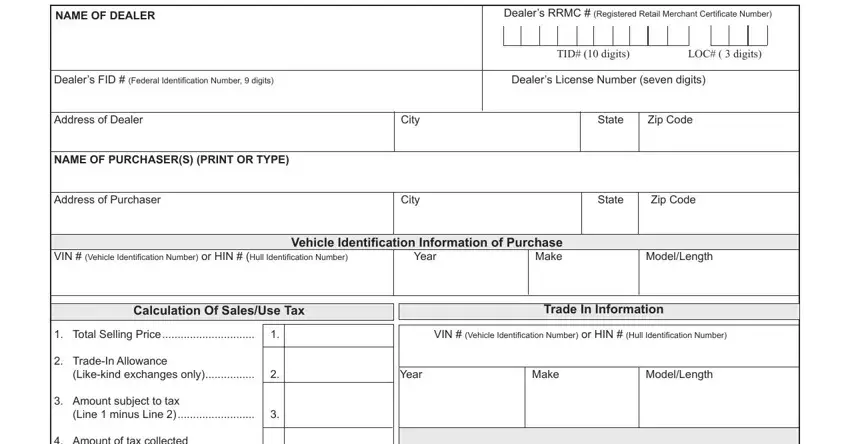

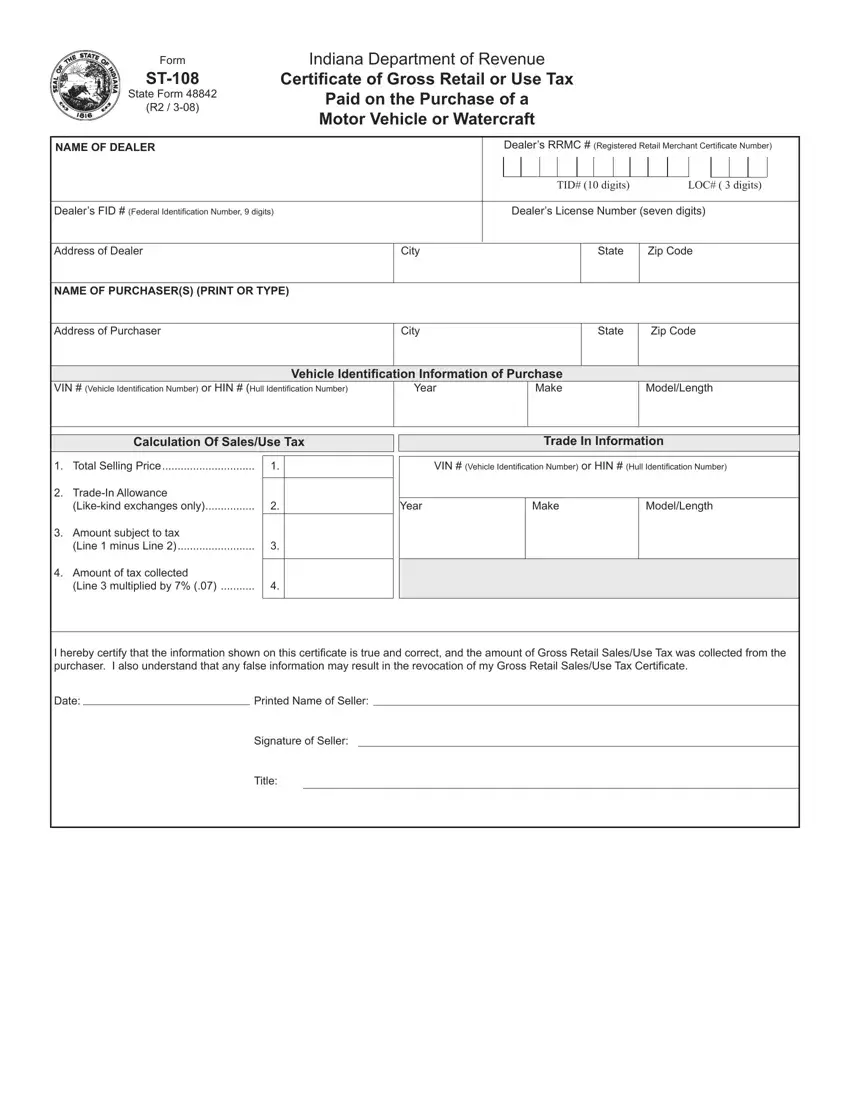

Form

ST-108

State Form 48842

(R2 / 3-08)

Indiana Department of Revenue

Certificate of Gross Retail or Use Tax

Paid on the Purchase of a

Motor Vehicle or Watercraft

NAME OF DEALER |

|

|

Dealer’s RRMC # (Registered Retail Merchant Certificate Number) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TID# (10 digits) |

|

|

LOC# ( 3 digits) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dealer’s FID # (Federal Identification Number, 9 digits) |

|

|

Dealer’s License Number (seven digits) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of Dealer |

City |

|

|

|

|

|

|

|

State |

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Purchaser(s) (pRINT OR tYPE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of Purchaser |

