It is not hard to complete the how to form ss 4418. Our editor was built to be easy-to-use and let you complete any form swiftly. These are the steps to follow:

Step 1: On this web page, click the orange "Get form now" button.

Step 2: Now you are on the document editing page. You can edit, add text, highlight selected words or phrases, insert crosses or checks, and insert images.

Fill in the how to form s, s 4418 PDF by providing the information meant for every single area.

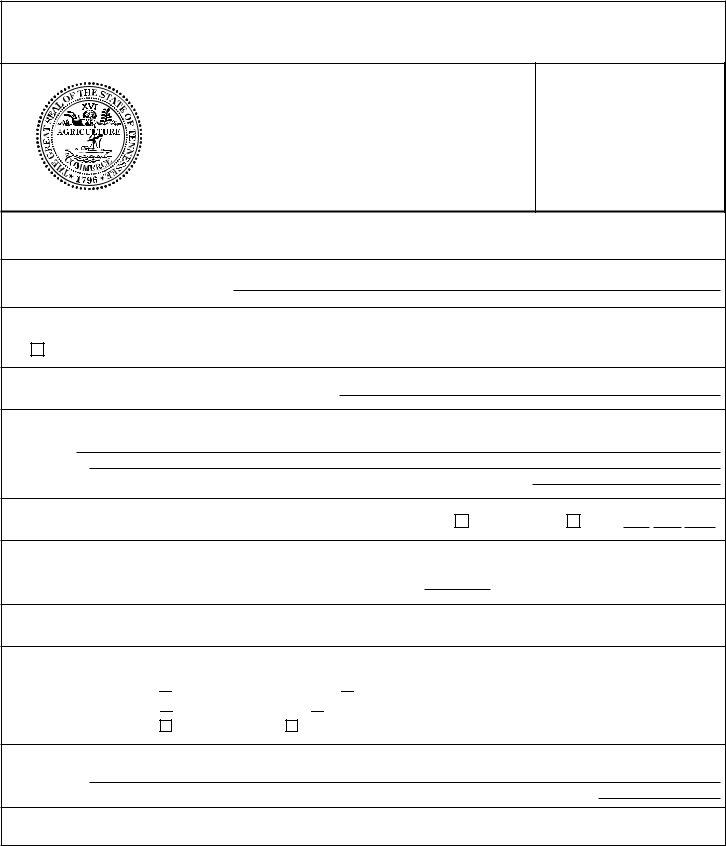

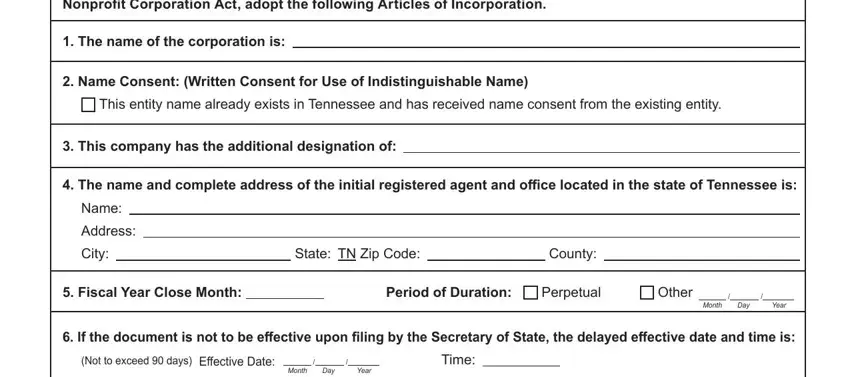

The software will need you to prepare the The, name, of, the, corporation, is Name, Address, City State, TN, Zip, Code County, Fiscal, Year, Close, Month Period, of, Duration Perpetual, Other, Month, Day, Year, Not, to, exceed, days Time, Effective, Date Month, and Day section.

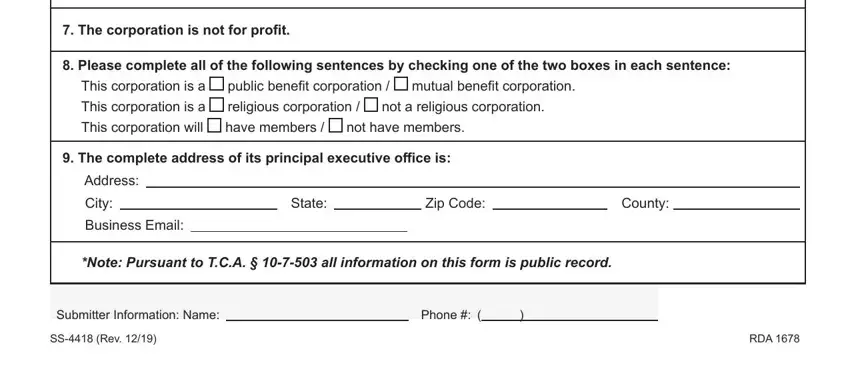

Emphasize the considerable details about the Month, The, corporation, is, not, for, profit not, have, members mutual, benefit, corporation not, a, religious, corporation Address, City, Business, Email State, Zip, Code County, Submitter, Information, NameS, S, Rev Phone, and RD, A box.

