related, and attaching Item Continuation, Item Industry Group, Select one, and Agriculture Banking and Financial with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

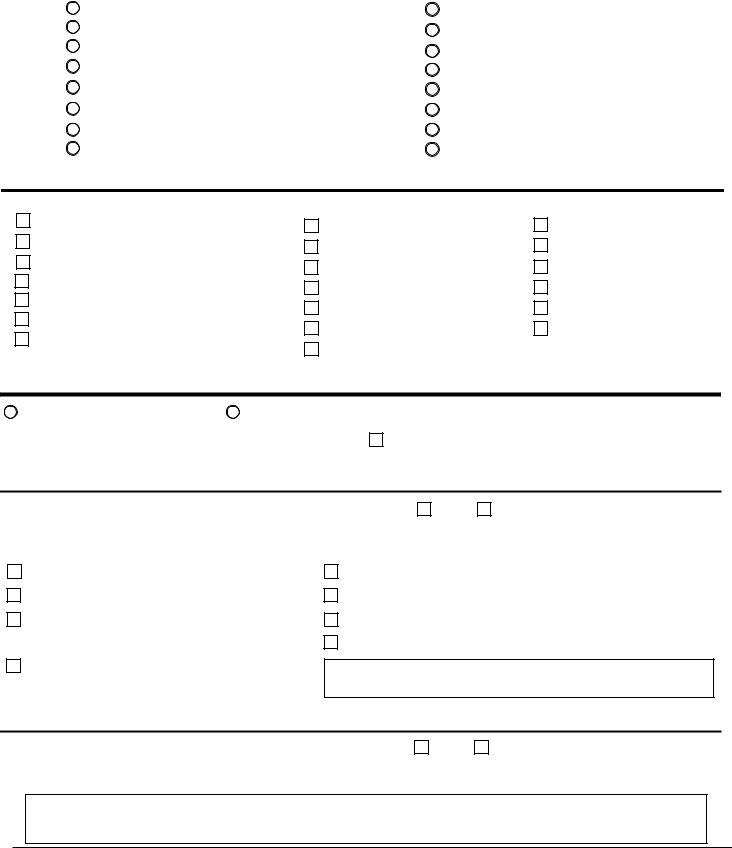

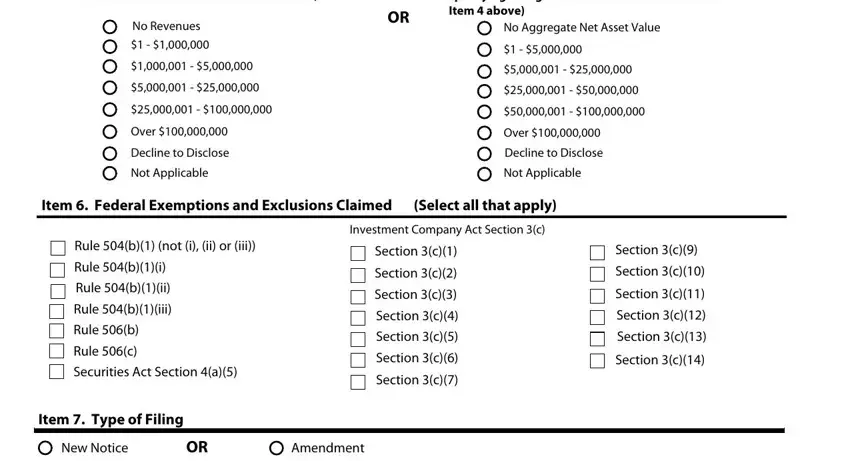

3. Completing Revenue Range for issuer not, No Revenues, Over, Decline to Disclose, Not Applicable, Aggregate Net Asset Value Range, No Aggregate Net Asset Value, Over, Decline to Disclose, Not Applicable, Item Federal Exemptions and, Select all that apply, Investment Company Act Section c, Rule b not i ii or iii, and Rule bi is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

In terms of No Revenues and Item Federal Exemptions and, be certain that you double-check them in this current part. Both these could be the most significant fields in the document.

