waiver form ssa 632 can be completed easily. Simply make use of FormsPal PDF tool to perform the job without delay. The tool is continually improved by our staff, acquiring powerful functions and turning out to be better. All it requires is a couple of easy steps:

Step 1: Click the "Get Form" button above. It's going to open our pdf tool so you can start filling out your form.

Step 2: As soon as you launch the file editor, you will see the document all set to be filled out. Apart from filling out different blanks, you can also perform several other things with the file, including putting on any words, editing the original text, adding illustrations or photos, affixing your signature to the document, and a lot more.

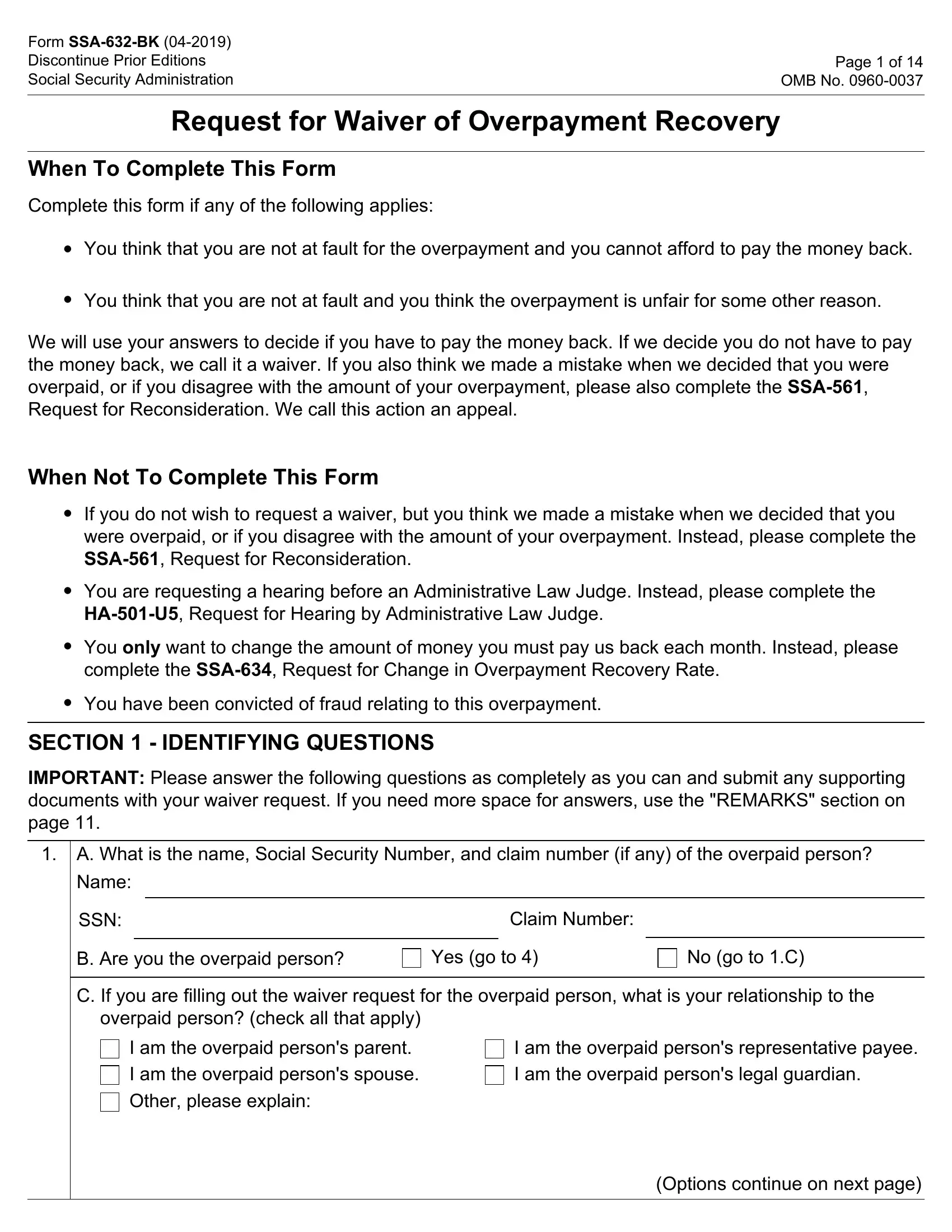

