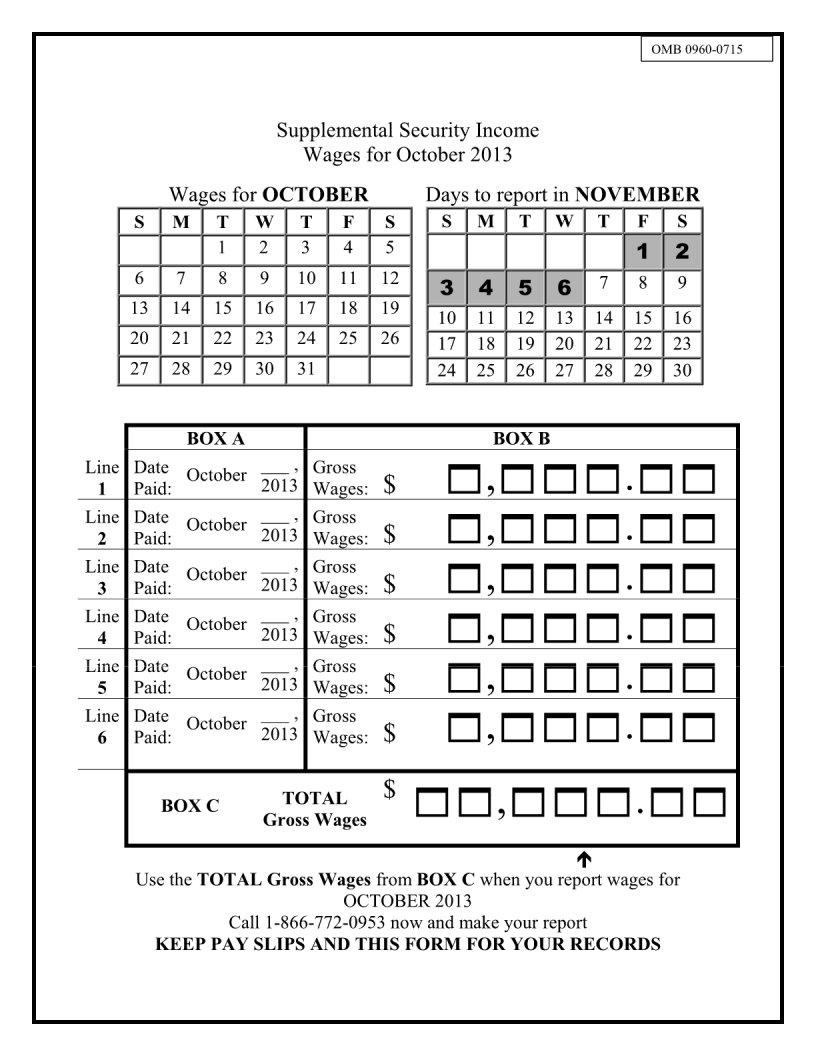

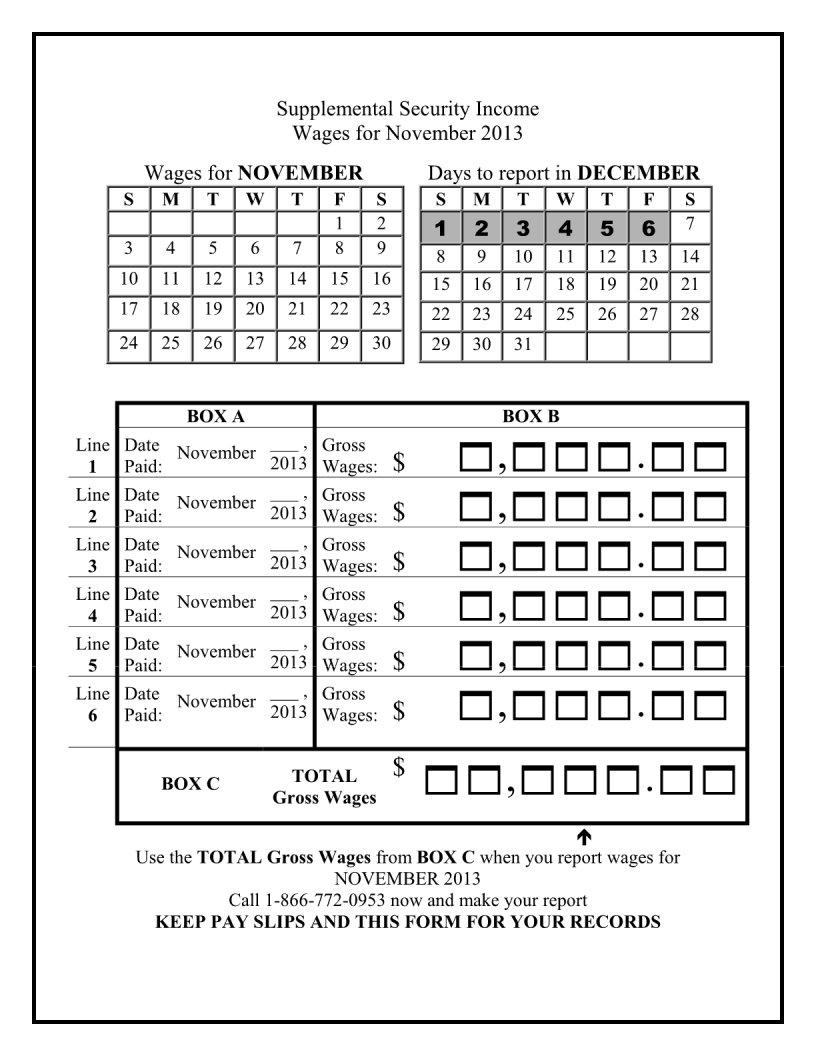

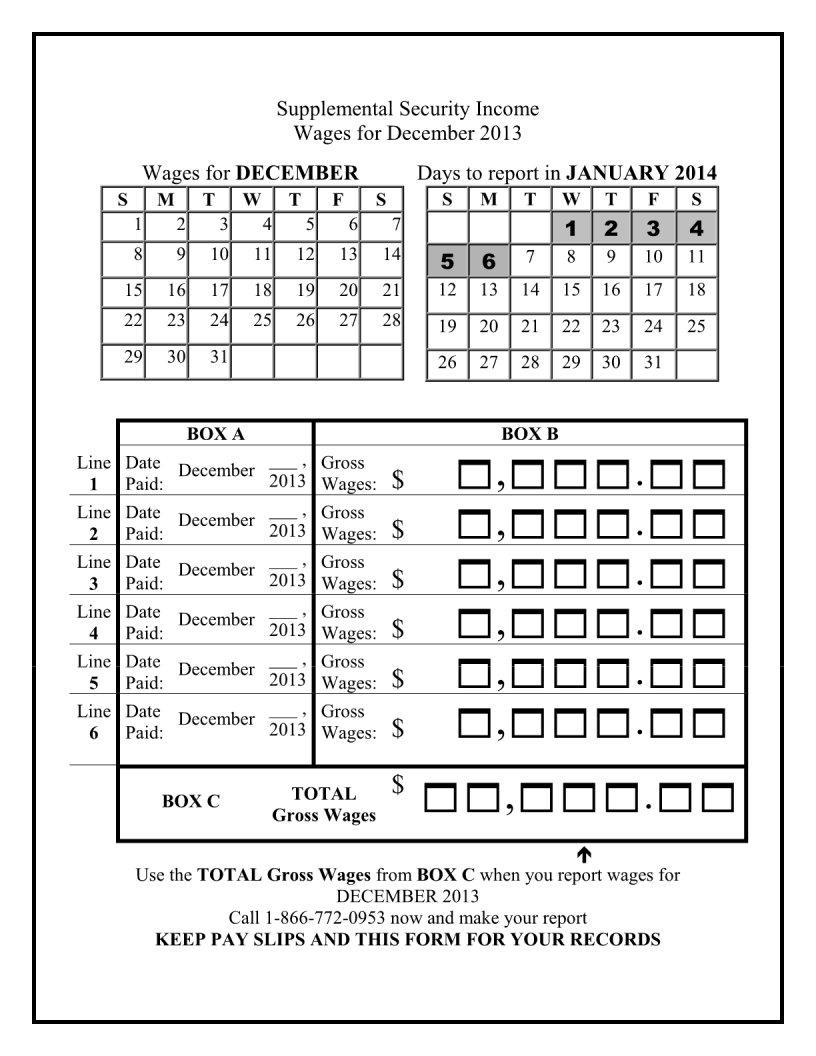

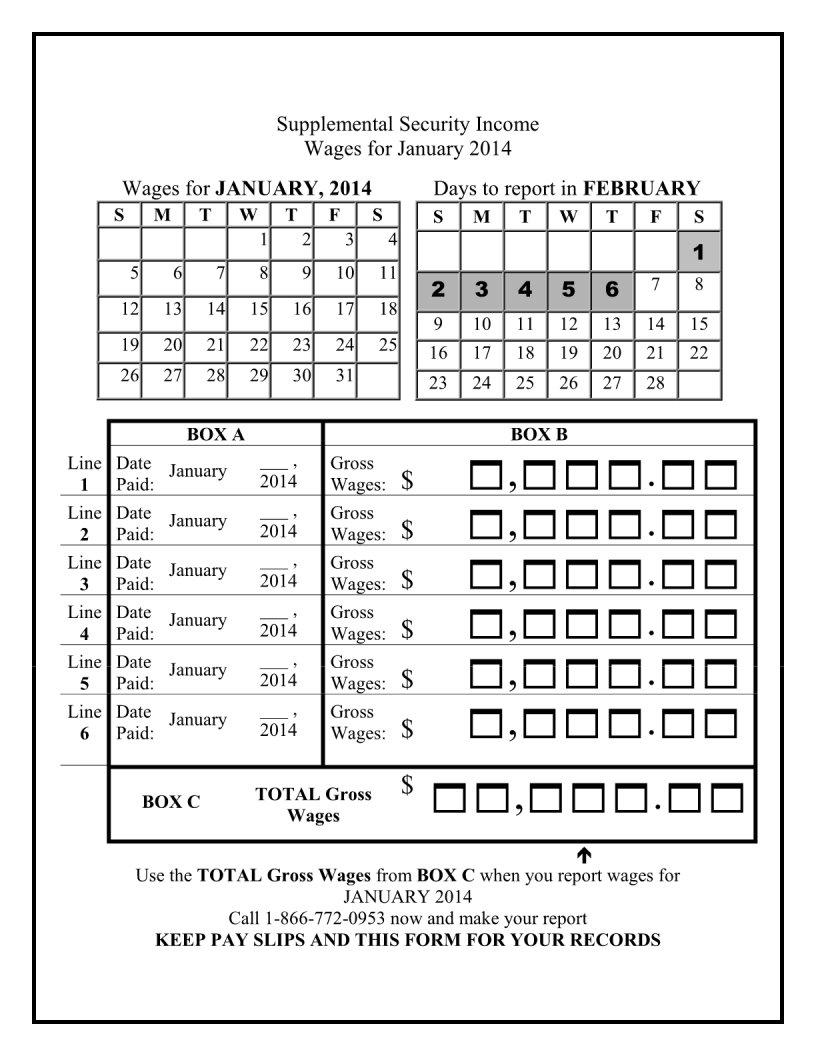

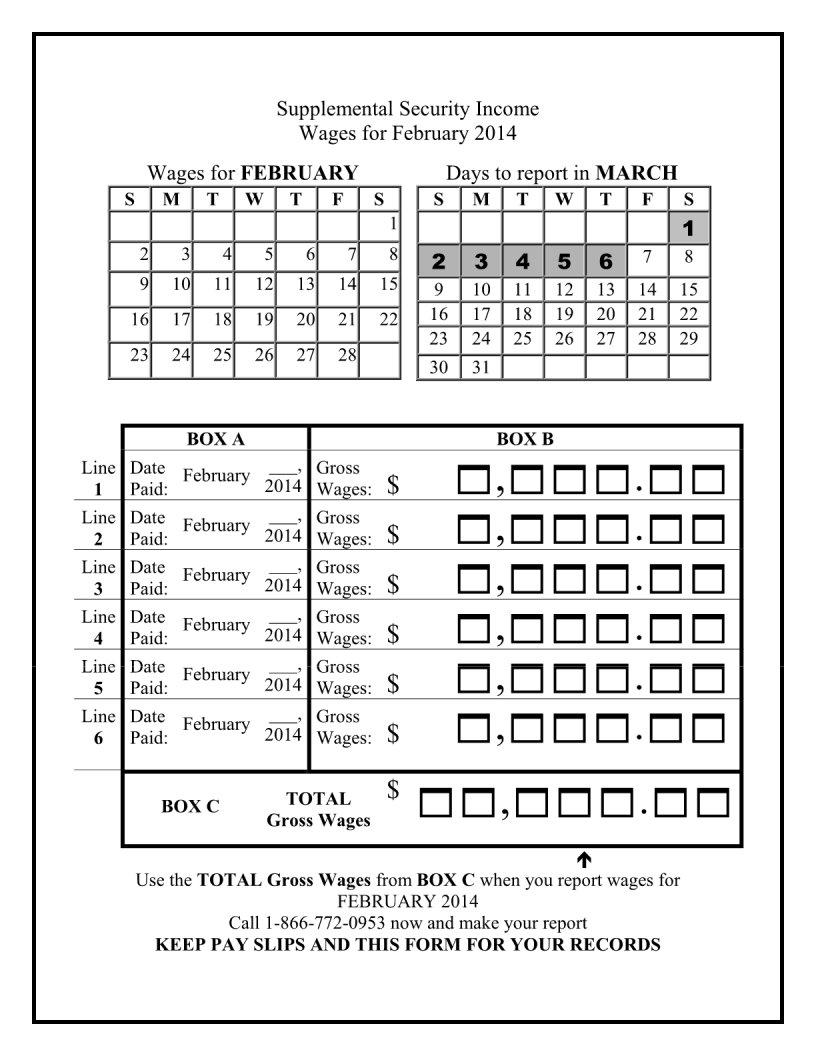

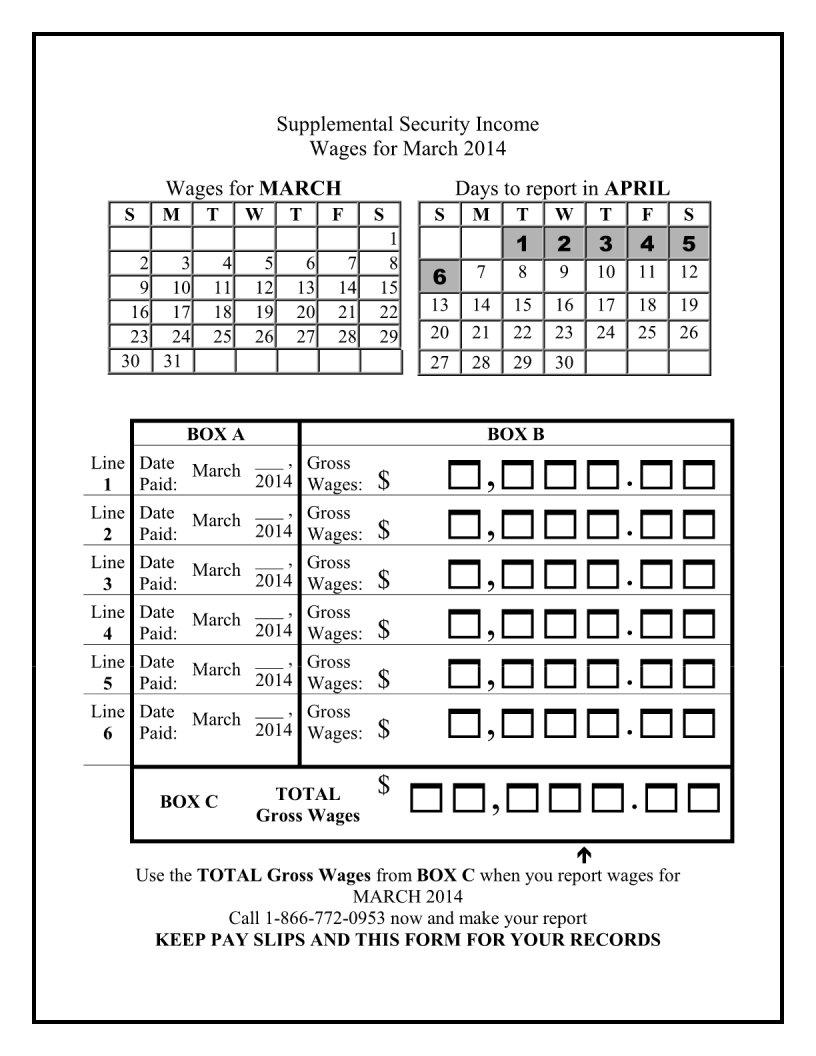

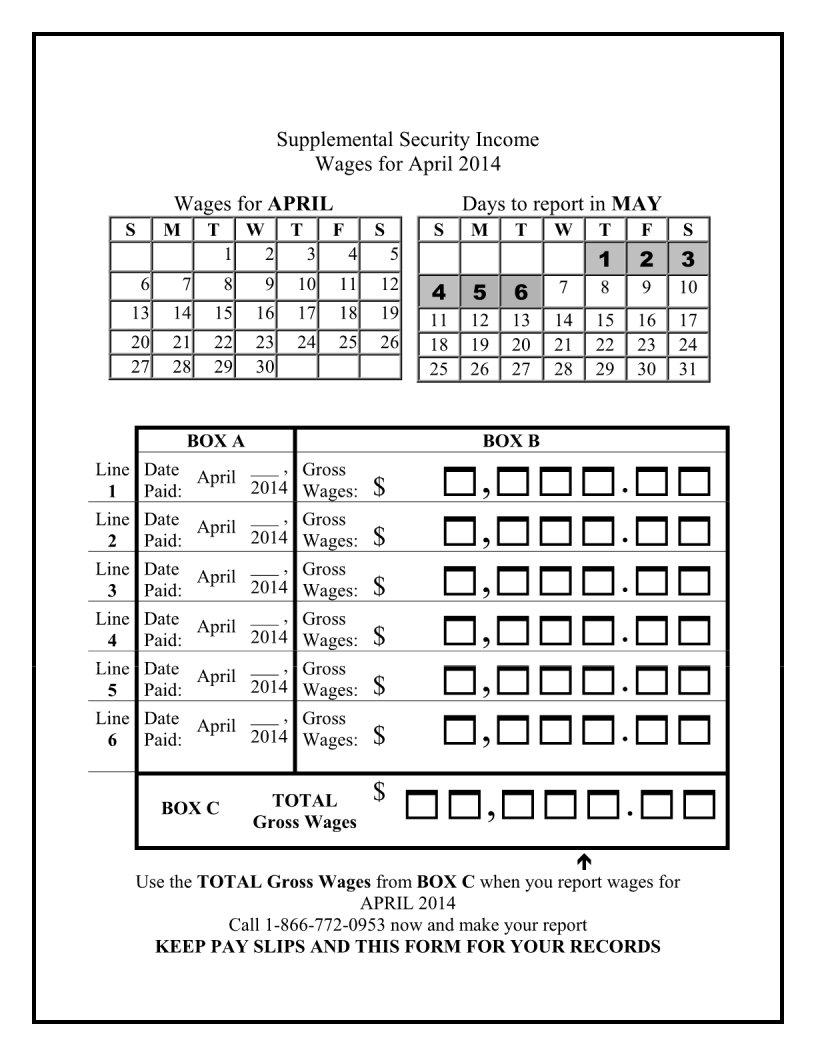

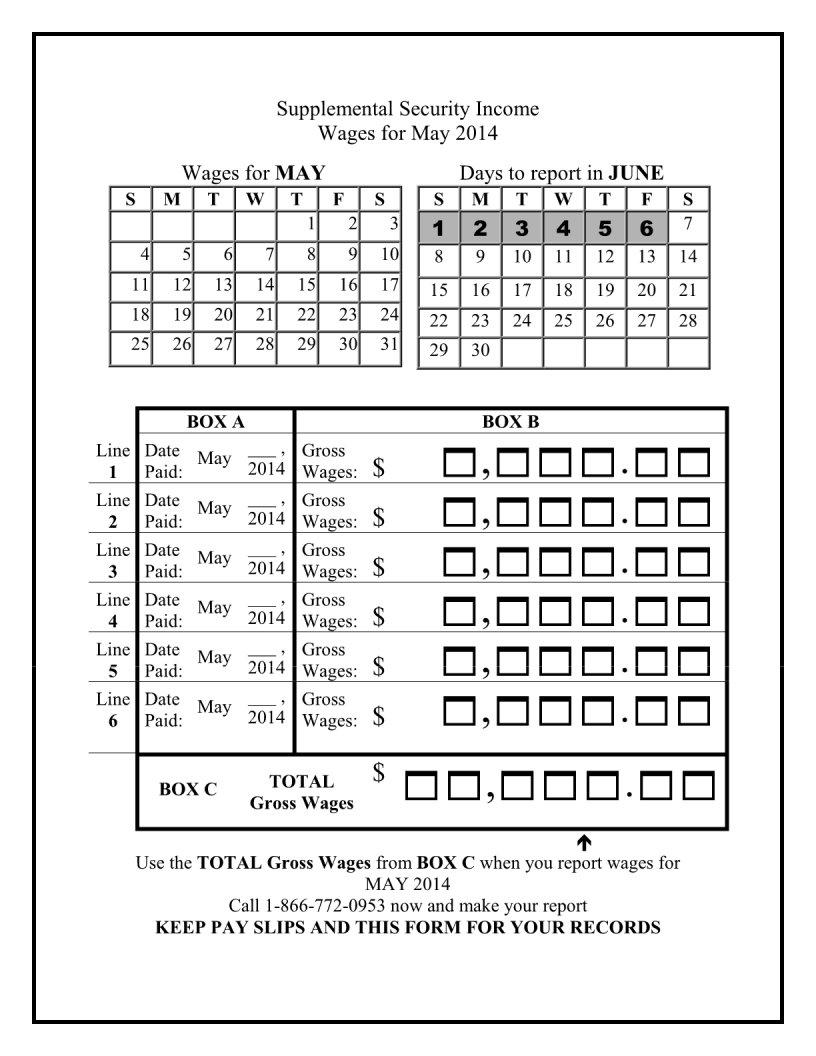