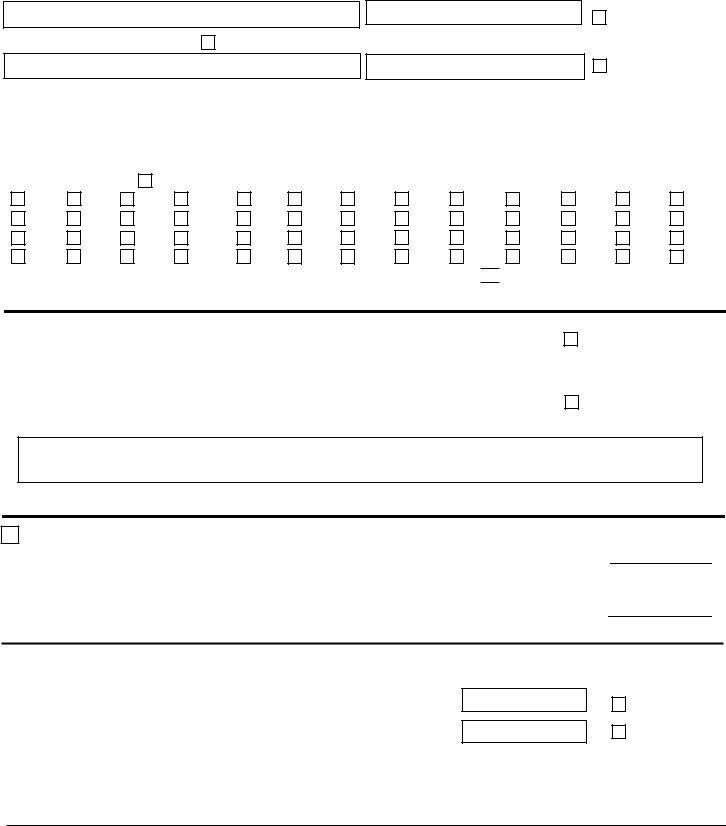

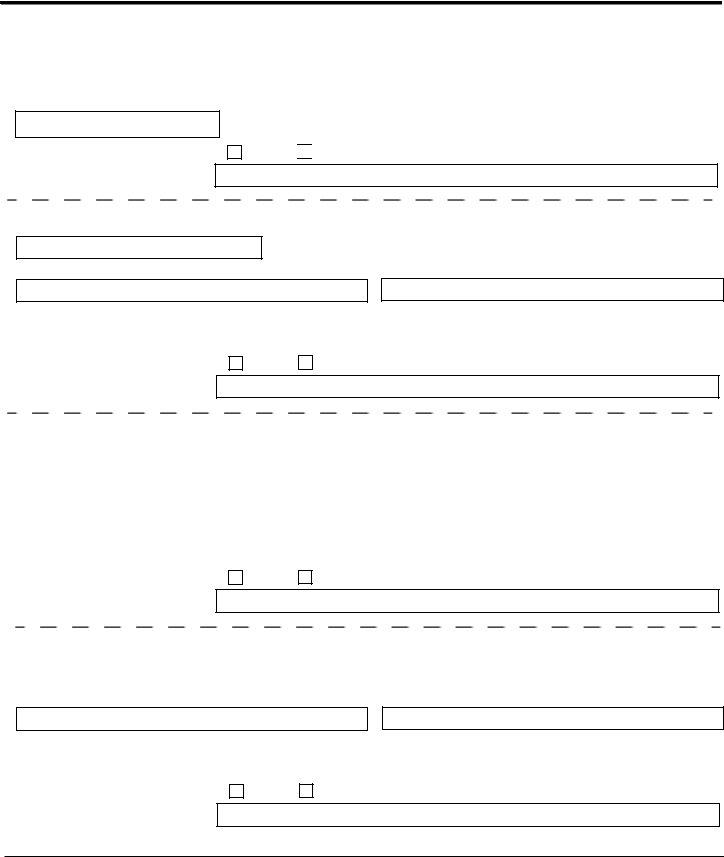

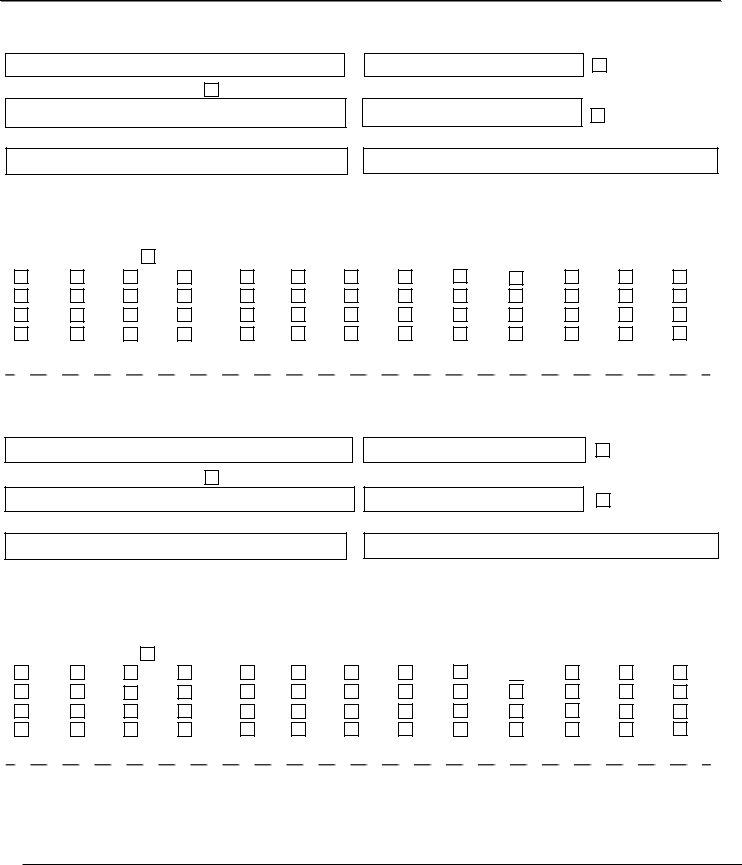

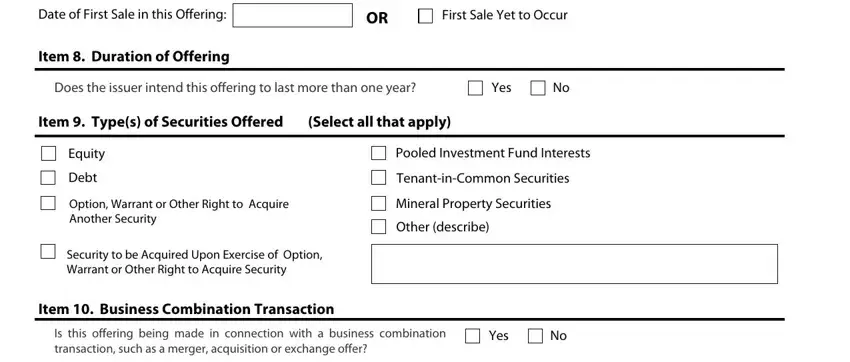

4. This subsection comes with these empty form fields to type in your particulars in: Date of First Sale in this Offering, First Sale Yet to Occur, Item Duration of Offering, Does the issuer intend this, Yes, Item Types of Securities Offered, Select all that apply, Equity, Debt, Option Warrant or Other Right to, Security to be Acquired Upon, Pooled Investment Fund Interests, TenantinCommon Securities, Mineral Property Securities Other, and Item Business Combination.

5. To finish your document, the final area includes a number of extra fields. Completing Is this offering being made in, and Form D will finalize everything and you can be done in the blink of an eye!

Step 3: Immediately after rereading the filled out blanks, hit "Done" and you're all set! Download the notice form d as soon as you join for a free trial. Conveniently use the form from your personal account, along with any modifications and changes being all kept! FormsPal guarantees your information confidentiality with a secure method that in no way records or shares any kind of sensitive information provided. Be confident knowing your docs are kept safe every time you work with our editor!