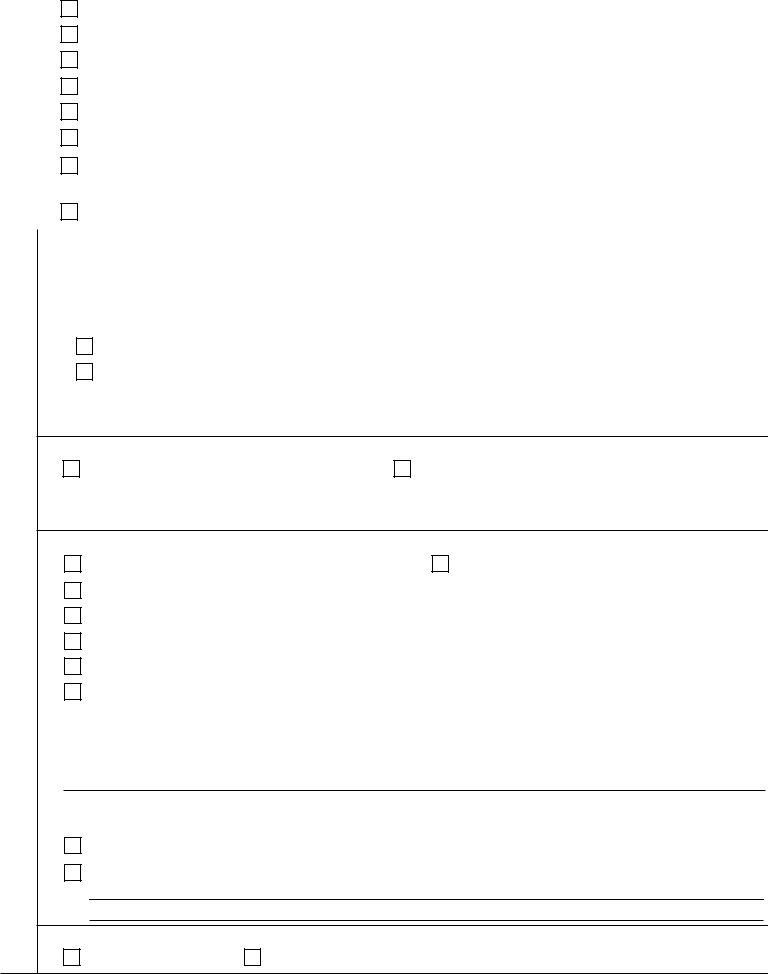

With regards to the blanks of this specific document, here's what you should consider:

1. You should complete the waiver form ssa 632 properly, therefore be careful when filling out the sections containing these blank fields:

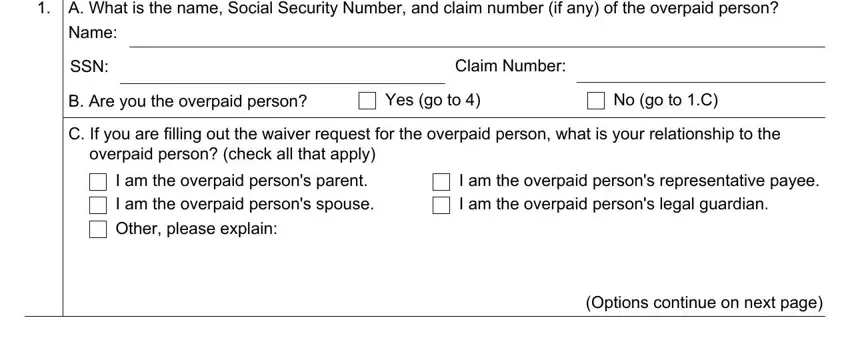

2. Once your current task is complete, take the next step – fill out all of these fields - you represent, Name, E If you are the overpaid persons, the overpayment occurred, Yes, SECTION QUESTIONS FOR, IMPORTANT If you were the, A Was the overpaid person living, Yes, B Does the overpaid person, Yes, C Are you requesting a waiver for, Yes, D Did you tell us about the change, and Yes with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