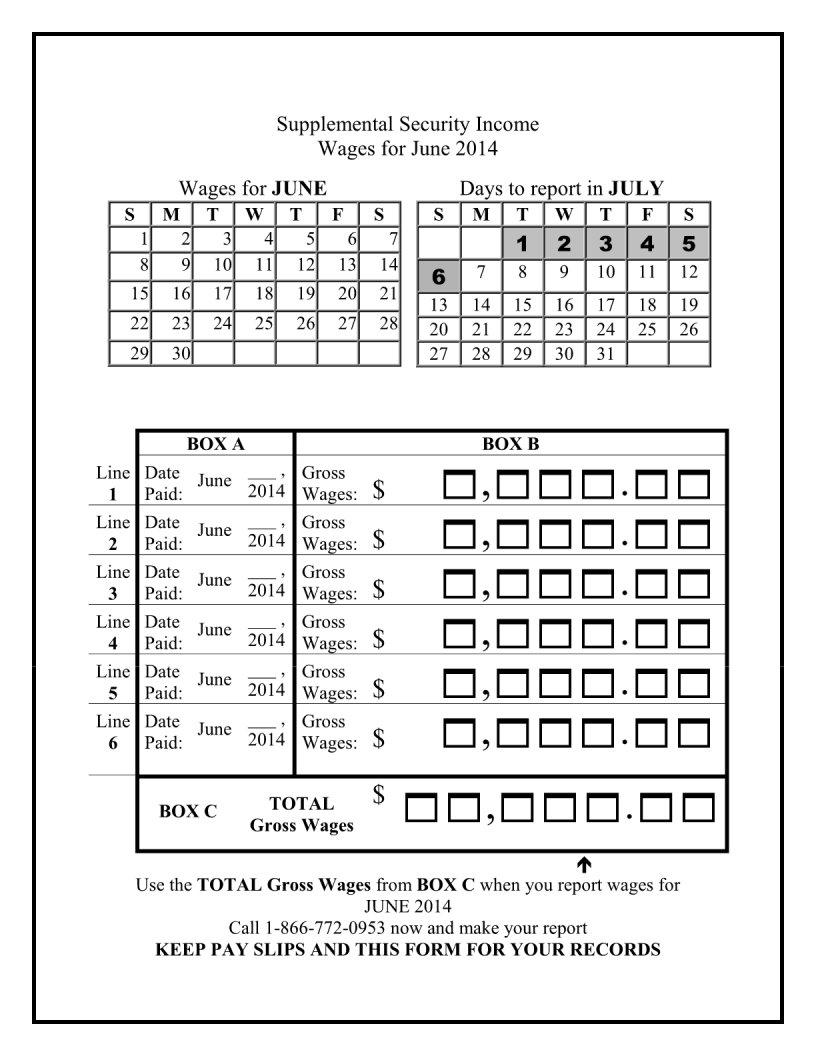

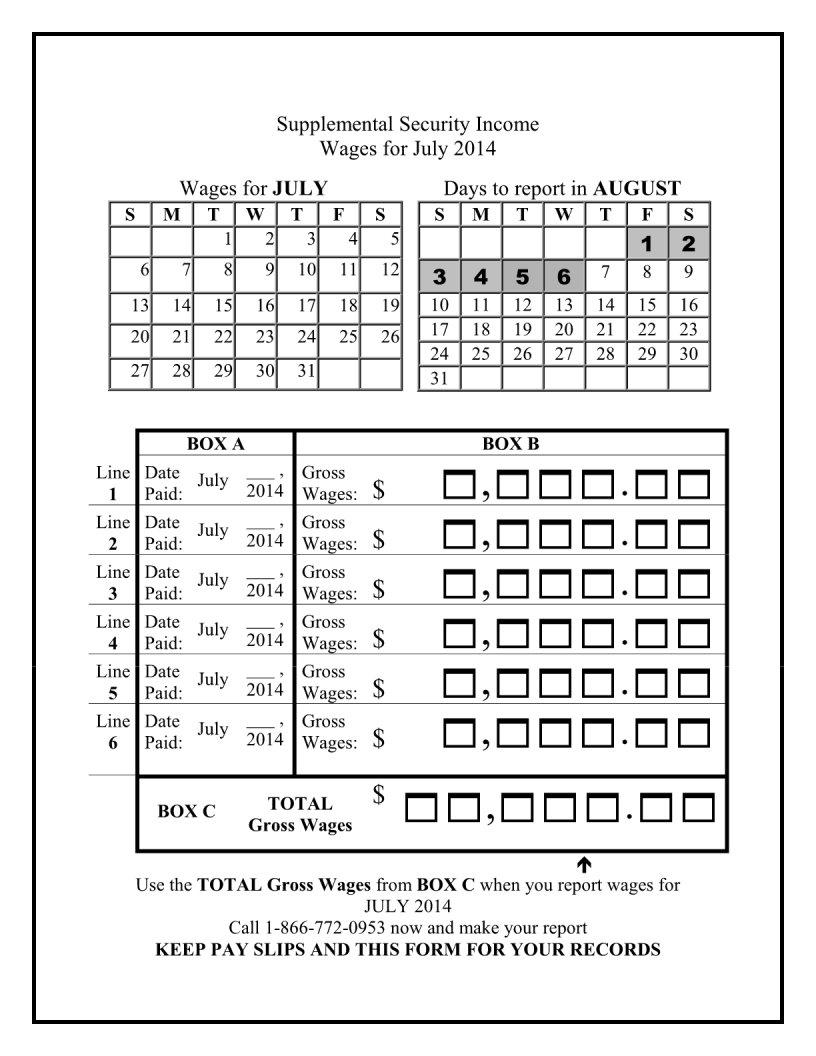

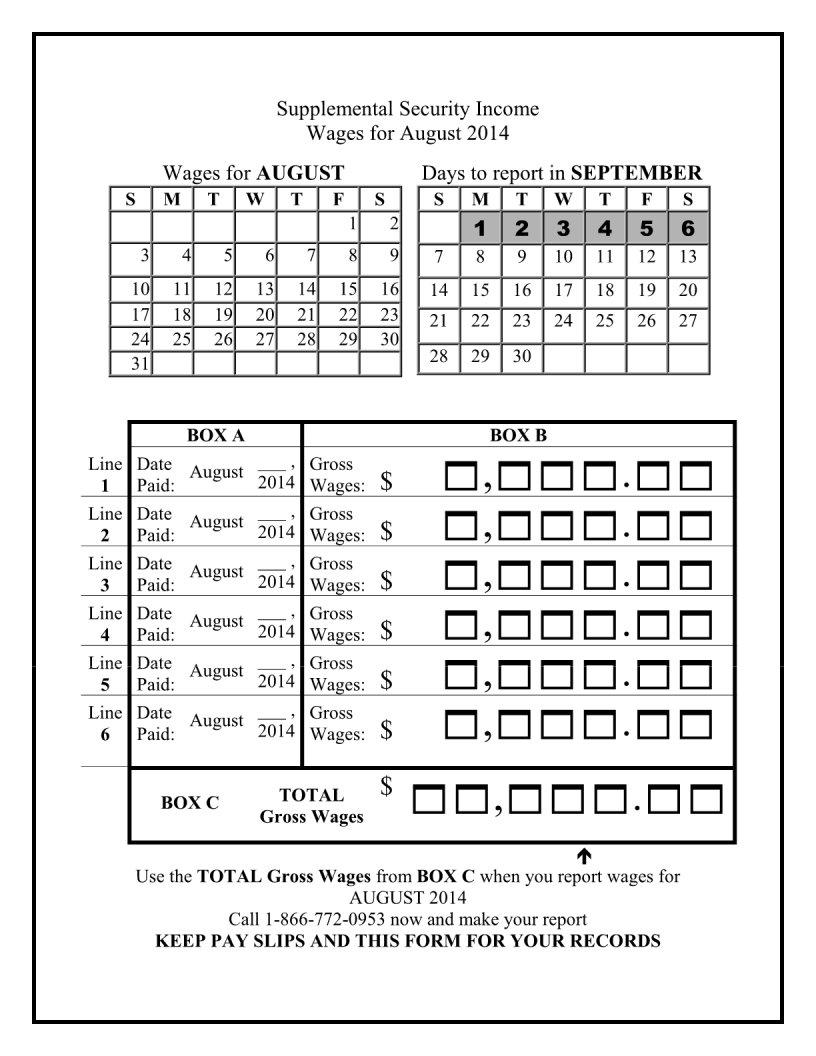

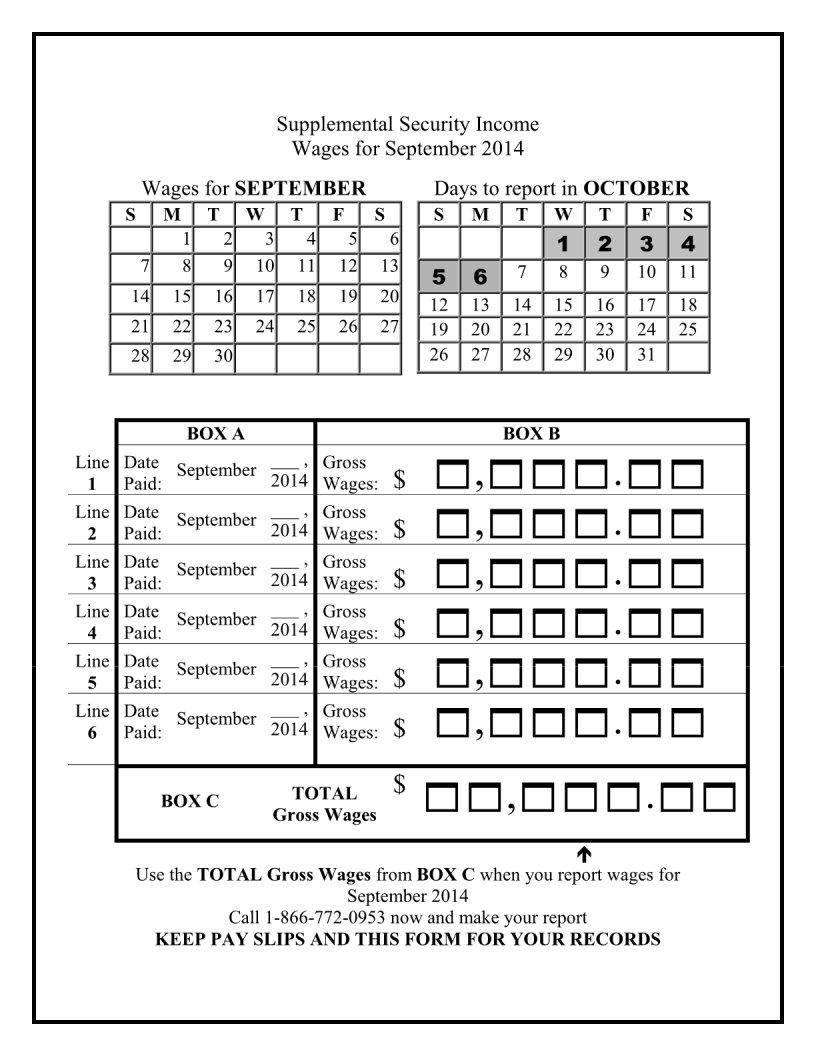

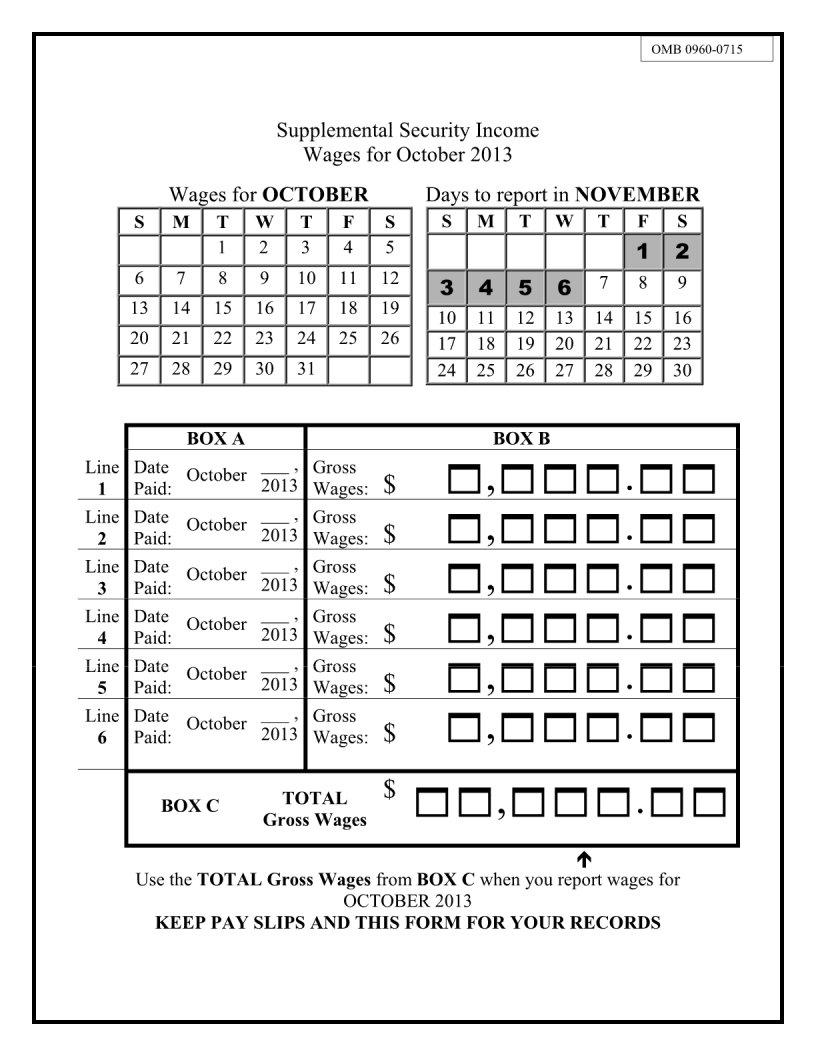

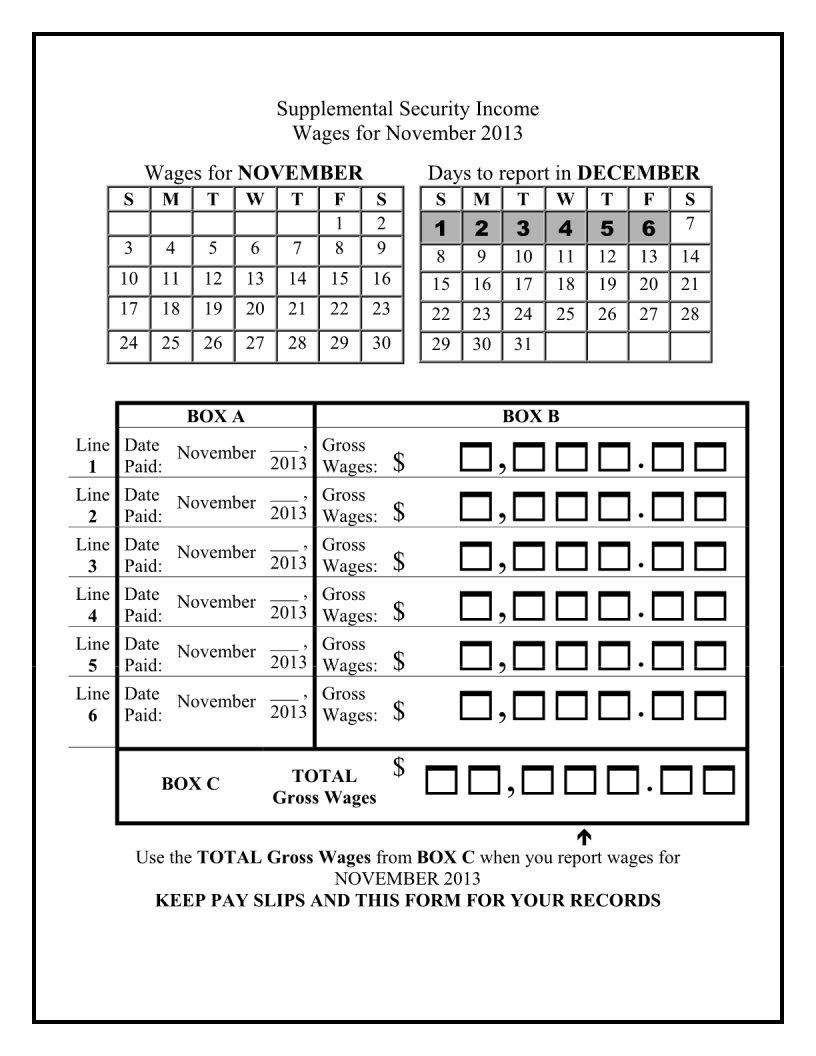

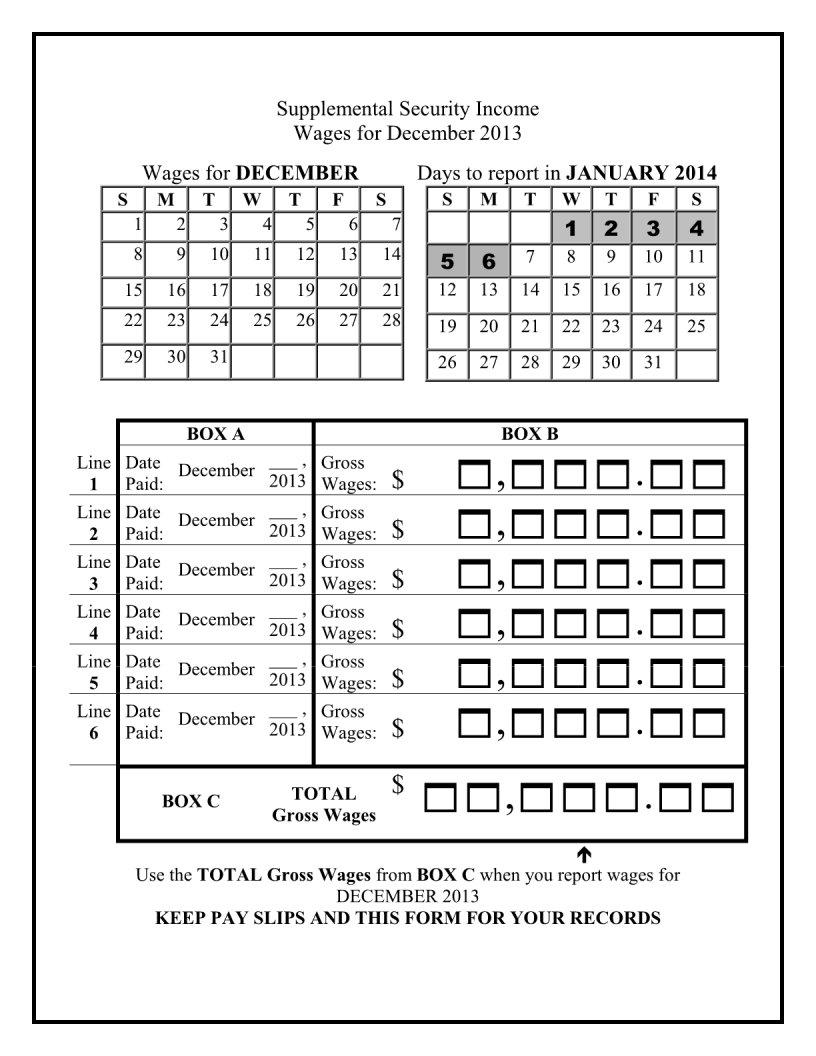

