Republic of the Philippines

SOCIAL SECURITY SYSTEM

MEMBER LOAN APPLICATION

MLP-01287 (12-2016)

| |

T |

I |

F |

B |

REPRODUCED A |

I N |

|

|

SA . |

T |

I |

|

AL |

|

E DO NL |

|

|

T |

E S |

|

E I |

|

|

. . . . |

|

| |

|

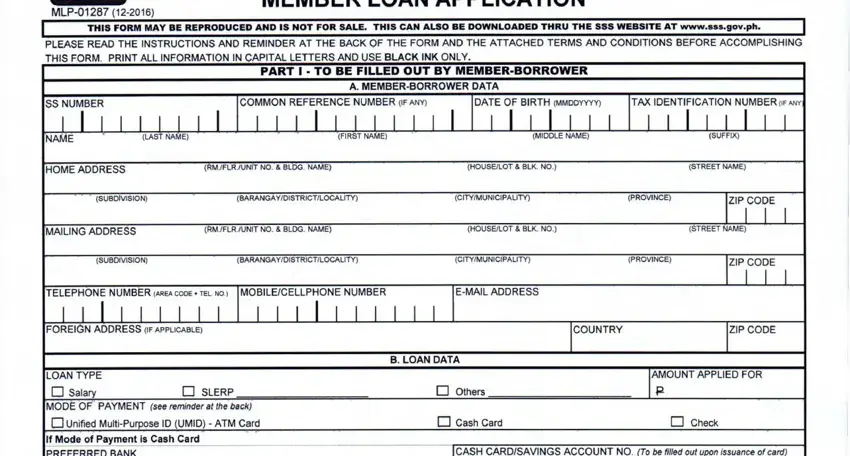

THIS FORM MAY BE REPRODUCED AND |

IS NOTT FOR |

SALE. |

THIS |

CAN ALSO BE DOWNLOADED |

THRU THE SSS WEBSITE AT www.sss.gov.ph. |

|

|

PLEASE READ THE INSTRUCTIONS AND REMINDER AT THE BACK OF THE FORM AND THE ATTACHED TERMS AND CONDITIONS BEFORE ACCOMPLISHING |

THIS FORM. PRINT ALL INFORMATION IN CAPITAL LETTERS AND USE BLACK INK ONLY. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

