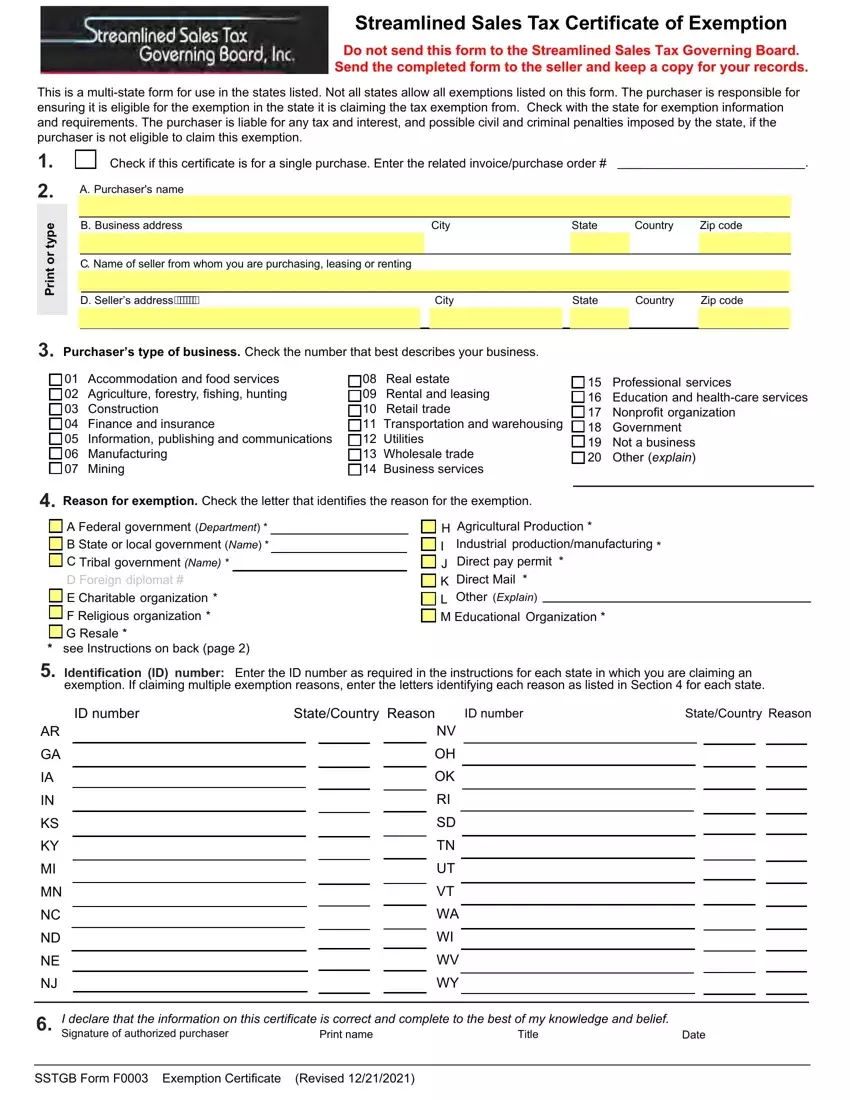

Streamlined Sales and Use Tax Exemption Certificate Instructions

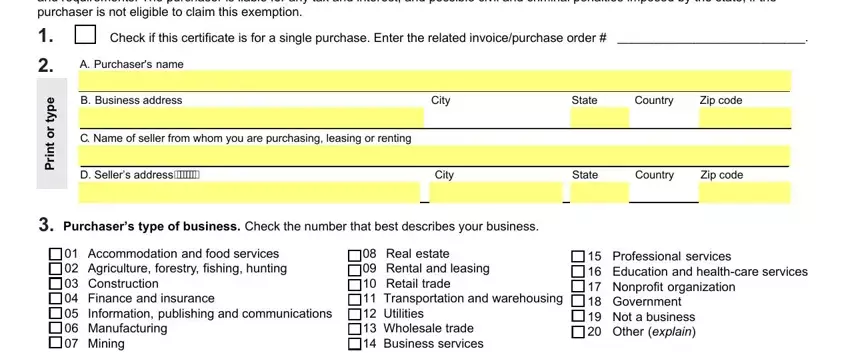

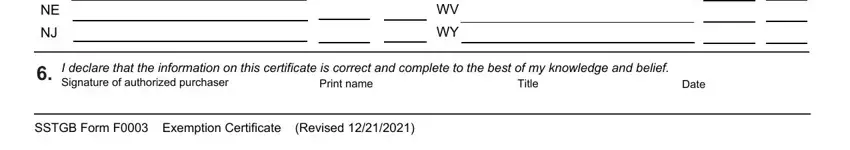

Sections 1‐6 are required information. A signature is not required if in electronic form.

Section 1: Check the box for a single purchase and enter the invoice number. If the box is not checked, this certificate is considered a blanket certificate and remains effective until cancelled by the purchaser if purchases are no more than 12 months apart , unless a longer period is allowed by a state.