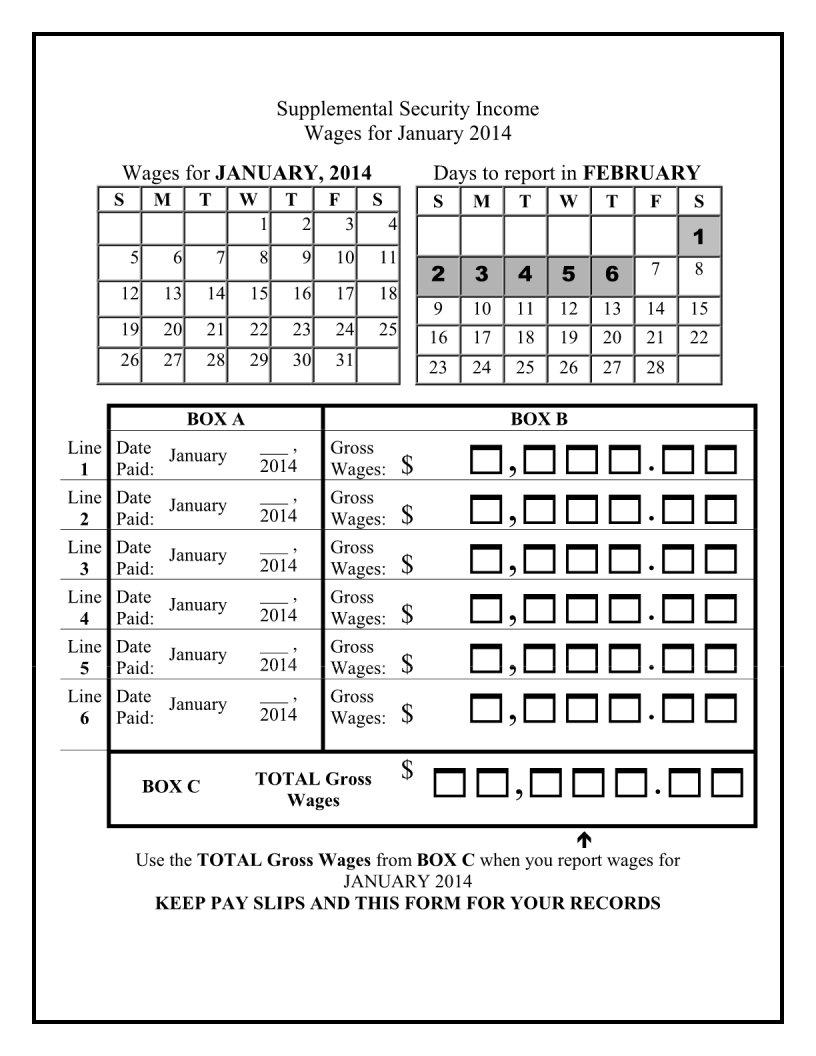

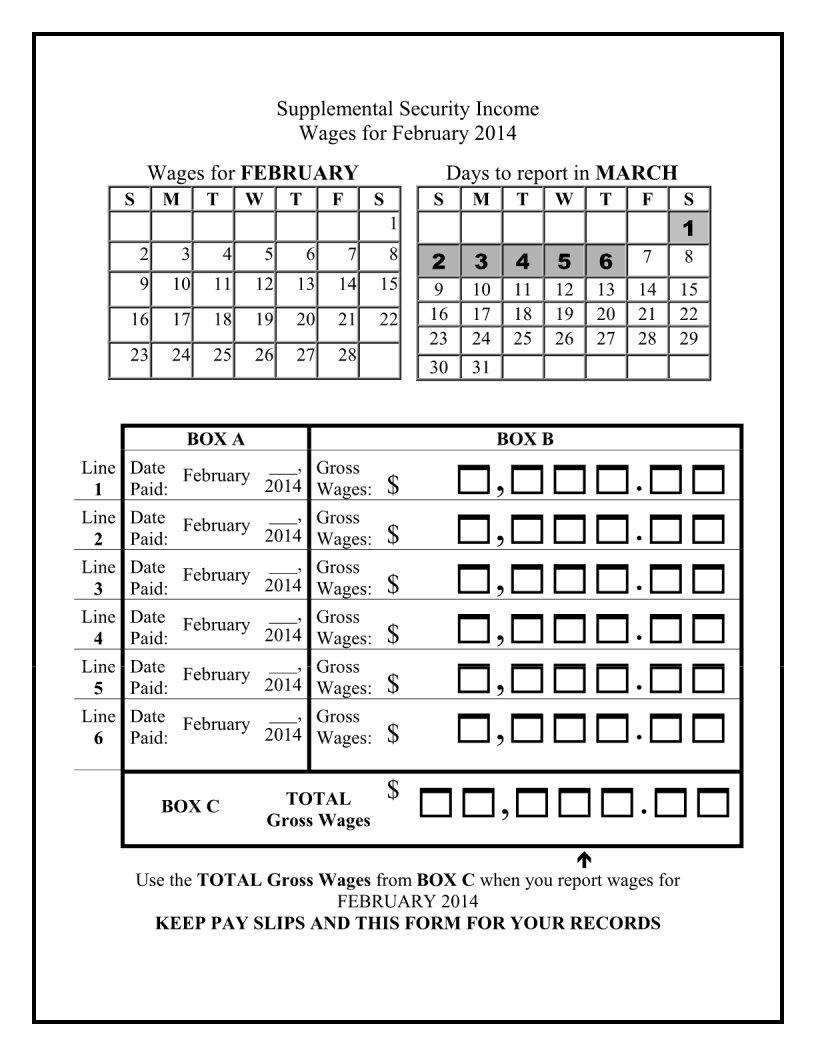

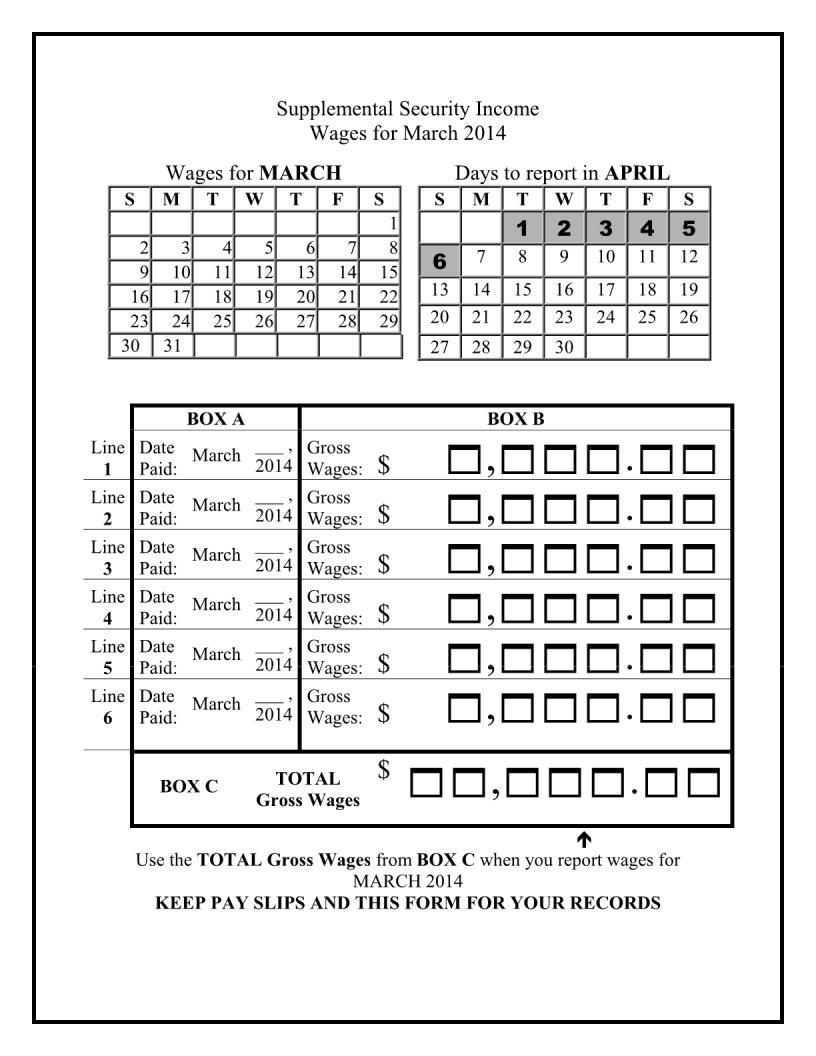

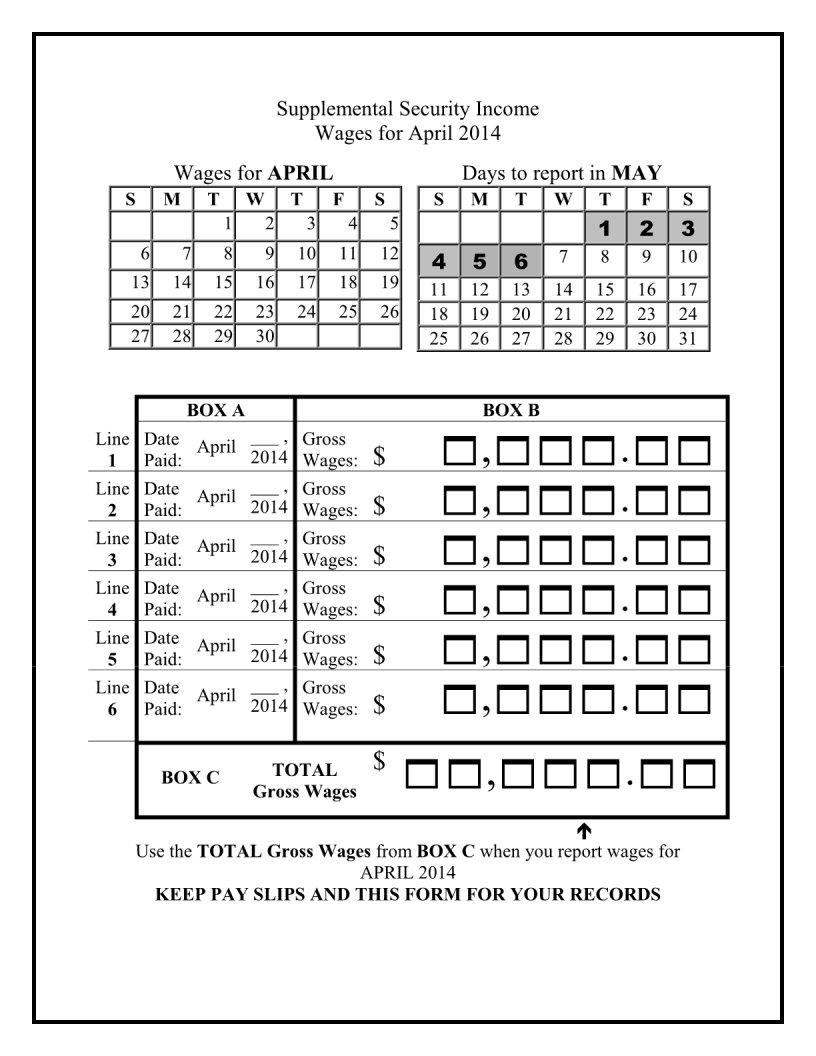

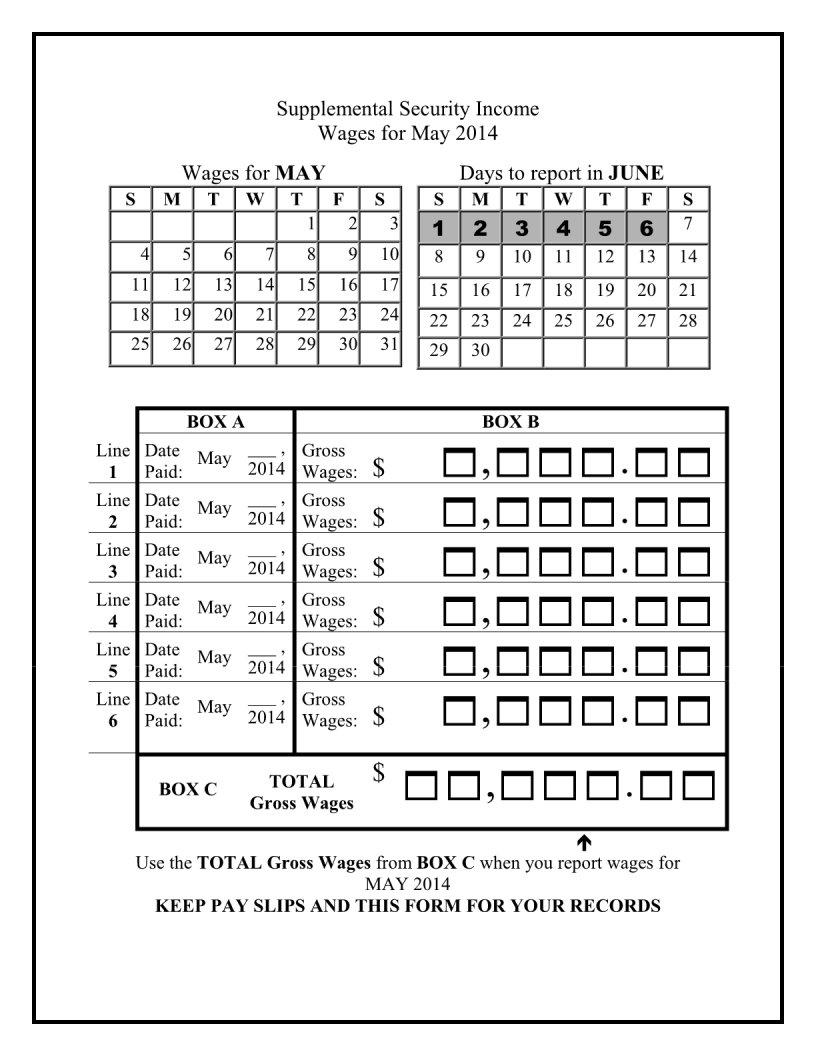

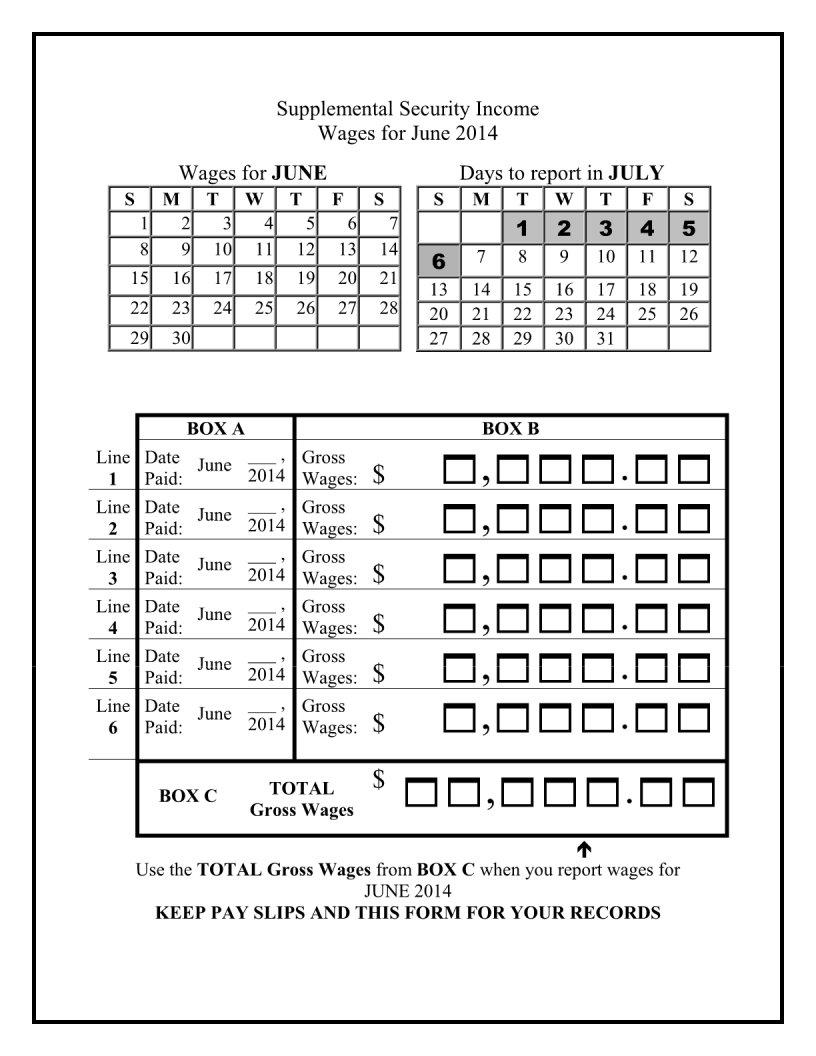

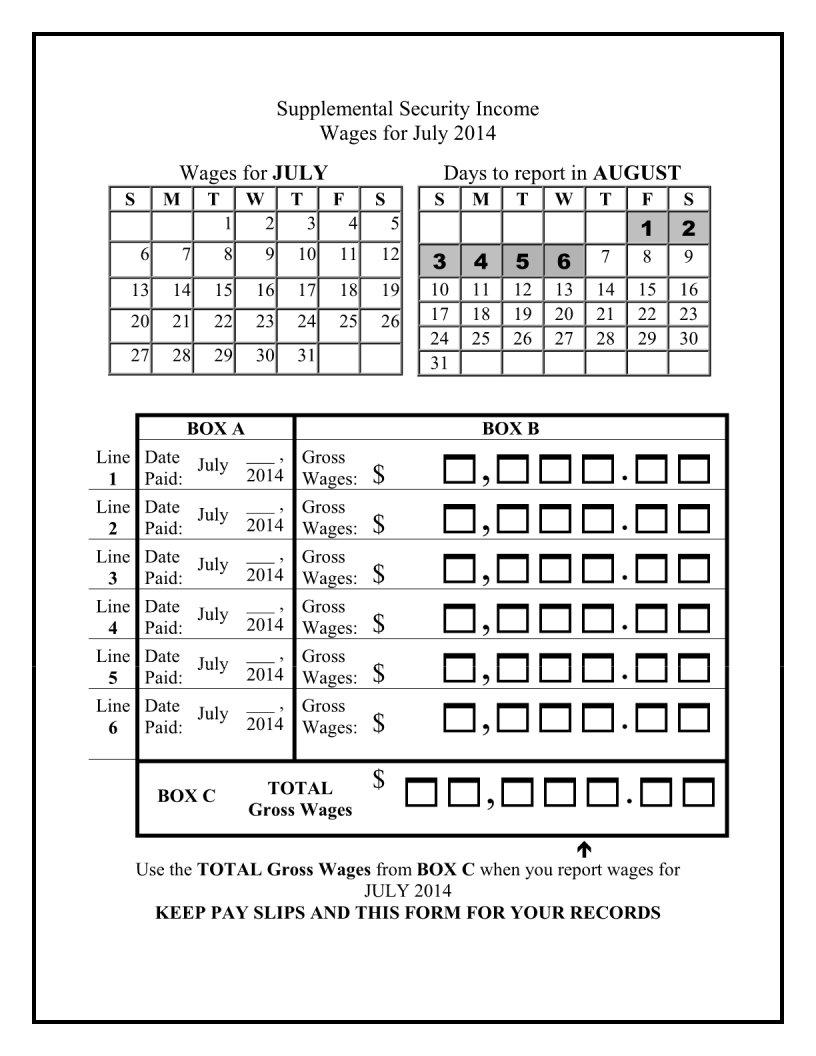

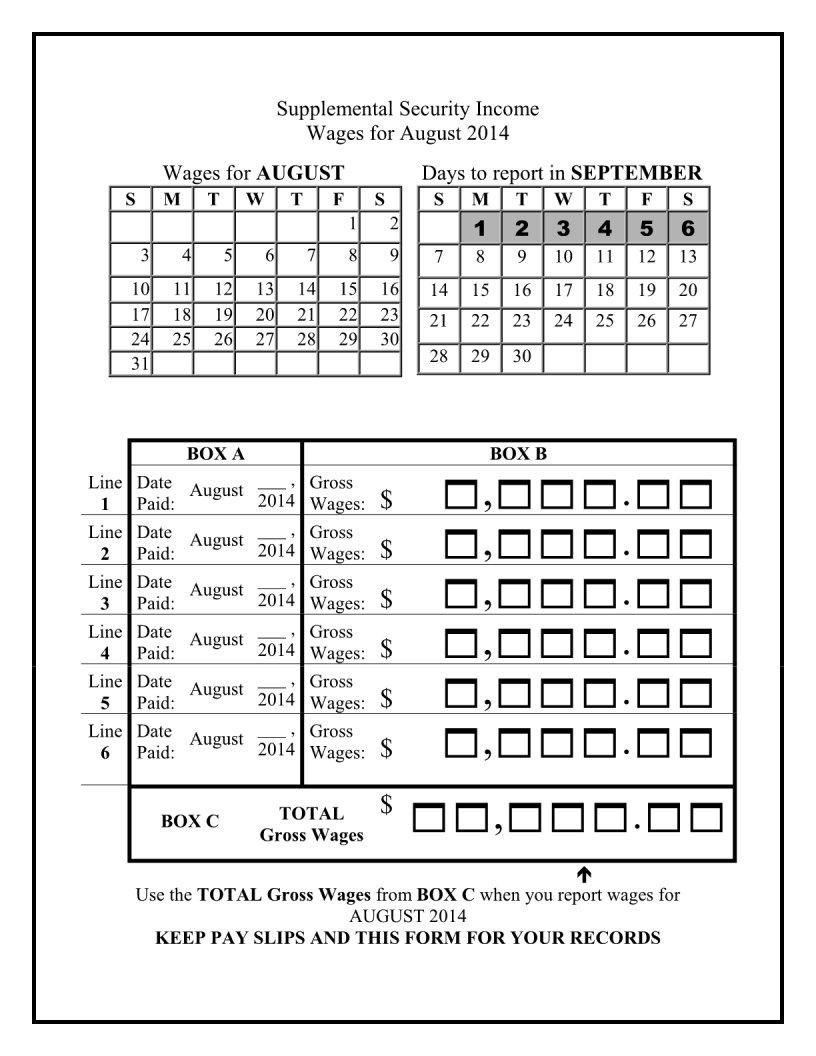

