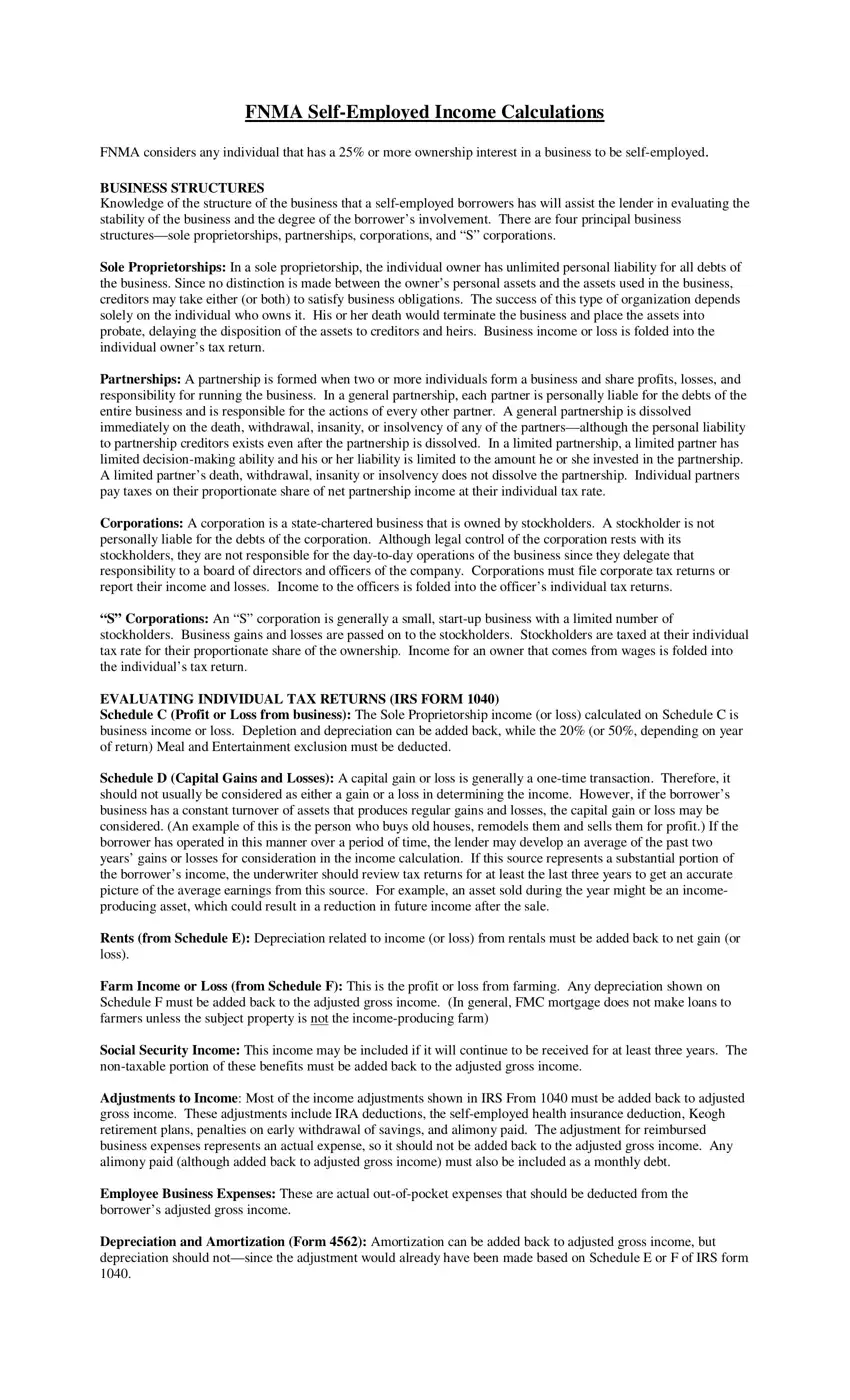

FNMA Self-Employed Income Calculations

FNMA considers any individual that has a 25% or more ownership interest in a business to be self-employed.

