Filling out new york state annual sales tax form st 101 is easy. Our team created our tool to make it easy to use and allow you to prepare any PDF online. Here are a couple steps you'll want to stick to:

Step 1: Find the button "Get Form Here" and then click it.

Step 2: It's now possible to update the new york state annual sales tax form st 101. Our multifunctional toolbar will let you insert, erase, customize, and highlight content material or perhaps carry out several other commands.

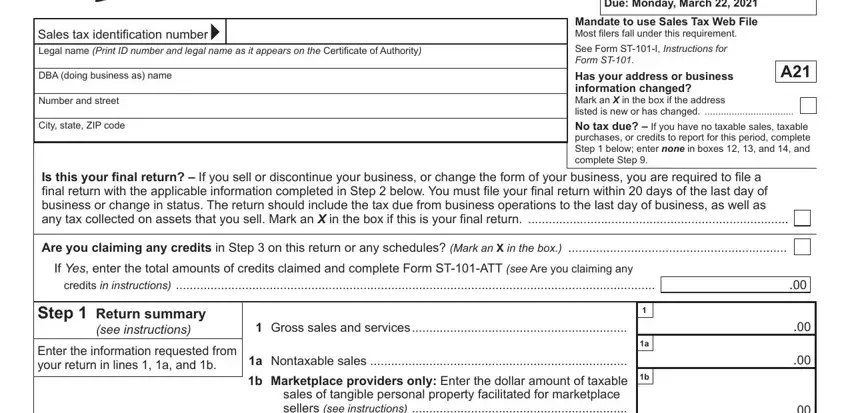

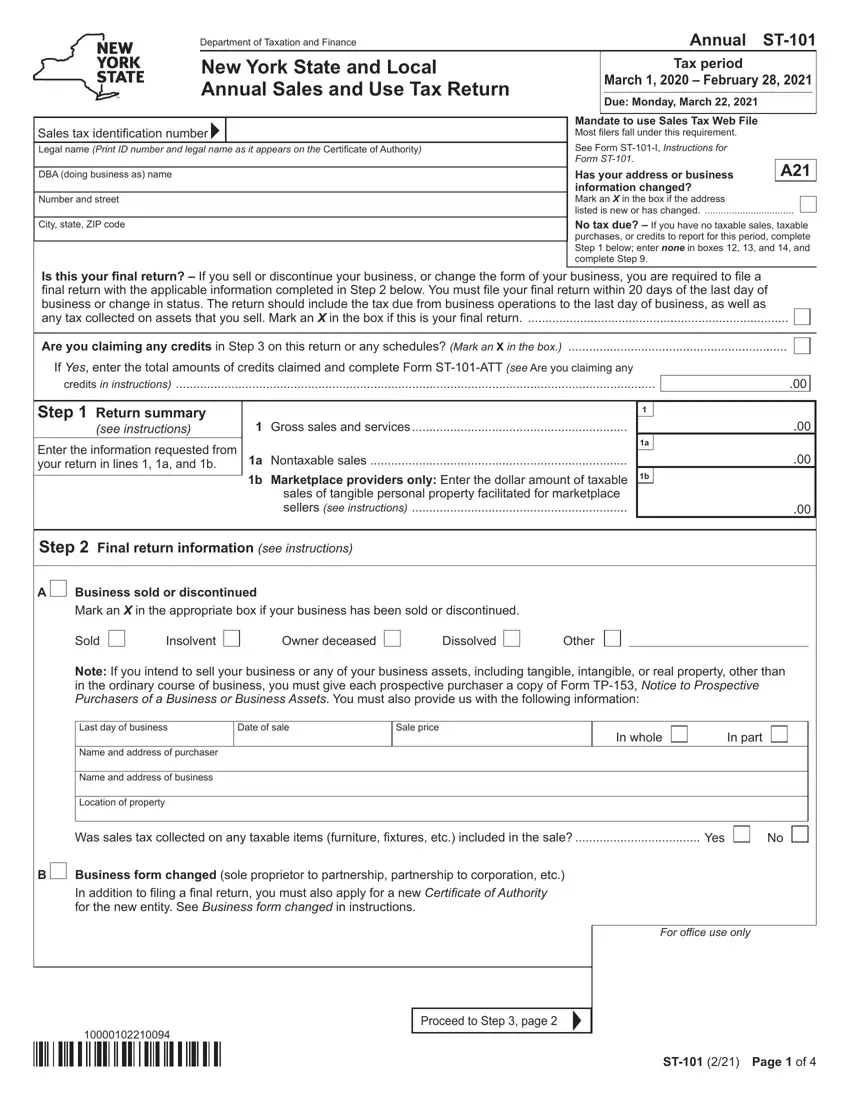

You should type in the following details to complete the new york state annual sales tax form st 101 PDF:

