This PDF editor was built with the objective of allowing it to be as effortless and easy-to-use as possible. The following steps can certainly make completing the tax exempt form st 119 1 quick and simple.

Step 1: The web page includes an orange button that says "Get Form Now". Select it.

Step 2: Right now, you are able to change your tax exempt form st 119 1. Our multifunctional toolbar helps you include, remove, transform, highlight, as well as undertake other sorts of commands to the content and fields within the file.

The next areas are what you will need to complete to obtain the finished PDF form.

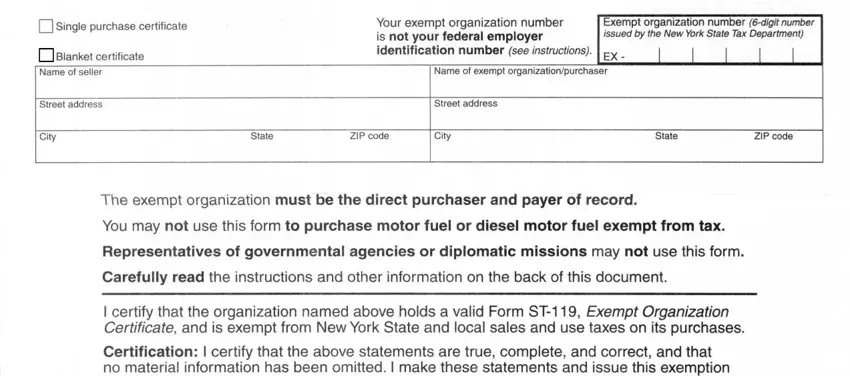

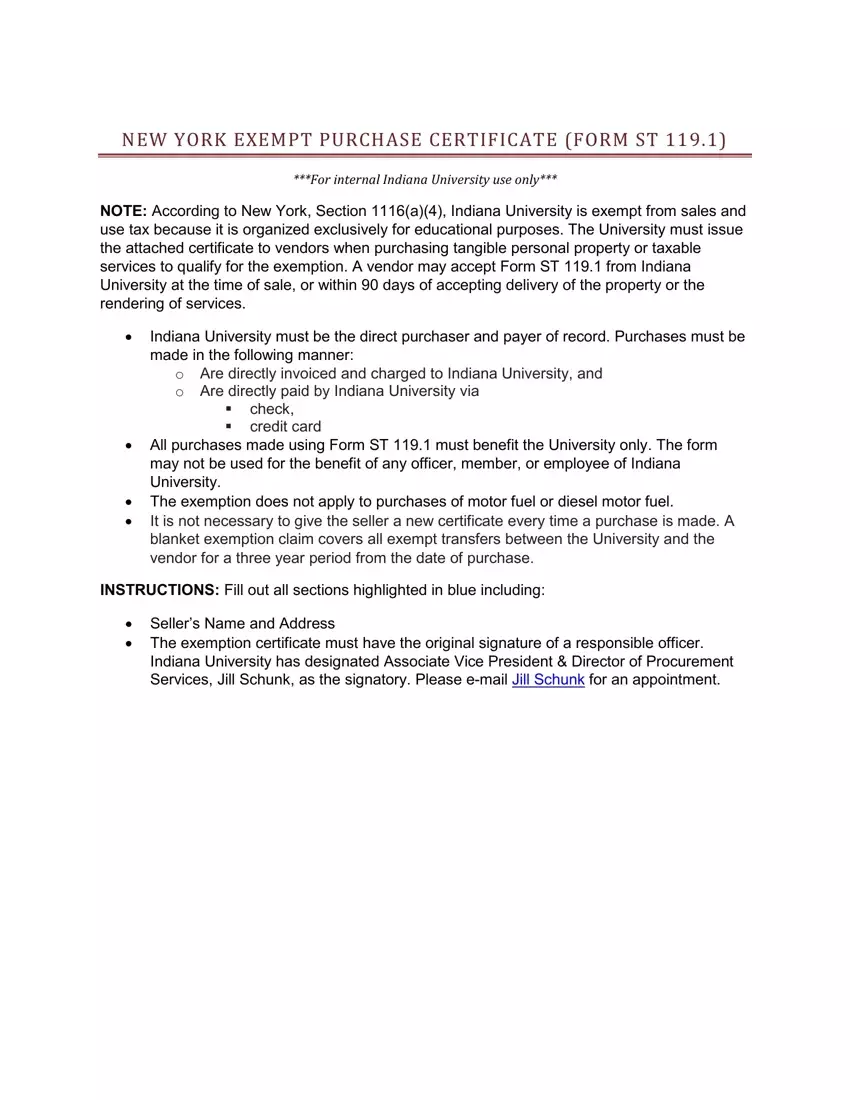

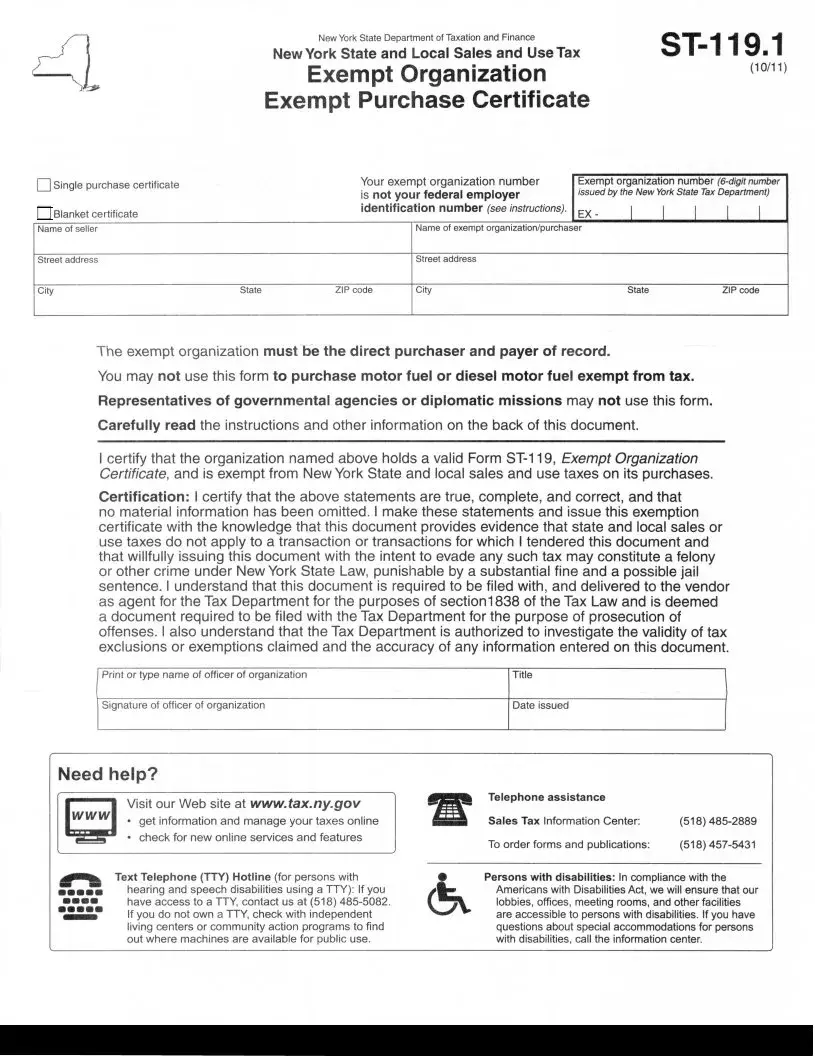

Provide the demanded details in the Single purchase certificate, Street address, City, Your exempt organization number is, Exempt organization number digit, Name of exempt, Street address, State, ZIP code, City, State, ZIP code, The exempt organization must be, You may not use this form to, and Representatives of governmental field.