BUSINESS STRUCTURES

Knowledge of the structure of the business that a self-employed borrowers has will assist the lender in evaluating the stability of the business and the degree of the borrower’s involvement. There are four principal business structures—sole proprietorships, partnerships, corporations, and “S” corporations.

Sole Proprietorships: In a sole proprietorship, the individual owner has unlimited personal liability for all debts of the business. Since no distinction is made between the owner’s personal assets and the assets used in the business, creditors may take either (or both) to satisfy business obligations. The success of this type of organization depends solely on the individual who owns it. His or her death would terminate the business and place the assets into probate, delaying the disposition of the assets to creditors and heirs. Business income or loss is folded into the individual owner’s tax return.

Partnerships: A partnership is formed when two or more individuals form a business and share profits, losses, and responsibility for running the business. In a general partnership, each partner is personally liable for the debts of the entire business and is responsible for the actions of every other partner. A general partnership is dissolved immediately on the death, withdrawal, insanity, or insolvency of any of the partners—although the personal liability to partnership creditors exists even after the partnership is dissolved. In a limited partnership, a limited partner has limited decision-making ability and his or her liability is limited to the amount he or she invested in the partnership. A limited partner’s death, withdrawal, insanity or insolvency does not dissolve the partnership. Individual partners pay taxes on their proportionate share of net partnership income at their individual tax rate.

Corporations: A corporation is a state-chartered business that is owned by stockholders. A stockholder is not personally liable for the debts of the corporation. Although legal control of the corporation rests with its stockholders, they are not responsible for the day-to-day operations of the business since they delegate that responsibility to a board of directors and officers of the company. Corporations must file corporate tax returns or report their income and losses. Income to the officers is folded into the officer’s individual tax returns.

“S” Corporations: An “S” corporation is generally a small, start-up business with a limited number of stockholders. Business gains and losses are passed on to the stockholders. Stockholders are taxed at their individual tax rate for their proportionate share of the ownership. Income for an owner that comes from wages is folded into the individual’s tax return.

EVALUATING INDIVIDUAL TAX RETURNS (IRS FORM 1040)

Schedule C (Profit or Loss from business): The Sole Proprietorship income (or loss) calculated on Schedule C is business income or loss. Depletion and depreciation can be added back, while the 20% (or 50%, depending on year of return) Meal and Entertainment exclusion must be deducted.

Schedule D (Capital Gains and Losses): A capital gain or loss is generally a one-time transaction. Therefore, it should not usually be considered as either a gain or a loss in determining the income. However, if the borrower’s business has a constant turnover of assets that produces regular gains and losses, the capital gain or loss may be considered. (An example of this is the person who buys old houses, remodels them and sells them for profit.) If the borrower has operated in this manner over a period of time, the lender may develop an average of the past two years’ gains or losses for consideration in the income calculation. If this source represents a substantial portion of the borrower’s income, the underwriter should review tax returns for at least the last three years to get an accurate picture of the average earnings from this source. For example, an asset sold during the year might be an income- producing asset, which could result in a reduction in future income after the sale.

Rents (from Schedule E): Depreciation related to income (or loss) from rentals must be added back to net gain (or loss).

Farm Income or Loss (from Schedule F): This is the profit or loss from farming. Any depreciation shown on Schedule F must be added back to the adjusted gross income. (In general, FMC mortgage does not make loans to farmers unless the subject property is not the income-producing farm)

Social Security Income: This income may be included if it will continue to be received for at least three years. The non-taxable portion of these benefits must be added back to the adjusted gross income.

Adjustments to Income: Most of the income adjustments shown in IRS From 1040 must be added back to adjusted gross income. These adjustments include IRA deductions, the self-employed health insurance deduction, Keogh retirement plans, penalties on early withdrawal of savings, and alimony paid. The adjustment for reimbursed business expenses represents an actual expense, so it should not be added back to the adjusted gross income. Any alimony paid (although added back to adjusted gross income) must also be included as a monthly debt.

