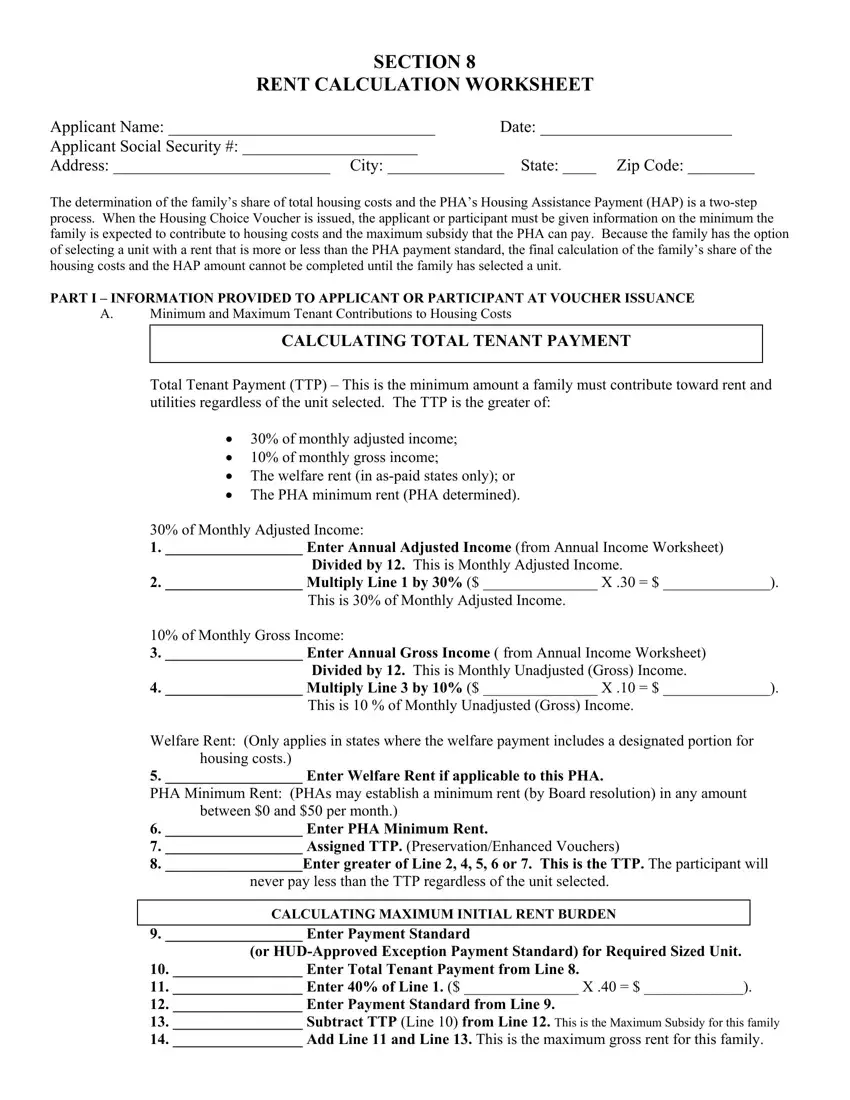

SECTION 8

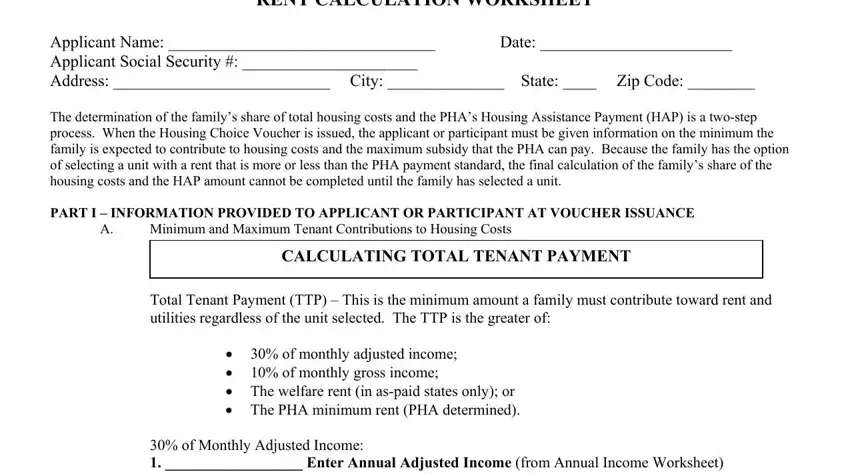

RENT CALCULATION WORKSHEET

Applicant Name: ________________________________ |

Date: _______________________ |

Applicant Social Security #: _____________________ |

|

Address: __________________________ City: ______________ State: ____ Zip Code: ________