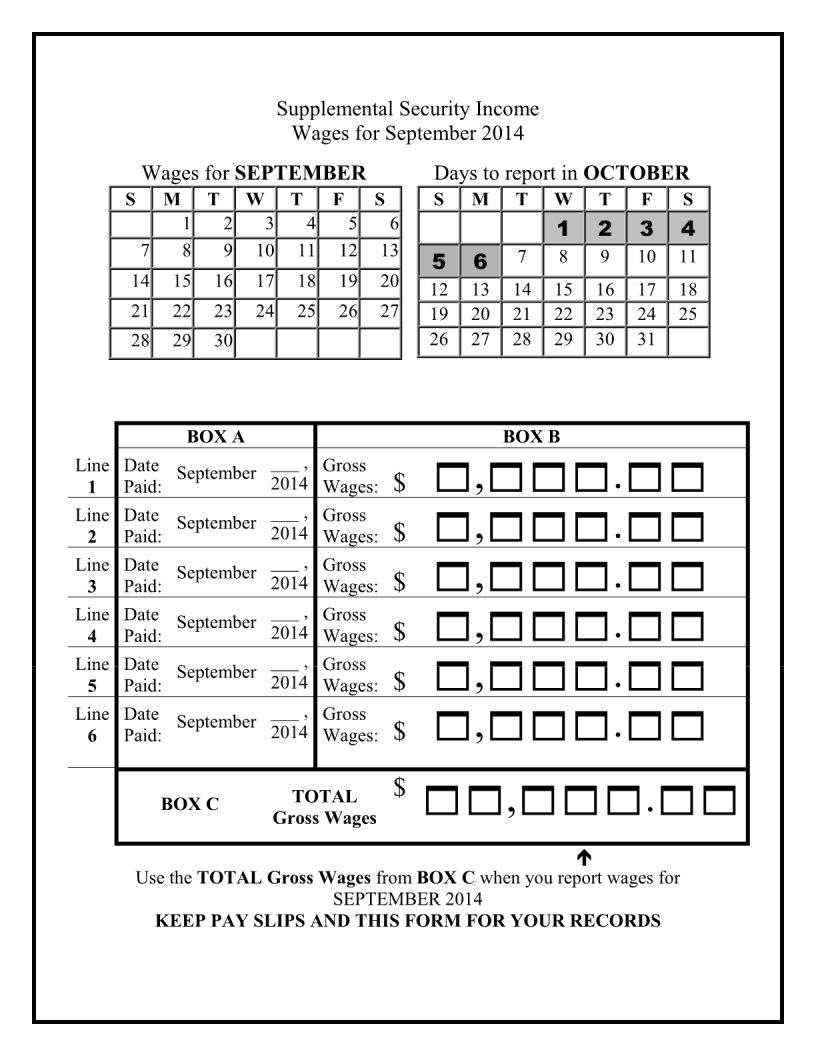

Navigating the landscape of Social Security contributions can often feel like a daunting endeavor. Central to understanding how these contributions work and their impact on your future benefits is the Social Security Wage form. This pivotal document serves as a vital link between your earnings and the Social Security Administration (SSA), ensuring that all your hard-earned money is accurately accounted for. It plays a crucial role in determining your eligibility for retirement, disability, and survivor benefits by recording the amount of income subject to Social Security taxes. Moreover, this form underscores the significance of the wage base limit, which sets the maximum amount of your earnings that can be taxed for Social Security in any given year. As such, it directly influences the size of your future Social Security benefits. For both employees and employers, understanding the nuances of this form is essential for accurate payroll processing and for ensuring that the correct amount of Social Security taxes is being paid. Hence, deciphering the complexities of the Social Security Wage form is not just a matter of bureaucratic compliance, but a step towards securing one's financial future and peace of mind.

| Question | Answer |

|---|---|

| Form Name | Social Security Wage Form |

| Form Length | 34 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 8 min 30 sec |

| Other names | ssi wage reporting forms 2018, social security wage reporting form, ssi wage reporting sheet, form to report wages to ssi |