Employee Business Expenses: These are actual out-of-pocket expenses that should be deducted from the borrower’s adjusted gross income.

Depreciation and Amortization (Form 4562): Amortization can be added back to adjusted gross income, but depreciation should not—since the adjustment would already have been made based on Schedule E or F of IRS form 1040.

EVALUATING CORPORATE TAX RETURNS:

The self-employed income analysis (form 1084A or 1084B) should be used to determine the borrower’s share or a corporation’s after-tax income and non-cash expenses after obligations that are payable in less than one year have been deducted from the corporate tax returns. The borrower’s percentage of ownership can usually be determined from the “compensation of officers” section of the corporate tax return. If this information is not provided, the lender must obtain other evidence of the borrower’s ownership before this income can be considered. (A statement from the corporation’s accountant will be considered as acceptable evidence.) Before using the borrower’s share of a corporation’s funds to qualify the borrower for the mortgage, the lender must verify the borrower’s right to the funds by obtaining a corporate resolution or other comparable document that establishes that right.

If the corporation operates on a fiscal year that is different from the calendar year, the lender must make time adjustments to relate the corporate income to the individual tax return (which is on a calendar year basis.)

Lenders should pay particular attention to the following items when evaluating income from U.S. corporation income tax returns (IRS form 1120) to make sure they develop the correct “adjusted” business income. *Taxable Income: This is the corporation’s net profit. IT must be reduced by the corporation’s total taxes to determine after-tax income.

*Depreciation: This non-cash expense must be added back to the corporation’s after-tax income.

*Depletion: This non-cash expense must be added back to the corporation’s after-tax income.

*Mortgage, notes, bonds payable in less than one year: This figure, which is found on the corporation’s balance sheet, must be deducted from the corporation’s after-tax income since it is not available for distribution because the funds must be used to meet the next year’s obligations.

Once the adjusted business income has been developed, it should be multiplied by the borrower’s percentage of ownership in the business. The lender should then subtract any dividend income from the business that the borrower reported on his or her individual tax return to arrive at the total income available to the borrower for qualifying purposes. After the income available to the borrower for qualifying purposes has been determined, the lender should re-evaluate the corporation’s overall financial position, using the Comparative Income Analysis or other alternative documentation that FNMA considers acceptable. A borrower’s withdrawal of cash may have a severe negative impact on the corporation and may lead to negative cash flow. When this occurs, it may not be possible to confirm the stable, on-going income that is needed to approve the mortgage.

EVALUATING “S” CORPORATION TAX RETURNS:

The Self-Employed Income Analysis (Form 1084A or 1084B) should be used to determine the borrower’s share of the “S” corporation’s adjusted business income that will be available for qualifying the borrower for the mortgage (if the borrower is able to provide evidence that he or she has access to the funds). “S” corporations pass gains and losses onto their shareholders, who are then taxed at the tax rates for individuals. This income or loss, which is reflected on the U.S. Income Tax Return for an “S” Corporation (IRS Form 1120S), is transferred to Schedule E of the individual owner’s U.S. Income Tax Return (IRS Form 1040). The primary source of income for an owner of an “S” corporation comes from W-2 wages, which can be traced to the “compensation of officers” line in IRS Form 1120S and is transferred to the individual owner’s IRS Form 1040.. Depreciation and depletion from the “S” corporation’s tax returns can be proportionately added back to the borrower’s income – since they are actually non- cash expenses. However, they first must be reduced by the borrower’s proportionate share of the “S” corporation’s total obligations that are payable in less than one year. (This will help the lender determine whether the business will be able to meet its short-term obligations.)

Once the income available to the borrower for qualifying purposes has been determined, the lender should re- evaluate the “S” corporation’s overall financial position, using the Comparative Income Analysis (Form 1088) or other alternative documentation that FNMA considers acceptable. A borrower’s withdrawal of cash may have a severe negative impact on the business and may lead to a negative cash flow. When this occurs, it may not be possible to confirm the stable, on-going income that is needed to approve the mortgage.

