When working in the online PDF editor by FormsPal, you can easily fill out or change social ssaocrsm right here and now. We are dedicated to giving you the best possible experience with our editor by constantly introducing new capabilities and improvements. With these improvements, using our editor gets better than ever! All it takes is several easy steps:

Step 1: Hit the orange "Get Form" button above. It'll open up our pdf editor so you can start filling in your form.

Step 2: With our advanced PDF tool, you may do more than simply fill out blank form fields. Edit away and make your forms appear great with custom textual content added in, or optimize the original input to perfection - all that accompanied by an ability to add stunning photos and sign the document off.

When it comes to fields of this particular form, here is what you should know:

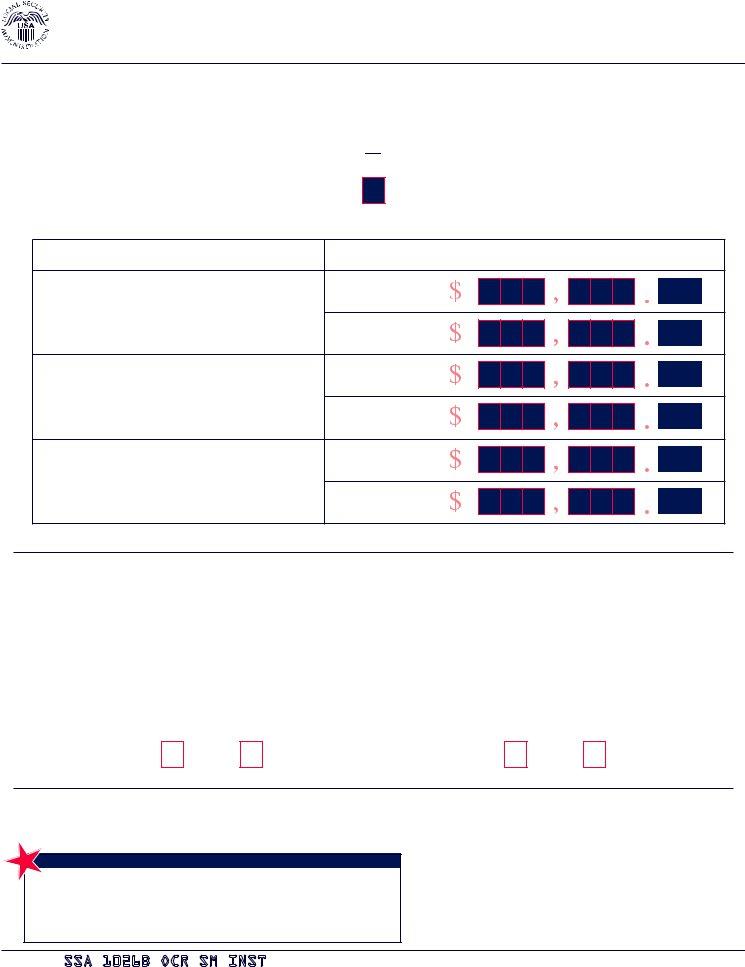

1. Begin completing your social ssaocrsm with a selection of major blanks. Note all the required information and ensure there is nothing omitted!

