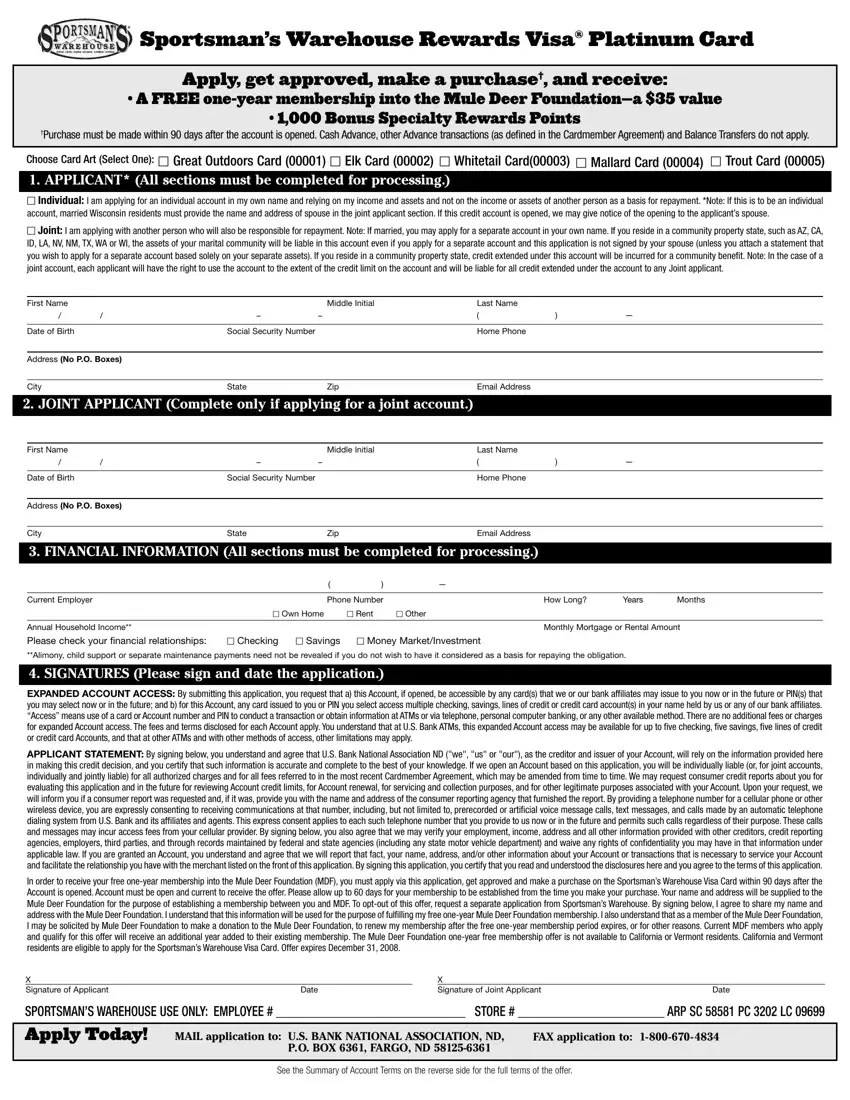

SportsmanÕs Warehouse Rewards Visa¨ Platinum Card |

Apply, get approved, make a purchase , and receive:

¥ A FREE one-year membership into the Mule Deer FoundationÑa $35 value

¥ 1,000 Bonus Specialty Rewards Points

†Purchase must be made within 90 days after the account is opened. Cash Advance, other Advance transactions (as defined in the Cardmember Agreement) and Balance Transfers do not apply.