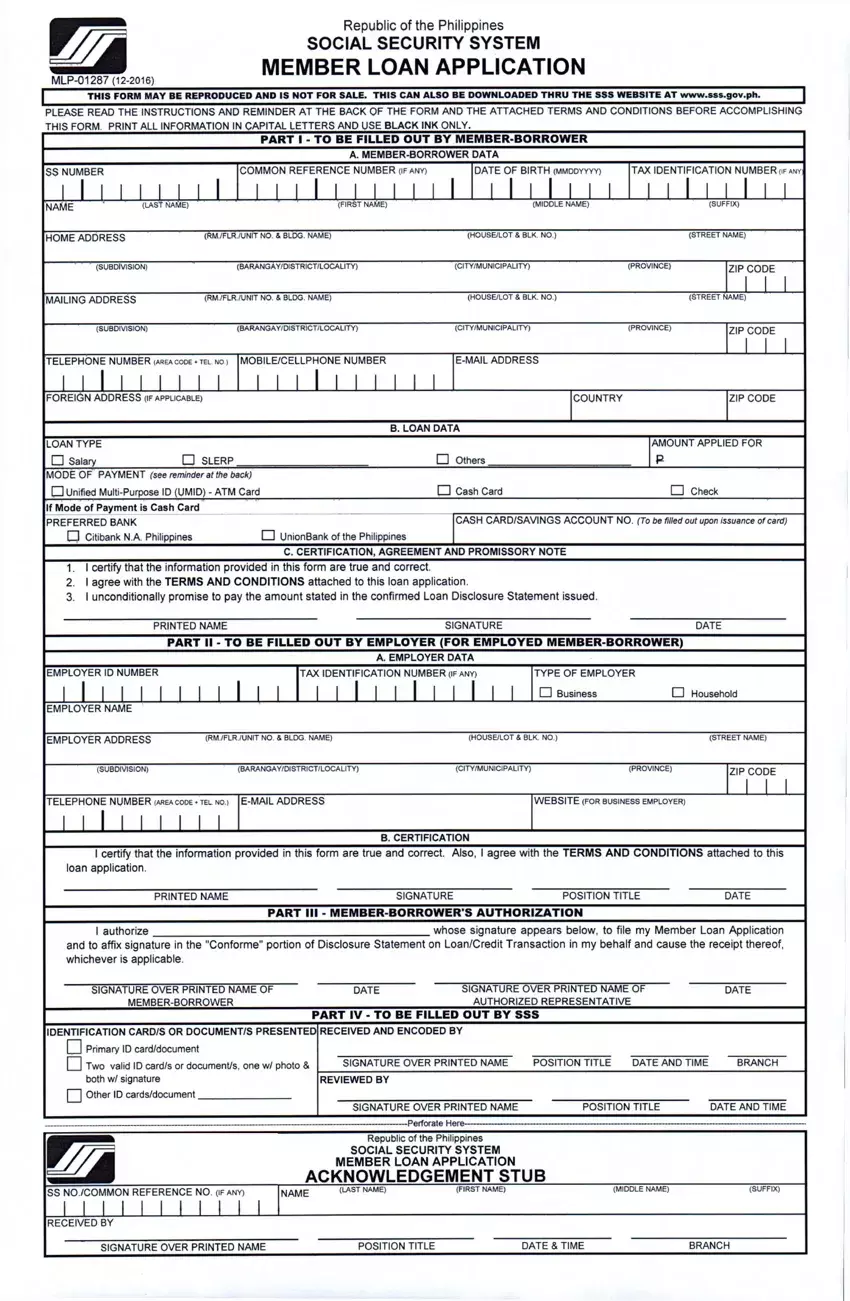

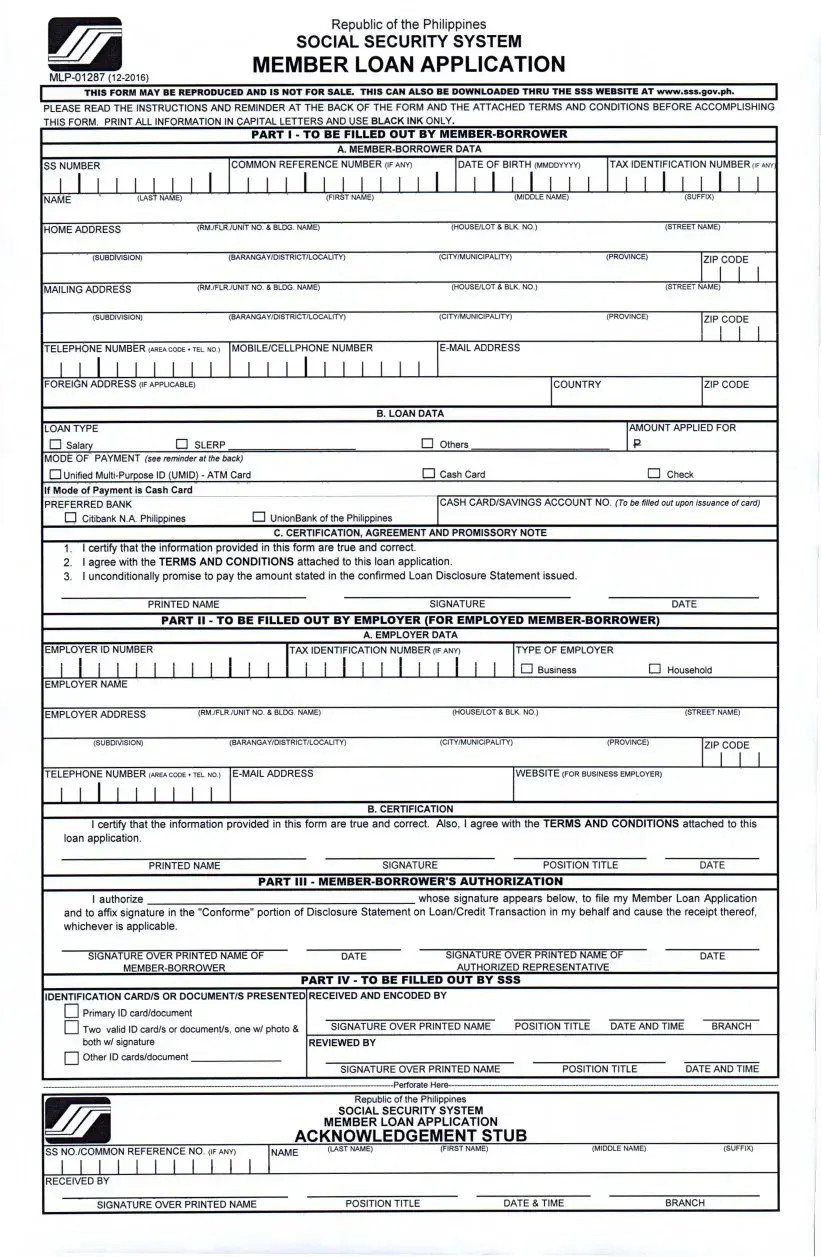

PART 1 - TO BE FILLED OUT BY MEMBER-BORROWER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. MEMBER-BORROWER DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SS NUMBER |

