Using PDF documents online is actually surprisingly easy with this PDF editor. Anyone can fill in soh form statement health here without trouble. The editor is continually updated by our team, getting powerful functions and becoming better. This is what you would need to do to start:

Step 1: Click the "Get Form" button above. It'll open up our pdf tool so you could begin filling out your form.

Step 2: After you access the editor, you will find the form made ready to be filled out. Apart from filling in different blank fields, you could also perform some other things with the file, particularly putting on custom textual content, modifying the original textual content, inserting graphics, placing your signature to the PDF, and a lot more.

This form will need specific information; to guarantee consistency, make sure you pay attention to the next steps:

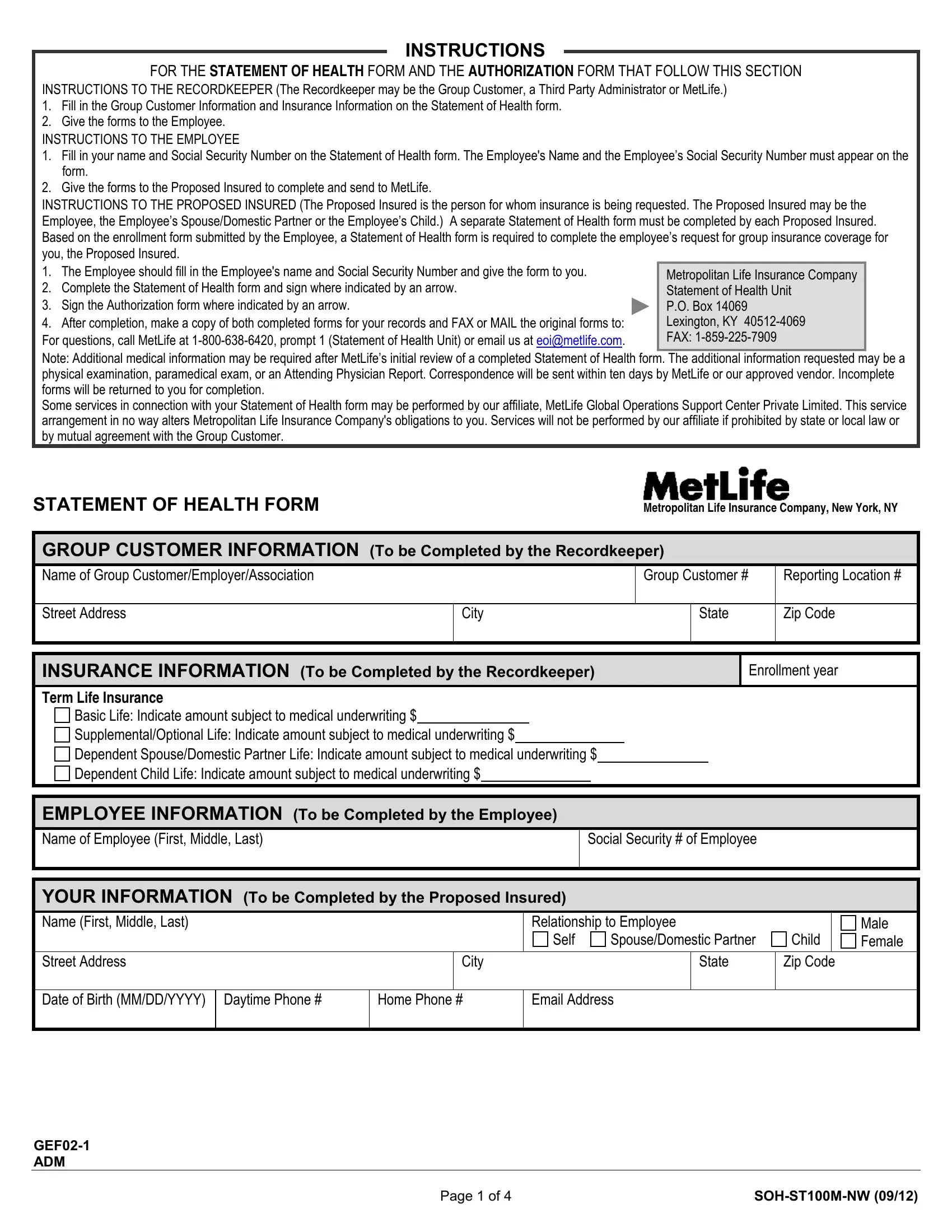

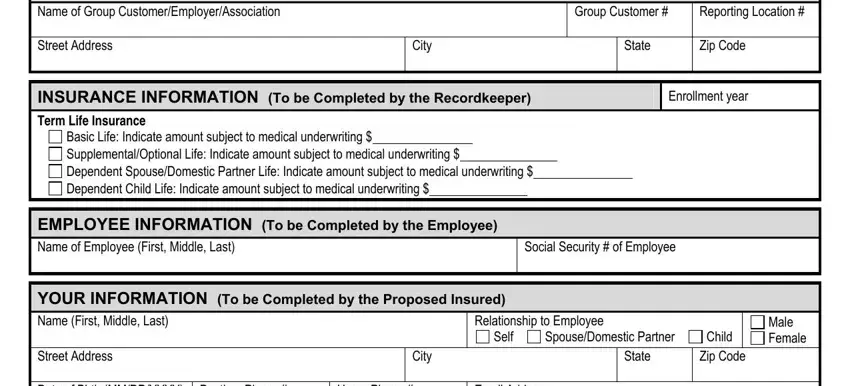

1. You'll want to complete the soh form statement health properly, hence be attentive while filling in the parts including all these blanks:

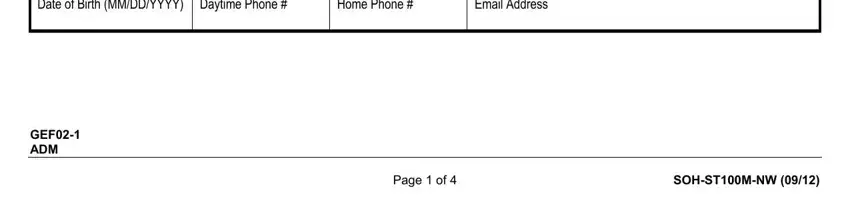

2. When the previous section is completed, it's time to insert the required specifics in YOUR INFORMATION To be Completed, Daytime Phone, Home Phone, Email Address, GEF ADM, Page of, and SOHSTMNW in order to proceed further.

As to Email Address and SOHSTMNW, ensure you don't make any mistakes here. Both of these could be the key ones in the form.