CHOOSE CARD ART (SELECT ONE): 5 GREAT OUTDOORS CARD (00001) 5 ELK CARD (00002) 5 WHITETAIL CARD(00003) 5 MALLARD CARD (00004) 5 TROUT CARD (00005)

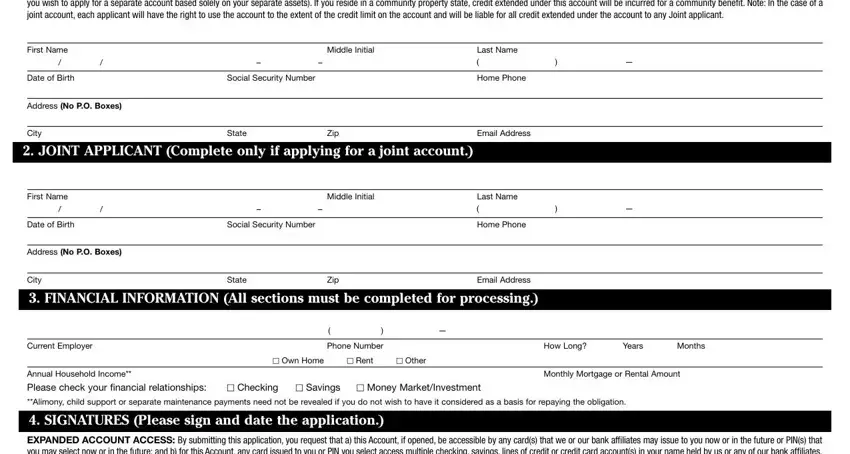

1. APPLICANT* (All sections must be completed for processing.)

5Individual: I am applying for an individual account in my own name and relying on my income and assets and not on the income or assets of another person as a basis for repayment. *Note: If this is to be an individual account, married Wisconsin residents must provide the name and address of spouse in the joint applicant section. If this credit account is opened, we may give notice of the opening to the applicant’s spouse.

5Joint: I am applying with another person who will also be responsible for repayment. Note: If married, you may apply for a separate account in your own name. If you reside in a community property state, such as AZ,CA, ID, LA, NV, NM, TX, WA or WI, the assets of your marital community will be liable in this account even if you apply for a separate account and this application is not signed by your spouse (unless you attach a statement that you wish to apply for a separate account based solely on your separate assets). If you reside in a community property state, credit extended under this account will be incurred for a community benefit. Note: In the case of a joint account, each applicant will have the right to use the account to the extent of the credit limit on the account and will be liable for all credit extended under the account to any Joint applicant.

First Name |

|

|

Middle Initial |

Last Name |

|

|

/ |

/ |

– |

– |

( |

) |

— |

|

|

|

|

|

|

|

Date of Birth |

|

Social Security Number |

|

Home Phone |

|

|

|

|

|

|

|

|

Address (NO P.O. BOXES) |

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

Zip |

Email Address |

|

|

2. JOINT APPLICANT (Complete only if applying for a joint account.)

First Name |

|

|

Middle Initial |

Last Name |

|

|

/ |

/ |

– |

– |

( |

) |

— |

|

|

|

|

|

|

|

Date of Birth |

|

Social Security Number |

|

Home Phone |

|

|

|

|

|

|

|

|

Address (NO P.O. BOXES) |

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

Zip |

Email Address |

|

|

3. FINANCIAL INFORMATION (All sections must be completed for processing.)

|

|

( |

) |

— |

|

|

|

|

|

|

|

|

Current Employer |

|

Phone Number |

How Long? |

Years |

Months |

|

5 Own Home |

5 Rent |

5 Other |

|

|

Annual Household Income** |

|

|

|

Monthly Mortgage or Rental Amount |

Please check your financial relationships: |

5 Checking |

5 Savings |

5 Money Market/Investment |

|

|

**Alimony, child support or separate maintenance payments need not be revealed if you do not wish to have it considered as a basis for repaying the obligation.

