Working with PDF documents online is definitely surprisingly easy with this PDF editor. Anyone can fill in standard form 3106 here and use a number of other options we offer. We at FormsPal are committed to providing you the perfect experience with our editor by regularly introducing new capabilities and upgrades. With these updates, working with our editor becomes better than ever! Starting is effortless! All you have to do is take the following easy steps down below:

Step 1: Access the PDF file inside our editor by clicking on the "Get Form Button" at the top of this page.

Step 2: As soon as you launch the file editor, you will see the document ready to be completed. Other than filling out various fields, it's also possible to do many other things with the PDF, namely writing custom words, editing the initial text, adding graphics, putting your signature on the document, and more.

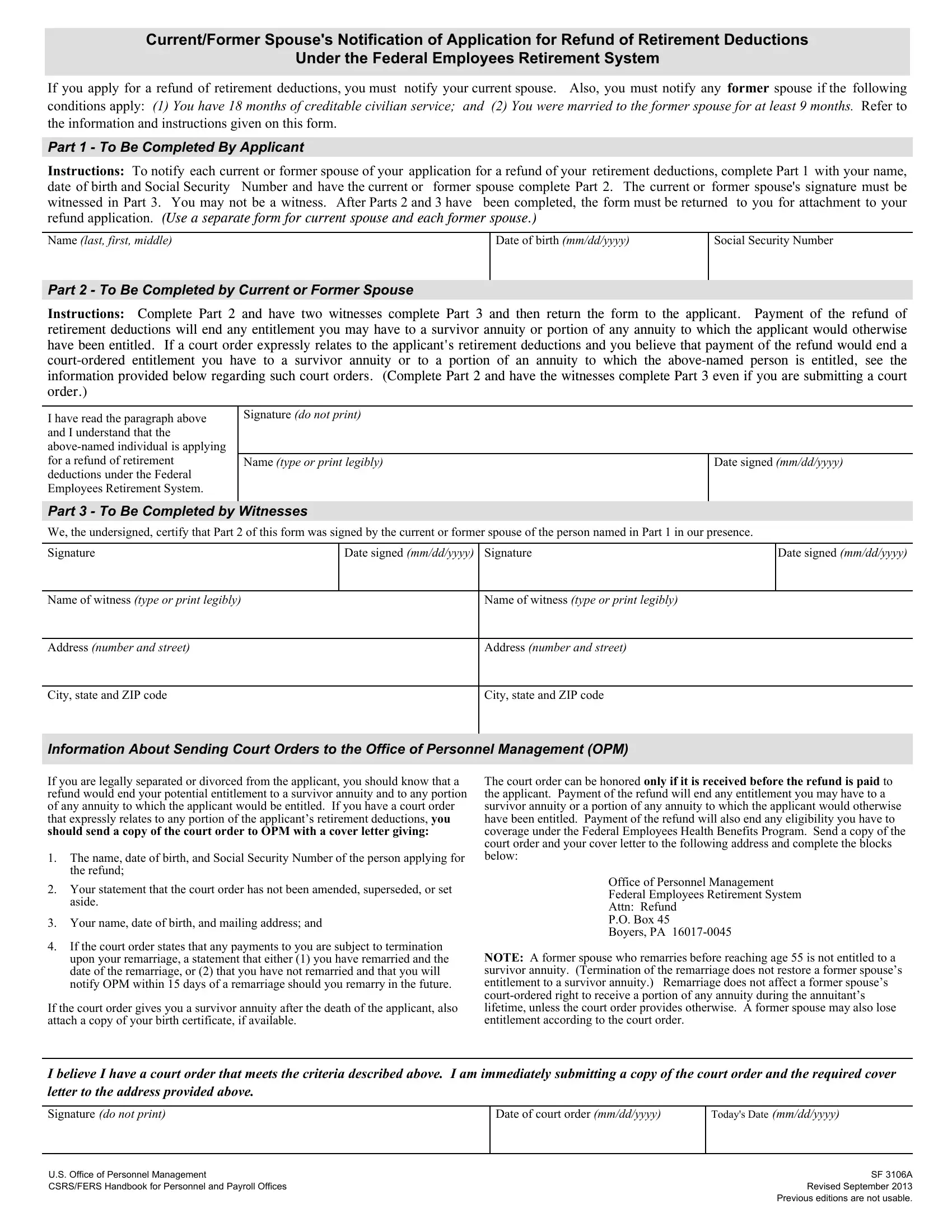

This PDF doc requires specific information; to ensure consistency, you should adhere to the suggestions listed below:

1. To begin with, once filling out the standard form 3106, beging with the section that includes the next blank fields:

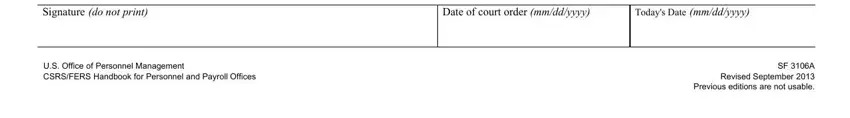

2. The next step is usually to complete these particular blanks: I believe I have a court order, Date of court order mmddyyyy, Todays Date mmddyyyy, US Office of Personnel Management, and SF A Revised September Previous.

You can potentially make a mistake while completing the Todays Date mmddyyyy, therefore be sure you look again before you decide to finalize the form.

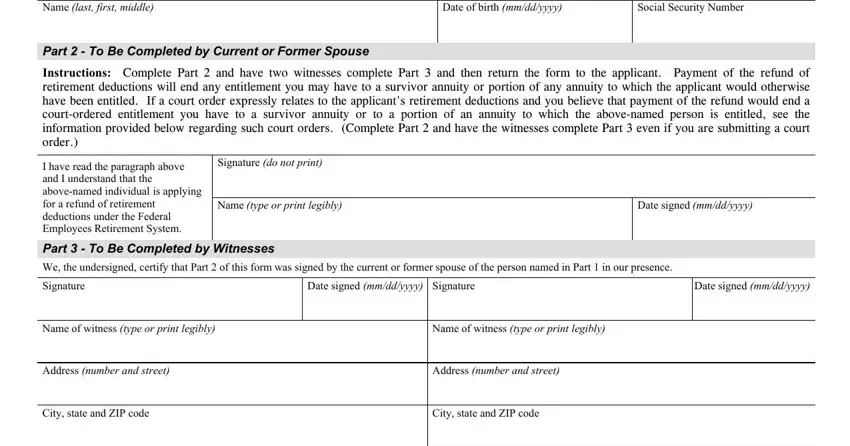

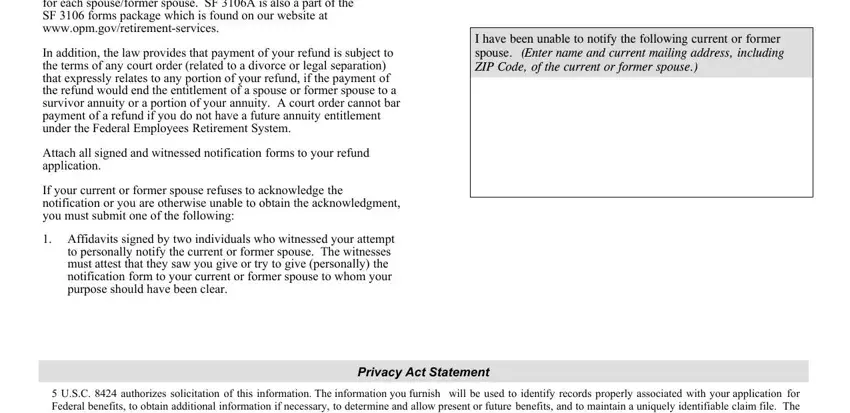

3. The following segment is all about whom is unrelated to you stating, I have been unable to notify the, You should provide a copy of, In addition the law provides that, Attach all signed and witnessed, If your current or former spouse, Privacy Act Statement, and USC authorizes solicitation of - complete all of these blank fields.

Step 3: After rereading your filled out blanks, press "Done" and you're all set! Sign up with FormsPal now and easily obtain standard form 3106, all set for downloading. All modifications made by you are kept , which means you can edit the document at a later stage if necessary. We don't share the information that you type in whenever filling out forms at FormsPal.