|

|

|

|

COMMON REFERENCE NUMBER (ifany) |

|

L |

DATE OF BIRTH (MMDDYYYY) |

|

TAX IDENTIFICATION NUMBER(ifany: |

1 1 1 1 Mill |

I |

I |

I |

I |

I |

I |

I |

I |

I |

I |

I |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME |

|

|

(LAST NAME) |

|

|

|

|

|

|

(FIRST NAME) |

|

|

|

|

|

(MIDDLE NAME) |

|

|

|

|

|

|

(SUFFIX) |

|

|

HOME ADDRESS |

|

|

(RM./flr./unit no. & bldg, name) |

|

|

|

|

|

|

|

(house/lot & blk. no.) |

|

|

|

|

|

(street name) |

|

|

|

|

(SUBDIVISION) |

|

|

(BARANGAY/DISTRICT/LOCALITY) |

|

|

|

|

|

(CITY/MUNICIPALITY) |

|

|

|

|

|

(PROVINCE) |

|

|

|

ZIP CODE |

|

MAILING ADDRESS |

|

|

(RM./flr./unit no. & bldg, name) |

|

|

|

|

|

|

|

(house/lot & blk. no.) |

|

|

|

|

|

(street name) |

|

|

|

|

(SUBDIVISION) |

|

|

(BARANGAY/DISTRICT/LOCALITY) |

|

|

|

|

|

(CITY/MUNICIPALITY) |

|

|

|

|

|

(PROVINCE) |

|

|

|

ZIP CODE |

|

TELEPHONE NUMBER (area code + tel. no.) |

MOBILE/CELLPHONE NUMBER |

I |

|

|

|

E-MAIL ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

1 |

1 |

1 |

1 |

1 1 1 |

1 |

1 |

I |

I |

I |

I |

I |

I |

I |

I |

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOREIGN ADDRESS (IF applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COUNTRY |

|

|

|

|

|

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. LOAN DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOAN TYPE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMOUNT APPLIED FOR |

|

|

|

Salary |

|

|

|

|

SLERP |

|

|

|

|

|

|

|

|

|

|

|

Others |

|

|

|

|

|

|

|

R |

|

|

|

|

|

|

MODE OF PAYMENT (see reminder at the back) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unified Multi-Purpose ID (UMID) - ATM Card |

|

|

|

|

|

|

|

|

|

O Cash Card |

|

|

|

|

|

|

|

O Check |

|

|

|

If Mode of Payment is Cash Card |

|

|

|

|

|

|

|

|

|

|

|

|

CASH CARD/SAVINGS ACCOUNT NO. (To be filled out upon issuance of card) |

PREFERRED BANK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Citibank N.A. Philippines |

|

|

O UnionBank of the Philippines |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

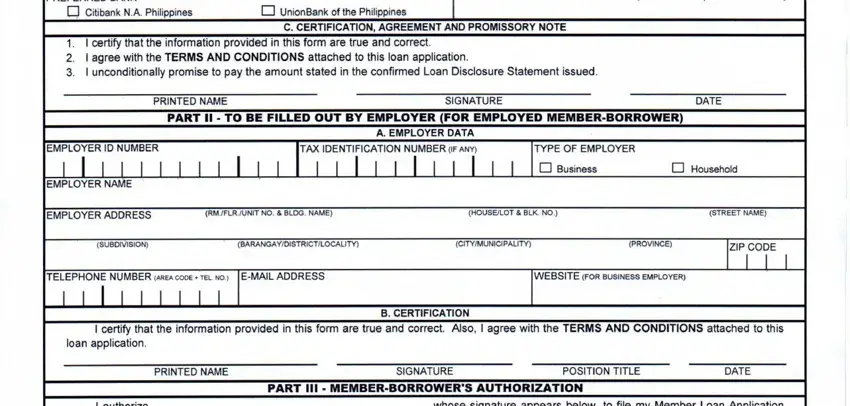

C. CERTIFICATION, AGREEMENT AND PROMISSORY NOTE

1.I certify that the information provided in this form are true and correct.

2.I agree with the TERMS AND CONDITIONS attached to this loan application.

3.I unconditionally promise to pay the amount stated in the confirmed Loan Disclosure Statement issued.

PRINTED NAMESIGNATUREDATE

PART II - TO BE FILLED OUT BY EMPLOYER (FOR EMPLOYED MEMBER-BORROWER)

A. EMPLOYER DATA

EMPLOYER ID NUMBER |

I I ILll |

TAX IDENTIFICATION NUMBER (if an>9 |

TYPE OF EMPLOYER |

|

|

|

I I I I I I I |

I I |

I I I |

I I |

I I |

|

|

|

|

|

|

|

|

Lll |

Business |

|

O Household |

|

|

|

|

|

|

|

|

|

|

|

EMPLOYER NAME |

|

|

|

|

|

|

|

|

|

|

EMPLOYER ADDRESS |

(rm./flr./unit no. & bldg, name) |

|

|

(house/lot & blk. no.) |

|

(street name) |

|

(SUBDIVISION) |

(BARANGAY/DISTRICT/LOCALITY) |

|

(CITY/MUNICIPALITY) |

|

(PROVINCE) |

ZIP |

CODE |

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

1 |

1 |

TELEPHONE NUMBER (area code ♦tel. no.) E-MAIL ADDRESS |

WEBSITE (FOR BUSINESS EMPLOYER) |

I I I I I I I I I

B. CERTIFICATION

I certify that the information provided in this form are true and correct. Also, I agree with the TERMS AND CONDITIONS attached to this loan application.

