In the complex world of employment taxation, navigating the intricacies of settlements can be a daunting task. The PAYE Settlement Agreement calculation form serves as a vital tool for employers, simplifying this process significantly. It's designed to provide HM Revenue & Customs (HMRC) with detailed information about the taxable items included in the PAYE Settlement Agreement for a specific tax year. Employers must diligently record the value of each benefit or expense paid, helping HMRC to determine the precise amount of tax and National Insurance contributions (NICs) due. The form insists on timely submission, ideally well before the payment deadline of 19 October—or 22 October for those opting for electronic payment methods—to avoid potential interest and/or penalties. Moreover, the form outlines a method to calculate taxes and NICs based on the tax bands of the recipients, ensuring accuracy in the grossed-up value of benefits provided. In instances where the final settlement amount might be delayed, employers are encouraged to make a payment on account by the due date to mitigate against any unforeseen issues. This prudent approach underscores the importance of early and transparent communication with HMRC, aiming to foster a smooth settlement process.

| Question | Answer |

|---|---|

| Form Name | Settlement Agreement Calculation Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | hmrc psa1, settlement agreement calculator, paye settlement agreement calculator, psa1 form 2020 21 |

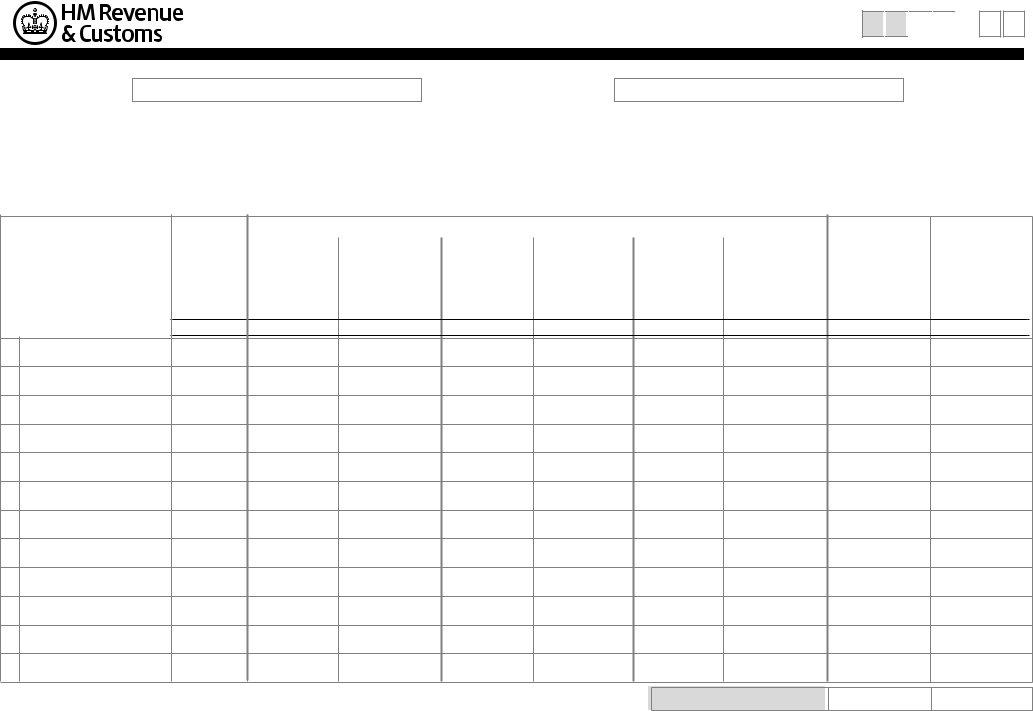

Employer name

PAYE Settlement Agreement calculation Tax year 2 0

PAYE reference

—

You can use this form to tell us the value of the items included in your PAYE Settlement Agreement. Please tell us as early as possible so that we have time to check your figures and agree the amount of tax and National Insurance contributions (NICs) due.

You must pay the total amount due no later than 19 October (22 October if you pay by electronic means) following the tax year to which this agreement relates. You may be charged interest and/or penalties if your payment is late. If there is a delay in agreeing the amount due under this agreement, it would be to your advantage to make a payment on account, on or before 19 October. Please contact your HM Revenue & Customs office for details of how to make a payment on account. This avoids any potential problems due to last minute notifications.

|

|

|

|

Tax band split |

|

|

|

|

|

Type of benefit or |

Total cost of |

|

|

|

|

|

|

|

|

Value of |

Grossed up |

Value of |

Grossed up |

Value of |

Grossed up |

Total tax due = |

Total Class 1B |

||

expense paid |

benefit or |

benefit |

tax = B x 20% |

benefit |

tax = D x 40% |

benefit |

tax = F x 45% |

C + E + G |

NICs due |

(including VAT) |

expense paid |

provided to |

x 100/80 |

provided to |

x 100/60 |

provided to |

x 100/55 |

|

|

20% taxpayers |

|

40% taxpayers |

|

45% taxpayers |

|

|

(A + H) x 13.8% |

||

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

A |

B |

C |

D |

E |

F |

G |

H |

I |

1

2

3

4

5

6

7

8

9

10

11

12

Totals (£)

PSA1 |

HMRC 12/13 |