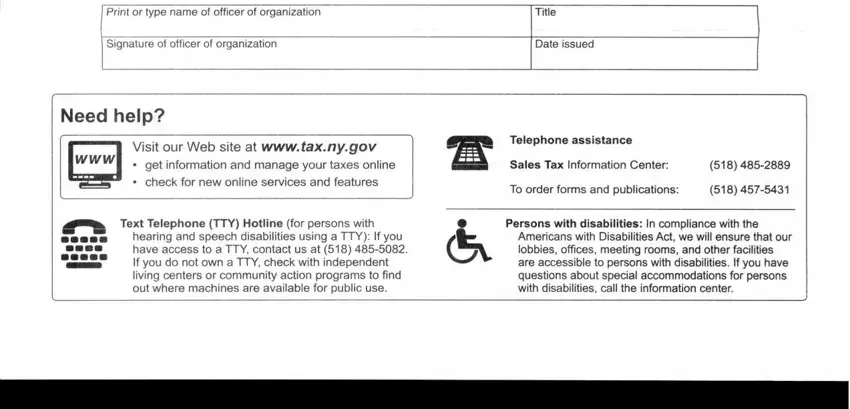

Within the section dealing with Print or type name of officer of, Signature of officer of, Title, Date issued, Need help, check for new online services and, get information and manage your, Visit our Web site at wwwtaxnygov, hearing and speech disabilities, Text Telephone TTY Hotline for, out where machines are available, Sales Tax Information Center, To order forms and publications, Persons with disabilities In, and Americans with Disabilities Act we, one should note some appropriate information.

Step 3: As soon as you are done, press the "Done" button to transfer your PDF form.

Step 4: To protect yourself from any type of difficulties as time goes on, be sure to create a minimum of two or three copies of the document.

Blanket certificate Name of seller

Blanket certificate Name of seller