City |

|

|

|

|

|

|

|

State |

|

Zip Code |

Vehicle Identification Information of Purchase

VIN # (Vehicle Identification Number) or HIN # (Hull Identification Number) |

Year |

Make |

Model/Length |

|

|

|

|

Calculation Of Sales/Use Tax

1. |

Total Selling Price |

1. |

|

2. |

Trade-In Allowance |

|

|

|

(Like-kind exchanges only) |

2. |

|

3. |

Amount subject to tax |

|

|

|

(Line 1 minus Line 2) |

3. |

|

4. |

Amount of tax collected |

|

|

|

|

|

(Line 3 multiplied by 7% (.07) |

4. |

|

|

|

|

|

Trade In Information

VIN # (Vehicle Identification Number) or HIN # (Hull Identification Number)

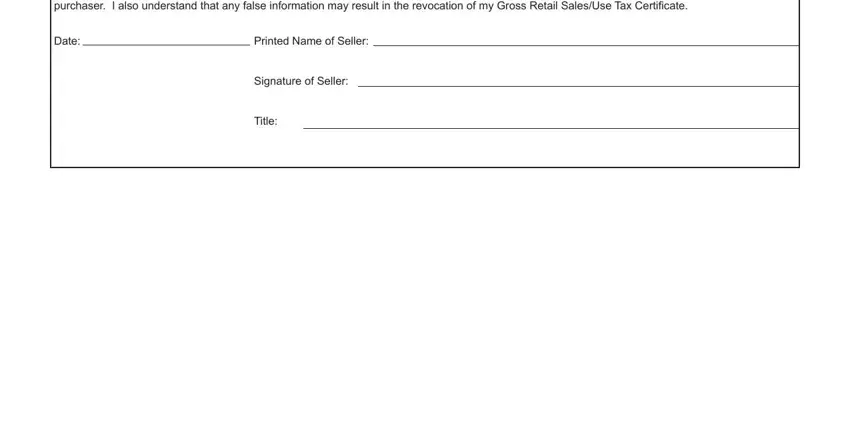

I hereby certify that the information shown on this certificate is true and correct, and the amount of Gross Retail Sales/Use Tax was collected from the purchaser. I also understand that any false information may result in the revocation of my Gross Retail Sales/Use Tax Certificate.

Date: |

|

Printed Name of Seller: |

|

|

Signature of Seller: |

|

|

|

Title: |

Instructions for completing Form ST-108, Certificate of Gross Retail

or Use Tax on the Purchase of a Motor Vehicle or Watercraft.

INDIANA CODE 6-2.5-9-6 requires that a person titling a vehicle or watercraft present certification indicating the state gross sales and use tax has been paid; otherwise the payment of the tax must be made directly to a Bureau of Motor Vehicles license branch.

The ST-108 allows the dealer to indicate the amount of tax collected from the purchaser. The dealer is then required to submit the sales/use tax to the Department of Revenue on a sales and use tax report.

If an exemption from the tax is claimed, the purchaser and the dealer must complete Form ST-108E and submit it to the license branch at the time of licensing. ST-108E serves as an affidavit of exemption by the purchaser and lists the exemptions available to qualified purchases.

Seller Information

NAME OF DEALER: Indicate the name of the dealer as it appears on the Registered Retail Merchant Certificate (RRMC).

FID # (Federal Identification Number): Indicate the Federal Identification Number of the dealer, if applicable.

Dealer’s License #: Indicate the Dealer’s License Number(seven digits) as it appears on the Dealer’s License Certificate.

RRMC # (same as TID # - 10 Digits + LOC # - 3 Digits): Indicate the Indiana Taxpayer Identification Number and Location Number as it appears on the Registered Retail Merchant Certificate. This number must be in the following format: 0001234567-001. If this number is not present or not in this format the ST-108 WILL BE REJECTED by the license branch and the purchaser will have to return to the seller to obtain the valid number.

Address of Dealer: Indicate the address of the dealer as it appears on the Registered Retail Merchant Certifi- cate.

Vehicle Identification Information

VIN or HIN ID #: Enter the Vehicle ID # (VIN) or the Hull ID # (HIN).

YEAR: Indicate the year the motor vehicle or watercraft was manufactured.

MODEL # OR WATERCRAFT LENGTH: If a motor vehicle is being sold indicate the model name for the vehicle. If a watercraft is being sold indicate the length of the craft.

Calculation of Sales/Use Tax

TOTAL SELLING PRICE: When determining the total selling price include all delivery, make ready, repair, or other costs incurred prior to transfer to the buyer. Federal excise tax is NOT included.

TRADE-IN ALLOWANCE: The trade-in allowance exemption is for like-kind vehicles or watercraft only. (i.e. A boat may be traded for a car; however, the value of the non like-kind items do not reduce the taxable selling price).

You must also indicate the make, model, year, and ID # of the trade-in vehicle or watercraft.

AMOUNT SUBJECT TO TAX: Line 1 minus Line 2 results in the amount on which the sales/use tax will be calcu- lated.

AMOUNT OF TAX COLLECTED: Line 3 multiplied by 7% or .07 equals the amount to be collected by the seller.

Signature Section: The Seller must sign the ST-108 certifying seller has collected the sales/use tax and will forward it to the Department of Revenue with the Sales/Use Tax Return. Failure to sign the ST-108 will result in the rejection of the form by the license branch and the purchaser will have to return to the seller for the signature.