Section 2: Enter the purchaser’s and seller’s name, street address, city, state, country and zip code.

Section 3 Type of Business: Check the number that best describes the purchaser’s business or organization. If none of the categories apply, check 20 and provide a brief description.

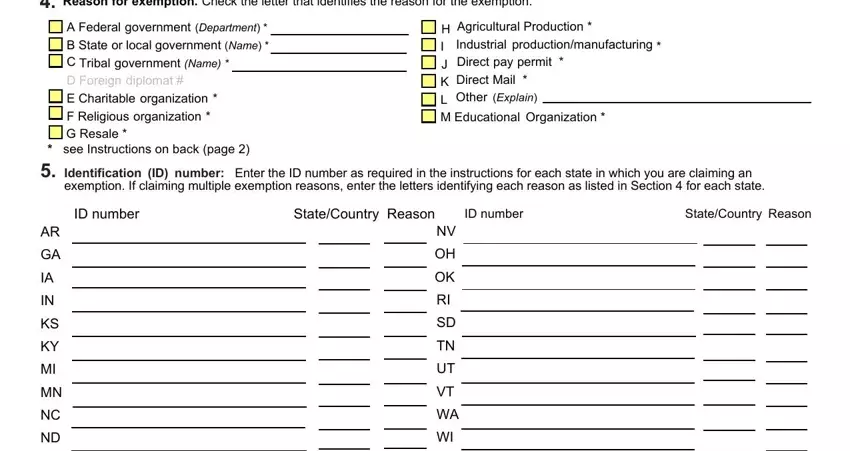

Section 4 Reason for Exemption: Check the letter that identifies the reason for the exemption. If the exemption you are claiming is not listed, check “L Other” and provide a clear and concise explanation of the exemption claimed. Not all states allow all exemptions listed on this form. The purchaser must check with that state for exemption information and requirements.

Section 5 Identification ID Number:

Purchaser's Instructions:

Enter the ID number as required in the instructions below for each state in which you are claiming an exemption. Identify the state or if a foreign ID, the country the ID number is from. If multiple exemption reasons are being claimed enter the letters identifying the reasons for exemption as listed in Section 4 for each state.

ID Numbers for Exemptions other than resale: You are responsible for ensuring that you are eligible for the exemption in the state you are claiming the tax exemption. Provide the ID number to claim exemption from sales tax that is required by the taxing state. Check with that state to determine your exemption requirements and status.

Foreign diplomats and consular personnel must enter their individual tax identification number shown on their sales tax exemption card issued by the United States Department of State's Office of Foreign Missions.

ID Numbers for Resale Purchases (Including Drop Shipments): If you are claiming a purchase is not subject to tax because it is for resale (Exemption Reason G.) and you are:

1.Required to be registered in the state you are claiming the tax exemption: Provide your sales tax ID number issued by that state. If claiming exemption in OH and registration is not required in the state, enter any tax ID number issued by OH. If claiming exemption in MI and registration is not required in the state, enter “Not Required”.

2.Not registered in the state you are claiming the tax exemption: Provide your sales tax ID number issued by any state.

3.Not required to register for sales tax and you do not have a sales tax identification number from any state: Enter ‐Your FEIN.

‐If you do not have a FEIN, enter a different state‐issued business ID number.

‐If you do not have any state‐issued business ID number or FEIN, enter your state driver's license number.

4.A foreign purchaser and you do not have an ID number described in 1, 2 or 3: The following states will accept the tax ID number

(e.g., VAT number) issued by your country: AR, IN, KS, KY, ND, NJ, OK, RI, SD, TN, UT, WA, WY. All other states require an ID number as listed in 1, 2 or 3.

If you do not have any of the ID numbers listed in 1 thru 4: You are not required to list an ID number for the following states: NE, OH, SD, WI. Enter "Not Required" and the reason for exemption for that state. All other states require an ID number.

Seller’s Instructions

The seller is not required to verify the purchaser’s ID number or determine the purchaser's registration requirements. (GA requires the seller verify the purchaser’s ID number.) The seller is required to maintain proper records of exempt transactions and provide those records to the state when requested in the form in which it is maintained. These certificates may be provided in paper or electronic format.

The seller is not liable for any tax, interest, or penalty if the purchaser improperly claims an exemption or provides incorrect information on the certificate, provided all the following conditions are met:

1.The fully completed exemption certificate is provided to the seller at the time of sale or within 90 days subsequent to the date of sale;

2.The seller did not fraudulently fail to collect the tax due; and

3.The seller did not solicit customers to unlawfully claim an exemption.

Note: A seller may not accept a certificate of exemption for an entity‐based exemption on a sale made at a location operated by the seller within the designated state if the state does not allow such an entity‐based exemption.

Drop Shipper Instructions: The drop shipper may accept an ID number to claim the resale exemption as provided above in the Purchaser’s Instructions. The ID number may include an ID number issued by another state. This may result in the same ID number being used for multiple states to claim the resale exemption (e.g., a retailer or marketplace seller may only be required to register for sales tax in one state).