Filling in California is not difficult. Our team designed our editor to make it convenient to use and help you fill in any form online. Listed below are steps that you need to stick to:

Step 1: The website page has an orange button stating "Get Form Now". Merely click it.

Step 2: Now it's easy to update your California. The multifunctional toolbar enables you to insert, remove, customize, and highlight content material or perform many other commands.

For each section, fill in the information requested by the program.

Type in the demanded data in the field is recommended you, Before submitting the completed, file a Statement of, Operating Agreements are to be, Fees, Filing Fee The fee for filing the, Faster Service Fee, Counter and guaranteed expedite, Sacramento office, Counter Drop Off A separate, drop off your completed document, Guaranteed Expedite Drop Off For, and guaranteed timeframe for a.

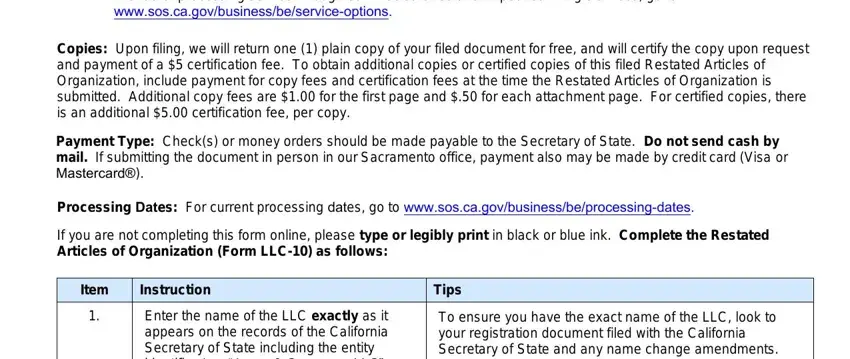

You can be required to provide the details to let the platform prepare the field guaranteed timeframe for a, Copies Upon filing we will return, Payment Type Checks or money, Processing Dates For current, If you are not completing this, Item, Instruction, Tips, Enter the name of the LLC exactly, and To ensure you have the exact name.

Through box LLC Instructions REV, and California Secretary of State, state the rights and responsibilities.

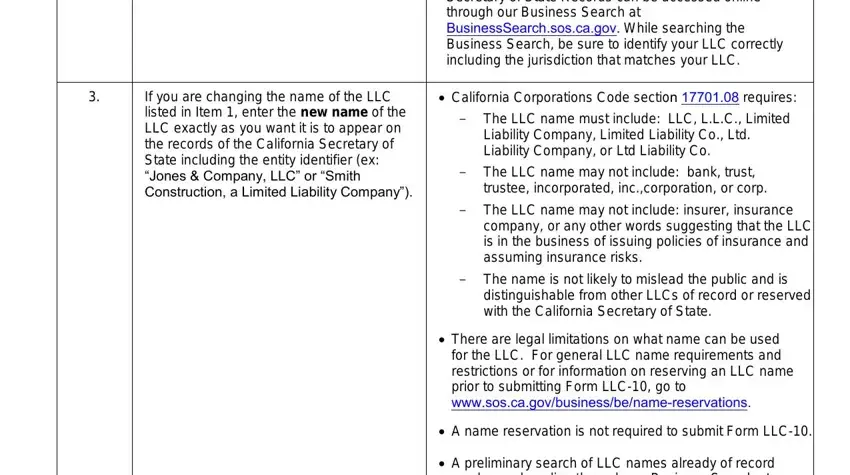

Look at the sections If you are changing the name of, Secretary of State Records can be, through our Business Search at, California Corporations Code, Liability Company Limited, The LLC name may not include bank, trustee incorporated, company or any other words, The name is not likely to mislead, distinguishable from other LLCs of, There are legal limitations on, A name reservation is not, and A preliminary search of LLC names and next complete them.

Step 3: Click the "Done" button. Now, you may transfer your PDF file - save it to your electronic device or send it by using email.

Step 4: You can make duplicates of the form toremain away from different forthcoming issues. You need not worry, we do not display or track your data.