PRINTED NAME |

SIGNATURE |

POSITION TITLE |

DATE |

|

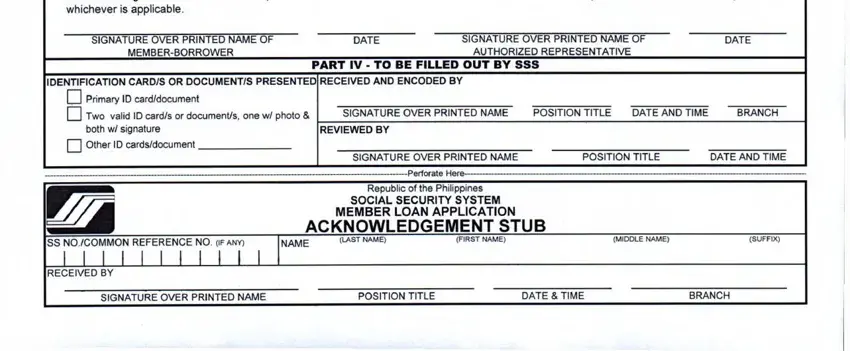

PART III - MEMBER-BORROWER'S AUTHORIZATION |

|

I authorize |

whose siqnature appears below, to file mv Member Loan Application |

and to affix signature in the "Conforme" portio 1 of Disclosure Statement on Loan/Credit Transaction in my behalf and cause the receipt thereof, whichever is applicable.