The determination of the family’s share of total housing costs and the PHA’s Housing Assistance Payment (HAP) is a two-step process. When the Housing Choice Voucher is issued, the applicant or participant must be given information on the minimum the family is expected to contribute to housing costs and the maximum subsidy that the PHA can pay. Because the family has the option of selecting a unit with a rent that is more or less than the PHA payment standard, the final calculation of the family’s share of the housing costs and the HAP amount cannot be completed until the family has selected a unit.

PART I – INFORMATION PROVIDED TO APPLICANT OR PARTICIPANT AT VOUCHER ISSUANCE

A.Minimum and Maximum Tenant Contributions to Housing Costs

CALCULATING TOTAL TENANT PAYMENT

Total Tenant Payment (TTP) – This is the minimum amount a family must contribute toward rent and utilities regardless of the unit selected. The TTP is the greater of:

•30% of monthly adjusted income;

•10% of monthly gross income;

•The welfare rent (in as-paid states only); or

•The PHA minimum rent (PHA determined).

30% of Monthly Adjusted Income:

1.__________________ Enter Annual Adjusted Income (from Annual Income Worksheet) Divided by 12. This is Monthly Adjusted Income.

2.__________________ Multiply Line 1 by 30% ($ _______________ X .30 = $ ______________). This is 30% of Monthly Adjusted Income.

10% of Monthly Gross Income:

3.__________________ Enter Annual Gross Income ( from Annual Income Worksheet) Divided by 12. This is Monthly Unadjusted (Gross) Income.

4.__________________ Multiply Line 3 by 10% ($ _______________ X .10 = $ ______________).

This is 10 % of Monthly Unadjusted (Gross) Income.

Welfare Rent: (Only applies in states where the welfare payment includes a designated portion for housing costs.)

5. __________________ Enter Welfare Rent if applicable to this PHA.

PHA Minimum Rent: (PHAs may establish a minimum rent (by Board resolution) in any amount between $0 and $50 per month.)

6.__________________ Enter PHA Minimum Rent.

7.__________________ Assigned TTP. (Preservation/Enhanced Vouchers)

8.__________________Enter greater of Line 2, 4, 5, 6 or 7. This is the TTP. The participant will never pay less than the TTP regardless of the unit selected.

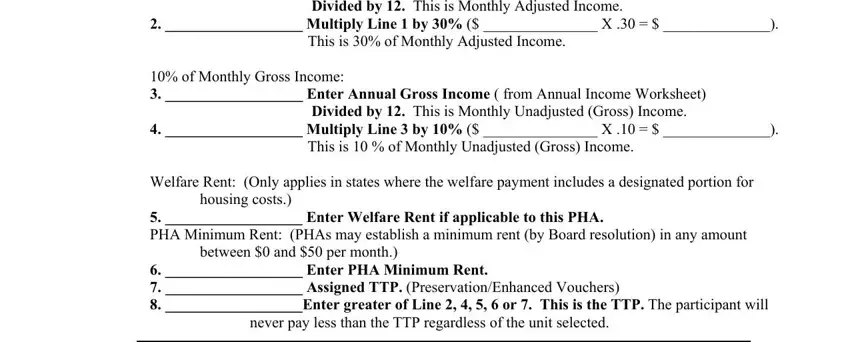

CALCULATING MAXIMUM INITIAL RENT BURDEN

9. __________________ Enter Payment Standard

(or HUD-Approved Exception Payment Standard) for Required Sized Unit.

10._________________ Enter Total Tenant Payment from Line 8.

11._________________ Enter 40% of Line 1. ($ _______________ X .40 = $ _____________).

12._________________ Enter Payment Standard from Line 9.

13._________________ Subtract TTP (Line 10) from Line 12. This is the Maximum Subsidy for this family

14._________________ Add Line 11 and Line 13. This is the maximum gross rent for this family.