EVALUATING PARTNERSHIP TAX RETURNS

The Self-Employed Income Analysis (Form 1084A or 1084B) should be used to determine the borrower’s share of the partnership’s adjusted business income that will be available for qualifying the borrower for the mortgage (if the borrower is able to provide evidence that he or she has access to the funds). Both general and limited partnerships use the U.S. Partnership Return of Income (IRS From 1065) and the Partner’s Share of Income, Credits, Deductions, etc. (Schedule K-1) for filing federal income tax returns for the partnership. The partner’s share of income is carried over to Schedule E of his or her U.S. Income Tax Return (IRS Form 1040). The borrower’s proportionate share of depreciation and depletion can be added back to the borrower’s income since they are non-cash expenses. However, they must first be reduced by the borrower’s proportionate share of the partnership’s total obligations that are payable in less than one year. (This will help the lender determine whether the business will be able to meet its short-term obligations.)

Once the income available to the borrower for qualifying purposes has been determined, the lender should re- evaluate the partnership’s overall financial position, using the Comparative Income Analysis (Form 1088) or other alternative documentation that FNMA considers acceptable. A borrower’s withdrawal of cash may have a severe negative impact on the business and may lead to a negative cash flow. When this occurs, it may not be possible to confirm the stable, on-going income that is needed to approve the mortgage.

EVALUATING PROFIT AND LOSS STATEMENTS:

Year-to-date income from a business can be used to qualify a borrower only if the income is in line with the previous year’s earnings for the business (or if audited financial statements are provided). The Self-Employed Income Analysis (Form 1084A or 1084B) can be used to determine the portion of a business’ year-to-date income that can be used in qualifying the borrower for a mortgage. A typical Profit and Loss Statement has a format similar to Schedule C of the U.S. Income Tax Return (IRS From 1040). Any salaries or draws received by the borrower, as well as the allowable addbacks indicated in the “adjustment to income” section, may be added to the net profit. However, only the borrower’s proportionate share of these items can be considered in determining the amount that can be used to qualify the borrower for the mortgage.

USE FOR BUSINESS INCOME ONLY

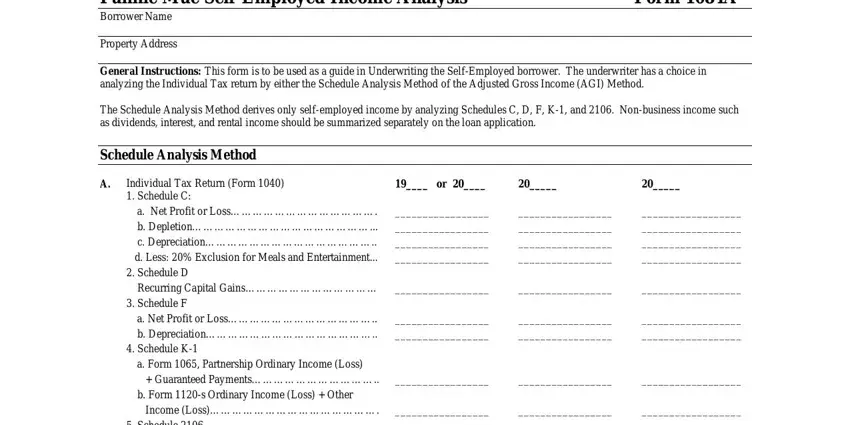

Fannie Mae Self-Employed Income Analysis |

Form 1084A |

Borrower Name |

|

|

|

Property Address |

|

General Instructions: This form is to be used as a guide in Underwriting the Self-Employed borrower. The underwriter has a choice in analyzing the Individual Tax return by either the Schedule Analysis Method of the Adjusted Gross Income (AGI) Method.

The Schedule Analysis Method derives only self-employed income by analyzing Schedules C, D, F, K-1, and 2106. Non-business income such as dividends, interest, and rental income should be summarized separately on the loan application.

