Handling PDF documents online is super easy with our PDF editor. You can fill in ssa 820 here and try out several other options we offer. To retain our tool on the cutting edge of convenience, we strive to implement user-oriented features and improvements on a regular basis. We are always grateful for any feedback - join us in revolutionizing PDF editing. To start your journey, go through these easy steps:

Step 1: First, open the editor by clicking the "Get Form Button" above on this webpage.

Step 2: With this state-of-the-art PDF editor, it's possible to accomplish more than merely complete blanks. Edit away and make your documents seem great with custom text added in, or modify the file's original content to excellence - all accompanied by the capability to insert your personal pictures and sign the file off.

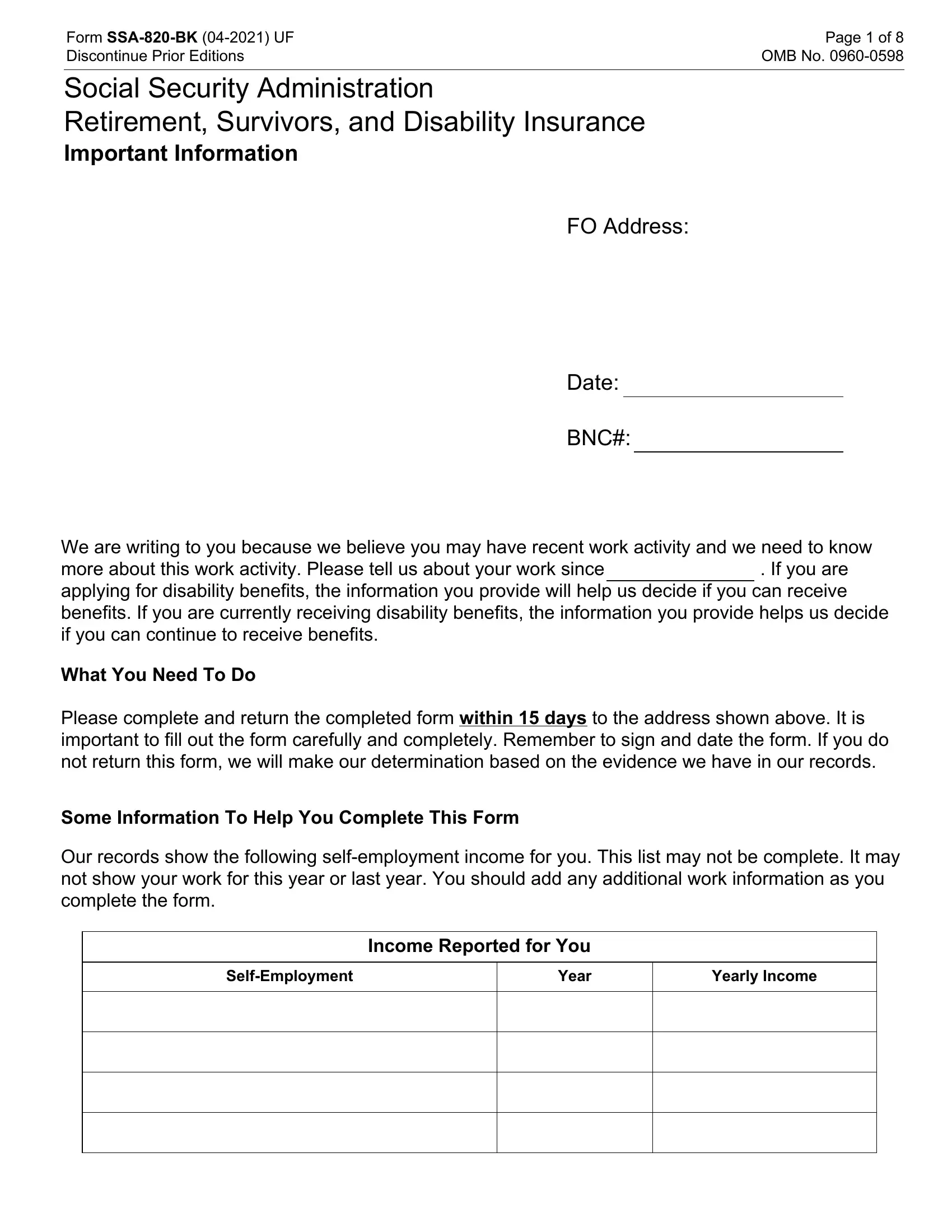

This document will require specific info to be entered, so be sure you take some time to type in what is requested:

1. The ssa 820 necessitates particular information to be typed in. Make sure the following blank fields are completed:

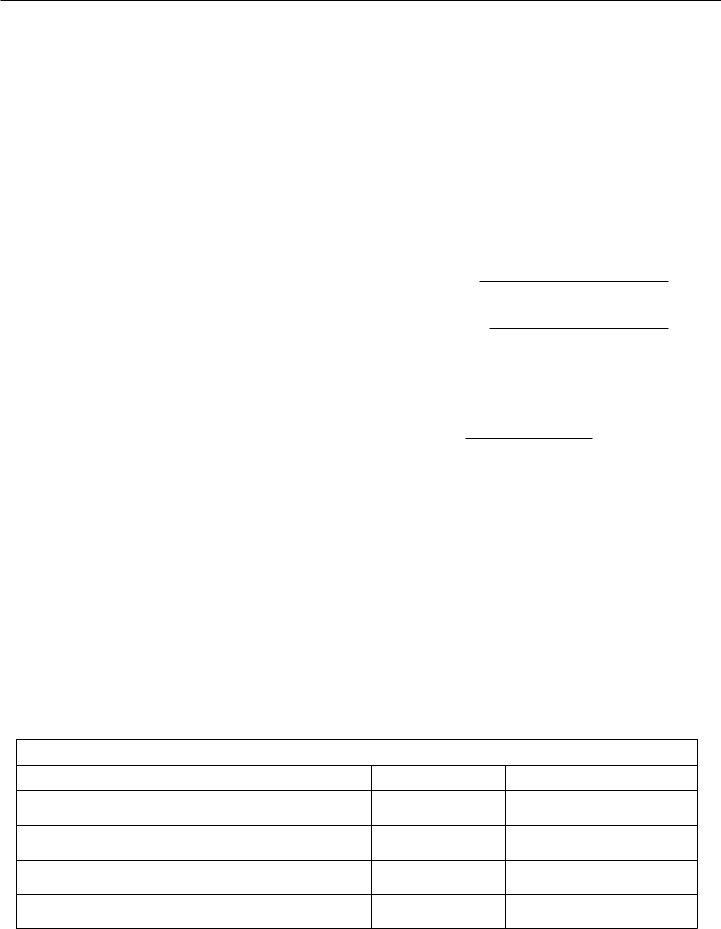

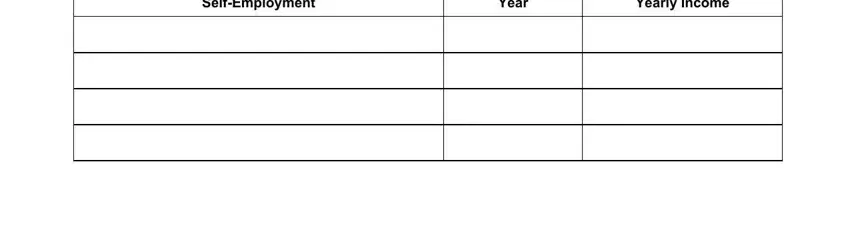

2. Once the previous array of fields is completed, you have to put in the needed specifics in SelfEmployment, Year, and Yearly Income so you can progress to the next step.