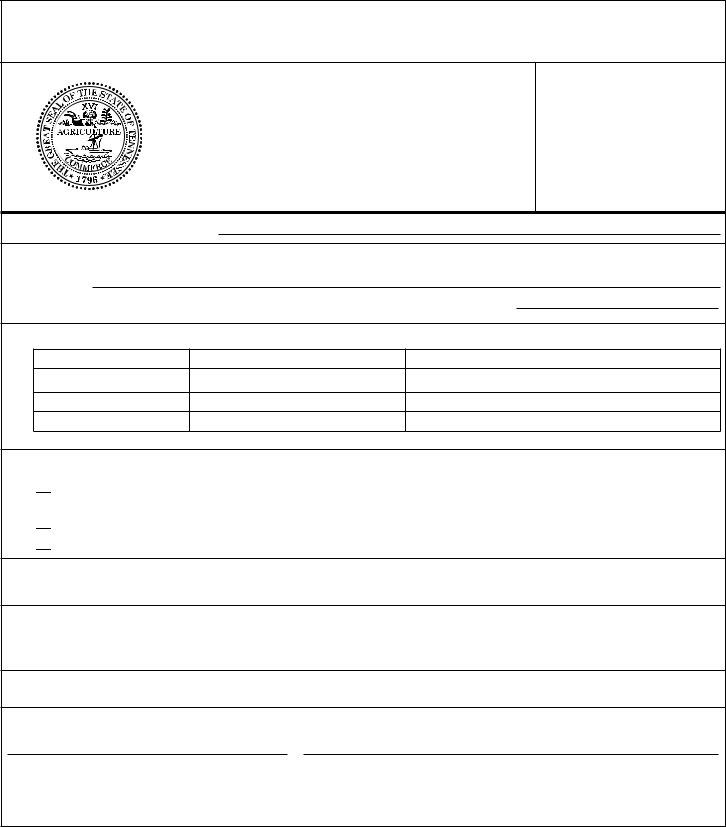

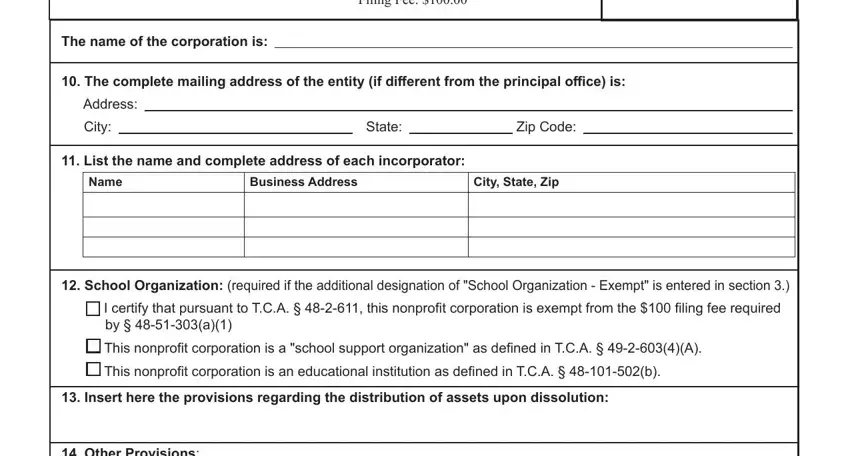

It is important to indicate the rights and obligations of both sides in field Filing, Fee The, name, of, the, corporation, is Address, City State, Zip, Code Name, Business, Address City, State, Zip and Other, Provisions

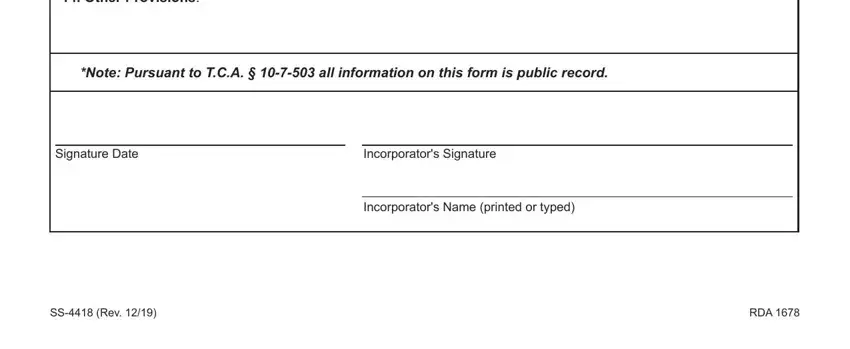

Finalize by checking the following areas and filling them out correspondingly: Other, Provisions Signature, Date In, corp, orators, Signature In, corp, orators, Name, printed, or, typed S, S, Rev and RD, A

Step 3: Choose the button "Done". Your PDF form may be transferred. It is possible to upload it to your computer or email it.

Step 4: Make minimally a couple of copies of the file to keep clear of any specific upcoming complications.