Schedule Analysis Method

A. Individual Tax Return (Form 1040) |

19____ or 20____ |

20_____ |

20_____ |

1. Schedule C: |

|

|

|

a. Net Profit or Loss…………………………………. |

_________________ |

_________________ |

__________________ |

b. Depletion…………………………………………... |

_________________ |

_________________ |

__________________ |

c. Depreciation……………………………………….. |

_________________ |

_________________ |

__________________ |

d. Less: 20% Exclusion for Meals and Entertainment... |

_________________ |

_________________ |

__________________ |

2. Schedule D |

|

|

|

Recurring Capital Gains……………………………… |

_________________ |

_________________ |

__________________ |

3. Schedule F |

|

|

|

a. Net Profit or Loss………………………………….. |

_________________ |

_________________ |

__________________ |

b. Depreciation……………………………………….. |

_________________ |

_________________ |

__________________ |

4. Schedule K-1 |

|

|

|

a. Form 1065, Partnership Ordinary Income (Loss) |

|

|

|

+ Guaranteed Payments…………………………….. |

_________________ |

_________________ |

__________________ |

b. Form 1120-s Ordinary Income (Loss) + Other |

|

|

|

Income (Loss)………………………………………. |

_________________ |

_________________ |

__________________ |

5. Schedule 2106 |

|

|

|

Total Expenses……………………………………….. |

(-)_______________ |

_________________ |

__________________ |

6. W-2 income from Corporation……………………….. |

(+)_______________ |

_________________ |

__________________ |

7. Total………………………………………………….. |

_________________ |

_________________ |

__________________ |

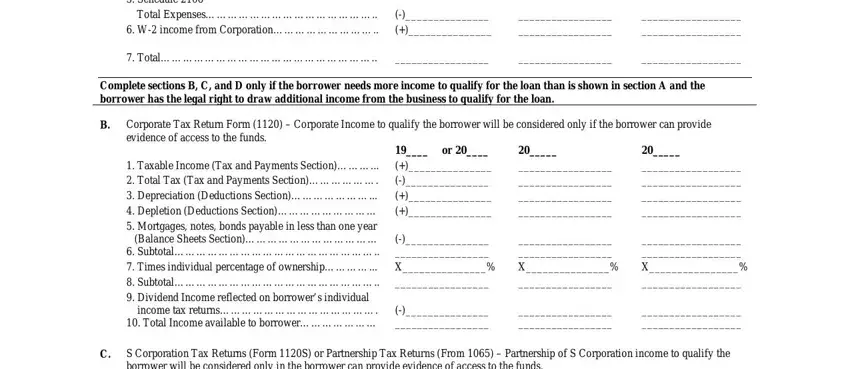

Complete sections B, C, and D only if the borrower needs more income to qualify for the loan than is shown in section A and the borrower has the legal right to draw additional income from the business to qualify for the loan.

B.Corporate Tax Return Form (1120) – Corporate Income to qualify the borrower will be considered only if the borrower can provide evidence of access to the funds.

|

19____ or 20____ |

20_____ |

20_____ |

1. Taxable Income (Tax and Payments Section)………... |

(+)_______________ |

_________________ |

__________________ |

2. Total Tax (Tax and Payments Section)………………. |

(-)_______________ |

_________________ |

__________________ |

3. Depreciation (Deductions Section)…………………... |

(+)_______________ |

_________________ |

__________________ |

4. Depletion (Deductions Section)……………………… |

(+)_______________ |

_________________ |

__________________ |

5. Mortgages, notes, bonds payable in less than one year |

|

|

|

(Balance Sheets Section)……………………………… |

(-)_______________ |

_________________ |

__________________ |

6. Subtotal……………………………………………….. |

_________________ |

_________________ |

__________________ |

7. Times individual percentage of ownership…………... |

X_______________% |

X_______________% |

X________________% |

8. Subtotal……………………………………………….. |

_________________ |

_________________ |

__________________ |

9. Dividend Income reflected on borrower’s individual |

|

|

|

income tax returns……………………………………. |

(-)_______________ |

_________________ |

__________________ |

10. Total Income available to borrower………………… |

_________________ |

_________________ |

__________________ |

C.S Corporation Tax Returns (Form 1120S) or Partnership Tax Returns (From 1065) – Partnership of S Corporation income to qualify the borrower will be considered only in the borrower can provide evidence of access to the funds.