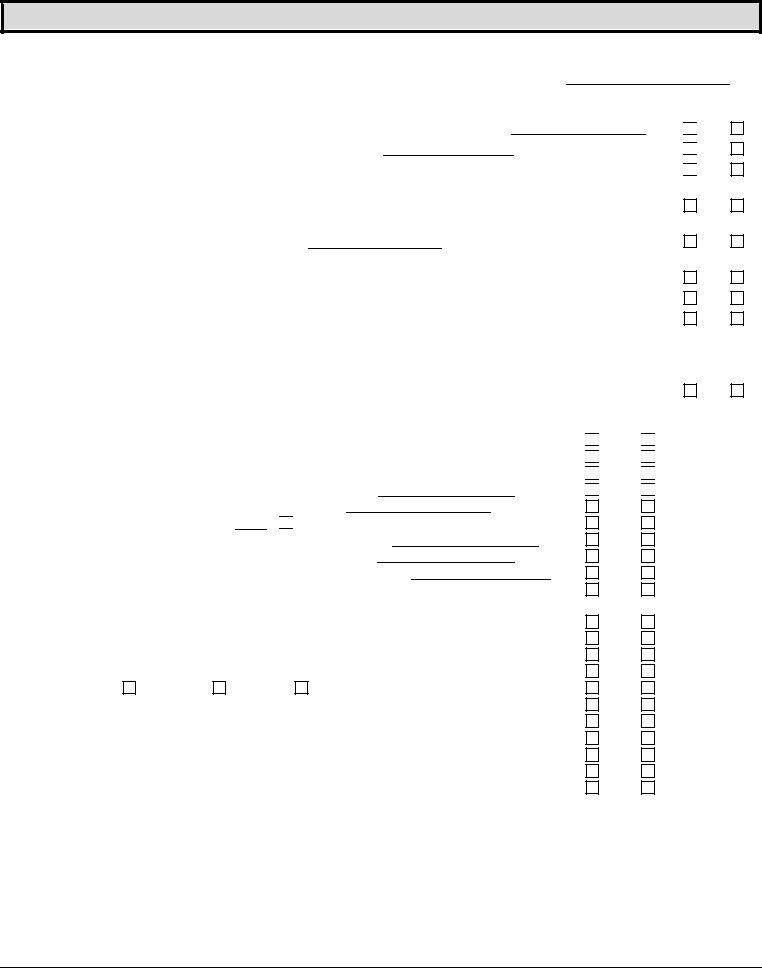

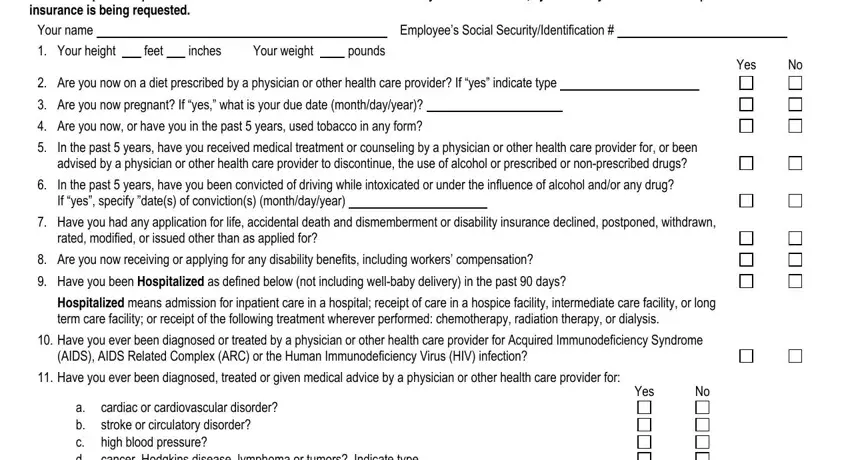

3. Completing Please complete all questions, Your name Your height feet inches, Employees Social, Yes, Are you now pregnant If yes what, Are you now or have you in the, In the past years have you, advised by a physician or other, In the past years have you been, If yes specify dates of, Have you had any application for, rated modified or issued other, Are you now receiving or applying, Have you been Hospitalized as, and Hospitalized means admission for is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

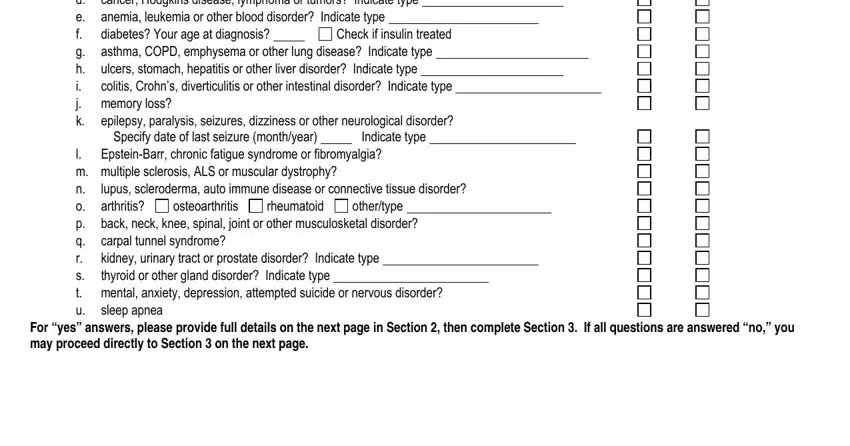

4. Completing cancer Hodgkins disease lymphoma, Have you ever been diagnosed, a b c high blood pressure d e, colitis Crohns diverticulitis or, diabetes Your age at diagnosis, Check if insulin treated, osteoarthritis, lupus scleroderma auto immune, Specify date of last seizure, l m multiple sclerosis ALS or, carpal tunnel syndrome kidney, othertype, rheumatoid, sleep apnea, and Yes is key in the fourth form section - don't forget to don't hurry and fill in each field!

