SIPC-6 |

|

SECURITIES INVESTOR PROTECTION CORPORATION |

|

SIPC-6 |

|

|

|

202 - 371 - 8300 |

|

|

|

|

|

|

|

P . O . Box 92185 Washington, D . C . 20090 - 2185 |

|

|

|

|

|

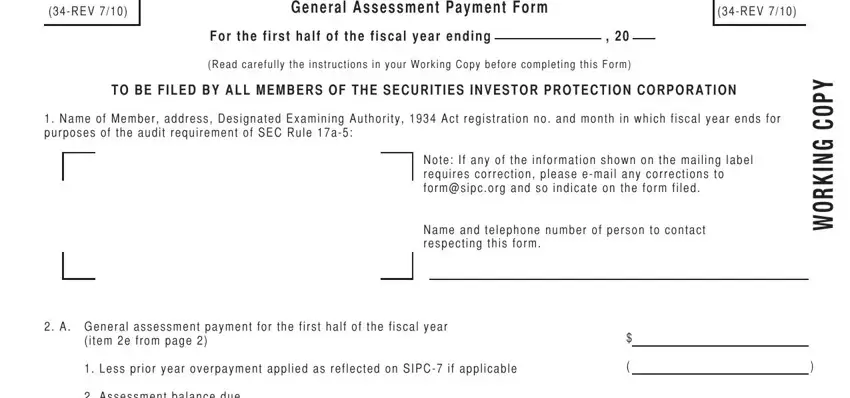

(34 - REV 7/10) |

|

General assessment Payment form |

|

|

|

|

(34 - REV 7/10) |

|

|

for the first half of the fiscal year ending |

|

, 20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

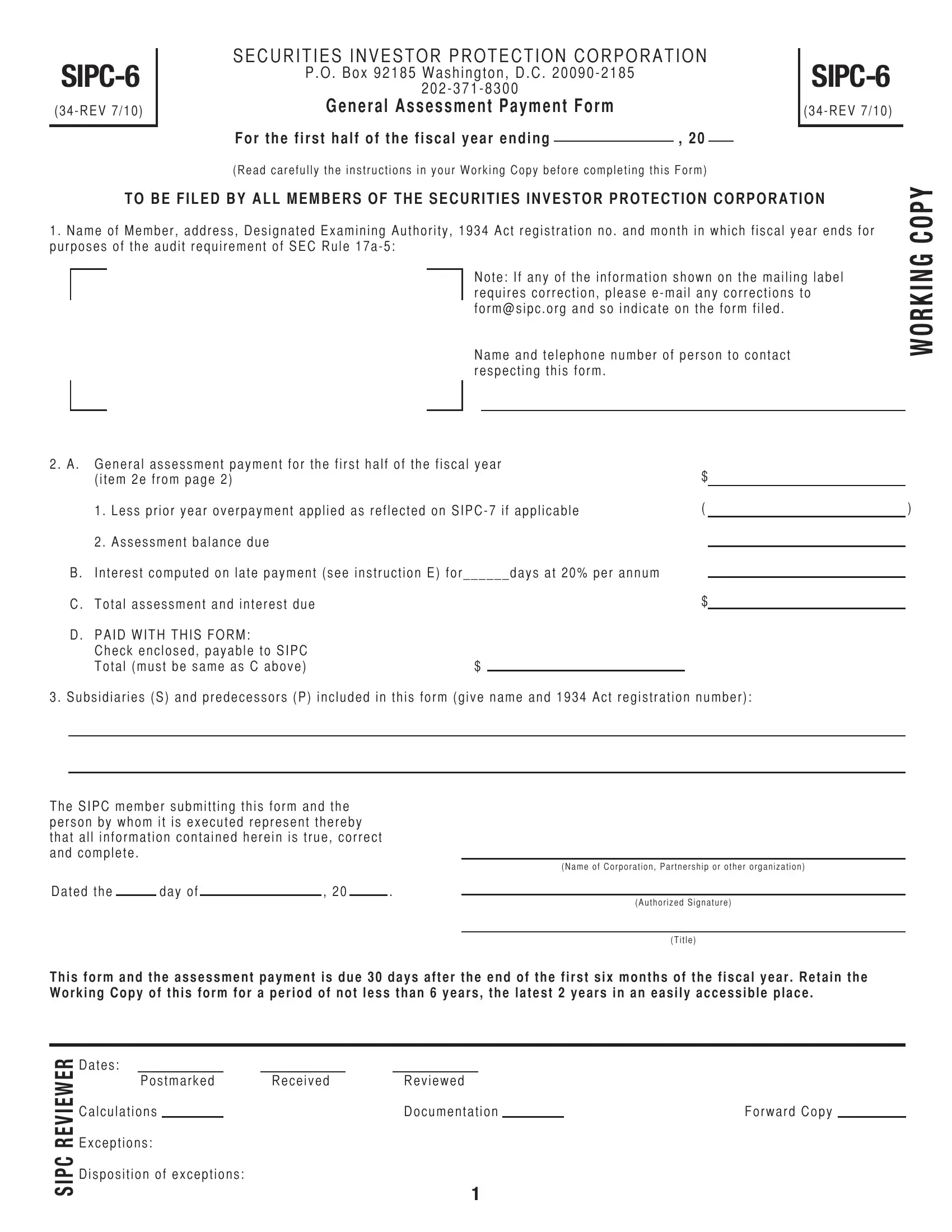

(Read carefully the instructions in your Working Copy before completing this Form)

To be filed by all members of THe seCUriTies iNVesTor ProTeCTioN CorPoraTioN

1 . Name of Member, address, Designated Examining Authority, 1934 Act registration no . and month in which fiscal year ends for purposes of the audit requirement of SEC Rule 17a - 5:

Note: If any of the information shown on the mailing label requires correction, please e - mail any corrections to form@sipc . org and so indicate on the form filed .

Name and telephone number of person to contact respecting this form .