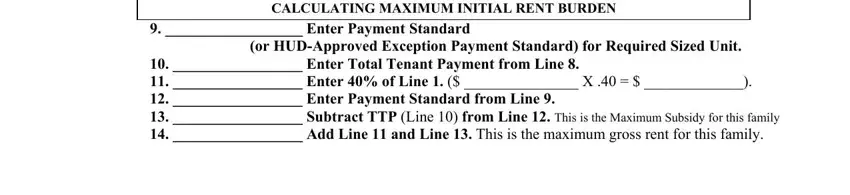

CALCULATING AFFORDABLE RENT FOR THIS FAMILY

|

|

(a) |

|

(b) |

15. |

Family TTP from Line 8. (Minimum the family will pay.) |

$ ________ |

|

|

16. |

Maximum Initial Rent Burden (Line 11) |

|

|

$_________ |

17. |

Maximum Subsidy from Line 13 (put on 17a & 17b) |

$ ________ |

|

$ _________ |

18. |

Family may consider units with gross rents between |

$ ________ |

and |

$ _________ |

|

(Add 15a + 17a) and (Add 16b + 17b) |

|

|

|

If the family selects a unit with a gross rent at or below Line 18(a), the family will pay the amount on Line 15. If the family selects a unit with a gross rent higher than the amount on Line 18(a), the family will pay the amount on Line 15 plus the *difference between Line 18(a) and 18(b). (*NOTE: Family cannot pay the difference if more than 40% of Monthly Adjusted Income on Line 11.)

|

CALCULATING UTILITY ALLOWANCE |

|

CALCULATING GROSS RENT |

List appropriate utility allowances from the Utility allowance schedule in your |

28. |

______________ Rent to Owner |

briefing packet. |

29. |

______________ Add Utility Allowance (from Line 26) |

|

|

30. |

______________ Gross Rent |

19. |

________________ Space Heating |

|

|

20. |

________________ Air Conditioning |

|

|

21. |

________________ Cooking |

|

|

22. |

________________ Other Electric |

|

|

23. |

________________ Water Heating |

|

|

24. |

________________ Water |

|

|

25. |

________________ Sewer |

|

|

26. |

________________ Trash Collection |

|

|

27. |

________________ Total Utility Allowance (Enter here and on Line 28.) |

|

|

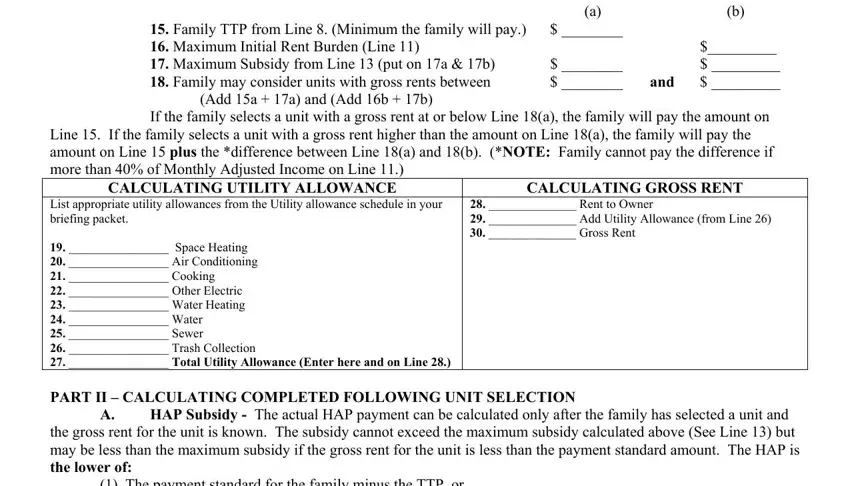

PART II – CALCULATING COMPLETED FOLLOWING UNIT SELECTION

A.HAP Subsidy - The actual HAP payment can be calculated only after the family has selected a unit and the gross rent for the unit is known. The subsidy cannot exceed the maximum subsidy calculated above (See Line 13) but may be less than the maximum subsidy if the gross rent for the unit is less than the payment standard amount. The HAP is the lower of:

(1) The payment standard for the family minus the TTP, or

(2) The gross rent minus the TTP.