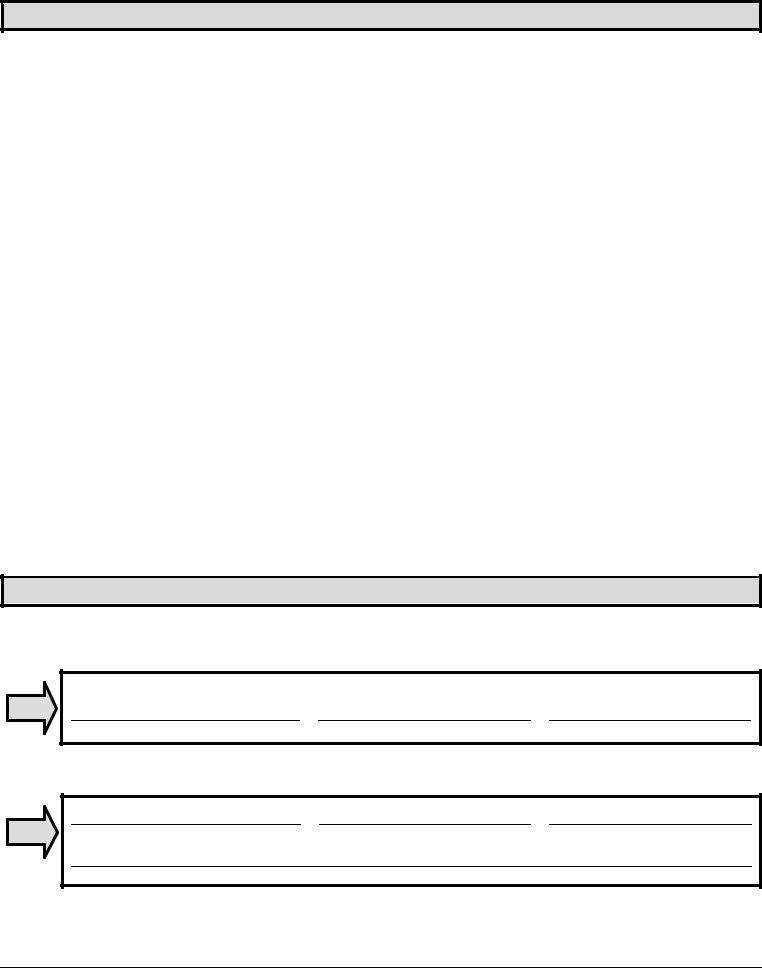

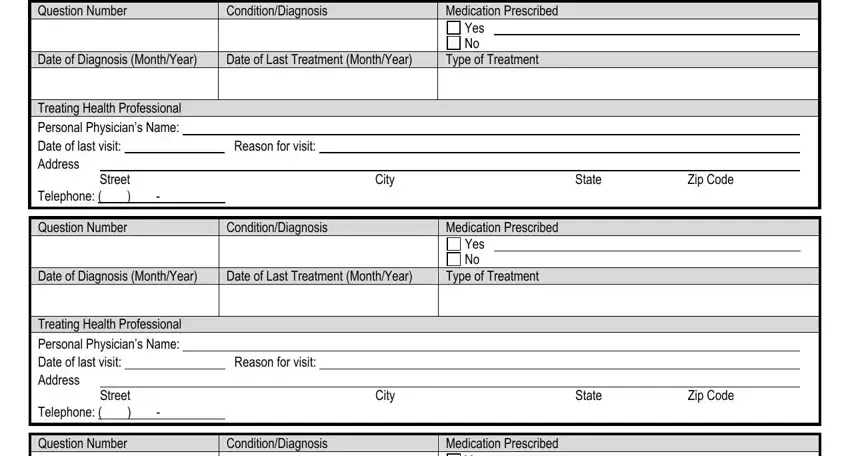

5. The very last notch to finish this PDF form is integral. You must fill in the displayed form fields, and this includes Question Number, ConditionDiagnosis, Medication Prescribed, Yes No, Date of Diagnosis MonthYear, Date of Last Treatment MonthYear, Type of Treatment, Treating Health Professional, Street, Reason for visit, City, State, Zip Code, Telephone, and Question Number, before using the pdf. Or else, it can produce an unfinished and probably unacceptable document!

Step 3: After you have glanced through the details you given, click on "Done" to finalize your form at FormsPal. After setting up a7-day free trial account here, you'll be able to download soh form statement health or email it immediately. The PDF will also be accessible in your personal cabinet with your every single modification. FormsPal guarantees your information confidentiality by using a protected system that in no way records or shares any private information involved in the process. Be confident knowing your files are kept protected every time you use our tools!