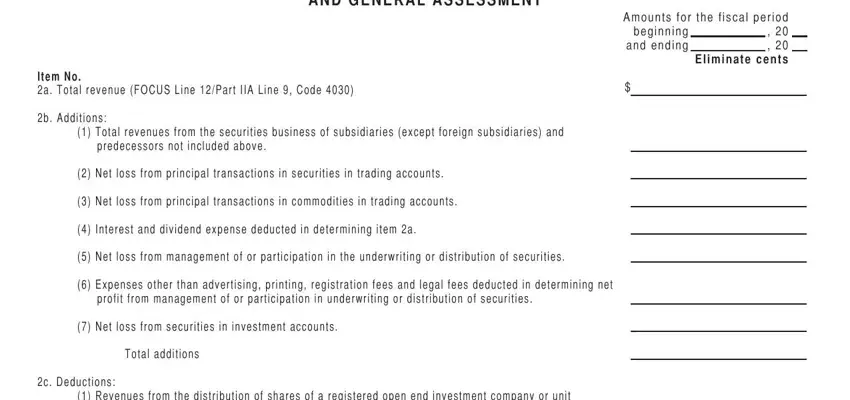

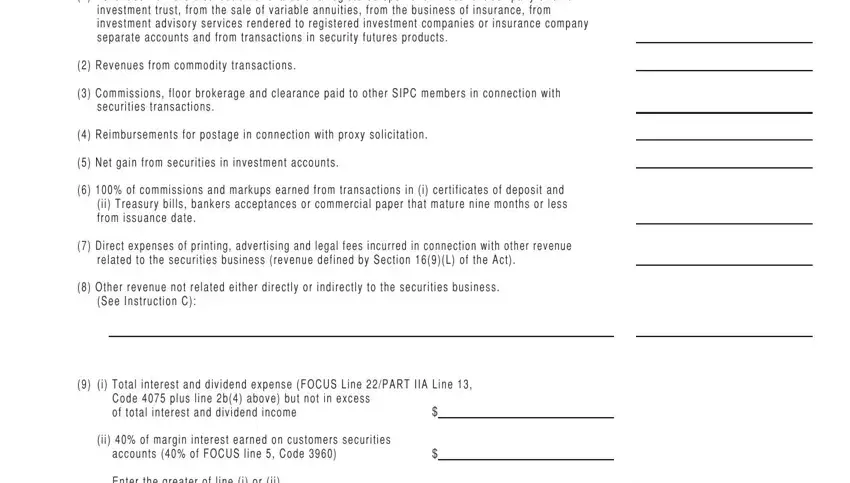

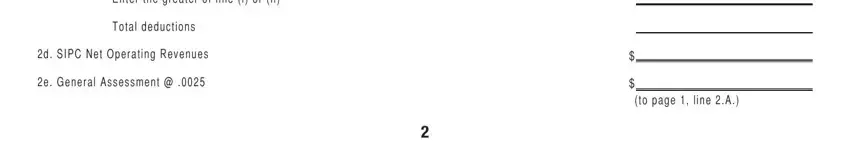

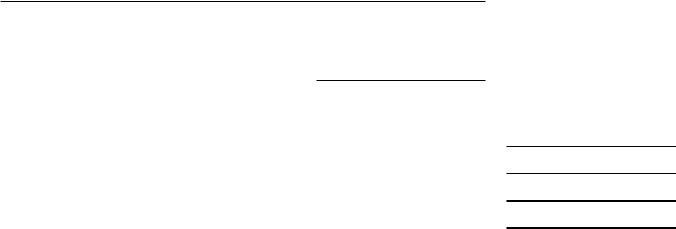

2 . A . General assessment payment for the first half of the fiscal year |

$ |

|

(item 2e from page 2) |

|

|

|

1 |

. Less prior year overpayment applied as reflected on SIPC - 7 if applicable |

( |

|

) |

2 |

. Assessment balance due |

|

|

|

|

|

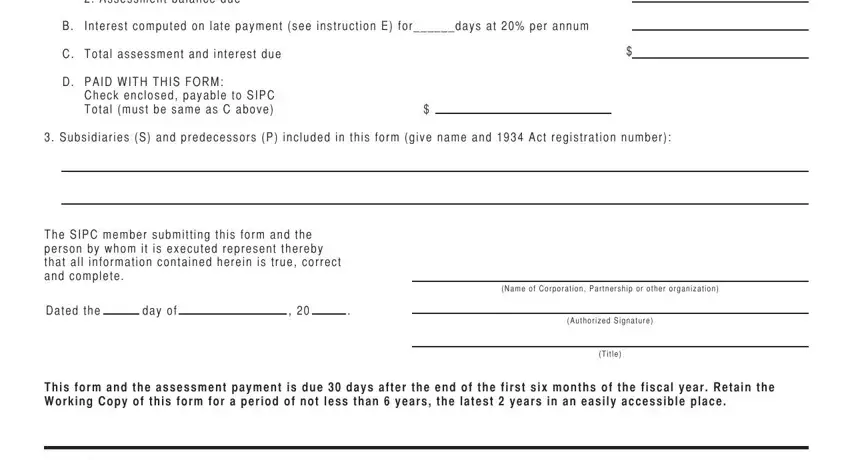

B . Interest computed on late payment (see instruction E) for ______ days at 20% per annum |

$ |

|

|

C . Total assessment and interest due |

|

|

|

|

D . PAID WITH THIS FORM: |

|

|

|

|

|

Check enclosed, payable to SIPC |

|

|

|

|

|

Total (must be same as C above) |

$ |

|

|

|

|