SIGNATURE OVER PRINTED NAME OF |

|

DATE |

SIGNATURE OVER PRINTED NAME OF |

|

DATE |

MEMBER-BORROWER |

|

|

AUTHORIZED REPRESENTATIVE |

|

|

|

|

PART IV - TO BE FILLED OUT BY SSS |

|

|

|

IDENTIFICATION CARD/S OR DOCUMENT/S PRESENTED RECEIVED AND ENCODED BY |

|

|

|

|

ZJ Primary ID card/document |

|

|

|

|

|

|

|

H Two valid ID card/s or document/s, one w/ photo & |

SIGNATURE OVER PRINTED NAME |

POSITION TITLE |

DATE AND TIME |

BRANCH |

both w/ signature |

|

REVIEWED BY |

|

|

|

|

|

2] Other ID cards/document |

|

|

|

|

|

|

|

|

|

SIGNATURE OVER PRINTED NAME |

POSITION TITLE |

|

DATE AND TIME |

_______________________________________________________________________________ Perforate Here- |

|

|

|

|

|

|

Republic of the Philippines |

|

|

|

|

|

|

SOCIAL SECURITY SYSTEM |

|

|

|

|

|

|

MEMBER LOAN APPLICATION |

|

|

|

|

|

ACKNOWLEDGEMENT STUB |

|

|

|

SS NO./COMMON REFERENCE NO. (if any) |

NAME |

(^ST NAME) |

(FIRST NAME) |

|

(MIDDLE NAME) |

|

(SUFFIX) |

RECEIVED BY |

|

|

|

|

|

|

|

SIGNATURE OVER PRINTED NAME |

|

POSITION TITLE |

|

DATE & TIME |

|

BRANCH |

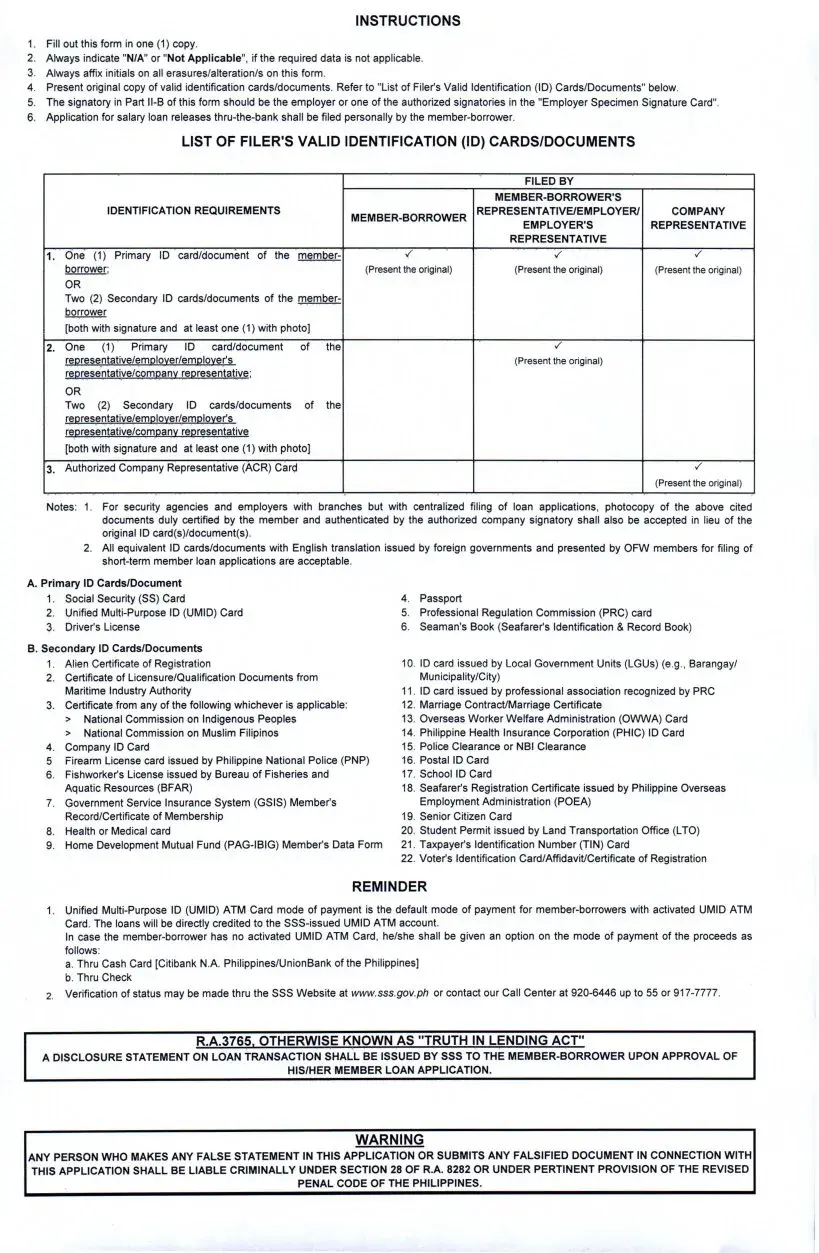

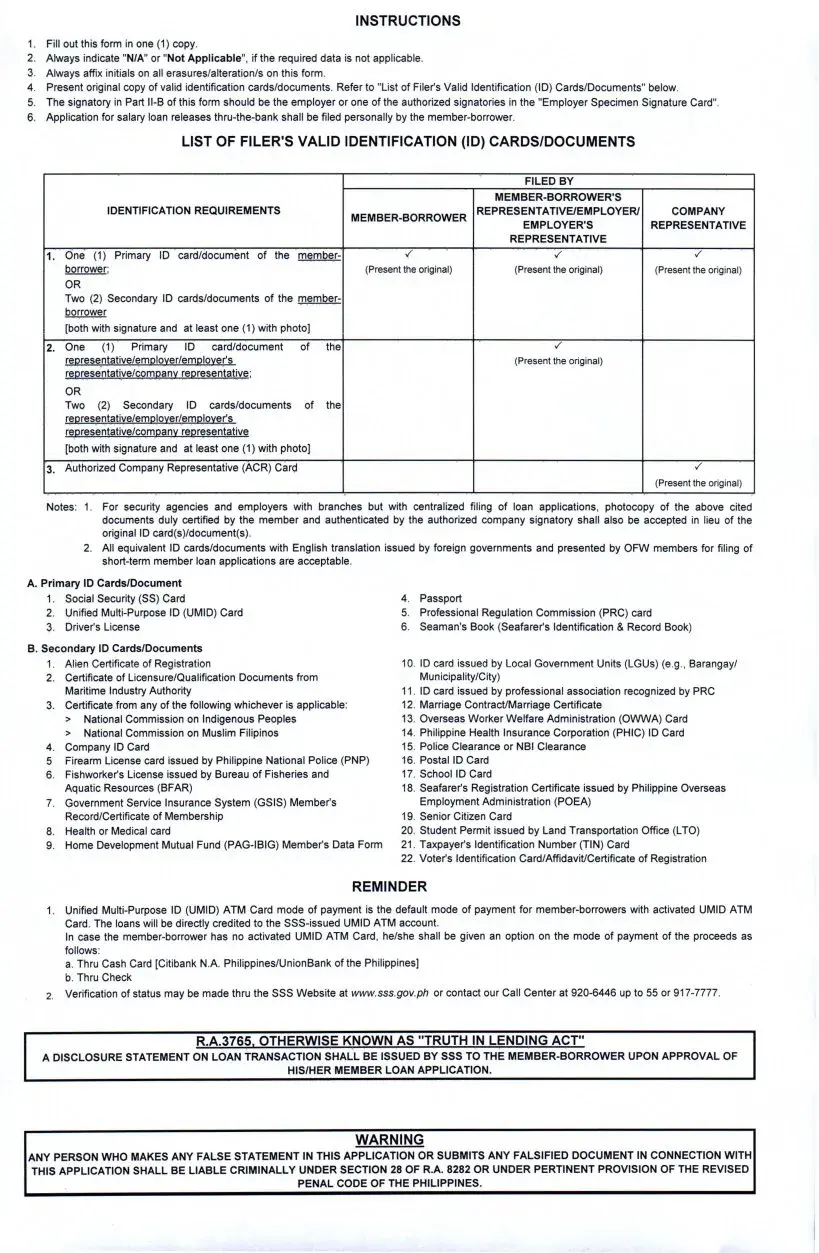

INSTRUCTIONS

1.Fill out this form in one (1) copy.

2.Always indicate "N/A" or "Not Applicable", if the required data is not applicable.

3.Always affix initials on all erasures/alteration/s on this form.

4.Present original copy of valid identification cards/documents. Refer to "List of Filer's Valid Identification (ID) Cards/Documents" below.

5.The signatory in Part ll-B of this form should be the employer or one of the authorized signatories in the "Employer Specimen Signature Card".