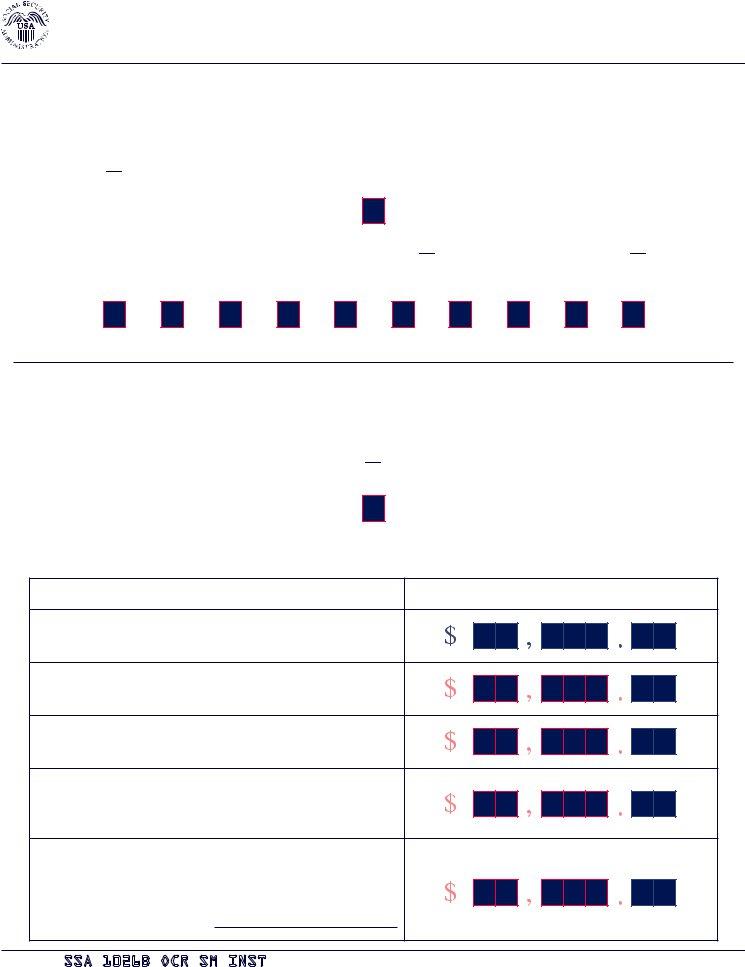

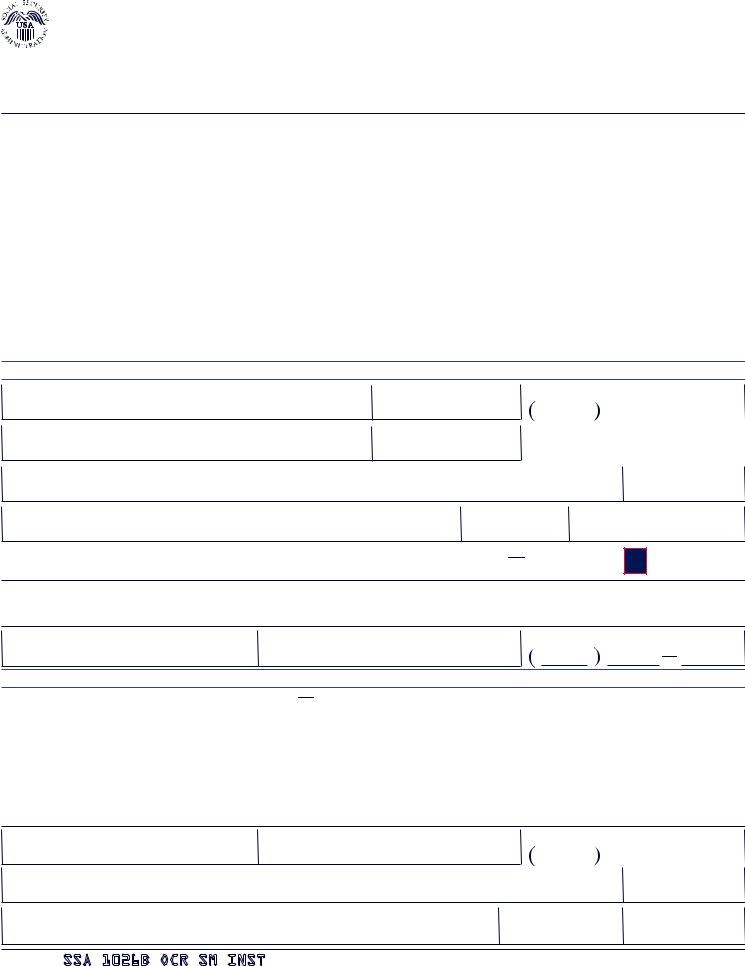

2. Soon after this section is done, go to type in the applicable information in all these - Net earnings from selfemployment, Yours, Your spouses, Net loss from selfemployment, Yours, Your spouses, Disability Or Blind Work Expenses, Monthly Amount, Disability work expenses, Blind work expenses, Form SSABOCRSMINST, and KEEP THIS PAGE FOR YOUR RECORDS.

Many people generally make errors when filling in Yours in this section. You should definitely go over what you enter right here.

