Our PDF editor that you can benefit from was made by our finest computer programmers. You can fill in the mini 1003 pdf document instantly and efficiently with our software. Simply try out this guide to begin with.

Step 1: You can choose the orange "Get Form Now" button at the top of the following web page.

Step 2: Now it's easy to manage your mini 1003 pdf. This multifunctional toolbar enables you to include, eliminate, modify, and highlight text as well as conduct many other commands.

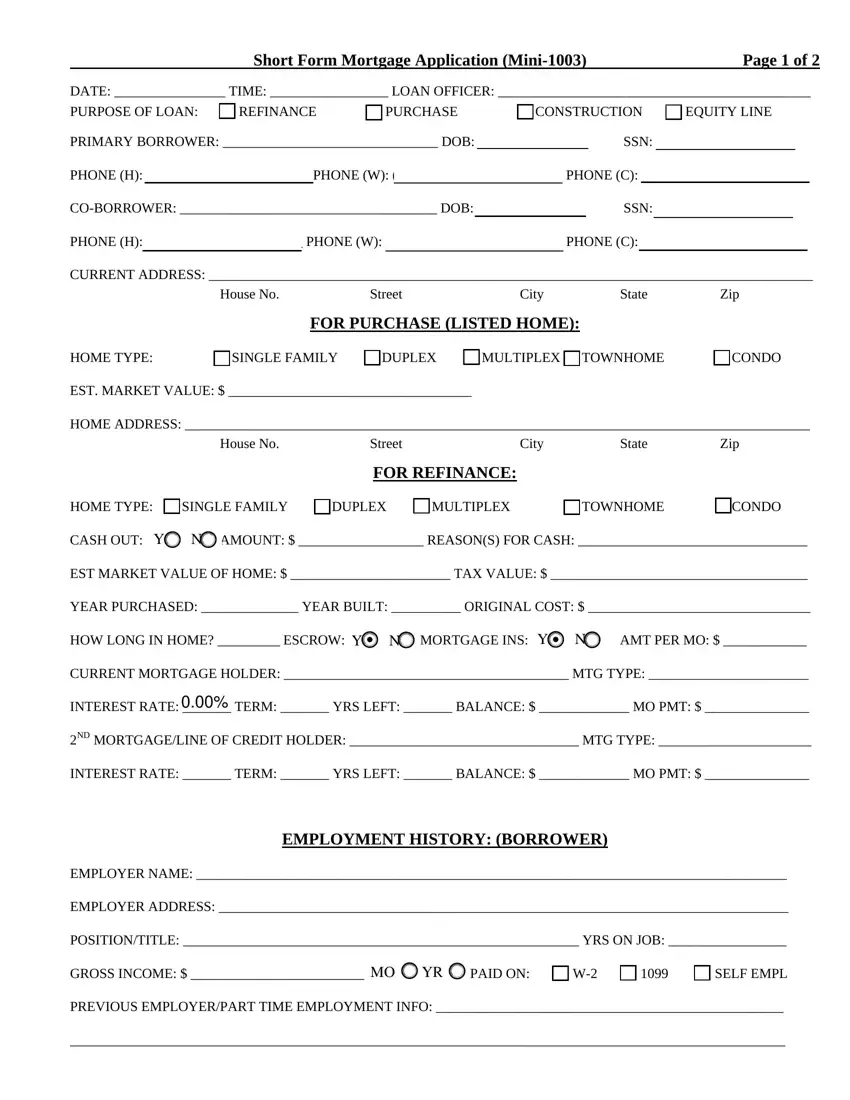

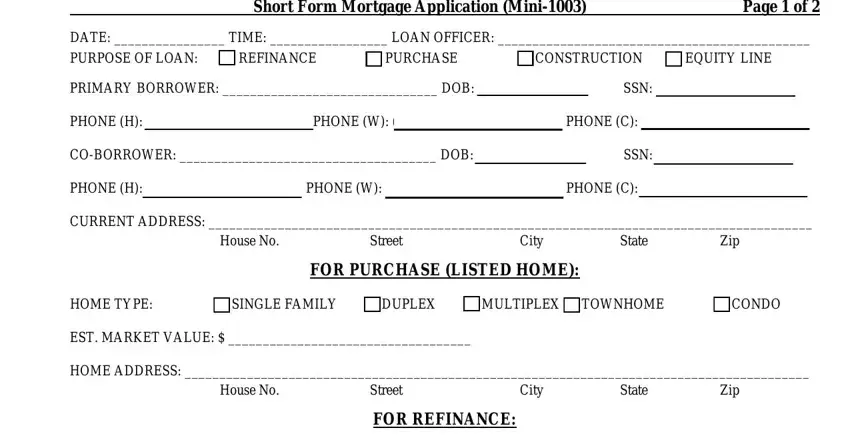

In order to fill out the document, enter the content the system will ask you to for each of the following areas:

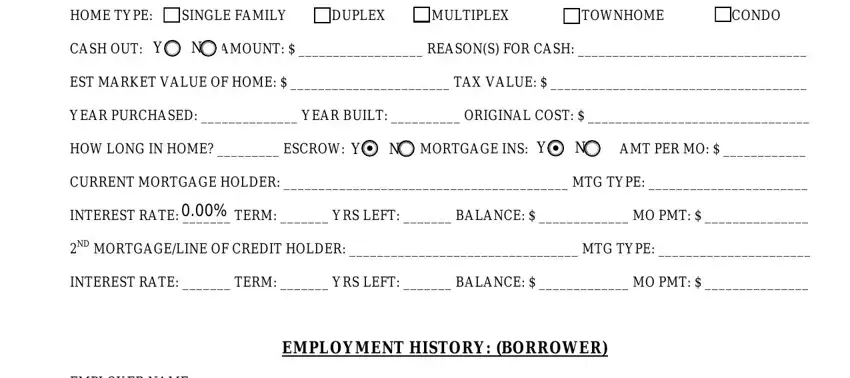

Put down the information in the HOME TYPE cid SINGLE FAMILY, cid DUPLEX, cid MULTIPLEX, cid TOWNHOME, cid CONDO, CASH OUT Y N, AMOUNT REASONS FOR CASH, EST MARKET VALUE OF HOME TAX, YEAR PURCHASED YEAR BUILT, HOW LONG IN HOME ESCROW Y N, MORTGAGE INS Y N, AMT PER MO, CURRENT MORTGAGE HOLDER MTG TYPE, INTEREST RATE TERM YRS LEFT, and ND MORTGAGELINE OF CREDIT HOLDER area.

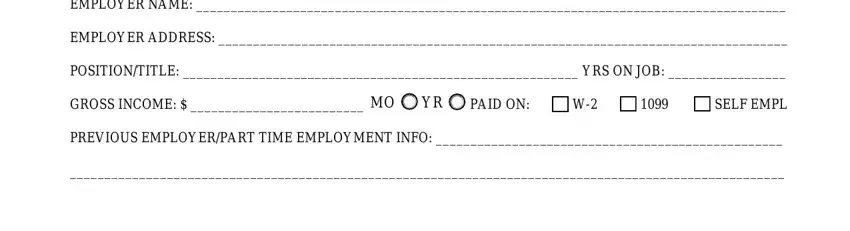

The application will request you to provide specific valuable info to effortlessly fill in the part EMPLOYER NAME, EMPLOYER ADDRESS, POSITIONTITLE YRS ON JOB, GROSS INCOME MO YR, PAID ON cid W cid cid SELF EMPL, and PREVIOUS EMPLOYERPART TIME.

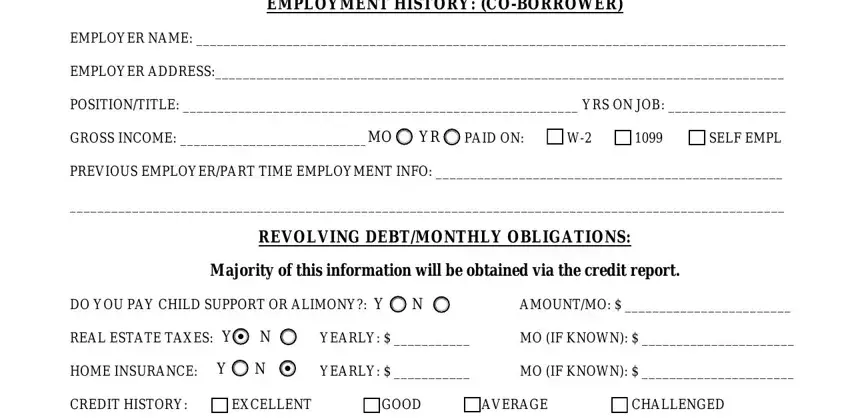

Inside the part EMPLOYMENT HISTORY COBORROWER, EMPLOYER NAME, EMPLOYER ADDRESS, POSITIONTITLE YRS ON JOB, GROSS INCOME MO YR PAID ON cid, PREVIOUS EMPLOYERPART TIME, REVOLVING DEBTMONTHLY OBLIGATIONS, Majority of this information will, DO YOU PAY CHILD SUPPORT OR, AMOUNTMO, REAL ESTATE TAXES Y N, YEARLY, MO IF KNOWN, HOME INSURANCE Y N, and YEARLY, include the rights and obligations of the sides.

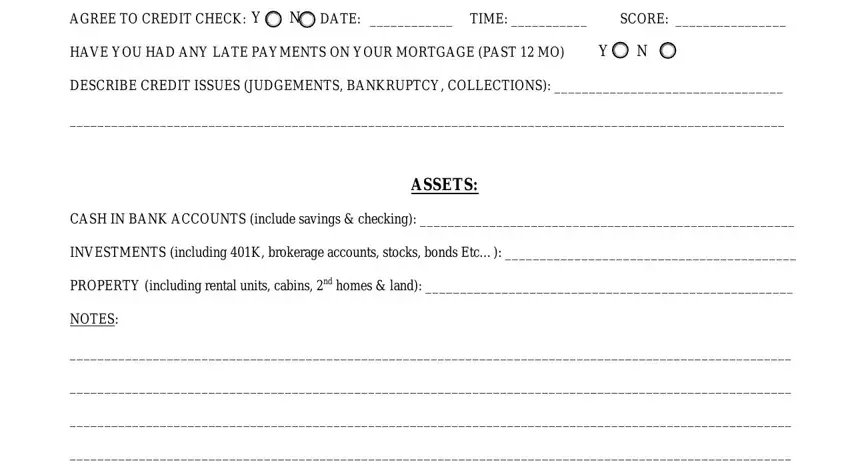

End up by analyzing all these fields and preparing them correspondingly: AGREE TO CREDIT CHECK Y N, DATE TIME, SCORE, HAVE YOU HAD ANY LATE PAYMENTS ON, Y N, DESCRIBE CREDIT ISSUES JUDGEMENTS, ASSETS, CASH IN BANK ACCOUNTS include, INVESTMENTS including K brokerage, PROPERTY including rental units, and NOTES.

Step 3: Select the "Done" button. So now, you can export your PDF file - upload it to your device or deliver it by means of electronic mail.

Step 4: Get a copy of every file. It can save you time and assist you to prevent worries in the future. Keep in mind, your information is not shared or viewed by us.