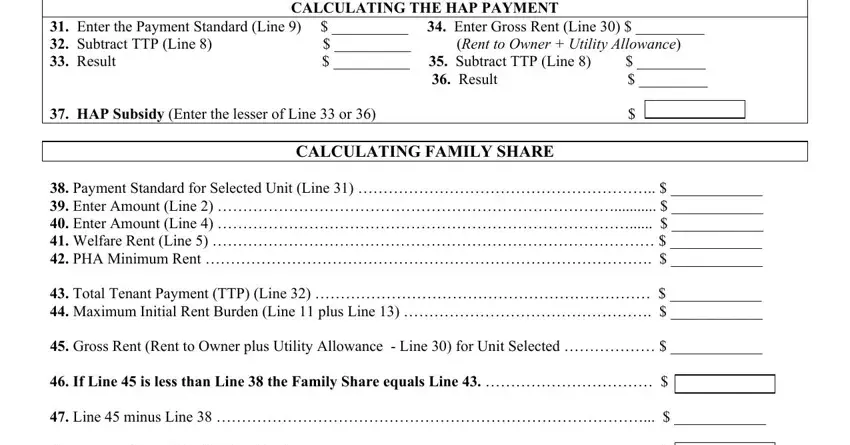

CALCULATING THE HAP PAYMENT

31. |

Enter the Payment Standard (Line 9) |

$ __________ |

34. |

Enter Gross Rent (Line 30) |

$ _________ |

|

32. |

Subtract TTP (Line 8) |

$ __________ |

|

(Rent to Owner + Utility Allowance) |

33. |

Result |

$ __________ |

35. |

Subtract TTP (Line 8) |

$ _________ |

|

|

|

|

36. |

Result |

$ _________ |

|

37. |

HAP Subsidy (Enter the lesser of Line 33 or 36) |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CALCULATING FAMILY SHARE |

|

|

|

38.Payment Standard for Selected Unit (Line 31) ………………………………………………….. $ ____________

39.Enter Amount (Line 2) ……………………………………………………………………........... $ ____________

40.Enter Amount (Line 4) ………………………………………………………………………...... $ ____________

41.Welfare Rent (Line 5) …………………………………………………………………………… $ ____________

42.PHA Minimum Rent ……………………………………………………………………………. $ ____________

43.Total Tenant Payment (TTP) (Line 32) ………………………………………………………… $ ____________

44.Maximum Initial Rent Burden (Line 11 plus Line 13) …………………………………………. $ ____________

45.Gross Rent (Rent to Owner plus Utility Allowance - Line 30) for Unit Selected ……………… $ ____________