1. Depreciation (Deductions Section)…………………... |

(+)_______________ |

_________________ |

__________________ |

2. Depletion (Deductions Section)……………………… |

(+)_______________ |

_________________ |

__________________ |

3. Mortgages, notes, bonds payable in less than one year |

|

|

|

(Balance Sheets Section)……………………………... |

(-)_______________ |

_________________ |

__________________ |

4. Subtotal……………………………………………….. |

_________________ |

_________________ |

__________________ |

5. Times individual percentage of ownership…………... |

X_______________% |

X_______________% |

X________________% |

6. Total Income available to borrower…..……………… |

_________________ |

_________________ |

__________________ |

Total Income Available (add A, B, and C)…………... |

I ________________ |

II________________ |

III________________ |

D.Year-to-Date Profit and Loss

Year-to-Date income to qualify the borrower will be considered only if that income is in line with the previous year’s earnings or it audited financial statements are provided.

1. Salary/Draws to Individual…………………………… |

$_________________ |

2. Total Allowable add back |

$______________ |

X __________% of individual ownership = |

$_________________ |

3. Total net profit |

$______________ |

X __________% of individual ownership = |

$_________________ |

4. Total………………………………………………….. |

$_________________ |

Combined Total I, II, III, YTD = $_______________ divided by _____________ months = $______________________ Monthly Average

This form is only a reference to help organize information from the tax returns. You must refer to the FNMA selling guide for complete underwriting requirements on the self-employed.

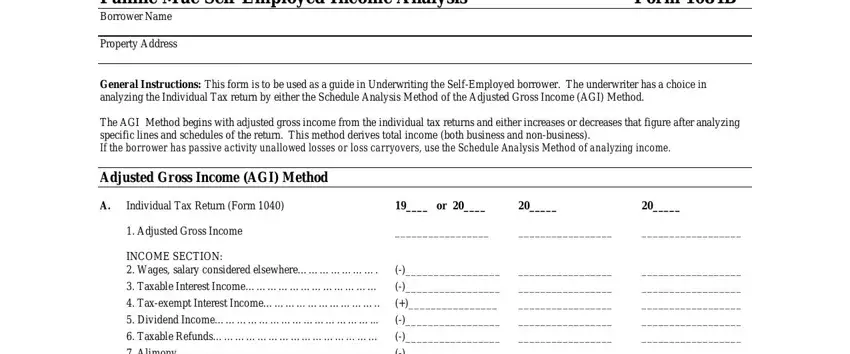

USE FOR BUSINESS AND NON-BUSINESS INCOME

(Rental Income, Dividends, and Interest)

Fannie Mae Self-Employed Income Analysis |

Form 1084B |

Borrower Name |

|

|

|

Property Address |

|

General Instructions: This form is to be used as a guide in Underwriting the Self-Employed borrower. The underwriter has a choice in analyzing the Individual Tax return by either the Schedule Analysis Method of the Adjusted Gross Income (AGI) Method.

The AGI Method begins with adjusted gross income from the individual tax returns and either increases or decreases that figure after analyzing specific lines and schedules of the return. This method derives total income (both business and non-business).

If the borrower has passive activity unallowed losses or loss carryovers, use the Schedule Analysis Method of analyzing income.

