Using the online PDF editor by FormsPal, you're able to fill in or modify ssa 8011 right here. To have our tool on the cutting edge of convenience, we strive to put into action user-oriented capabilities and improvements on a regular basis. We're routinely grateful for any feedback - join us in revolutionizing the way you work with PDF files. Starting is simple! Everything you need to do is stick to the next basic steps down below:

Step 1: Click on the orange "Get Form" button above. It'll open our tool so that you can begin completing your form.

Step 2: This tool grants the ability to modify your PDF file in a range of ways. Improve it by writing any text, correct existing content, and put in a signature - all at your disposal!

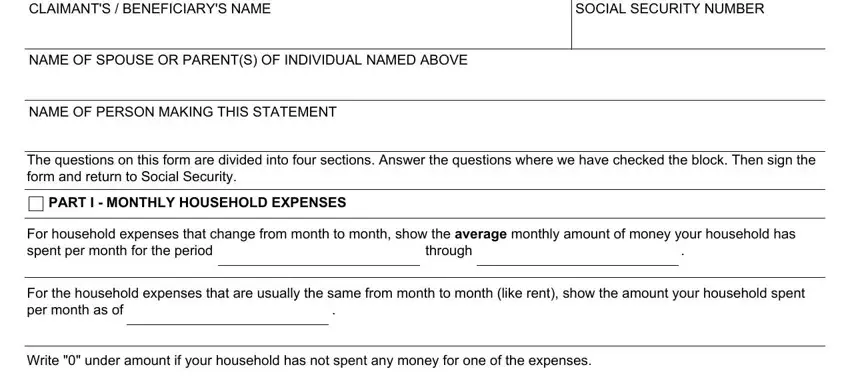

This document requires particular details to be typed in, hence you must take your time to enter exactly what is expected:

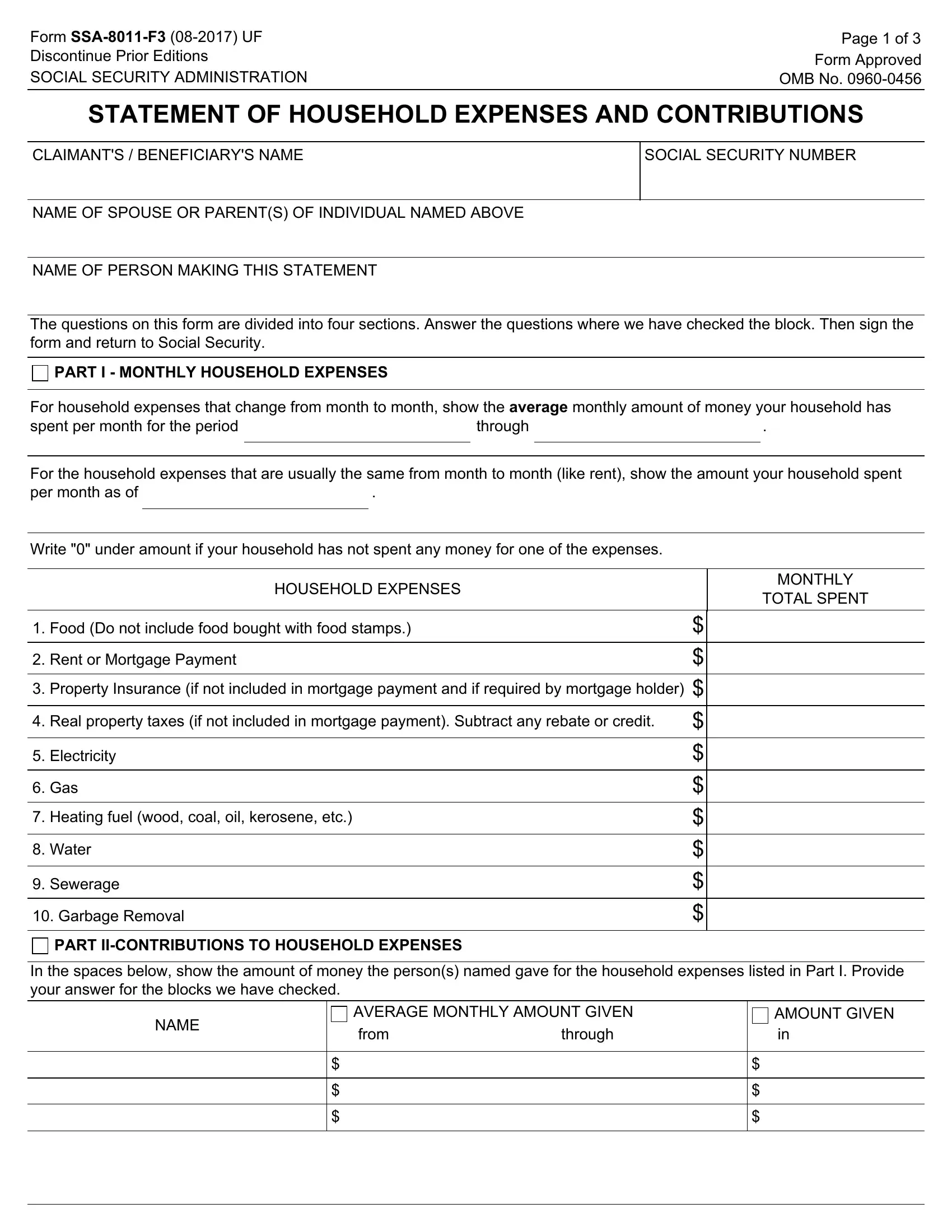

1. It is important to complete the ssa 8011 correctly, therefore be mindful when filling in the parts comprising these blank fields:

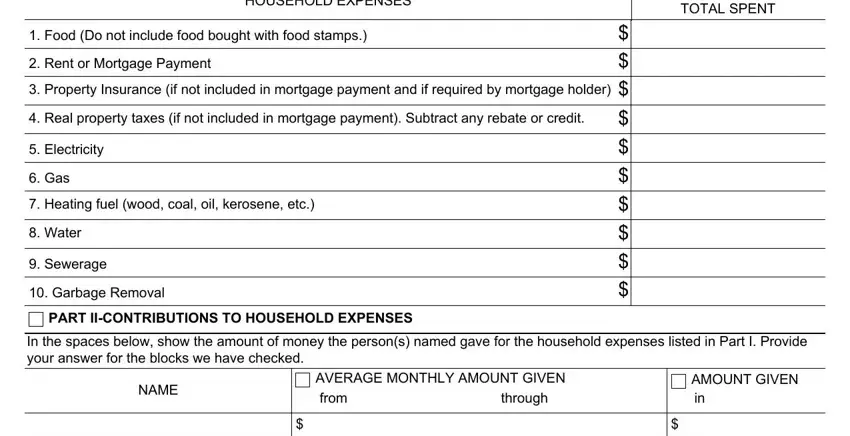

2. Now that the previous part is complete, it is time to put in the necessary particulars in HOUSEHOLD EXPENSES, MONTHLY TOTAL SPENT, Food Do not include food bought, Real property taxes if not, Water Sewerage Garbage, PART IICONTRIBUTIONS TO HOUSEHOLD, In the spaces below show the, NAME, AVERAGE MONTHLY AMOUNT GIVEN from, through, and AMOUNT GIVEN in so you can move on to the next part.

3. Completing is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

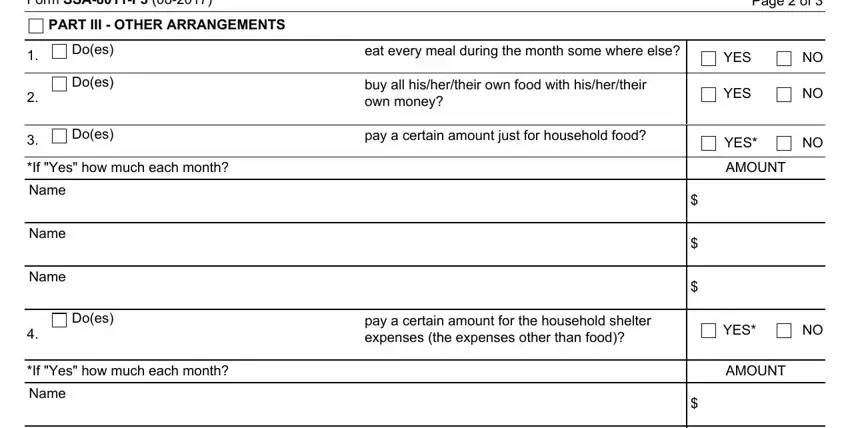

4. The form's fourth section arrives with these blank fields to consider: Form SSAF, PART III OTHER ARRANGEMENTS, Does, Does, Does, If Yes how much each month, Name, Name, Name, Does, If Yes how much each month, Name, eat every meal during the month, buy all hishertheir own food with, and pay a certain amount just for.

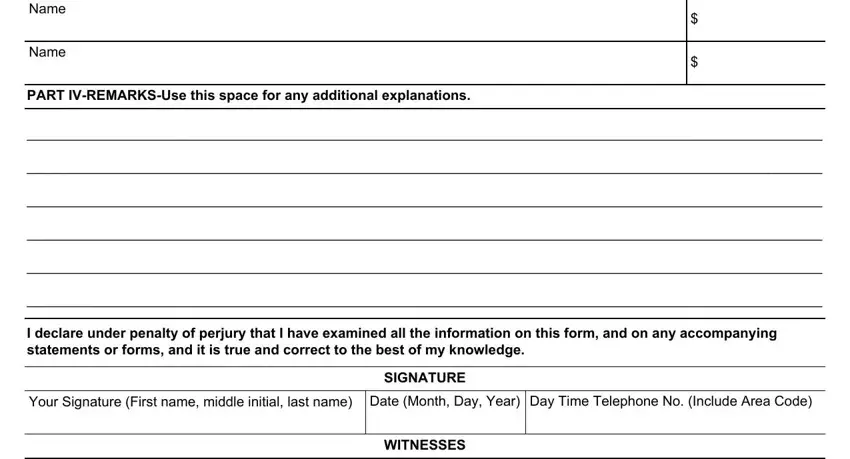

5. This final stage to finish this form is essential. Be sure you fill out the appropriate blanks, which includes Name, Name, PART IVREMARKSUse this space for, I declare under penalty of perjury, Your Signature First name middle, SIGNATURE, and WITNESSES, before submitting. Otherwise, it might contribute to a flawed and possibly incorrect document!

People who work with this document generally make mistakes while filling out I declare under penalty of perjury in this section. Ensure that you read twice whatever you enter right here.

Step 3: Prior to finishing this form, it's a good idea to ensure that all blanks were filled in the right way. The moment you’re satisfied with it, press “Done." Get hold of your ssa 8011 once you subscribe to a free trial. Instantly access the pdf inside your personal cabinet, with any modifications and changes automatically saved! If you use FormsPal, you'll be able to complete forms without needing to get worried about personal information incidents or entries getting distributed. Our secure system ensures that your personal details are stored safe.