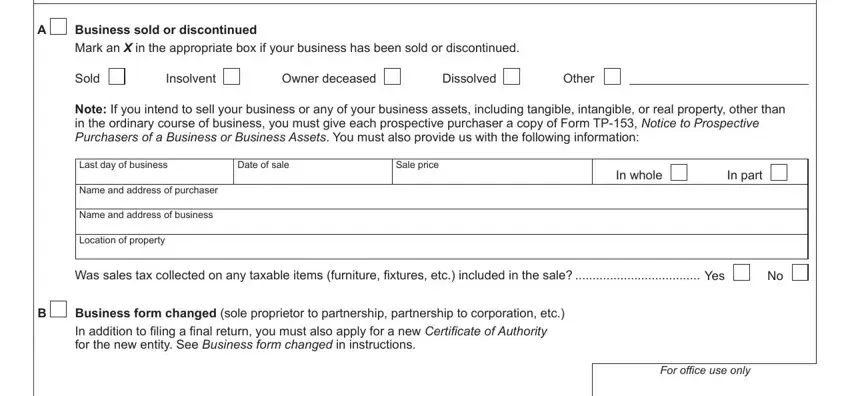

Provide the necessary details in the area Business sold or discontinued Mark, Sold, Insolvent, Owner deceased, Dissolved, Other, Note If you intend to sell your, Last day of business, Date of sale, Sale price, In whole, In part, Name and address of purchaser, Name and address of business, and Location of property.

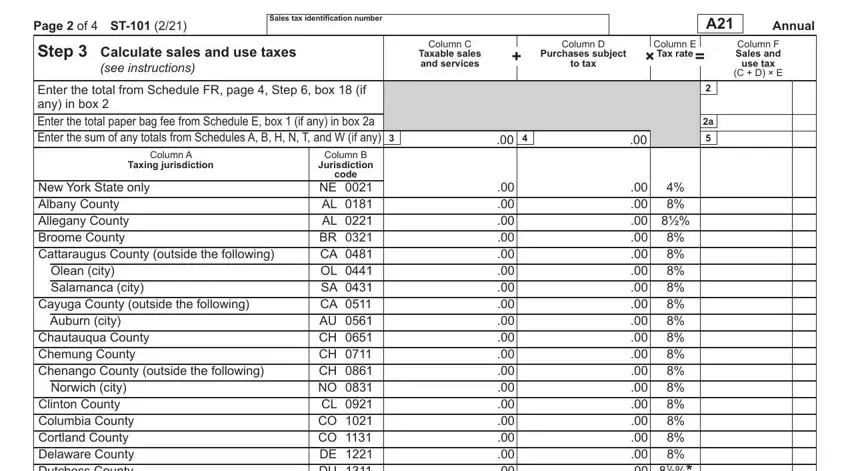

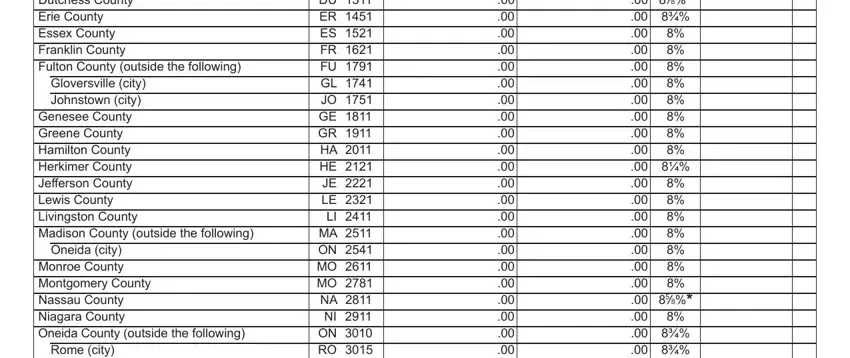

Write the main data in Page of ST, Sales tax identification number, Step Calculate sales and use taxes, see instructions, Enter the total from Schedule FR, Column A Taxing jurisdiction, New York State only Albany County, Column B Jurisdiction code NE AL, Column C Taxable sales and services, Column D, Column E, Purchases subject Tax rate, to tax, Column F Sales and use tax C D E, and Annual part.

The field New York State only Albany County, and Column B Jurisdiction code NE AL should be where one can indicate both sides' rights and obligations.

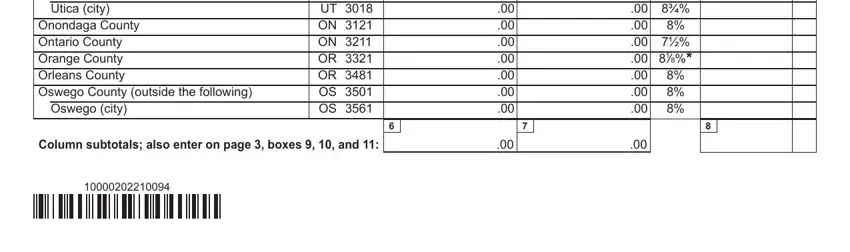

Finish by looking at these sections and filling them out accordingly: New York State only Albany County, Column B Jurisdiction code NE AL, and Column subtotals also enter on.

Step 3: Click the Done button to save the file. At this point it is ready for export to your device.

Step 4: Get duplicates of your document. This can protect you from possible difficulties. We cannot read or distribute your information, as a consequence be assured it will be safe.

Business sold or discontinued

Business sold or discontinued