Adjusted Gross Income (AGI) Method

A. Individual Tax Return (Form 1040) |

19____ or 20____ |

20_____ |

20_____ |

1. Adjusted Gross Income |

_________________ |

_________________ |

__________________ |

INCOME SECTION: |

|

|

|

2. Wages, salary considered elsewhere…………………. |

(-)_________________ |

_________________ |

__________________ |

3. Taxable Interest Income……………………………… |

(-)_________________ |

_________________ |

__________________ |

4. Tax-exempt Interest Income………………………….. |

(+)________________ |

_________________ |

__________________ |

5. Dividend Income……………………………………... |

(-)_________________ |

_________________ |

__________________ |

6. Taxable Refunds……………………………………… |

(-)_________________ |

_________________ |

__________________ |

7. Alimony………………………………………………. |

(-)_________________ |

_________________ |

__________________ |

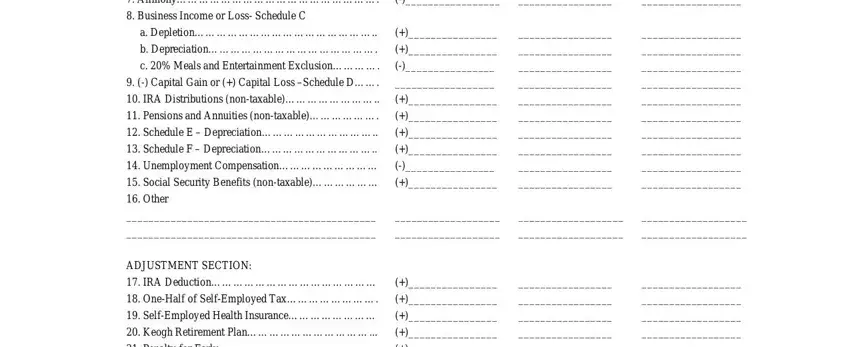

8. Business Income or Loss- Schedule C |

|

|

|

a. Depletion………………………………………….. |

(+)________________ |

_________________ |

__________________ |

b. Depreciation………………………………………. |

(+)________________ |

_________________ |

__________________ |

c. 20% Meals and Entertainment Exclusion…………. |

(-)________________ |

_________________ |

__________________ |

9. (-) Capital Gain or (+) Capital Loss –Schedule D……. |

__________________ |

_________________ |

__________________ |

10. IRA Distributions (non-taxable)…………………….. |

(+)________________ |

_________________ |

__________________ |

11. Pensions and Annuities (non-taxable)………………. |

(+)________________ |

_________________ |

__________________ |

12. Schedule E – Depreciation………………………….. |

(+)________________ |

_________________ |

__________________ |

13. Schedule F – Depreciation………………………….. |

(+)________________ |

_________________ |

__________________ |

14. Unemployment Compensation……………………… |

(-)________________ |

_________________ |

__________________ |

15. Social Security Benefits (non-taxable)……………… |

(+)________________ |

_________________ |

__________________ |

16. Other |

|

|

|

_____________________________________________ |

___________________ |

___________________ |

___________________ |

_____________________________________________ |

___________________ |

___________________ |

___________________ |

ADJUSTMENT SECTION: |

|

|

|

17. IRA Deduction……………………………………… |

(+)________________ |

_________________ |

__________________ |

18. One-Half of Self-Employed Tax……………………. |

(+)________________ |

_________________ |

__________________ |

19. Self-Employed Health Insurance…………………… |

(+)________________ |

_________________ |

__________________ |

20. Keogh Retirement Plan……………………………... |

(+)________________ |

_________________ |

__________________ |

21. Penalty for Early |

(+)________________ |

_________________ |

__________________ |

Withdrawal………………………... |

|

|

|

22. Alimony Paid……………………………………….. |

(+)________________ |

_________________ |

__________________ |

ADDITIONAL SCHEDULES: |

|

|

|

23. Form 2106 Unreimbursed expenses |

|

|

|

(not fully deductible)………………………………... |

(-)_________________ |

________________ |

__________________ |

24. Form 4562 Amortization……………………………. |

(+)________________ |

_________________ |

__________________ |

25. Total………………………………………………… |

__________________ |

_________________ |

__________________ |

Go on to next page and complete sections B, C, and D only if the borrower needs more income to qualify for the loan than is shown in section A and the borrower has the legal right to draw additional income from the business to qualify for the loan.