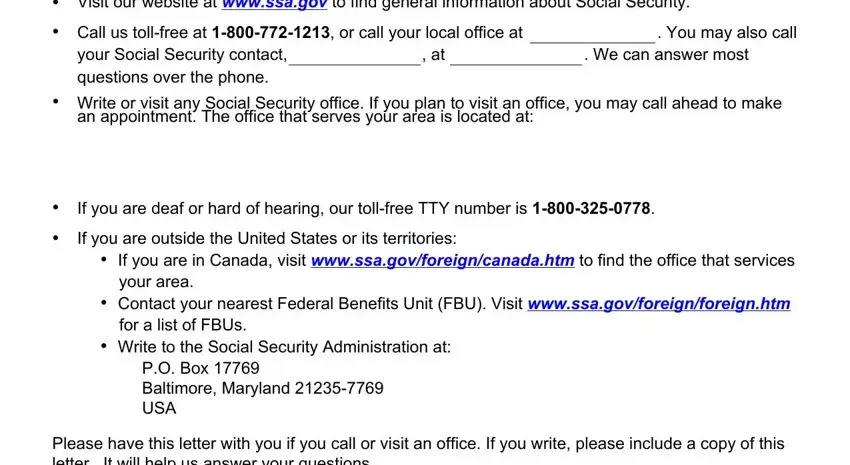

3. This next step will be focused on Visit our website at wwwssagov to, your Social Security contact at, Write or visit any Social, an appointment The office that, If you are deaf or hard of hearing, If you are outside the United, for a list of FBUs, Write to the Social Security, and Please have this letter with you - complete each of these empty form fields.

You can potentially get it wrong when completing the your Social Security contact at, and so be sure to take another look before you submit it.

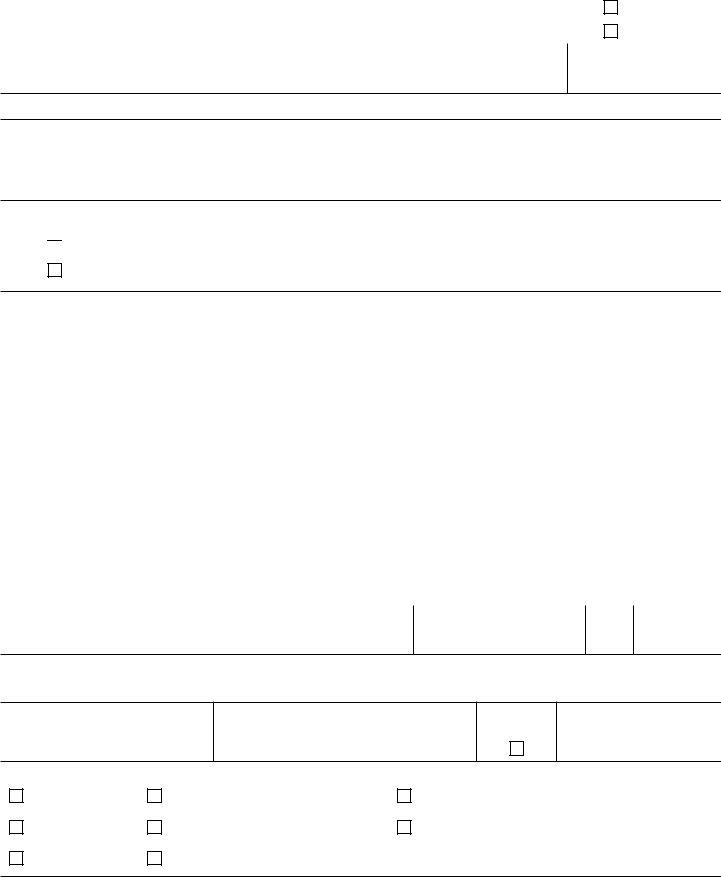

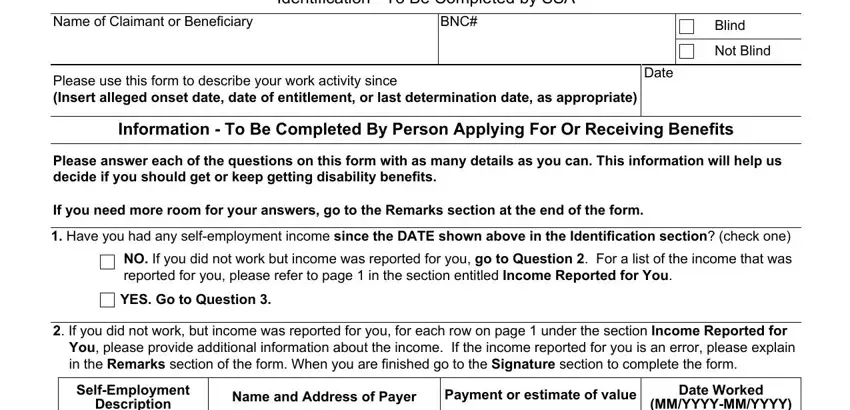

4. Completing Identification To Be Completed by, Name of Claimant or Beneficiary, BNC, Please use this form to describe, Blind, Not Blind, Date, Information To Be Completed By, Please answer each of the, Have you had any selfemployment, NO If you did not work but income, YES Go to Question, If you did not work but income, You please provide additional, and SelfEmployment is crucial in the fourth stage - make certain that you don't rush and take a close look at every field!