6.Application for salary loan releases thru-the-bank shall be filed personally by the member-borrower.

LIST OF FILER’S VALID IDENTIFICATION (ID) CARDS/DOCUMENTS

|

|

|

FILED BY |

|

|

IDENTIFICATION REQUIREMENTS |

|

MEMBER-BORROWER’S |

|

|

MEMBER-BORROWER |

REPRESENTATIVE/EMPLOYER/ |

COMPANY |

|

|

|

EMPLOYER’S |

REPRESENTATIVE |

|

|

|

REPRESENTATIVE |

|

1. |

One (1) Primary ID card/document of the member- |

Z |

Z |

Z |

|

borrower: |

(Present the original) |

(Present the original) |

(Present the original) |

|

OR |

|

|

|

|

Two (2) Secondary ID cards/documents of the member- |

|

|

|

|

borrower |

|

|

|

|

[both with signature and at least one (1) with photo] |

|

|

|

2. |

One (1) Primary ID card/document of the |

|

Z |

|

|

reoresentative/emolover/emolover's |

|

(Present the original) |

|

|

reoresentative/comoanv representative: |

|

|

|

|

OR |

|

|

|

|

Two (2) Secondary ID cards/documents of the |

|

|

|

|

representative/emplover/emplover's |

|

|

|

|

representative/companv representative |

|

|

|

|

[both with signature and at least one (1) with photo] |

|

|

|

3. |

Authorized Company Representative (ACR) Card |

|

|

Z |

|

|

|

|

(Present the original) |

Notes: 1. For security agencies and employers with branches but with centralized filing of loan applications, photocopy of the above cited documents duly certified by the member and authenticated by the authorized company signatory shall also be accepted in lieu of the original ID card(s)/document(s).

2.All equivalent ID cards/documents with English translation issued by foreign governments and presented by OFW members for filing of short-term member loan applications are acceptable.

A. Primary ID Cards/Document

1.Social Security (SS) Card

2.Unified Multi-Purpose ID (UMID) Card

3.Driver's License

B. Secondary ID Cards/Documents

1.Alien Certificate of Registration

2.Certificate of Licensure/Qualification Documents from Maritime Industry Authority

3.Certificate from any of the following whichever is applicable:

>National Commission on Indigenous Peoples

>National Commission on Muslim Filipinos

4.Company ID Card

5 Firearm License card issued by Philippine National Police (PNP)

6.Fishworker's License issued by Bureau of Fisheries and Aquatic Resources (BFAR)

7.Government Service Insurance System (GSIS) Member's Record/Certificate of Membership

8.Health or Medical card

9.Home Development Mutual Fund (PAG-IBIG) Member's Data Form

4.Passport

5.Professional Regulation Commission (PRC) card

6.Seaman's Book (Seafarer's Identification & Record Book)

10.ID card issued by Local Government Units (LGUs) (e.g., Barangay/ Municipality/City)

11.ID card issued by professional association recognized by PRC

12.Marriage Contract/Marriage Certificate

13.Overseas Worker Welfare Administration (OWWA) Card

14.Philippine Health Insurance Corporation (PHIC) ID Card

15.Police Clearance or NBI Clearance

16.Postal ID Card

17.School ID Card

18.Seafarer's Registration Certificate issued by Philippine Overseas Employment Administration (POEA)

19.Senior Citizen Card

20.Student Permit issued by Land Transportation Office (LTO)

21.Taxpayer's Identification Number (TIN) Card

22.Voter's Identification Card/Affidavit/Certificate of Registration

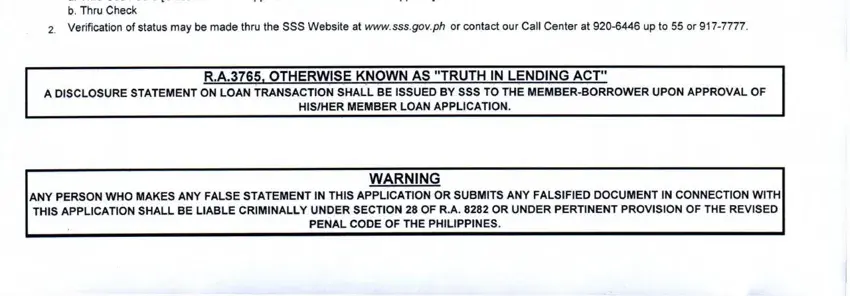

REMINDER

1.Unified Multi-Purpose ID (UMID) ATM Card mode of payment is the default mode of payment for member-borrowers with activated UMID ATM Card. The loans will be directly credited to the SSS-issued UMID ATM account.

In case the member-borrower has no activated UMID ATM Card, he/she shall be given an option on the mode of payment of the proceeds as follows:

a.Thru Cash Card [Citibank N.A. Philippines/UnionBank of the Philippines]

b.Thru Check

2.Verification of status may be made thru the SSS Website at www.sss.gov.ph or contact our Call Center at 920-6446 up to 55 or 917-7777.