B.Corporate Tax Return Form (1120) – Corporate Income to qualify the borrower will be considered only if the borrower can provide evidence of access to the funds.

|

19____ or 20____ |

20_____ |

20_____ |

1. Taxable Income (Tax and Payments Section)………... |

(+)_______________ |

_________________ |

__________________ |

2. Total Tax (Tax and Payments Section)………………. |

(-)_______________ |

_________________ |

__________________ |

3. Depreciation (Deductions Section)…………………... |

(+)_______________ |

_________________ |

__________________ |

4. Depletion (Deductions Section)……………………… |

(+)_______________ |

_________________ |

__________________ |

5. Mortgages, notes, bonds payable in less than one year |

|

|

|

(Balance Sheets Section)……………………………… |

(-)_______________ |

_________________ |

__________________ |

6. Subtotal……………………………………………….. |

_________________ |

_________________ |

__________________ |

7. Times individual percentage of ownership…………... |

X_______________% |

X_______________% |

X________________% |

8. Subtotal……………………………………………….. |

_________________ |

_________________ |

__________________ |

9. Dividend Income reflected on borrower’s individual |

|

|

|

income tax returns……………………………………. |

(-)_______________ |

_________________ |

__________________ |

10. Total Income available to borrower………………… |

_________________ |

_________________ |

__________________ |

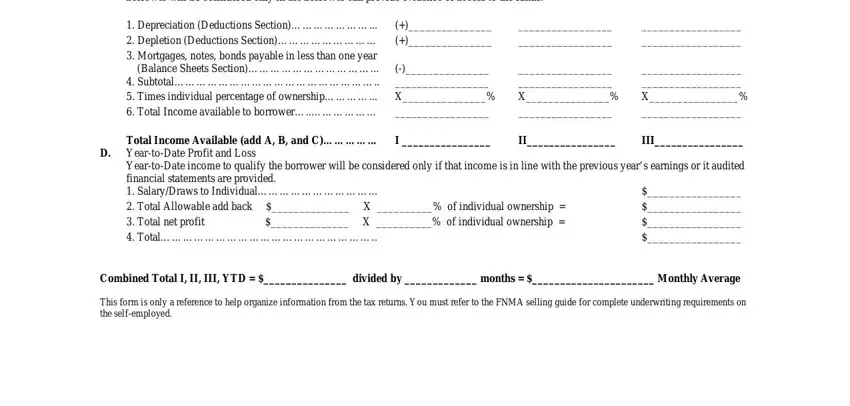

C.S Corporation Tax Returns (Form 1120S) or Partnership Tax Returns (From 1065) – Partnership of S Corporation income to qualify the borrower will be considered only in the borrower can provide evidence of access to the funds.

1. Depreciation (Deductions Section)…………………... |

(+)_______________ |

_________________ |

__________________ |

2. Depletion (Deductions Section)……………………… |

(+)_______________ |

_________________ |

__________________ |

3. Mortgages, notes, bonds payable in less than one year |

|

|

|

(Balance Sheets Section)……………………………... |

(-)_______________ |

_________________ |

__________________ |

4. Subtotal……………………………………………….. |

_________________ |

_________________ |

__________________ |

5. Times individual percentage of ownership…………... |

X_______________% |

X_______________% |

X________________% |

6. Total Income available to borrower…..……………… |

_________________ |

_________________ |

__________________ |

Total Income Available (add A, B, and C)…………... |

I ________________ |

II________________ |

III________________ |

D.Year-to-Date Profit and Loss

Year-to-Date income to qualify the borrower will be considered only if that income is in line with the previous year’s earnings or it audited

financial statements are provided. |

|

|

1. Salary/Draws to Individual…………………………… |

$_________________ |

2. Total Allowable add back |

$______________ |

X __________% of individual ownership = |

$_________________ |

3. Total net profit |

$______________ |

X __________% of individual ownership = |

$_________________ |

4. Total………………………………………………….. |

$_________________ |

Combined Total I, II, III, YTD = $_______________ divided by _____________ months = $______________________ Monthly Average

This form is only a reference to help organize information from the tax returns. You must refer to the FNMA selling guide for complete underwriting requirements on the self-employed.