4. SIGNATURES (Please sign and date the application.)

EXPANDED ACCOUNT ACCESS: By submitting this application, you request that a) this Account, if opened, be accessible by any card(s) that we or our bank affiliates may issue to you now or in the future or PIN(s) that you may select now or in the future; and b) for this Account, any card issued to you or PIN you select access multiple checking, savings, lines of credit or credit card account(s) in your name held by us or any of our bank affiliates. “Access” means use of a card or Account number and PIN to conduct a transaction or obtain information at ATMs or via telephone, personal computer banking, or any other available method. There are no additional fees or charges for expanded Account access. The fees and terms disclosed for each Account apply. You understand that at U.S. Bank ATMs, this expanded Account access may be available for up to five checking, five savings, five lines of credit or credit card Accounts, and that at other ATMs and with other methods of access, other limitations may apply.

APPLICANT STATEMENT: By signing below, you understand and agree that U.S. Bank National Association ND ("we", "us" or "our"), as the creditor and issuer of your Account, will rely on the information provided here in making this credit decision, and you certify that such information is accurate and complete to the best of your knowledge. If we open an Account based on this application, you will be individually liable (or, for joint accounts, individually and jointly liable) for all authorized charges and for all fees referred to in the most recent Cardmember Agreement, which may be amended from time to time. We may request consumer credit reports about you for evaluating this application and in the future for reviewing Account credit limits, for Account renewal, for servicing and collection purposes, and for other legitimate purposes associated with your Account. Upon your request, we will inform you if a consumer report was requested and, if it was, provide you with the name and address of the consumer reporting agency that furnished the report. By providing a telephone number for a cellular phone or other wireless device, you are expressly consenting to receiving communications at that number, including, but not limited to, prerecorded or artificial voice message calls, text messages, and calls made by an automatic telephone dialing system from U.S. Bank and its affiliates and agents. This express consent applies to each such telephone number that you provide to us now or in the future and permits such calls regardless of their purpose. These calls and messages may incur access fees from your cellular provider. By signing below, you also agree that we may verify your employment, income, address and all other information provided with other creditors, credit reporting agencies, employers, third parties, and through records maintained by federal and state agencies (including any state motor vehicle department) and waive any rights of confidentiality you may have in that information under applicable law. If you are granted an Account, you understand and agree that we will report that fact, your name, address, and/or other information about your Account or transactions that is necessary to service your Account and facilitate the relationship you have with the merchant listed on the front of this application. By signing this application, you certify that you read and understood the disclosures here and you agree to the terms of this application.

In order to receive your free one-year membership into the Mule Deer Foundation (MDF), you must apply via this application, get approved and make a purchase on the Sportsman’s Warehouse Visa Card within 90 days after the Account is opened. Account must be open and current to receive the offer. Please allow up to 60 days for your membership to be established from the time you make your purchase. Your name and address will be supplied to the Mule Deer Foundation for the purpose of establishing a membership between you and MDF. To opt-out of this offer, request a separate application from Sportsman’s Warehouse. By signing below, I agree to share my name and address with the Mule Deer Foundation. I understand that this information will be used for the purpose of fulfilling my free one-year Mule Deer Foundation membership. I also understand that as a member of the Mule Deer Foundation, I may be solicited by Mule Deer Foundation to make a donation to the Mule Deer Foundation, to renew my membership after the free one-year membership period expires, or for other reasons. Current MDF members who apply and qualify for this offer will receive an additional year added to their existing membership. The Mule Deer Foundation one-year free membership offer is not available to California or Vermont residents. California and Vermont residents are eligible to apply for the Sportsman’s Warehouse Visa Card. Offer expires December 31, 2008.

X |

|

|

X |

|

Signature of Applicant |

Date |

|

Signature of Joint Applicant |

Date |

SPORTSMAN’S WAREHOUSE USE ONLY: EMPLOYEE # _______________________________ STORE # ________________________ ARP SC 58581 PC 3202 LC 09699

Apply Today! |

MAIL application to: U.S. BANK NATIONAL ASSOCIATION, ND, |

FAX application to: 1- 800-670- 4834 |

|

P.O. BOX 6361, FARGO, ND 58125-6361 |

|

|

|

|