R.A.3765, OTHERWISE KNOWN AS "TRUTH IN LENDING ACT"

A DISCLOSURE STATEMENT ON LOAN TRANSACTION SHALL BE ISSUED BY SSS TO THE MEMBER-BORROWER UPON APPROVAL OF

HIS/HER MEMBER LOAN APPLICATION.

WARNING

ANY PERSON WHO MAKES ANY FALSE STATEMENT IN THIS APPLICATION OR SUBMITS ANY FALSIFIED DOCUMENT IN CONNECTION WITH THIS APPLICATION SHALL BE LIABLE CRIMINALLY UNDER SECTION 28 OF R.A. 8282 OR UNDER PERTINENT PROVISION OF THE REVISED PENAL CODE OF THE PHILIPPINES.

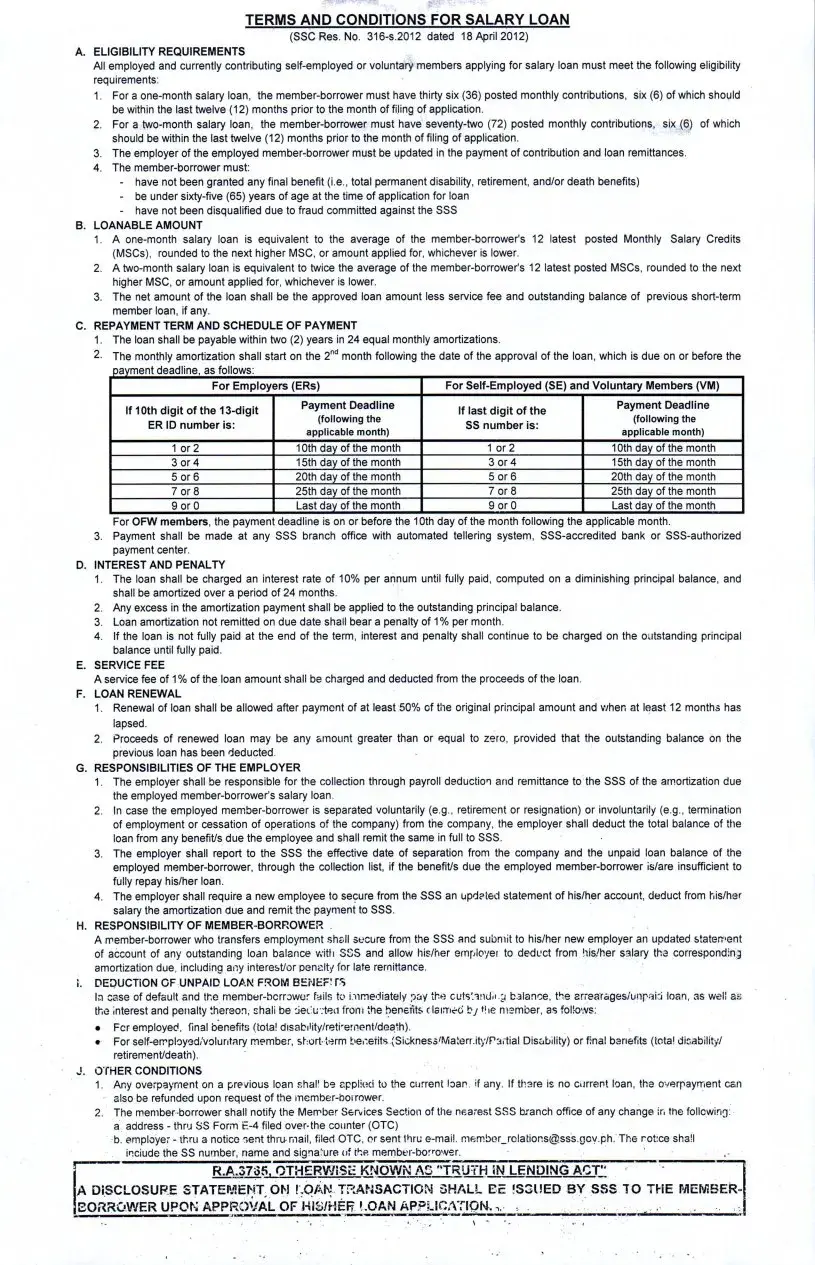

TERMS AND CONDITIONS FOR SALARY LOAN

(SSCRes. No. 316-S.2012 dated 18 April 2012)

A.ELIGIBILITY REQUIREMENTS

All employed and currently contributing self-employed or voluntary members applying for salary loan must meet the following eligibility requirements:

1.For a one-month salary loan, the member-borrower must have thirty six (36) posted monthly contributions, six (6) of which should be within the last twelve (12) months prior to the month of filing of application.

2.For a two-month salary loan, the member-borrower must have seventy-two (72) posted monthly contributions, six (6) of which should be within the last twelve (12) months prior to the month of filing of application.

3.The employer of the employed member-borrower must be updated in the payment of contribution and loan remittances.

4.The member-borrower must:

-have not been granted any final benefit (i.e., total permanent disability, retirement, and/or death benefits)

-be under sixty-five (65) years of age at the time of application for loan

-have not been disqualified due to fraud committed against the SSS

B.LOANABLE AMOUNT

1.A one-month salary loan is equivalent to the average of the member-borrower's 12 latest posted Monthly Salary Credits (MSCs), rounded to the next higher MSC, or amount applied for, whichever is lower.