3 . Subsidiaries (S) and predecessors (P) included in this form (give name and 1934 Act registration number):

The SIPC member submitting this form and the person by whom it is executed represent thereby that all information contained herein is true, correct and complete .

(Name of Corporation, Partnership or other organization)

(Authorized Signature)

(Title)

This form and the assessment payment is due 30 days after the end of the first six months of the fiscal year . retain the Working Copy of this form for a period of not less than 6 years, the latest 2 years in an easily accessible place .

Dates:

Postmarked

Calculations

Exceptions:

Disposition of exceptions:

ReceivedReviewed

Documentation |

|

Forward Copy |

1

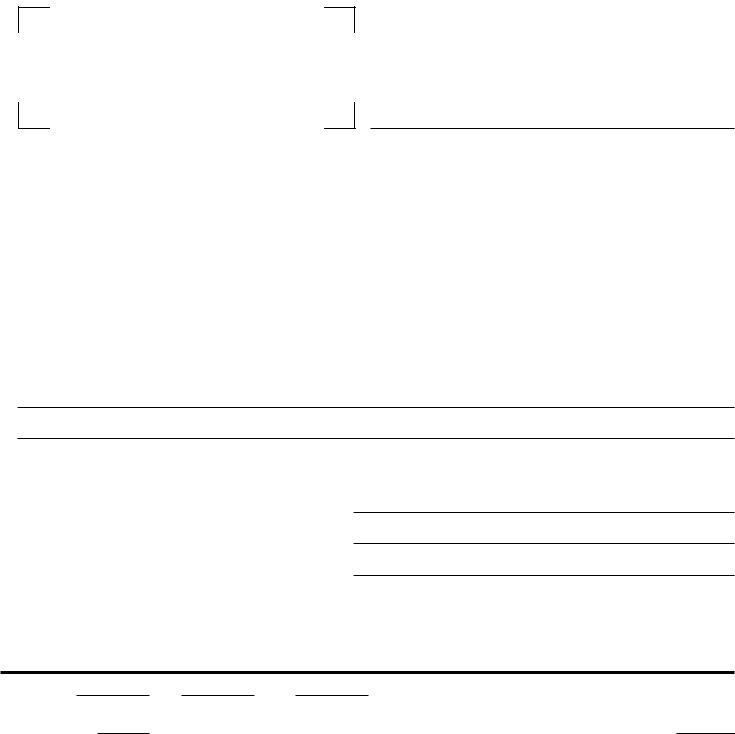

from section 16(9) of the act:

The term “gross revenues from the securities business” means the sum of (but without duplication) —

(A)commissions earned in connection with transactions in securities effected for customers as agent (net of commissions paid to other brokers and dealers in connection with such transactions) and markups with respect to purchases or sales of securities as principal;

(B)charges for executing or clearing transactions in securities for other brokers and dealers;

(C)the net realized gain, if any, from principal transactions in securities in trading accounts;

(D)the net profit, if any, from the management of or participation in the underwriting or distribution of securities;

(E)interest earned on customers’ securities accounts;

(F)fees for investment advisory services (except when rendered to one or more registered investment companies or

insurance company separate accounts) or account supervision with respect to securities;

(G)fees for the solicitation of proxies with respect to, or tenders or exchanges of, securities;

(H)income from service charges or other surcharges with respect to securities;

(I)except as otherwise provided by rule of the Commission, dividends and interest received on securities in investment accounts of the broker or dealer;

(J)fees in connection with put, call, and other options transactions in securities;

(K)commissions earned for transactions in (i) certificates of deposit, and (ii) Treasury bills, bankers acceptances, or commercial paper which have a maturity at the time of issuance of not exceeding nine months, exclusive of days of grace, or any renewal thereof, the maturity of which is likewise limited, except that SIPC shall by bylaw include in the aggregate of gross revenues only an appropriate percentage of such commissions based on SIPC’s loss experience with respect to such instruments over at least the preceding five years; and

(L)fees and other income from such other categories of the securities business as SIPC shall provide by bylaw .

Such term includes revenues earned by a broker or dealer in connection with a transaction in the portfolio margining account of a customer carried as securities accounts pursuant to a portfolio margining program approved by the Commission . Such term does not include revenues received by a broker or dealer in connection with the distribution of shares of a registered open end invest - ment company or unit investment trust or revenues derived by a broker or dealer from the sales of variable annuities, the busi - ness of insurance, or transactions in security futures products .

from section 16(14) of the act:

The term “Security” means any note, stock, treasury stock, bond, debenture, evidence of indebtedness, any collateral trust certificate, preorganization certificate or subscription, transferable share, voting trust certificate, certificate of deposit, certificate of deposit for a security, or any security future as that term is defined in section 78c(a)(55)(A) of this title, any investment contract or certificate

of interest or participation in any profit - sharing agreement or in any oil, gas or mineral royalty or lease (if such investment contract or interest is the subject of a registration statement with the Commission pursuant to the provisions of the Securities Act of 1933 [15 U . S . C . 77a et seq . ]), any put, call, straddle, option, or privilege on any security, or group or index of securities (including any interest therein or based on the value thereof), or any put, call, straddle, option, or privilege entered into on a national securities exchange relating to foreign currency, any certificate of interest or participation in , temporary or interim certificate for, receipt for, guarantee of, or warrant or right to subscribe to or purchase or sell any of the foregoing, and any other instrument commonly known as a secu - rity . Except as specifically provided above, the term “security” does not include any currency, or any commodity or related contract or futures contract, or any warrant or right to subscribe to or purchase or sell any of the foregoing .

from siPC bylaw article 6 (assessments): section 1(f):

The term “gross revenues from the securities business” includes the revenues in the definition of gross revenues from the securities business set forth in the applicable sections of the Act .

section 3:

For purpose of this article:

(a)The term “securities in trading accounts” shall mean securities held for sale in the ordinary course of business and not identified as having been held for investment .

(b)The term “securities in investment accounts” shall mean securities that are clearly identified as having been acquired for investment in accordance with provisions of the Internal Revenue Code applicable to dealers in securities .

(c)The term “fees and other income from such other categories of the securities business” shall mean all revenue related either directly or indirectly to the securities business except revenue included in Section 16(9)(A) - (L) and revenue specifically excepted in Section 4(c)(3)(C)[Item 2c(1), page 2] .

Note: If the amount of assessment entered on line 2e of SIPC - 6 is greater than 1/2 of 1% of “gross revenues from the securities business” as defined above, you may submit that calculation along with the SIPC - 6 form to SIPC and pay the smaller amount, subject to review by your Examining Authority and by SIPC .

SIPC Examining Authorities: |

|

|

|

ASE |

American Stock Exchange, LLC |

|

FINRA |

Financial Industry Regulatory Authority |

CBOE |

Chicago Board Options Exchange, Incorporated |

|

NYSE, Arca, Inc . |

CHX |

Chicago Stock Exchange, Incorporated |

4 |

NASDAQ OMX PHLX |

|

|

SIPC |

Securities Investor Protection Corporation |