With the objective of making it as simple to apply as possible, we made our PDF editor. The whole process of filling the 5 sss r is going to be effortless for those who follow the following steps.

Step 1: Initially, press the orange button "Get Form Now".

Step 2: At this point, you're on the form editing page. You can add information, edit present details, highlight particular words or phrases, place crosses or checks, add images, sign the file, erase unrequired fields, etc.

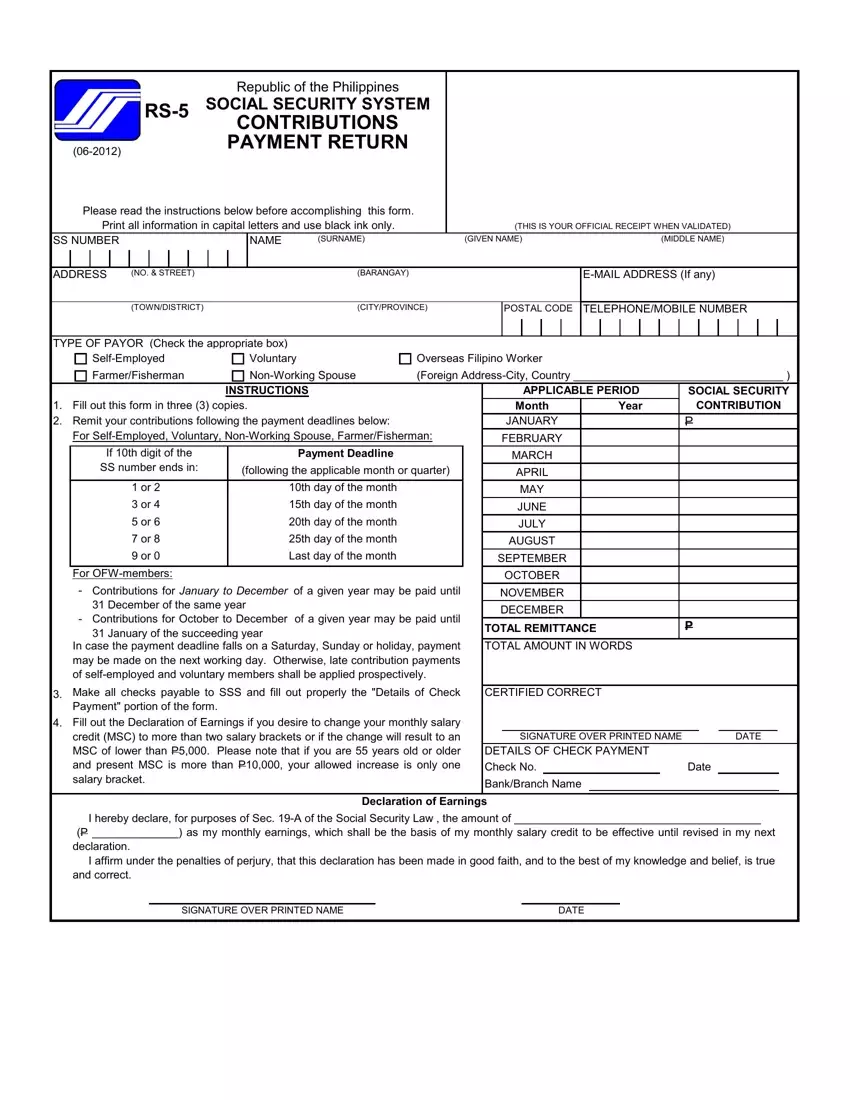

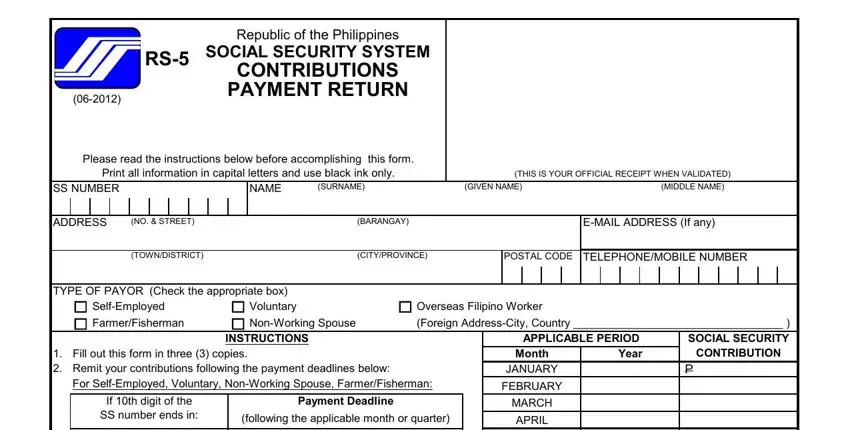

Type in the content requested by the application to prepare the file.

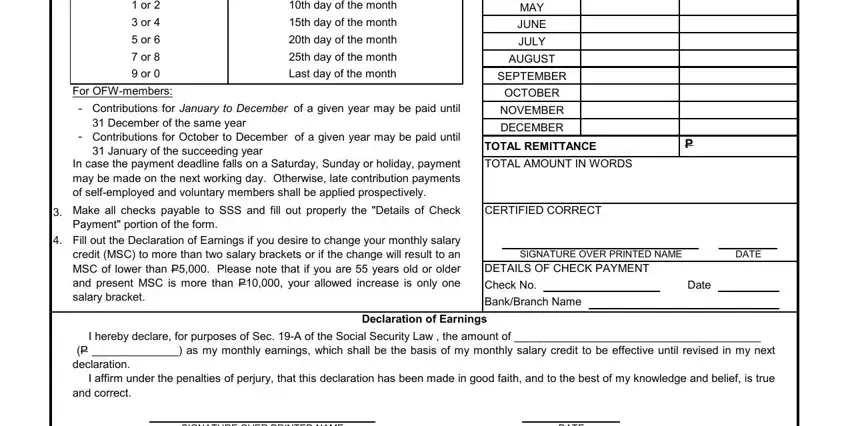

Make sure you note your particulars in the box th day of the month, th day of the month, th day of the month, th day of the month, Last day of the month, For OFWmembers, Contributions for January to, In case the payment deadline falls, MAY, JUNE, JULY, AUGUST, SEPTEMBER, OCTOBER, and NOVEMBER.

Step 3: When you click the Done button, your completed document is simply exportable to each of your gadgets. Or, you can send it using mail.

Step 4: Generate no less than a couple of copies of your document to remain away from different potential future troubles.