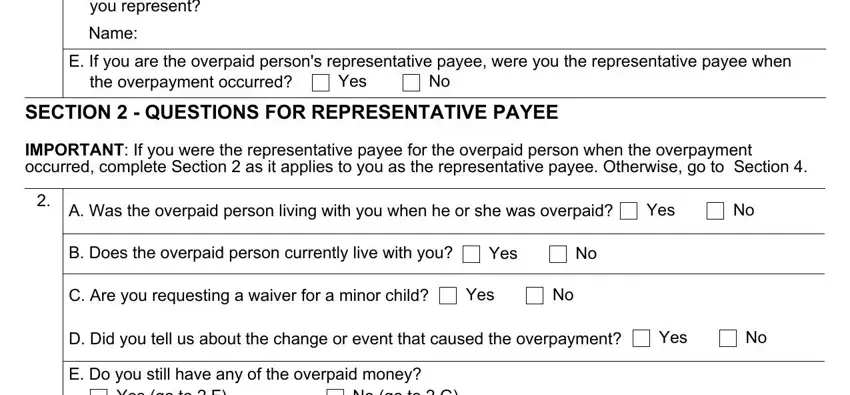

3. This next section will be focused on Yes go to F, No go to G, F How much of the overpaid money, G Did you use the overpaid money, Yes, No go to H, H Explain how you used the, SECTION IF YOU ARE RESPONSIBLE, INDIVIDUALS OVERPAYMENT, IMPORTANT If we told you in the, A Did we tell you in the, individuals overpayment, Yes go to B, No go to, and B Was the overpaid person living - type in all of these blanks.

Be very careful while filling in No go to and F How much of the overpaid money, because this is where many people make some mistakes.