46. If Line 45 is less than Line 38 the Family Share equals Line 43. …………………………… $

47.Line 45 minus Line 38 …………………………………………………………………………... $ ____________

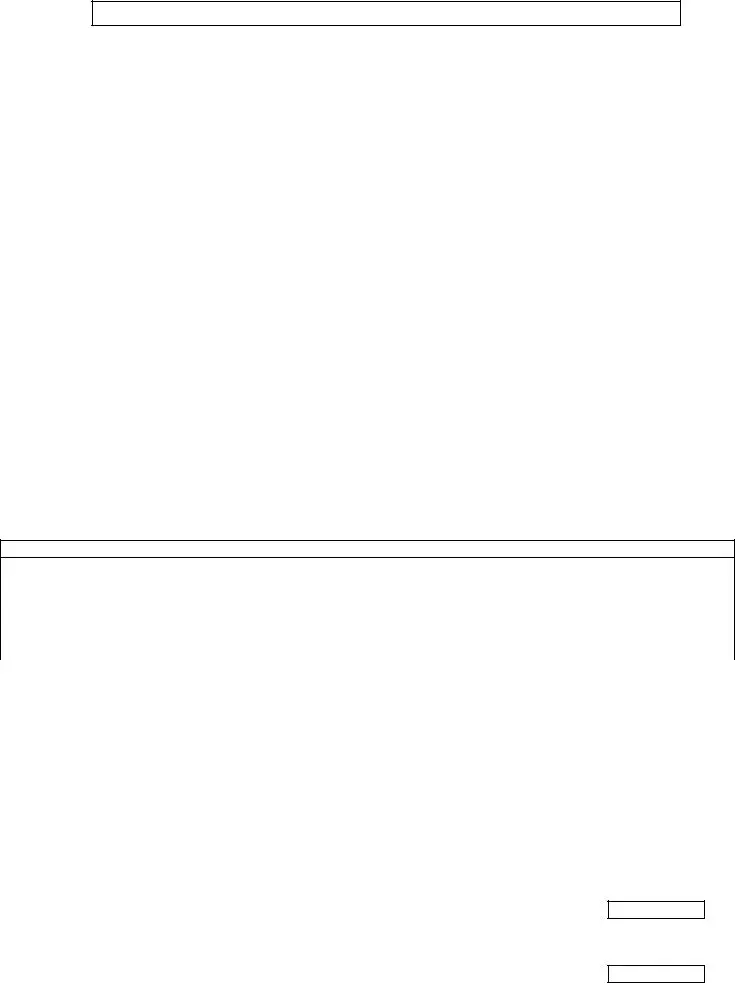

48. Family Share (Line 43 plus Line 47) …………………………………………………………… $

RENT CALCULATION

B.Standard Rent Calculation (If prorated rent, skip to Line 56)

49.Total Family Share from Line 46 or 48 whichever applies………………………………………. $ ____________

50.Rent to Owner …………………………………………………………………………………… $ ____________

51.Lower of Line 38 or Line 45 …………………………………………………………………….. $ ____________

52.Line 51 minus Line 43 …………………………………………………………………………... $ ____________

53.HAP to Owner: lower of Liner 50 or Line 52 …………………………………………………… $ ____________

54.Tenant Rent to Owner: Line 50 minus Line 53 …………………………………………………. $ ____________

55.Utility Reimbursement to family: Line 52 minus Line 53, but do not exceed Line 27 …………. $ ____________

C.Prorated Rent Calculation – For families that include both members who are citizens or have eligible immigration status and members who do not have eligible immigration status (or elect not to state that they have eligibility status), the amount of assistance is prorated, based on the percentage of household members who are citizens or documented eligible immigrants. Use steps 56 through 64 to determine prorated assistance.

56.Norman Total HAP: coy from Line 52, but do not exceed Line 45 ……………………………… $ ___________

57.Total Number of Eligible …………………………………………………….. ____________

58.Total Number in Family ……………………………………………………… ____________

59.Proration Percentage: Line 45 divided by Line 56 ………………………….. ____________

60.Prorated Total HAP: Line 56 X Line 59 …………………………………….. $___________

61.Mixed Family total family contribution: Line 45 minus Line 60 …………… $ ___________

62.Utility Allowance if any: coy from Line 27 …………………………………. $ ___________

63.Mixed Family tenant rent to owner: Line 61 minus 62 – If positive or 0, put tenant rent ………….. $

If negative, credit tenant ………………… $

64.Prorated HAP to Owner: Line 50 minus Line 63. If Line 63 is negative, put Line 50 amount …….. $

SUMMARY

(For PHA Staf Use in completing HUD-52641 HAP Contract)

TOTAL TENANT PAYMENT (TTP) (Line 8) …………………………………………………….$ _____________

PAYMENT STANDARD (Line 31) ………………………………………………………………. $ _____________

MAXIMUM GROSS RENT (Line 14) ……………………………………………………………. $ _____________

GROSS RENT RANGE FOR THIS FAMILY (Line 18A & 18B) FROM $ ___________ TO $ ____________

UTILITY ALLOWANCE (Line 27) ………………………………………………………………. $ ____________

HAP SUBSIDY (LINE 37) ……………………………………………………………………..… $ ____________

FAMILY SHARE (Line 46 or 48, whichever applies) ……………………………………………. $ ____________

RENT TO OWNER (Line 50) ………………………………………………………………………$ _____________

HAP TO OWNER (Line 53 or Line 64) Enter here and on Line 7 of HAP Contract ……………… $ ____________

TENANT RENT TO OWNER (Line 54 OR Line 63) ………………………………………………$____________

INITIAL LEASE TERM From __________ To _________ (Enter here and on Line 5 of HAP Contract)

CONTRACT UNIT (Enter Unit information below and on Line 3 of HAP Contract):

Unit Size (Circle One) 1BR 2BR 3BR 4BR Other _____________

Unit Address: ______________________________ City: _______________ State: _____ Zipcode: _________

Name of Owner: ___________________________

Address: ______________________________ City: _______________ State: _____ Zipcode: _________

HOUSEHOLD (List names of persons who may reside in the unit here and on Line 4 of HAP Contract):

_____________________________________________ |

________________________________________ |

_____________________________________________ |

________________________________________ |

_____________________________________________ |

________________________________________ |