2.A two-month salary loan is equivalent to twice the average of the member-borrower's 12 latest posted MSCs, rounded to the next higher MSC, or amount applied for, whichever is lower.

3.The net amount of the loan shall be the approved loan amount less service fee and outstanding balance of previous short-term member loan, if any.

C.REPAYMENT TERM AND SCHEDULE OF PAYMENT

1.The loan shall be payable within two (2) years in 24 equal monthly amortizations.

2.The monthly amortization shall start on the 2nd month following the date of the approval of the loan, which is due on or before the payment deadline, as follows:

|

For Employers (ERs) |

For Self-Employed (SE) and Voluntary Members (VM) |

|

If 10th digit of the 13-digit |

Payment Deadline |

If last digit of the |

Payment Deadline |

|

(following the |

(following the |

|

ER ID number is: |

SS number is: |

|

applicable month) |

applicable month) |

|

|

|

|

1 or 2 |

10th day of the month |

1 or 2 |

10th day of the month |

|

3 or 4 |

15th day of the month |

3 or 4 |

15th day of the month |

: |

5 or 6 |

20th day of the month |

5 or 6 |

20th day of the month |

|

7 or 8 |

25th day of the month |

7 or 8 |

25th day of the month |

|

9 or 0 |

Last day of the month |

9 or 0 |

Last day of the month |

For OFW members, the payment deadline is on or before the 10th day of the month following the applicable month.

3.Payment shall be made at any SSS branch office with automated tellering system, SSS-accredited bank or SSS-authorized payment center.

D.INTERESTAND PENALTY

1.The loan shall be charged an interest rate of 10% per annum until fully paid, computed on a diminishing principal balance, and shall be amortized over a period of 24 months.

2.Any excess in the amortization payment shall be applied to the outstanding principal balance.

3.Loan amortization not remitted on due date shall bear a penalty of 1% per month.

4.If the loan is not fully paid at the end of the term, interest and penalty shall continue to be charged on the outstanding principal balance until fully paid.

E.SERVICE FEE

A service fee of 1% of the loan amount shall be charged and deducted from the proceeds of the loan.

F.LOAN RENEWAL

1.Renewal of loan shall be allowed after payment of at least 50% of the original principal amount and when at least 12 months has lapsed.

2.Proceeds of renewed loan may be any amount greater than or equal to zero, provided that the outstanding balance on the previous loan has been deducted.

G.RESPONSIBILITIES OF THE EMPLOYER

1.The employer shall be responsible for the collection through payroll deduction and remittance to the SSS of the amortization due the employed member-borrower’s salary loan.

2.In case the employed member-borrower is separated voluntarily (e.g., retirement or resignation) or involuntarily (e.g., termination of employment or cessation of operations of the company) from the company, the employer shall deduct the total balance of the loan from any benefit/s due the employee and shall remit the same in full to SSS.

3.The employer shall report to the SSS the effective date of separation from the company and the unpaid loan balance of the employed member-borrower, through the collection list, if the benefit/s due the employed member-borrower is/are insufficient to fully repay his/her loan.

4.The employer shall require a new employee to secure from the SSS an updated statement of his/her account, deduct from his/her salary the amortization due and remit the payment to SSS.

H.RESPONSIBILITY OF MEMBER BORROWER

A member-borrower who transfers employment shall secure from the SSS and submit to his/her new employer an updated statement of account of any outstanding loan balance with SSS and allow his/her employer to deduct from his/her salary the corresponding amortization due, including any interest/or penalty for late remittance.

i. DEDUCTION OF UNPAID LOAN FROM BENER PS

In case of default and the memPer-bcrrower fails to immediately pay the cuts'.andn .g balance, the arrearages/unpaid loan, as well as the interest and penalty thereon, shali be deducted from the benefits claimed by the member, as follows:

•Fcr employed, final benefits (tola! disabiHty/retrernent/dea*h).

•For self-employed/voluntary member, short-term benefits .(Sickness'MaterrJty/Partial Disability) or final benefits (total disability/ retirement/death).

J.OTHER CONDITIONS

1.Any overpayment on a previous loan shall be applied to the current loan, if any. If there is no current loan, the overpayment can also be refunded upon request of the member-boi rower.

2.The member-borrower shall notify the Member Services Section of the nearest SSS branch office of any change in the following: a address - thru SS Form E-4 filed over-the counter (OTC)

b. employer - thru a notice sent thru mail, filed OTC, or sent thru e-mail, member_rolations@sss.gcy.ph. The rotice shall inciude the SS number, name and signature of the member-bomower.

“ |

R.AJ3735, OTHERWISE KNOWN AS R1J:rH7N~LENDINGACT,: ” ' |

A DISCLOSURE STATEMENT ON LOAN TRANSACTION SHALL EE ’S3UED BY SSS TO THE MEMBER

BORROWER UPON APPROVAL OF HIS/HER LOAN APPLICATION, n. t |

. |