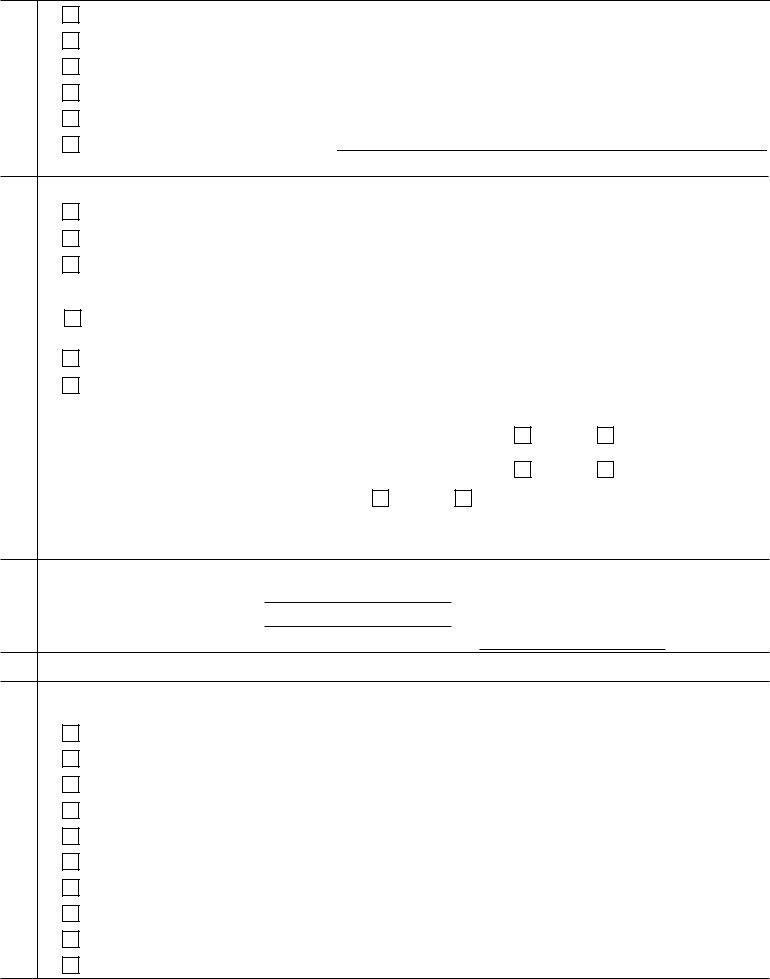

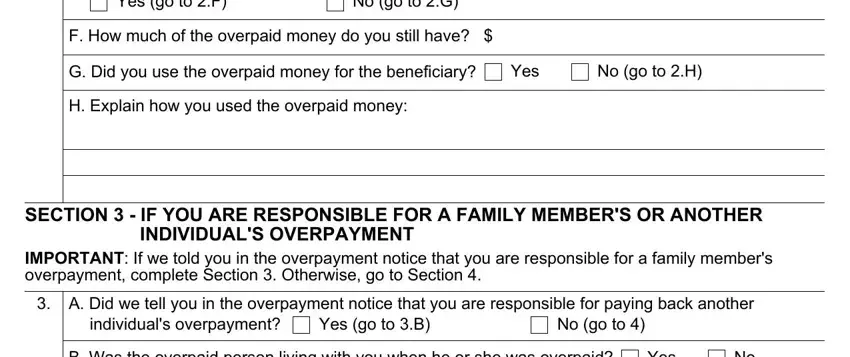

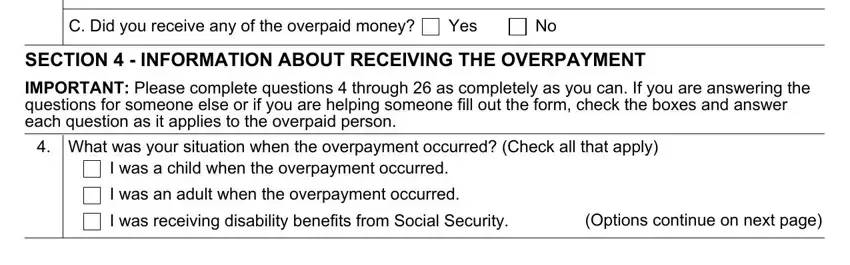

4. To go ahead, this fourth section involves filling in several fields. Included in these are B Was the overpaid person living, Yes, C Did you receive any of the, Yes, SECTION INFORMATION ABOUT, IMPORTANT Please complete, What was your situation when the, I was a child when the overpayment, I was an adult when the, I was receiving disability, and Options continue on next page, which you'll find essential to carrying on with this form.

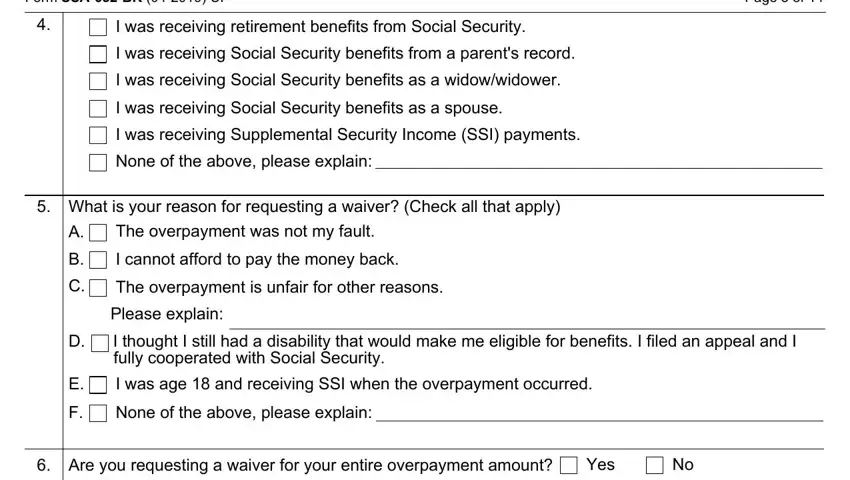

5. To wrap up your form, this final subsection incorporates some extra blank fields. Entering Form SSABK UF, Page of, I was receiving retirement, I was receiving Social Security, I was receiving Social Security, I was receiving Social Security, I was receiving Supplemental, None of the above please explain, What is your reason for requesting, The overpayment was not my fault, I cannot afford to pay the money, The overpayment is unfair for, Please explain, D I thought I still had a, and fully cooperated with Social is going to finalize everything and you'll be done in the blink of an eye!

Step 3: Make certain your details are correct and then simply click "Done" to continue further. Right after registering afree trial account with us, you'll be able to download waiver form ssa 632 or send it via email right away. The file will also be readily accessible in your personal account menu with all of your edits. Here at FormsPal.com, we aim to be sure that all of your details are stored protected.