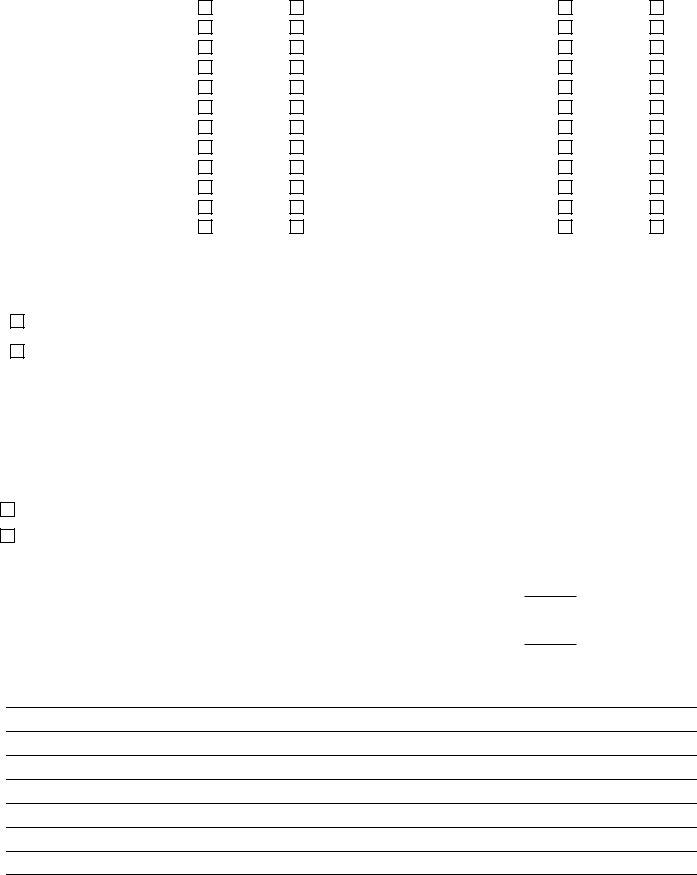

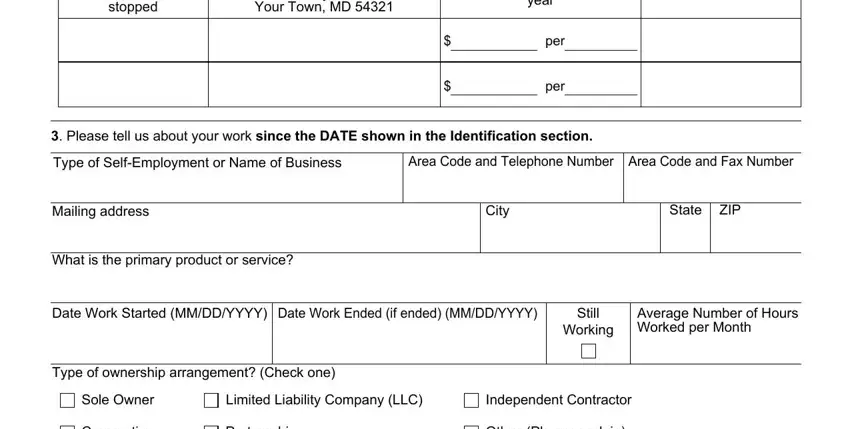

5. To wrap up your document, this particular subsection incorporates several extra blanks. Completing after business, stopped, ABC Company Any Street, Your Town MD, year, per, per, Please tell us about your work, Type of SelfEmployment or Name of, Area Code and Telephone Number, Mailing address, City, State ZIP, What is the primary product or, and Date Work Started MMDDYYYY Date will certainly finalize the process and you'll definitely be done in no time at all!

Step 3: Revise what you have entered into the form fields and then hit the "Done" button. Try a free trial option at FormsPal and acquire direct access to ssa 820 - downloadable, emailable, and editable inside your FormsPal cabinet. FormsPal guarantees your information confidentiality with a secure system that never saves or distributes any type of sensitive information used. Feel safe knowing your files are kept confidential whenever you work with our editor!