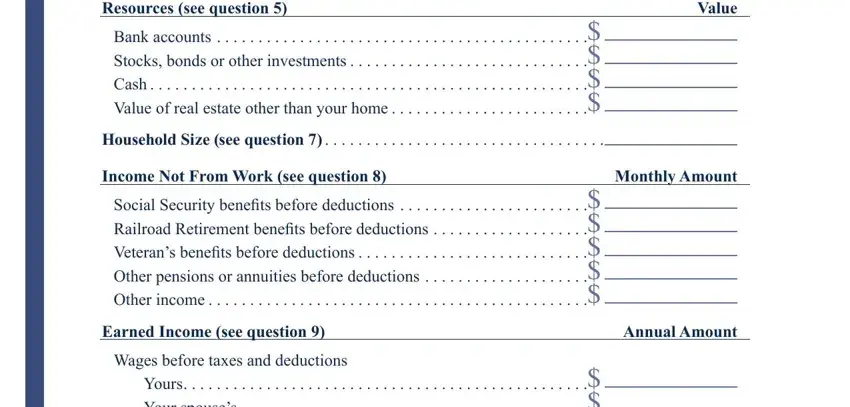

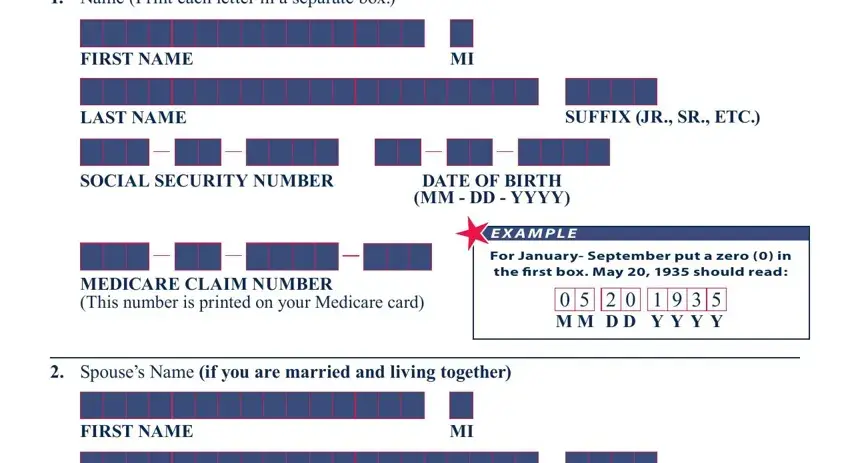

3. This next part focuses on Name Print each letter in a, FIRST NAME, LAST NAME, SUFFIX JR SR ETC, SOCIAL SECURITY NUMBER, DATE OF BIRTH MM DD YYYY, E X A M P L E, MEDICARE CLAIM NUMBER This number, For January September put a zero, M M D D Y Y Y Y, Spouses Name if you are married, and FIRST NAME - complete all these fields.

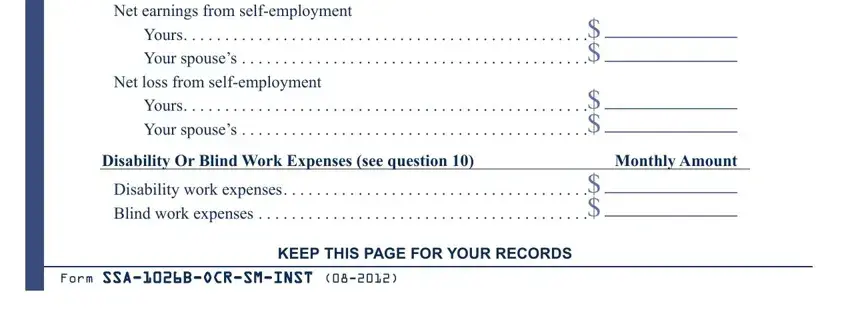

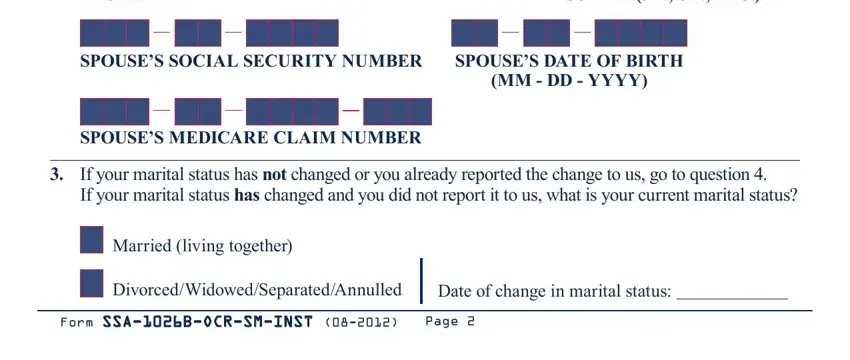

4. All set to fill in this next part! Here you'll get all these LAST NAME, SUFFIX JR SR ETC, SPOUSES SOCIAL SECURITY NUMBER, SPOUSES DATE OF BIRTH, MM DD YYYY, SPOUSES MEDICARE CLAIM NUMBER, If your marital status has not, If your marital status has changed, Married living together, DivorcedWidowedSeparatedAnnulled, Date of change in marital status, Form SSABOCRSMINST, and Page fields to fill in.

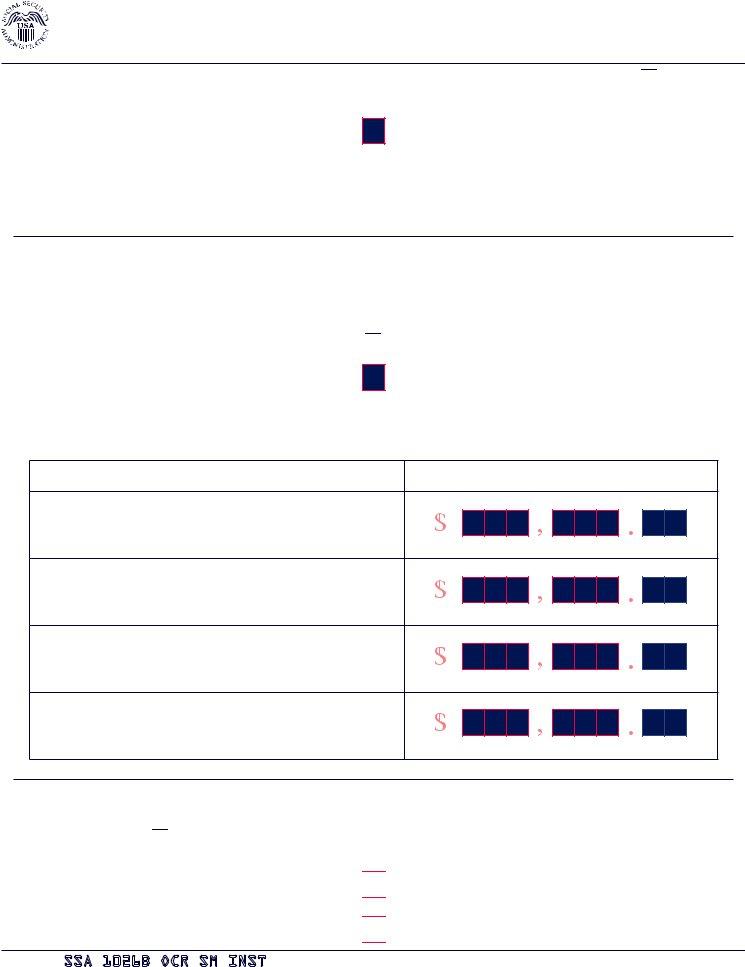

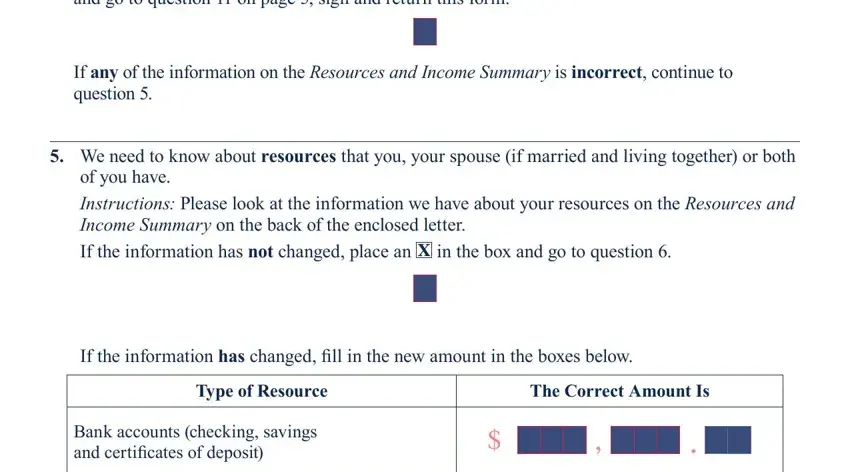

5. Since you approach the conclusion of this document, you will find several more requirements that should be fulfilled. In particular, and go to question on page sign, If any of the information on the, We need to know about resources, of you have, Instructions Please look at the, If the information has not changed, in the box and go to question, If the information has changed, Type of Resource, The Correct Amount Is, and Bank accounts checking savings and must be filled in.

Step 3: Make sure your details are accurate and click on "Done" to complete the process. Try a 7-day free trial plan at FormsPal and acquire immediate access to social ssaocrsm - downloadable, emailable, and editable from your personal cabinet. FormsPal offers risk-free document tools devoid of personal information recording or distributing. Feel comfortable knowing that your data is safe here!